How do I increase spot me limit on Chime? Increasing the amount of your direct deposit may also help to improve your limit. When you become eligible for a higher SpotMe limit, you will be notified through email and in the Chime banking app. This is an entirely automated process, and you

How SpotMe Works. SpotMe allows Chime account holders with monthly direct deposits of $500 or more an overdraft cushion of a set amount. Your SpotMe overdraft limit will start at $20 and may increase over time (up to $100) based on your account history and activity.[3].

What is the Chime SpotMe feature? How can I avoid getting an overdraft fee? You have this question in your mind. So, the excellent thing you can do to increase your SpotMe limits from $20 to $100 is received payment in your Chime account through direct deposit at least once in a month.

The Chime SPotMe programs gives users an overdraft of up to $100 without an overdraft fee. Who are those Eligible for the Chime SpotMe Program? To qualify to overdraw from your Chime account with no service fee, you need to receive a $500 direct deposit 31 days preceding the day of the drawing.

Your limit starts at $20, but can be increased $100. How to Start Spotme. To check your eligibility, go to the Chime App, then go to settings. Select Spot Me. Use my exclu s ive link to sign up for a fully digital Chime bank account today and we'll both get $50.

Chime SpotMe Overdraft Protection. Traditional banks charge around $34 whenever you overdraw your checking account, even if you're only over by a few dollars (and that fee can hit someone's account multiple times). The coverage limit starts off at $20 and can be increased to $100 or more over time.

How do I increase my SpotMe limit with chime?Launch the Chime on the Settings to SpotMe on the SpotMe your new How To Repair and Restore Windows 10Click Startup System your "cmd" into the main

How Do You Increase SpotMe on Chime? When you sign up for SpotMe on Chime and are approved, you will be given a SpotMe limit. This is typically between $20 and $100 based on risk factors such as your direct deposit history and the amount normally deposited.

18. How to Increase the Chime SpotMe Limit? Chime will increase your SpotMe limit over time based on how much money is direct deposited into your account each month and your account history.

How Chime SpotMe works: Fees, features and requirements. SpotMe lets you overdraft your Chime account when you make a purchase with your debit card. Limits start at $20, but account history and regular deposits let you increase your limit to $200.

Chime SpotMe is a feature that comes with Chime that will protect you from potential overspending and can come in handy on debit card purchases. How Do You Increase SpotMe on Chime? As mentioned above, you will start off with a limit of $20, but you will have the opportunity to increase

answering

4 How Do You Increase SpotMe on Chime? 5 How To Get Started With SpotMe. Chime doesn't set a number to how many times you can overdraft. The bank uses a total dollar amount limit instead. For example, if your SpotMe limit is $20 per month, you can overdraft 10 times if each debit

Chime's SpotMe is an overdraft facility without any charges or fees. The maximum overdraft you can take on debit card purchases and cash withdrawals is up to $200. Also Check:- Chime Direct Deposit Limit. Page Contents. How to use spotme on chime?

How does spot me work with chime?Подробнее. Can You Get Cash Back with Chime SPOTME? Chime bank $2,000 stimulus check DIRECT deposit update increased spot me $200Подробнее.

Chime SpotMe is an optional feature that allows Chime members to overdraft their accounts without paying overdraft fees when making debit card How does it work and who is eligible to use Chime SpotMe? Where can you use Chime SpotMe if you need it? Don't worry, we got you and we

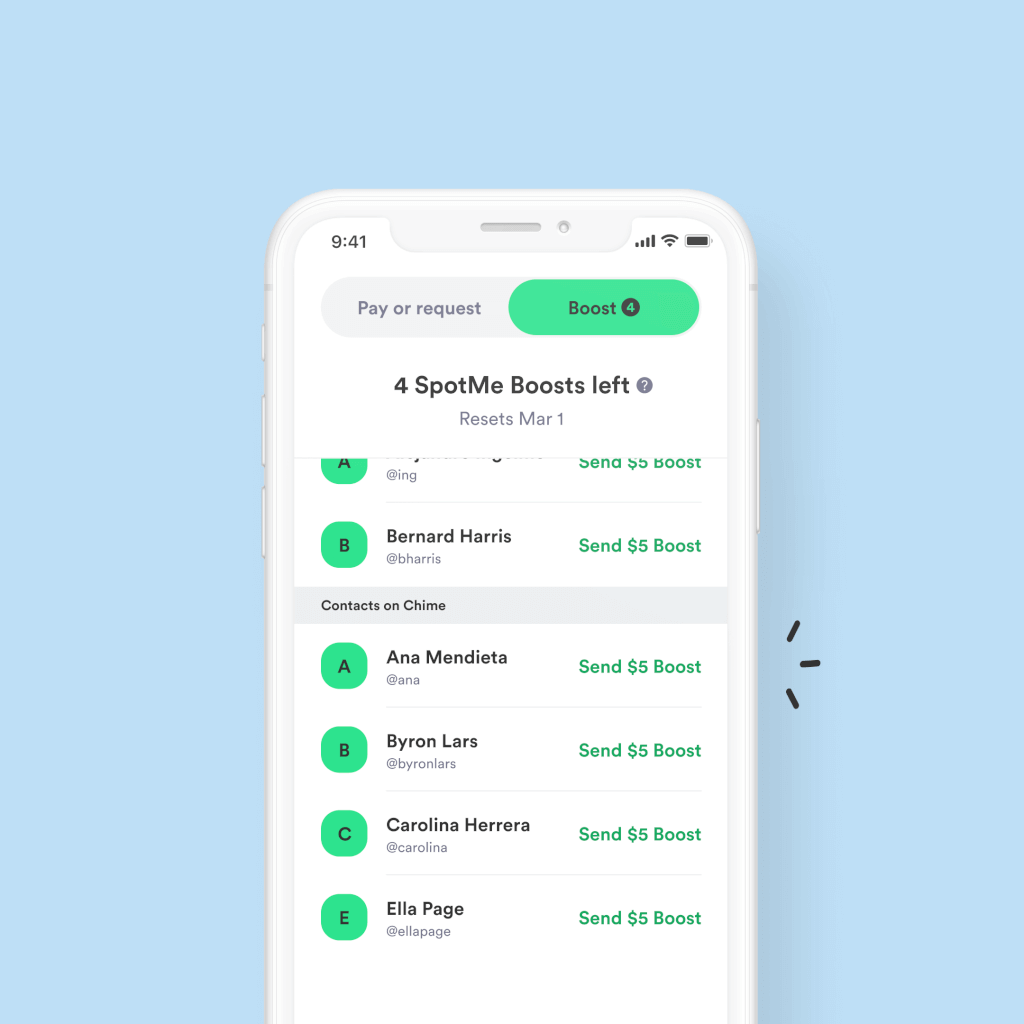

Chime SpotMe Boosts are temporary increases to the SpotMe limit. Every month, you will receive a certain number of SpotMe Boosts to send to your friends on Chime. These boosts do not come out of your limit and are meant for people who need money urgently.

saree mumtaz draping retro styles indian priyanka bollywood wear 1960s chopra 60s outfits 1960 hair drape era colours navel sarees

Contents 3 How do I change my SpotMe Chime limit? 5 How often does chime increase spot me? How do I raise my SpotMe limit? Increasing the amount of your direct deposit may also help

SpotMe Boosts are temporary increases to a person's SpotMe limit that you can send someone through the Chime app. Every month, you'll get SpotMe Boosts to send people you know on Chime, to increase their SpotMe limit. To be clear, Boosts never come out of your own limit.

mesh angel deco easy angels ribbon using projects instructions cut creation simple engel

How Do You Increase SpotMe on Chime? When you sign up for SpotMe on Chime and are approved, you will be given a SpotMe limit. This is typically between $20 and $100 based on risk factors such as your direct deposit history and the amount normally deposited.

![]()

patronus potter harry fantastic corporeal james beasts them hp mythical lexicon creature character magic

spotme delivering

To increase your Chime SpotMe limit. Launch the Chime app. What can I use my Chime spot me for? SpotMe only covers debit card purchases and cash withdrawals. It does not cover Pay Friends transfers, ACH transfers (including direct debits), or Chime Checkbook transactions.

How Does SpotMe Work? Chime SpotMe only works if you use Chime's services. As time goes on and Chime deems your account to be healthy through things like frequent direct deposits and spending activity, they can increase this $20 limit up to $100 dollars to give you a huge cushion when it

How to increase your chime bank spot me limit $200.

· How Does SpotMe Work on Chime? Chime will send you a notification inviting you to enroll through the Chime app for SpotMe once the bank sees you're receiving at least $500 per month in direct deposits. The overdraft coverage limit starts at $20, although it can be increased up to $100.

Chime Spotme - Chime has another very convenient and exciting feature known as the Chime Spot. The feature spots you whenever you need any help to bear an expense. However, the feature is only available if you receive regular deposits of $500 every month.

Chime SpotMe is not working because you do not meet the basic requirements, you haven't turned it on, you are using it to pay for your friends, your account stopped receiving Qualifying Direct Table of Contents. How does Spotme on Chime work. Why is my Chime Spot Me not working.

Spot me increase. My employer doesn't have a direct deposit option so I get checks instead. Is this going to cause longterm issues with getting increases in my spotme? I'm new to chime and was wondering is there a way for me to earn a chime credit builder account without direct deposits.

How do I increase my SpotMe limit with chime? Launch the Chime app. Tap on the Settings option. Go to SpotMe section. What is the highest SpotMe on chime? Your SpotMe limit starts at $20 and can be increased up to $100* or more based on account history and activity.

How to Increase Chime Spot Me Limit [Ways in depth]. Chime Spot Me is a unique zero-fee overdraft service from Chime, that has been gaining rapid traction. With Chime SpotMe, you can overdraw your account up to your SpotMe Limit, which can range from $20 to $200.

Answer The Question. Similar Questions. Why is my chime spot me not workin. Can I overdraft my chime car. How does SpotMe on chime wor. Can you have 2 chime account. Is chime a real checking accoun. Why does my cash APP have a negative balanc.

How much can you transfer on chime? Bank (ACH) transfers to the Spending Account that are initiated through Chime using the Chime mobile app or the website are limited to: A maximum of $200 per day. A maximum of up to $1,000 per calendar month. No limit to the number of times per