A surety bond is a contract that is made between three parties where the guarantor guarantees to fulfill the specified Surety - The Surety is issuing and backing the bond for the principal and guaranteeing the indemnification to the Now let's take an example and understand how Surety bond works.

Surety Bonds and Credit Checks. It's easy to think of a surety bond as a type of insurance in case of the worst-case scenario. As you're researching the average bond premium and how to get bonded in your state, keep in mind that some companies simply have more resources and flexibility when

How to get a license. A surety bond is a promise by a bonding company to pay all or a portion of a CCB final order if a contractor fails to pay the order in order to protect consumers.

Surety bonds protect the obligee from financial harm in the event that the principal violates the bond provisions. How Can an Insurance Agent Obtain a Surety Bond? BondExchange makes obtaining surety bonds easy. Simply login to your account and use our keyword search to find your bond

is the association of and resource for surety bond producers and allied professionals. NASBP producers specialize in providing surety bonds for construction contracts and other purposes to companies and individuals needing the assurance offered by surety bonds.

01, 2020 · Welcome to the LSNJLAW SM website, provided by Legal Services of New Jersey (LSNJ). LSNJ is a 501(c)(3) nonprofit offering free legal advice to low-income people in New Jersey. Find legal information by clicking on a legal topic …

For information regarding surety bond producer processes, see the Surety Bond Producer page. What do I need to do to get started? Step 1: Request a Surety Company account in NMLS. Create an association with each surety bond producer that will be authorized to create bonds on your

Q: How much does it cost to get a surety bond? A: The cost of your surety bond will vary depending on the type of bond and the amount of bond coverage you need. is licensed to issue bonds in all 50 states. Call 1 (800) 308-4358 or submit a request for a quote and our

How does a surety bond in New Jersey work? Surety bonds are a form of financial guarantee. Viking Bond Service is a leading supplier of surety bonds in NJ. We have many years of experience helping clients in New Jersey get the surety bonds they need when they need them.

Surety Company is a leading provider of notary bonds. We’re licensed in all 50 states and territories and make it easy to obtain your I-Bond® (instant, online surety bond). Professional Liability (E&O) Insurance is now available for notaries from Colonial.

Whether you're getting a surety bond for the first time—or getting different policies as your business grows—it's important to understand how bond costs work. Surety companies assess the level of risk by the bond type and the applicant's financial history. A bond type with higher risk plus an applicant'

![]()

surety bonds

25, 2015 · • A rider or endorsement to your Notary bond from the bond agency or surety, and • A $20 filing fee. All four of these items must be sent at the same time. Instructions are provided on Form 2305. Hotline answers are based on the laws in the state where the question originated and may not reflect the laws of other states.

How Surety Bonds Work. There are three parties involved in a surety bond: the principal, the So the obligee is the beneficiary of the surety bond in the sense that the principal is making a promise If you get a bond for $10 million that is not reflecting as part of your reduction in the availability

Find out how you can get the surety bond you need from ! Various states require a surety bond in addition to the license and each state has bond language that covers specific obligations, such as ensuring tax or wage payments are made.

How to Get Bonded. Bonded and Insured. Surety Bond Companies. Bryant Surety Bonds, Inc. is a surety bond agency based in Pennsylvania. Licensed in all 50 states and with access to over 20 T-listed, A-Rated bonding companies, we have the contacts, expertise, and top service to provide

a State to Find Your Surety Bond. No matter the surety bond you need, sets the standard in getting you bonded quickly and easily. Our team has compiled the most comprehensive list of state, county and city-specific surety bonds online—allowing you to find your exact bond in minutes. Find the bond you need by selecting ...

example, if you get quoted a 5% rate on a $10,000 bond, you will pay $500 for your surety bond. The actual bond amount, and the percentage, will vary depending on your industry, your company's reputation and credit rating, and even the surety company's assessment of your ability to uphold your end of the agreement.

paterson bonds

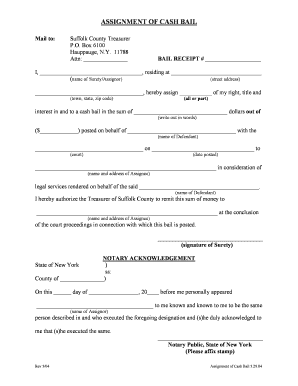

form bail fill bond bay bonds 2006 area blank pdffiller application forms printable

garfield office

by Nexus is a Company that Helps Immigrants in Detention. Libre can help: 1-888-997-7646

permit license babilonia

How Do I Get Bonded? Mortgage Broker Bonds in New Jersey Explained. In essence, a surety bond is a contract between three entities. Your mortgage brokering business is the principal that needs the bond.

A surety bond is an agreement that guarantees that a project will be completed or that terms will be met. Understanding how it works will help you Anyone seeking a contract bond will likely not be able to get around the credit history analysis. Not having the best credit score will likely make

A surety bond can help small contractors compete for big contracts. Here's a guide to surety bonds, how they work and how to get one. Surety bonds can be used to ensure that government contracts are completed, cover losses arising from a court case or protect a company from employee dishonesty.

Locally Owned Bond & Surety Agency in Hackensack, New Jersey. Bonds can be a difficult and arduous process. Allow our knowledgeable and friendly staff to help you through it with great rates, quick turnaround time and possible same day service.

Surety bonds can be confusing. In this article we answer some of the most frequently asked questions regarding surety bonds. 4 What Kind of Financial Statements are Required to Get a Surety Bond? 5 Can I Get a Surety Bond with Bad Credit, Bankruptcy, Judgments or Liens?

bonds jersey surety bond nj

A surety bond, also known as a contract bond or contractor bond, may be required by the owner of a project and will be described in the project specifications. Information on eligibility, surety bond cost, and how to apply The application process always begins by contacting an SBA-authorized agent.

Surety Solutions is more than just a surety bond agency. We truly care about educating people about the surety bond process from start to finish. Whether you are looking to get licensed for the first time or you're just looking for general information, we are here to help with our short, quick videos.

, a surety bond serves as a guarantee that your business won't engage in unethical conduct. That can include everything from misrepresenting a vehicle's condition to not paying sales taxes. State law will determine how much your bond needs to cover, but amounts can range anywhere from $10,000 to $100,000.

Get a free surety bond quote. The three things you will be evaluated on to determine your surety bond rate are credit history, experience, and finances. Experience - Your experience with past surety bonds and past obligations determines how much you'll pay for your bond. You will be

Surety bonds include three-party agreements, whereas traditional insurance policies have only two-way agreements. In fact, a surety company does not expect to suffer losses or damage; if a surety pays out as a result of a claim, the bonded contractor must repay the Bankruptcy question in NJ?

How Surety Bonds Work. This article is the second installment of an abridged version of Federal Publications' A surety must decide how much work a contractor can perform profitably in order to set a bonding limit Visit the surety bond learning center to get your surety bond questions answered.

How do Surety Bonds work? With a surety bond, your company makes a payment to the insurance company and in return for this payment, the insurance You may be required to purchase a surety bond in the following situations: When bidding on government construction jobs, some federal,

A surety bond—also known as a probate bond, an executor bond, or a guardianship bond—is a contract or agreement If you are acting as an executor of the estate and you need a surety bond, you might consider contacting a professional bonding company or an insurance company to get one.

Click here to get a Surety Bond. Surety bonds usually do not terminate until the obligation has been fulfilled or completed. So how exactly is the underwriting done on surety bonds? Each company has its own guidelines and criteria but the same basic factors are taken into account by

Surety Company is a direct writer of ERISA bonds, surety bonds, fidelity bonds, fiduciary bonds, license and permit bonds, and insurance.

Getting one requires a surety bond provided by a licensed surety lender. For a small fee (usually under $100), the lender promises to cover any If you choose not to get the surety bond within that time, you'll have to get a new letter from the DMV. How Long Does It Take to Receive a Bonded Title?

How does NJ A 1285 affect build contracts in New Jersey? Traditional build contracts are awarded using a design-bid-build system, where Eric is the Chief Marketing Officer of JW Surety Bonds. With years of experience in the surety industry, he is also a contributing author to the surety bond blog.

Like most bonds, these surety bonds act as a guarantee to the obligee. They simply make sure that the principal is able to perform its job correctly and You can also learn how to raise your surety credit. It is possible to get bonded with a low credit score, and the surety agency will help you do so.

$10,000 Surety Bond is required in your business name and address with an expiration date coinciding with the licensing year. Violations. The Chief Administrator of the MVC may suspend or revoke your dealer or leasing license or registration privilege for non-compliance at any time under the statutes and regulations that govern their issuance.

Surety bonds provide a kind of insurance guarantee that the bondholder will follow the laws or meet requirements outlined in a contract or agreement. Some municipalities require contractors to obtain license and permit surety bonds to ensure workers meet building codes.

Surety bonds are not insurance. Surety bonds provide a third party guarantee that a Principal will perform an obligation. A surety company will look to be made whole should there be a loss. Insurance assumes there will be losses and charges a premium accordingly. Insurance losses are paid regularly.

bail receipt bond form blank fillable forms template county fill printable cash pdffiller suffolk

alfano godspeed

State of New Jersey, guarantying full and faithful completion of improvements approved by the approving authority, in lieu of completing the required improvements prior to the granting of final approval. estimate shall be the limit of the surety's obligation under this bond in any case.