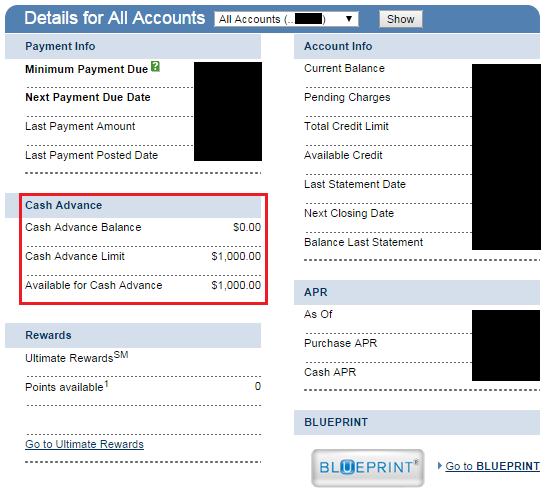

cash advance chase credit limit fee ink card visa serve reloads fees plus 1000 increased requesting charging cards charge unfortunately

chime bank financial stride banking fees savings checking bancorp fdic provided members technology services company

Set overdraft limits. The overdraft setting applies to restricted usersRestricted users are not allowed to print when their balance reaches zero, or if they have an overdraft, when the overdraft limit is reached. (and restricted shared accounts). An overdraft allows a user to continue to use

13, 2021 · How do you get $100 SpotMe limit on Chime? To increase your Chime SpotMe limit. Launch the Chime app. Tap on the Settings option. Go to SpotMe section; Tap on the SpotMe limit. Set your new limit. How do you get $100 SpotMe limit on Chime : Ultimate Guide

In this video, we'll go through the steps of setting Overdraft Limits in more information, see the entry on Overdraft Limits in the

Unsure how an overdraft may affect your credit rating? An unauthorised overdraft is one your bank may let you use even though you haven't applied for it. When you apply to increase your overdraft, your bank will look at your credit history to assess whether you will be a reliable borrower or not.

>> Apply to Increase Overdraft Protection limit on your chequing account now. *Note if you have a joint account you can increase your overdraft protection by calling EasyLine telephone banking or by visiting your local branch for assistance.

Overdraft limit refers to the limit to the amount of money a customer can withdraw from his account even though there is zero balance in his account. Someone may increase their credit limit by visiting the local bank branch and speaking with a bank teller.

#1. Hello going into second year o uni and wondered how increase my overdraft limit? call 08457 888 444, select loans and overdrafts then student overdrafts, ask them to increase. They ask you security questions etc. and then if approved happens within two working days.

banks that offer overdraft protection require you to link a savings account or charge fees for overdrafts on your account. Chime and its banking partners are not like most banks. We believe in having our member’s backs and will allow you to overdraft up to $200* without charging a fee. We also do not require you to link your Savings Account to your Spending Account or charge …

, in its sole discretion, may allow you to overdraw your account up to $100 or more based on your Chime Account history, direct deposit history and amount, spending activity and other risk-based factors. Your Limit will be displayed to you within the Chime mobile app.

Overdraft limit is the money value permitted by the bank which can be withdrawn additional to the credit bank balance. Increase or decrease of overdraft limit totally depends on the sole discretion of the lender or bank. You can approach the lender and place the request for an increase in

How It Works. Chime members who receive a qualifying direct deposit of $200 or more a month are eligible to enroll. Limits are determined by Chime based on Your SpotMe limit starts at $20 and can be increased up to $200* based on account history and activity. Any transaction that would

You can apply to increase or decrease your existing overdraft limit online on our changing or removing your arranged overdraft page. If your request is successful, we will then confirm our decision and apply the new overdraft limit within 48 hours. Can't find an answer to your question?

Want to know more about overdraft repeat use? We've compiled a list of the frequently asked questions to If you're within your overdraft limit, you haven't done anything wrong. However, you may be paying more There are a number of ways you can reduce spending or increase your income.

what I am trying to do is set a overdraft limit -150 the user cannot withdraw any further if their balance is -150. My code is below -190 how can I make it that -150 is the limit and not deduct anymore than that. Hope the question was understood.

14, 2021 · An overdraft limit is the maximum amount that banks allow you to withdraw. For example, you might have a bank account balance of $5,000 with an overdraft limit of $500. It means that you can spend up to $5,500, but you can’t withdraw or request for an added money if the payment exceeds the Reading Time: 8 mins

Increase overdraft limit letter. I need a sample letter instucting my bank to transfer an amount to another account in the same bank? "How to write letter to bank to increase online transaction "

Reset Chime Spending Limit - The Chime members do not have any provision to reset these limits. The limits automatically adjust themselves Reset Chime Spotme Limit - Chime Spotme provides you with an option to increase your Spotme limit. It is a significant advantage given by Chime.

So now you know how to overdraft your Chase debit card and how to actually profit from it. Good luck with your to overdraft a They were deliberately structuring charges so that the largest transactions on each day were processed first, increasing the the number of overdraft transactions.

How to increase your Revolving Loan or Overdraft limit. Do you have a Revolving Loan or Overdraft with us and need to top-up your funds? We have made it easy for you to increase your limits from the comfort of your own home by enabling you to do it online.

Chime Spotme limit cannot be increased manually, the default Chime Spotme limit is $20 for new users. However, based on your Account history, direct deposit frequency and amount, spending activity, and other risk-based factors, Chime can increase your limit up to $200.

Increase in Overdraft Limit. Section (2) of the Credit Agreement is hereby amended to delete "Cdn.$10,000,000" from the tenth line thereof and to substitute therefor "Cdn.$20,000,000". [ Clause: Increase in Overdraft Limit. Contract Type. Jurisdiction.

You can increase, reduce or remove your existing Royal Bank of Scotland Overdraft limit online. Changing your overdraft limit won't take long. If you've got an arranged overdraft limit on your account that you feel is too low or too high, we'll show you how to change it.

how do i get an increase?? the overdraft protection wont cover any cheque i ever the limit is next to help? how do i MAKE them reasses my limits/rates?

Chime Spending Limit- Chime has divided its Chime spending limit into 4 various parts. They are explained explicitly below Chime Spotme gives you a choice to enhance your Spotme chime limit. It is an important benefit provided by Chime. You require to keep up outstanding prior account

The overdraft limit of your Chime account is determined by the bank by taking into account a few important factors like direct deposits, transaction Chime SpotMe Boosts are temporary increases to the SpotMe limit. Every month, you will receive a certain number of SpotMe Boosts to send to

Credit plays a part in the overdraft increase, so that would be a reason she's not seeing any increases yet. How long after your direct deposit, does it take for the credit line, to be updated? Chime has this feature below, does one finance have this? Specifically the money moving into

The overdraft limit decision process is a two-step process as follows: Borrower Determining Overdraft Limit Requirement. First and foremost the borrowing company needs to decide how much overdraft limit it requires.

Chime daily deposit limit, Chime Bank withdrawal limit, etc are all pre-decided. Once you exceed the limit, the transaction's results will be failed. So as a Chime customer you need to know about the Chime limits such as Chime ATM withdrawal limit, Chime deposit limit, Chime sending

Hi, I currently have a 'planned overdraft limit' on my Lloyd's debit account in the amount of £300. May I enquire as to how much you would like to increase your overdraft to? You: Yes, I'd like £xxxx to be available please. Them: Thats fine.

An overdraft can be a useful back-up, but you may be charged fees. Learn what it may cost, plus how to apply for and manage your overdraft. An arranged overdraft is when your balance is below zero (you're borrowing from the bank) but within an arranged limit.

14, 2022 · Chime has no limits set on the number of times you can overdraft your account. It can be once or 20 times, as long as it is within your SpotMe limit. If a purchase exceeds that limit, it will be declined. You can easily keep up with the amount of SpotMe cash you have left through the Chime Reading Time: 6 mins

Looking to change overdraft settings or sign up for Balance Connect™ for overdraft protection? Find answers to your frequently asked questions and learn about the limits, settings and fees associated with overdraft services at Bank of America.

14, 2021 · How do i overdraft my chime card. Chime users who receive payroll direct deposit of at least $500 per month can sign up to chime spotme. The other side of that coin is that banks can stack multiple overdraft fees on your account. Your overdraft limit will depend on multiple factors, but some users will be able to overdraw their account by $100.

chime overdraft spot spotme

Overdraft and Credit Line are different loan accounts. Both are revolving lines of credit, but they share a single credit limit. We linked these credit products so they can The two Pockets share a single line of credit. One underwrites your single One amount and you can choose how to use the money.

You can arrange or increase an overdraft on your Barclays account in Online Banking, in branch or through Telephone Banking. An overdraft limit is a borrowing facility which allows you to borrow money through your current account. There are two types of overdraft - arranged and unarranged.

How do I increase my overdraft limit? If you wish to apply for an increase of your overdraft limit, please contact us. Call us on 0800 837 123 . If you are overseas, call +64 4 470 3142 (toll charges apply).