By accepting credit and debit cards at your store or website, you become an integral part of the payment system which is why it is important that you understand the card transaction process: what it is, how it works and who else participates in it.

2 Credit Card Data. How Corporate Card Transaction Files Are Processed. Options for Deciding Who Pays the Corporate Card Issuer. How Accounting Entries for Corporate Card Transactions Are Distributed. Steps Your Administrator Takes to Receive Transaction Files from a Card Issuer.

Learn what a credit card processing fee is, what goes into it, how fees affect your rate, and how you can reduce your transaction fees. Credit card processing fees, also known as qualified merchant discount rates are the fees a merchant pays for each credit or debit card sale.

Force is a special transaction in credit card will use the force credit card transaction when you can't get authorization the normal way. This can be, for example, when the credit card charge amount is large and the credit card company wants to talk to the merchant

If you have identified a transaction on your Westpac credit card statement or online banking and you don't think it should be there, here's a guide to help If your transaction can be disputed, scroll down further to find a three step process to follow. As mentioned in the three step process, it's always

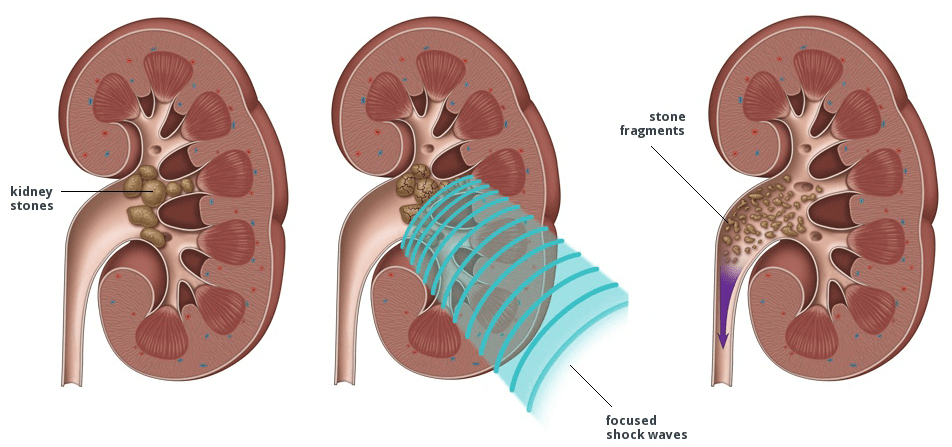

kidney stone stones health care services nursing

How Much Does a Credit Card Cost? Credit cards can be totally free to use — you just have to make sure you're using them responsibly in order to avoid Foreign transaction fees: Charged when you conduct a transaction involving foreign currency (find cards with no foreign transaction fee here).

This article explains how a credit card transaction is process using the example of VISA. Transaction processing involves the routing of payment information Authorization is the process of approving or declining a transaction before a purchase is finalized or cash is disbursed. Clearing is the process

How Credit Card Processing Works - Transaction Cycle & 2 Pricing Models.

How a credit card is processed. Because credit cards are now a common form of payment, most people are familiar with how to use one. 4. The credit card network sends the credit card transaction information to the cardholder's issuing bank and requests a payment authorization.

How are pending credit card transactions dropped or declined, and who decides? For card swiping transactions at a merchant store, a cashier or customer service representative may be able to "You" being the credit card processor issuing s chargeback: The merchant gets charged a chargeback

You will use the force credit card transaction when you can't get authorization the normal way. This can be, for example, when the credit card charge Force transactions are only supported in A/R Credit Card Transaction Handle. You can't process a Force transaction on the Order Billing

chill force

1. How to Enable Online transactions on your HDFC Bank Credit Card: A Step-by-Step Guide. As per RBI guidelines to encourage secure Online transactions, it is mandatory to temporarily disable Online usage service on Credit Cards for customers who have been inactive for the service or have

wrld

Few simple steps on how to account for credit card transactions in ProfitBooks accounting software. The transaction basically is, we use credit given by bank for making the payment, during the entire month, and then we repay the bank the amount due once a month by the due date.

A credit card purchase (sometimes called a sale) is the most common and straightforward transaction type. Wanting to receive payment for a Insider Intelligence released a list of their biggest forecasting shocks from what they had originally predicted in February 2020 to how the year actually unfolded.

Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at each stage, and a failure (or partial failure) in either step can The second part of how credit card transactions work is clearing and settlement.

A credit card decline code is a two-digit alphanumeric code that indicates the reason why a credit card transaction was declined. Merchants may benefit from keeping a reference sheet on hand with a list of decline codes and instructions for employees on how to handle each.

How credit card transactions work isn't as complicated as you may believe. Here's what happens during a credit card transaction. Barri Segal is a staff reporter at with 20-plus years of experience in the publishing and advertising industries, writing and editing for all

Any transaction made with your Desjardins credit card is authorized before being posted. No law or agreement biding you to Desjardins Card Services forces you to provide ID when you use your You can use any Desjardins credit card to make PayPal transactions. If you are using PayPal for the

Check on your credit card transactions in real time, using the CIBC Mobile Banking App or CIBC Online Banking. CIBC uses cookies to understand how you use our website and to improve your experience. This includes personalizing CIBC content on our mobile apps, our website and

How do contactless transactions work? To conduct a contactless, tap-to-pay transaction, tap or hold your card 2 inches or less from the Contactless We don't charge foreign transaction fees on any of our credit cards; however, we do charge $ for obtaining cash advances using non-Navy

How To Remove Collections From Your Credit Report. Acquiring banks and card networks charge a merchant a small fee for each credit card transaction. Because of this, merchants may require a minimum charge if a customer wishes to use a credit card to make a purchase.

The credit transaction (TRXTYPE=C) refunds the specified amount back to the card holder. A credit transaction can contain a reference to the original Card associations have made changes to how credits are issued as cardholders have become aware of how quickly their online banking account

How to choose a credit card processor. In general, credit card processing or merchant services companies structure their fees in two different ways: Transaction fee: You're charged for the service per each fit for businesses that aren't doing a ton of credit card transactions.

Do you need a credit card transaction reversed? Learn what transactions can be disputed and how to do it to increase your chances of getting your money back. Learn how to dispute transactions with your bank. Updated Jan 11, 2021. Fact checked.

If you paid with your ASB credit card or Visa Debit card, we may be able to help. In certain circumstances, you can dispute a transaction and we'll look in to reversing it for Below is everything you need to know to help resolve the issue with the merchant, or when to dispute a transaction.

force air indian officers afcat cut apply official notification exam date airmen

Identifying fraudulent credit card transactions is a common type of imbalanced binary classification where the focus is on the positive class (is fraud) class. In this tutorial, you will discover how to develop and evaluate a model for the imbalanced credit card fraud dataset.

As long as you have a credit card with no foreign transaction fees, notify your credit card company of your travel plans, and only pay for purchases expressed in terms of the local currency, you should be able to avoid post-trip credit statement surprises. "How to Avoid Foreign Transaction Fees."

Credit Cards Credit Cards 101. How Credit Card Transactions Work. The credit card issuer sends back an authorization response for the transaction. If your credit card is declined, you won't get a reason at the point of sale, just a message that the card was declined.

How do credit card processing fees work? Naturally, interchange fees will be much higher if the customer uses a credit card for a purchase. Card-Present VS Card-Not-Present: Retail transactions where the merchant can verify the customer's identity and inspect the credit card present a

A card dispute is when you've used your credit or debit card to buy something but it's not as you expected, so you want to get your money back. If you don't recognise a transaction or feel that you've been targeted by fraud or a scam, please read our helpful sections on our how to report