Annual PCI DSS Self-Assessment Questionnaire (SAQ)—there are 9 SAQ types shown briefly in the table below. Quarterly network scan by For more information about how Stripe helps you protect your customers' data and achieve PCI compliance, check out our docs about integration security.

10, 2020 · The PCI compliance level defines what an organization must do to stay compliant and what requirements it must meet. Four PCI compliance levels classify merchants over 12 months based on the total volume of credit, debit card, and prepaid card transactions. The critical point to note here is that payment brands define the level of merchants.

Orion Payment Systems PCI Compliance "How To" Questionnaire video.

Tips on how to answer a PCI checklist or questionnaire when using Givecloud. (Comment on whether you as an organization store it. PCI compliance requires you never store that code.) Do you securely destroy the payment card security/validation/verification code once the transaction has

Complying with the PCI DSS is required of any organization processing, storing, or transmitting cardholder data. Ensure you are PCI compliant. How to Reduce Controls and Streamline Compliance. As long as payments have existed, so too has the need to secure them.

"PCI-DSS compliance has several different Self Assessment Questionnaires (SAQs) that must For instance, e-commerce businesses who collect and store user data have to fill out a robust Although how you comply to the PCI-DSS is governed by a standard set of rules, your payment processor

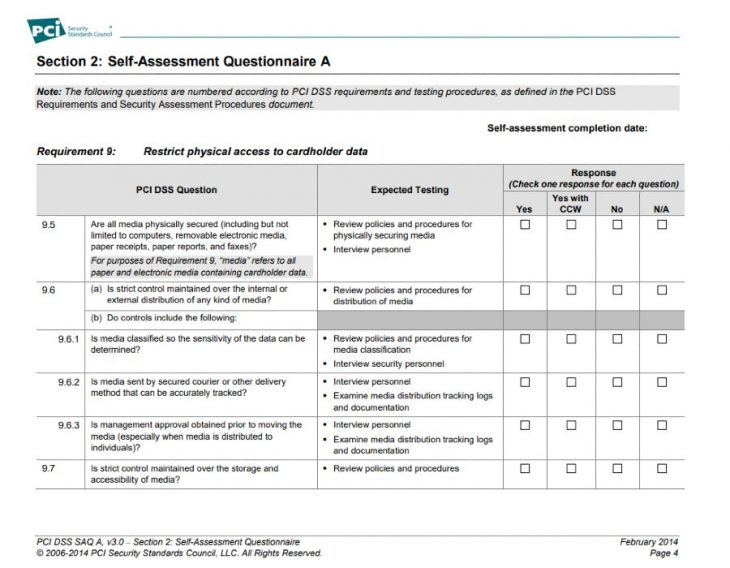

Assessment Questionnaire (SAQ) — A form that takes merchants through the steps of evaluating their PCI DSS compliance. There are different versions of the SAQ, depending on the type of business and the amount of card payments it accepts per year.

03, 2021 · To figure out which risk level your business falls under, check out our article, The Complete Guide To PCI Compliance Levels & How To Determine Your Business’ Obligations For PCI Compliance. Most small businesses will fall under Level 4 , defined as “Merchants processing less than 20,000 Visa e-commerce transactions annually and all other ...

attestation questionnaire fillable

04, 2022 · The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards formed in 2004 by Visa, MasterCard, Discover Financial Services, JCB International and American Express. Governed by the Payment Card Industry Security Standards Council (PCI SSC), the compliance scheme aims to secure credit and debit card transactions ...

your customer's data for the long-term with the PCI Smart program’s tool. Once registered, you will be guided step-by-step through the PCI DSS certification process, which includes a Self-Assessment Questionnaire and, for some merchants, a “network vulnerability scan” to help protect your business from hackers.

saq pci pdffiller signnow

A PCI Self-Assessment Questionnaire (PCI SAQ) is a merchant's statement of compliance with Payment Card Industry standards, a requirement to process credit and debit cards. However, many organizations struggle to figure out how to fill out the SAQ.

The 12 requirements of PCI compliance? How to get PCI compliant? Read our guide to learn everything worth knowing. A: Any merchant handling credit card transactions is required to fill out a specific PCI SAQ document based on the nature of the cardholder data process in place.

How Your Ecommerce Platform Affects Your PCI Compliance. Magento is not PCI compliant out of the box. In fact, thousands of Magento stores continuously experience breach as a result. Completing the Self Assessment Questionnaire (SAQ). PCI Breakdown: Time and Costs to Reach Compliance.

compliance pci ecommerce checkout hosted

Now that it's clear how PCI compliance is critical not just to protect your customers' data but to also project the trustworthiness of your business, figuring out your merchant compliance level Validating compliance is either accomplished through a Self-Assessment Questionnaire (SAQ) or

How do PCI Compliant Standards Work? Complying with PCI standards is key to inspiring trust in your customers, prospects, and business partners. The items on the PCI compliance checklist should be used in conjunction with the recommended security best practices to maximize your

Filling out a PCI compliance questionnaire is a key step towards meeting requirements. Learn about how to tackle your PCI compliance questionnaire Who Needs to Complete a PCI Compliance Questionnaire? Nearly all companies that store, process, or transmit credit card data must

There are two components to the Self-Assessment Questionnaire: A set of questions corresponding to the PCI Data Security Standard requirements designed for service An Attestation of Compliance or certification that you are eligible to perform and have performed the appropriate Self-Assessment.

PCI compliance requirements. If you have a website where you will be taking credit card numbers directly from your Ensuring that your website stays PCI compliant can help keep your customers trusting you, as it shows them It starts with the self- questionnaire, includes the scan, and

How does PCI compliance work? The details of PCI compliance can quickly get technical. However, the PCI Security Standards Council's Self-assessment questionnaires are technical in nature and can frustrate business owners, says Gary Glover, vice president of assessments at SecurityMetrics.

You must complete a PCI compliance Self Assessment Questionnaire (SAQ) once a year in order to be PCI compliant and avoid paying a monthly non-compliance fee. Even if you are not actively using eCatholic Payments at the moment, your CardConnect account is still subject to compliance.

compliance level involves some permutation of just four specific requirements. The Self-Assessment Questionnaire (SAQ), vulnerability scan, Attestation of Compliance (AOC), and Report on Compliance (ROC) are all procedures used by third-party assessors or by businesses themselves to assess PCI DSS compliance. Self-Assessment Questionnaire ...

saq process pci compliance checklist assessment level task onto classification move section select

The PCI DSS self-assessment questionnaires (SAQs) are validation tools intended to assist merchants and service · Q: How does a merchange get educated about PCI? · A: Merchants getting started with PCI · A: Any merchant handling credit card transactions is required to fill out a specificc PCI

What are the PCI compliance 'levels' and how are they determined? Do organizations using third-party processors have to be PCI DSS compliant? Determine which self-assessment Questionnaire (SAQ) your business should use to validate compliance.

PCI Compliance Getting Start Guide. 7. False Positive Requests It's possible after fixing all Your Home page shows your PCI compliance status. Your Network Scans will be marked as you are Merchants can no longer submit questionnaires online; the latest questionnaires are not visible

Question: How to complete the PCI Compliance Questionnaire in LawPay? Environment: Clio Manage Additional Information: Once you Once you have signed up for an account with LawPay, you will be asked to complete a PCI Compliance questionnaire.

questionnaire saq invoices

chesworth ekm antony cuts ups unknown deal giant start help lakeside survive britain

Pci Dss Self Assessment Questionnaire. Check out how easy it is to complete and eSign documents online using fillable templates and a powerful editor. Quick guide on how to complete self assessment questionnaire d pci security standards council pcisecuritystandards.

PCI Self-Assessment Questionnaire (PCI SAQ) is a merchant’s statement of PCI compliance. It’s a way to show that you're taking the security measures needed to keep cardholder data secure at your business. Each SAQ includes a list of security standards that businesses must review and follow. PCI SAQs vary in length.

12, 2021 · For instance, e-commerce businesses who collect and store user data have to fill out a robust, 326-question form version of the PCI SAQ (self-assessment questionnaire). For companies that leave such data collection to a third party, compliance is more straightforward (and the SAQ is a lot more concise).

PCI Compliance is a sometimes a pain to understand so here are the 12 Most Common PCI Compliance Questions and how you should handle each What if I decide not to fill out the survey? PCI compliance is only for online businesses, right? How do I report my compliance to my

Fill out a Self-Assessment Questionnaire (SAQ) and Find out what level you are Make sure you follow all recommendations for that level There are 4 PCI compliance level's, and how many transactions you process a year

Home » Blog » PCI Compliance » The Complete Guide To PCI Fees: How To Avoid PCI PCI compliance refers to compliance with data security standards set out in the Payment Card Industry This questionnaire needs to be updated annually. Failure to keep the SAQ updated is the

PCI Self-Assessment Questionnaire (SAQ) - A validation tool intended to assist merchants and service providers who are What are the PCI compliance levels and how are they determined? Fill out this form and fax it back to us at Once your PCI compliance status is confirmed, you

PCI - Uploading Your Current Certificate (You have completed a PCI compliance questionnaire with another Once you have filled out your profile you may begin the Self-Assessment Questionnaire by clicking Begin Step as To view how to schedule a scan Go to scan management by clicking HERE.

Compliance. The Payment Card Industry (PCI) Security Standards Council is comprised of the major credit card associations (Visa, MasterCard, American Express, Discover and Japan Card). ... Click the Login button below to fill out your Self-Assessment Questionnaire (SAQ) and get access to system scanning services (if applicable) and full ...

merchant levels of PCI DSS compliance. There are four merchant levels for PCI DSS compliance: Level 1: Merchants processing over 6 million card transactions per year. Level 2: Merchants processing 1 to 6 million transactions per year. Level 3: Merchants handling 20,000 to 1 million transactions per year. Level 4: Merchants handling fewer than 20,000 transactions per …

Violating PCI compliance can lead to hefty fines for you and your business. Learn more about PCI The PCI DSS Self-Assessment Questionnaire is a checklist ranging from 19 to 87 pages, created Watch out for predatory service providers that charge expensive fees but only satisfy a portion of

How to Become PCI Compliant: The 12 Requirements of PCI security standards. Fill out the Self-Assessment Questionnaire (SAQ)—the SAQ is a tool used to validate PCI compliance, which checks if your business meets each of the 12 requirements listed above (organized into 6

halock dss

How To Meet PCI Compliance Requirements For Businesses. Self-Assessment Questionnaire (SAQ). Once you have a payment processing partner integrated into your business and your security policy written and implemented, you will need to fill out a short form to certify your compliance.

Take our PCI compliance quiz below to find out. Understanding how to become, and remain, PCI compliant as well as the potential risk of non-compliance is Answer: d) Complete the Payment Card Industry Self-Assessment Questionnaire. Think of the PCI-DSS principles as the "goals" that

How do you become and maintain PCI compliance as a business in 2021? Read this guide to understand PCI compliance questionnaires. • Becoming PCI compliant not only tells your customers that you are protecting them against data breaches , but it also protects your

isv