With SAP Concur, employees can validate travel expense CFDIs automatically, capture receipt images and submit expense reports with a couple of clicks, and even check expenses before they are even spent! How to validate an electronic invoice through SAP Concur?

22, 2018 · Once they ask that you travel, inquire about them covering the expenses. This can be in the form of reimbursement so you can get an accurate quote before sending your invoice. In some cases, you may request the initial expenses upfront, such …

gildenlow

receipt

I paid $1700 when booking for hotel and airfare in Nov 2018. But the "actual travel" will not occur until March 2019. My company is C-corp taxed as S-corp. Should I record this travel expense in Nov How to record it correctly? I'm new to quickbooks online, I really need detailed step by step instructions.

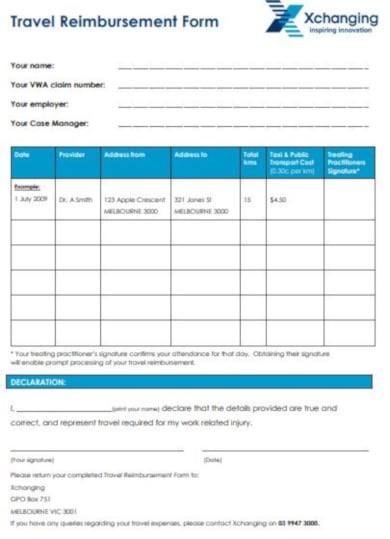

For guidance on individual travel expenses, see Guidelines for Travel and Other Reimbursable Expenses below. Original receipts must be included and attached to the Visa statement. (see How to Claim an Expense Reimbursement). In rare circumstances, it may be necessary for the payment

business travel expenses are covered by exemptions (which have replaced dispensations). This means you will not have to include them in your end-of-year reports. This means you will not have ...

If you have to travel for work, you may be able to claim at least a portion of your travel expenses as a deduction on your taxes. If you earn an hourly wage or salary, these 1 Categorizing Deductible Expenses. 2 Using Form 2016 and Schedule A. 3 Deducting Travel Expenses on Schedule C.

a complete list of SAP Concur integrated solutions that help to control business expenses and increase visibility. Simplify expense, travel, and invoice management with SAP Concur.

We explain here how to fulfill the requirements of the finance office: Invoice writing made easy. Special rules for invoicing. As it so often goes, there are exceptions when it comes to invoicing. Special cases include credit items, advance payments or partial services, as well as travel expenses.

Landlords can deduct travel expenses when traveling to visit a remote real estate investment in another market and for going to a The IRS also provides additional guidance for travel expense deductions in Publication 463. Each time you incur an auto expense, scan the receipt or invoice.

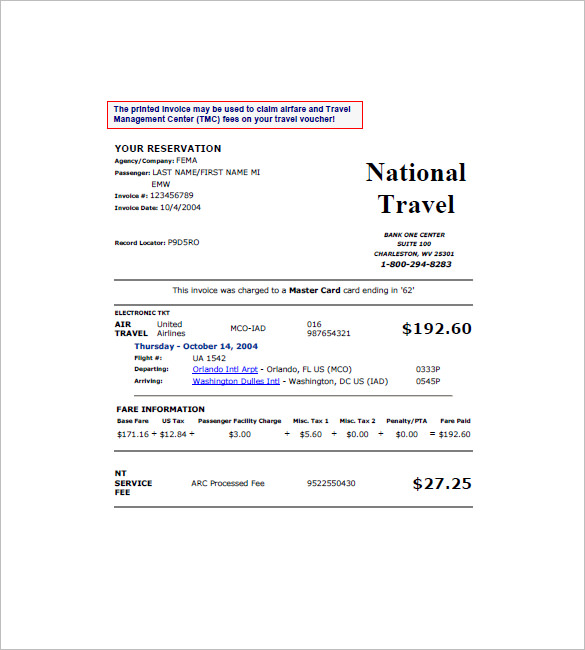

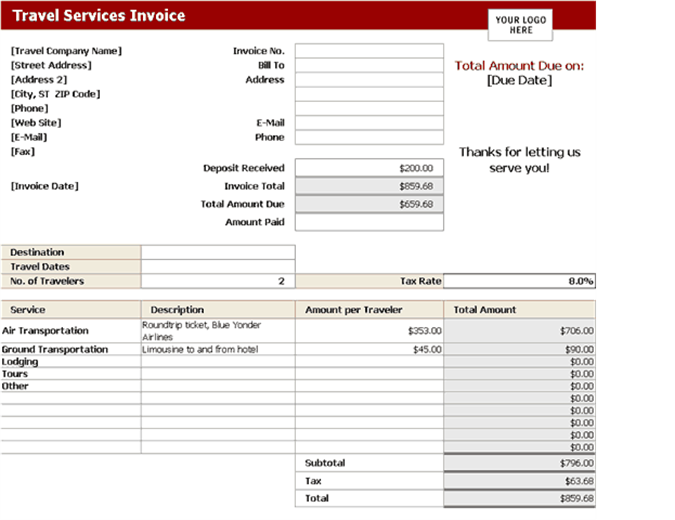

Travel invoices are important to both travelers and the travel agency, helping them keep a record of the booking. How to Create a Travel Invoice. A travel invoice should accomplish these basic functions: For travelers. Break down all travel expenses. Act as proof of completed payments.

invoice travel sample agent template templates word pdf

30, 2021 · When the AP department receives the invoice, it records a $500 credit in the accounts payable field and a $500 debit to office supply expense. As a result, if anyone looks at the balance in the ...

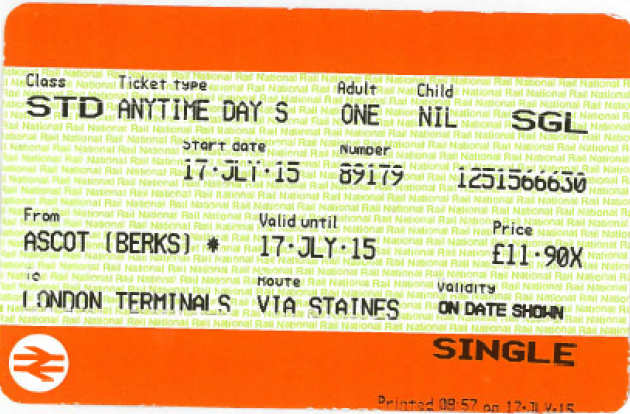

receipt examples train ticket travel receipts london imperial

A travel account combines all of your travel expenses from travel agencies and other travel suppliers onto a single invoice. Fewer invoices mean easier administration, total control and better basis for keeping track of costs.

invoice travel service templates bill format travels word invoices tours office agency template example pdf

certify mobile application app wallet expense

Travel Invoice Process Refers to all travel related expenses such as: Hotel Accommodation and Car Rental of All Regular Employees, Contractual and Interviewees To know how to process Travel Invoices. To share the rules when processing Invoices specially deals with InterCompany Charging.

Here's how you can invoice this to your client: As you can see in the example above, you originally paid 7% for some of these expenses. As a freelance consultant you must understand when and how you can invoice your travel expenses to your client. And remember, to make sure to agree on

For information on how to report your car expenses that your employer didn't provide or reimburse you for (such as when you pay for gas and It also discusses the standard meal allowance, rules for travel inside and outside the United States, luxury water travel, and deductible convention expenses.

guidance on individual travel expenses, see Guidelines for Travel and Other Reimbursable Expenses below. Approvals and Responsibilities 1. General. All expense reimbursement claims from University funds, whether operating, restricted, capital or ancillary funds, require approval on a one up basis by the person to whom a claimant reports.

Employee-initiated spend is an area that is often overlooked but can have a lasting effect on profitability. SAP Concur expense, travel, and

Invoicing Travel Expenses. When a company is fond of sending their employees to sites outside the office to meet up with their clients or for any other reason, as much as possible, they would want to monitor all the expenses made while traveling to know how much the company has paid for

concur app mobile travel expense sap expenses apps software platform cloud center overview

The last way to handle travel expenses is to invoice your clients for all costs directly, including VAT. You can do this either after the fact or by prior How does self-employed Sophie deduct travel expenses? Since Sophie starts the trip for professional reasons and works outside her normal

By fully automating expense, travel, and invoice systems with cloud-based tools available on mobile devices, you can reduce employee frustration, encourage adoption, and increase Download the full study now to learn more about how you can simplify your expense, travel, and invoice solutions.

Invoicing Software for Travel and Tourism Industry. Incurred an expense for a trip you are managing? Keep track of your expenses with less worry. To record advance payements, sign in to your Zoho Invoice account and go to Reatiner Invoices.

22, 2021 · Where to claim travel expenses. If you’re self-employed, you’ll claim travel expenses on Schedule C, which is part of Form 1040. — When it comes to taking advantage of the tax write-offs we’ve discussed in this article—or any tax write-offs, for that matter—the support of a professional bookkeeping team and a trusted CPA is essential.

reimbursement xchanging

integrated expense reporting, invoice management, time tracking, and travel solutions. These organizations use Emburse Nexonia. ... Create and manage your expenses faster, from anywhere. Seamless integrations. Effortlessly update …

Prior to booking and paying for travel-related expenses, please refer to Travel Services - Booking and Payment Procedures. The invoice is submitted with the comprehensive Expense Report following the trip (in order to account for the advance). For Adobe Fill & Sign How To's, please refer to:

5 Steps to Write a Travel Expense Invoice Template. Step 1: Identify Your Requirement. The internet consists of plenty of travel invoice templates, and you can shortlist or categorize them with respect to your needs depending on whether you are planning a business trip or a

booking travel, visit Health Alerts for Stanford Travelers for the most current travel guidance and restrictions due to Per the Administrative Guide Policy : Business and Travel Expenses, to be reimbursed for university-sponsored travel, faculty, staff, postdoctoral scholars and students must use Stanford Travel when booking airfare, hotels or …

Business travel spend. Expense management. Invoice processing. If you travel for work, incur expenses as a result, and these expenses are not reimbursed by your company, you may be able to claim tax back from the e-Receipts: How to store digital receipts for your business expenses.

10+ Travel Expense Invoice Templates - Google Docs, Google. 5 hours ago 5 Steps to Write a Travel Expense Invoice Template Step 1: Identify Your How should I invoice clients for travel expenses? Just Now Run the Profit and Loss report. That should show all the business income less

Travel agency invoice isn't just a record-keeping document for a client but it includes all information on their travel, travel expenses, and services is included in the travel plan. On the other hand, traveling invoices are important documents for accounts of traveling agencies to keep a record of their

How to Invoice for Travel & Vacation Services. Being a travel & tourism agent means carrying out many different tasks, from transportation & ticketing If you're a travel & tourism agent or agency, your contract should include details about when the client needs to pay for your work. The best time

Travel and expenses have to be treated as a fixed price item. It includes 2x visits, 2 consultants at both locations for 2 days per stay. The transaction price has been agreed to be 7500,- USD with an upfront invoice. How is this to be treated according to IFRS 15/ASC 606? - The typical solution is that

Here is how you can invoice for travel expenses in the right way so it's calculated and filed correctly. To invoice you must first determine which travel expenses ● Travel Cost - This includes spending on travel tickets for planes, trains, etc. plus hotel costs and other fees associated with those expenses.

Travel and expense management is a massive undertaking, whether you have 50 employees who travel for Customizable travel policies and approvals. Monthly invoice to consolidate payments. "With having a clear visibility on travel expenses, a company is able to accurately track travel

Knowing how to invoice for expenses when you first start out as a contractor, regardless of your profession, is crucial to ensure that you keep up a As a contractor, you are likely to incur a few expenses when providing your services to clients. For example, you may need to travel and

How to Record Reimbursable Expenses. Regardless of the type of reimbursable expense, it's vital An expense report is simply a report that itemizes all your expenses to track your spending and From there, simply pull that billable expense into an invoice and send it off to your client to get paid.

GST invoicing software for small businesses. Zoho Invoice is online invoicing software that helps you craft professional invoices, send payment reminders, keep track of expenses, log your work hours, and get paid faster—all for free!

Here are the expenses you can deduct for business travel, including special travel like conventions and cruise ships, and how to document these Other expenses; You can deduct other costs while traveling for business: Dry cleaning and laundry. Business phone calls and faxes (not personal calls).

Travel expenses and special materials or supplies are examples of common reimbursable expenses. When you bill your client, include these costs on the invoice so that they can reimburse you. To record a reimbursable expense in Wave, follow these steps: Create an account for your reimbursements.

and share invoice with ease. Sharing invoices is effortless using Zoho Invoice—create clones, print out a copy, or simply email them. You can also schedule emails for a later date and time, or send out invoice links having expiration dates.

Read our guide to discover how to claim expenses from clients in your invoice as a contractor. If your client reimburses your company for expenses incurred whilst undergoing your duties, these must be invoiced for using one of the following three methods