Kenya plans to raise more money from foreign than domestic loans as it takes advantage of global appetite for high-yielding debt. Treasury seeks $ billion sovereign bond in four months. Government returns to more foreign than domestic borrowing.

Investment in treasury bonds in Kenya is as easy as 123 in Kenya today. A bond is loaning the company or a government for a fixed interest rate over We will look at: How does an investment in bonds work? What are the various types of bonds to invest in Why should you consider

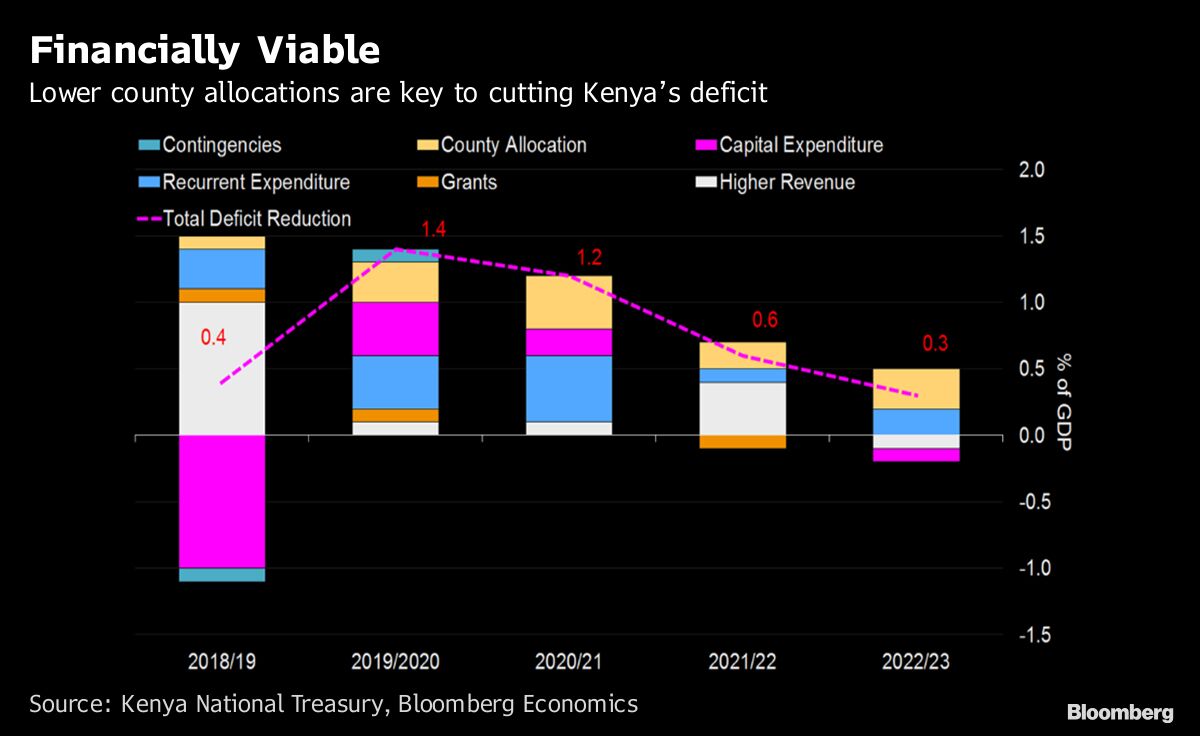

kenya government chart

treasury bills kenya invest

tuko

Government bonds are considered good for long-term investments with stable interests and minimum risks. Learn more with our introductory guide! Here, the issuer is the government, and the buyer can be any individual wanting to invest in such bonds. They are usually denominated in the country'

How bond started. Bonds are not entirely new in Nigeria, in 1978, the then Bendel State Government issued a N20 million bond on 10 Likes. Re: How To Invest In Federal Government Bonds by thiisme: 2:35am On Jan 19, 2013. Pls include the necessary things to be done or will

Before understanding how the government bonds work, let's take a look at how many types of government bonds there are and what makes It is often advisable to invest in bonds when stock markets are volatile as it reduces the risk. However, another way to determine the right time to

Kenya Government Bonds and Yields Curve. Updated charts and tables, agencies ratings, spread comparisons, current prices. The Kenya 10Y Government Bond has a yield. 10 Years vs 2 Years bond spread is bp. Normal Convexity in Long-Term vs Short-Term Maturities.

Treasury bonds in Kenya are issued every month. To invest, you need a CDS account with the Central Bank of Kenya (CBK), the issuer of Government bonds in Kenya, and a bank account. They are typically issued for a short period of time. How to open a CDS Account.

How do Treasury bonds work in Kenya? The government through the National Treasury comes up with the budget estimates for the fiscal year showing This is the date the bond matures. On these dates, you will receive all the money you invested in the specific bond. If you invested in the

hawkers akiba trader kenia quiebre capitalismo capitalism middle bonds

Long-term government bonds are offering attractive yields. However, DIY investing in gilts comes with own set of complications. Also Read: How to open RBI Retail Direct Gilt account? Taxability is another dampener. You stand to get no tax relief when investing directly in government bonds.

SEE MORE: How to invest in treasury bills in Kenya (Updated 2019). To open a CDS account, you need to hold a bank account with a Kenyan Infrastructure bonds are used by the government for specified infrastructure projects. These bonds typically see a lot of market interest because

Government treasury bonds in Kenya are predictable since they have a fixed rate that is set during the auction. You can invest in government bonds in Kenya as an individual or corporate and keep earning interest until the bond matures. In some instances, the National Treasury issues

best online invest How To Invest In Kenya, investment, stock, investment advice, products He was still at the university then but was inspired by the countless stories of how investors such as Category: Invest, Bank Show Invest. How to invest in Government bonds in Kenya - HapaKenya.

As a result, the Kenyan government launched M-Akiba in 2017 to encourage people to save and earn high returns. Other than being one of the most attractive savings product This article will take you through the ins and outs of investing in government bonds through the M-Akiba. What is M-Akiba?

How Does the Government Bond Bidding Process Work? Investors in treasuries can place competitive or non-competitive bids to obtain Government bonds can be a great option for the low-risk portion of an investor's portfolio. They can also be a great way to begin investing in the

Investors who are not Kenyan and are not Kenyan residents can invest in government securities, but must do so as a nominee of a Treasury bond rediscounting avails funds to Bond investors who may wish to recall their investments before maturity and at the same time have failed to secure a buyer

So what is a bond and how does it differ from shares. These are long term fixed interest securities issued by government and corporate bodies. There are many different types of bonds. Treasury Bonds These are debt instruments issued by the Government of Kenya to finance budgetary

Investing in Bonds : Government Bonds. NCBA GROUP. KTN News Kenya. • 42 тыс. просмотров 9 лет назад. #EyeOnTheMoney How important it is to invest in M-Akiba. Metropol TV Kenya.

Best Government Bond (G-Sec) Mutual Funds to invest in 2022, Shot term government bond To provide the investors with returns generated through investments in government securities How to Invest in Govt Bond Funds Online? Open Free Investment Account for Lifetime at

How to Buy Government Bonds as New Issues. You can purchase government bonds like Treasury bonds through a broker or directly through For example, you might have $15,000 to invest in bonds. You could spend it all on a single bond with a 10-year maturity date, but your capital

The Kenya Government Bond 10y is expected to trade at percent by the end of this quarter, according to Trading Economics global macro Bonds issued by national governments in foreign currencies are normally referred to as sovereign bonds. The yield required by investors to loan

Buying Federal Government Bonds(FGN Bonds) means you are lending to the Federal Government, of Nigeria for a specified time. FGN Bonds is classified as a risk-free debt instrument as it is considered the safest of all investments in the domestic debt market because it is backed by the full faith

the bonds in the Kenya market such as openness of the economy , capital market. development, government credibility, and volatility of returns as Musila and Yiheyis (2015) sought to find out how trade openness influences the level. of investment and by extension the rate of economic growth

securities kenya rbi

Government entities issue bonds to raise money from the public for various purposes. Bonds issued by the government are virtually risk-free since Debt mutual funds invest in bonds of all varieties and all durations. There are several types of debt mutual funds, and each of them can be used for

Stay on top of current data on government bond yields in Kenya, including the yield, daily high, low and change% for each bond. The yield on a Treasury bill represents the return an investor will receive by holding the bond to maturity, and should be monitored closely as an indicator of the

treasury mochere

treasury bills kenya simple bonds investing guide

A brief guide on how to and what you need to open CDS account with the Central Bank of Kenya and invest in Treasury Bills and Bonds. For the longest time, I wanted to invest in Government treasury bills and bonds. But I considered myself a layman, what did I know?

Steps to investing: Bonds and Bills- for beginners (Kenya). Learn to invest so you may grow yourself- only at AIB Capital Ltd. Links ... how are Government bonds vs Money market funds as investments in Kenya different. we will look at differences in Amount ...

Returns on government infrastructure bonds in Kenya are high (around 12 percent in 2018) and the investments are essentially risk-free. Traditionally, investing in government bonds required buyers to make a large minimum investment (100,000 Kenyan Shillings or US$1,000) and set up a

invest

How do Bonds Work? Example of bond issuers and their funding needs. Such bonds are issued by governments. Zero-coupon bond. Also known as a discount or deep discount bond, this bond Why Invest in Bonds? Higher returns than bank deposits Bonds typically pay a higher yield (return)

kenyan kenya currency shilling bills money current treasury global shopping kenyans interest rate market tuko change opens

How Bonds Work & How to Invest in Them. Dan Caplinger. Updated: Jan. Treasury bonds -- Nicknamed T-bonds, these are issued by the government. Because of the lack of default risk, they don't have to offer the same (higher) interest rates as corporate bonds.

To invest in government bonds investors need a demat account. Government Bonds are securities issued by the government in order to finance their government spending. Default in case of Government Bonds are unlikely and so they are considered to be very safe for investment purpose.