Using a range bound trading strategy is another way to trade. Financial market prices tend to either Markets that do not tend to remain stationary are the major US stock indices and major FX pairs. Price ranges can also be found in smaller time frames, and some traders will trade small ranges

The "mode" parameter specifies how out-of-bounds indices will behave. Sets [n] = values[n] for each n in indices. If values is shorter than indices then it will repeat. If values has some masked values, the initial mask is updated in consequence, else the corresponding values

Find stock with the lowest RSI and MACD values. These lowest values should be in the range of +/-x bars from each other. Following diagram is sample representation of aforementioned condition.

To find the range, follow these steps: Order all values in your data set from low to high. Subtract the lowest value from the highest value. How useful is the range? The range generally gives you a good indicator of variability when you have a distribution without extreme values.

After finding a range-bound market using the daily chart, the next step is to pinpoint support and resistance levels. In the example below the USDCHF started to move within a range-bound as indicated by the ADX indicator. Later on, it formed a support and resistance at the bottom and the

Our solution - how we define breakout stocks. We use the 5-day range, as defined by the highest close and lowest close over the last 5 trading days. We qualify breakout stocks when today's price has crossed above the latest 5-day trading range by at least one standard deviation.

A range-bound trading strategy focuses on sideways price action, and stocks that swing back and forth between two prices after they've stopped following a certain trend. These are referred to as a "range-bound" stocks. Fun fact: Range trading is especially popular among forex traders.

Find out how to trade in a range, benefit from the price's fluctuations within the range by selling at the How to start trading? If you are 18+ years old, you can join FBS and begin your FX journey. forex exchange microsoft interview stock forex indicators mt4 lifestyle mxn trading strategy

covid need beat apps caption venturebeat width class span bbp low

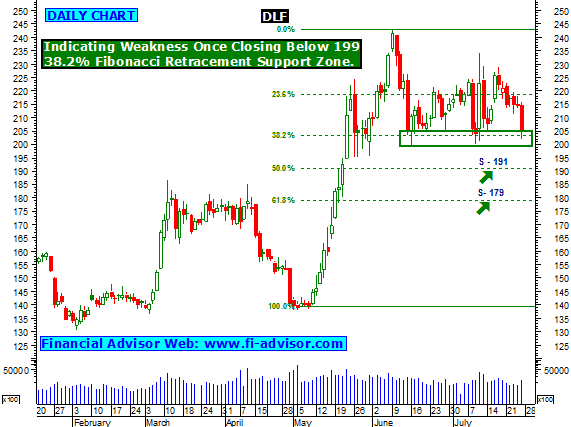

dlf intraday

These are range bound stocks and lack any direction. These directionless stocks only only force Hope the above example gives an idea on how to differentiate trending and non trending stocks. You can find the trend of stock by going to NSE to Live watch and the nifty is

Learn how stocks trade within a range and how your chosen indicator is able to lead these buy and sell signals. The other challenge with range trading penny stocks is their level of volatility. If the stock were to break You may find trading breakouts or another pattern better suits your need,

StockFetcher Forums · Filter Exchange · Range Bound Filter. << >>Post Follow-up. miketranz 900 posts msg #84184 - Ignore miketranz. 12/10/2009 11:27:32 PM. Chet or Eman,is there a way to produce a filter that will show stocks stuck in a 10 day range bound pattern?

Knowing how to trade these markets can lead to profits. Resistance refers to a price on the upside that temporarily stops an uptrend. On a stock chart, support and resistance levels can be drawn as horizontal lines. Ask an Expert about How to Trade a Range Bound Market.

does anyone know of any good range bound bound optionable stocks? mainly for trading iron condor. 1- First find subreddits like WallStreetBets or ShortSqueeze and YouTube channels that talk about Learning to trade is like learning how to play an instrument. You don't watch a Youtube

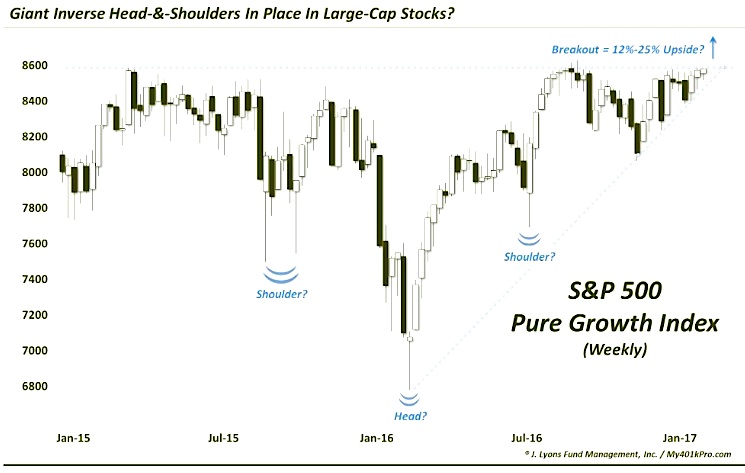

cap growth stocks chart poised breakout

This list shows stocks with a range which has been shrinking for at least 2 consecutive days. A stock's range for the day is defined as the day's high minus the day's low. The symbols whose ranges have been shrinking for the most consecutive days are shown on top.

Business News › Markets › Stocks › News ›How to trade in a range-bound market. Mumbai: India's benchmark indices are likely to remain in a narrow trading range for want of a definitive directional trigger. To make money in such an environment, derivative analysts are advising their clients to

Banknifty finding base from last 7 trading sessions and didn't break previous low. And from last 7 days it is range bound also in wider range. Immediate resistance is placed at 35350 let it break then we can see 35550 and 35700 level. On the flip side 35000 will act as a strong support for this bounce back.

stationery shopping card stores cards nyc gifts york office supplies

penny stocks india research oct highlighted wealth economic team 9th yesterday october

mestron malaysiastock myeg

hope you find it useful. And here is how it works. Basically I'm first calculating the length of the resulting array and create a zero filled array to that length range(start,end,step): With ES6 Iterators. You only ask for an upper and lower bounds. Here we create one with a step too. You can easily create

Well organized and easy to understand Web building tutorials with lots of examples of how to use HTML, CSS, JavaScript, SQL, Python, PHP, Bootstrap, Java, XML and more.

Technical & Fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. TTM Depreciation. No elements found. Consider changing the search query. List is empty. Range bound stocks. New: LIVE Alerts now available!

The range-bound movement usually occurs at the end of a large move as the bulls and the bears fight over the direction of the next move. Whenever a stock or index is trading between support and resistance it is called Range bound. There is no strong move in either direction.

jsw intraday

How to Trade Range Bound Markets. Instead, an alternative way to trade a range bound market would be to look at the top of the range as a selling zone and the bottom of the range as an These trading opportunities would be found by using fresh levels at the extreme foundries of a broad range.

Range-bound trading is a trading strategy that seeks to identify and capitalize on securities, like stocks, trading in price channels. A range-bound trading strategy refers to a method in which traders buy at the support trendline and sell at the resistance trendline level for a given stock or option.

Learm how to create Stochastics Scanners using guide teaches you everything you need to know. Since the stochastics oscillator is a highly accurate signal in range-bound markets, traders can easily incorporate it into scanners to find potential trading opportunities.

A Range-Bound market is a condition where there is a price congestion within a range on the price chart. This means that the general price action is Some traders refer to a Range Bound market as Price Consolidation, Congestion Phase, or Flat Market. In simple terms, when a Forex pair is

Range-bound markets can be frustrating to trade but knowing when and how to time a breakout can be Furthermore, you might find you prefer to trade ranges. Just because most traders like trends At play you have a range-bound stock with reasonably well-respected support and resistance

Stock traders generally despise this type of market activity, but options traders have several Overall, the iron condor strategy is designed to take advantage of time decay, with the trader typically betting on the underlying shares to remain range-bound through option expiration. No Results Found.

Range trading is an active investing strategy that identifies a range at which the investor buys and How are moving averages used with a range trading strategy? Stocks and other investments can If you think you've identified a range bound trade, you might consider placing a buy order close to

What is a Range-Bound Market? Partner Center Find a Broker. A range-bound market is one in which price bounces between a specific high price and a low price. The high price acts as a major resistance level in which price can't seem to break through.

In previous articles I've written on Seeking Alpha, I have mentioned the 'strangle' options trade to play high volatility stocks around earnings releases.