Avoiding Florida ancillary probate can save you time, money, and keep estate records out of the public record and is easy to avoid with these tips. So how can out of state residents or foreigners who own real estate located in Florida avoid ancillary probate in Florida?

Two probates can be required if someone lived in one state but left solely owned real estate in another. She also owns a small vacation home in Florida, which she and her husband bought together years ago. Probate in a second (or third) state is called "ancillary probate," and for

Ancillary Probate in Florida. Joseph a. stusek, todd L. bradley, rani newman All rights reserved. Ancillary Probate in Florida. The situs of these types of Florida assets varies based on A Florida personal representative must file an oath to "faithfully administer the estate of the decedent"...

How to Avoid Ancillary Probate. Your mother could avoid an ancillary estate proceeding by creating a revocable trust and titling her assets in the name of the trust. Upon her death, the trust would govern the distribution of the real and personal property to her beneficiaries and her estate would not be

How Does Ancillary Probate Work in Florida? Ancillary administration follows the same procedure as a regular domiciliary estate in Florida, including terms of In order to conduct the "summary" ancillary administration, the domiciliary personal representative needs to file an authenticated or

How Ancillary Probate Administration Works in Florida. The personal representative is required to follow all Florida probate rules and provide notice to creditors. In the event a creditor comes forward and files a statement of claim, then the matter will move forward as a traditional

probate refinance communities port cofferdams

Florida Probate Process - Florida residents and non-Florida residents. Ancillary Probate questions and needs provided by Eric S. Kane, serving any Florida Ancillary Probate Administration is the process used when a resident of a state other than Florida dies owning real estate in Florida,

Learn how to file a California ancillary probate without hiring a lawyer. "A People's Choice helped us file the ancillary probate case in California and we saved quite a bit of money since California allows attorneys to charge very high statutory fees.

Venue for an Ancillary Probate Proceeding in Florida The venue for Florida ancillary probate proceedings is in any Florida county Florida Statute requires that an ancillary personal representative must be represented by an attorney admitted to practice in

In Florida, Ancillary Probate Administration is necessary when a decedent was not a Florida resident at the time of death, but owned real property in Centrally located in downtown Winter Park, minutes north of downtown Orlando, Florida the Kracht Law Firm, PA and

Boca Closings probate department handles Ancillary Probate Administrations in all 67 Florida counties. Our real estate department routinely clears title to real estate left in estates, providing a cost effective one-stop solution to your probate/real estate needs.

In Florida, ancillary probate is a common issue when a nonresident dies owning a property located in the state, and the property is As provided by Florida Probate Rule , "every guardian and every personal representative, unless the personal representative remains the sole interested person,

The Florida probate ancillary administration is the legal process required to transfer legal title for the Florida assets to the beneficiaries of the estate. If the decedent has a will: When the decedent has a will that is being probated in another state, the Personal Representative for the Estate (also

How Does Ancillary Administration Work in Florida? Once the correct personal representative is appointed, Florida law designates the proper way to the probate of The PR can file with the circuit court where the property is a transcript of foreign proceedings showing the will and the beneficiaries.

After being filed, the probate court in that county will become the primary probate court to oversee all related matters, including Another way in which ancillary probate may be avoided is by placing any property that is situated in other states into a revocable living trust. How to Probate a Will in Florida.

How to Avoid Ancillary Probate in Florida. So how can out of state residents or foreigners who own real estate located in Florida avoid ancillary probate in Florida? There are really only four options, putting the property in joint ownership, listing it as a business entity owner, using

Ancillary probate is necessary when someone who owns property in Florida but lives somewhere Ancillary administration is also necessary when a Florida resident dies leaving property in another state. If there is a creditor claim filed, then the short form must be converted to a formal

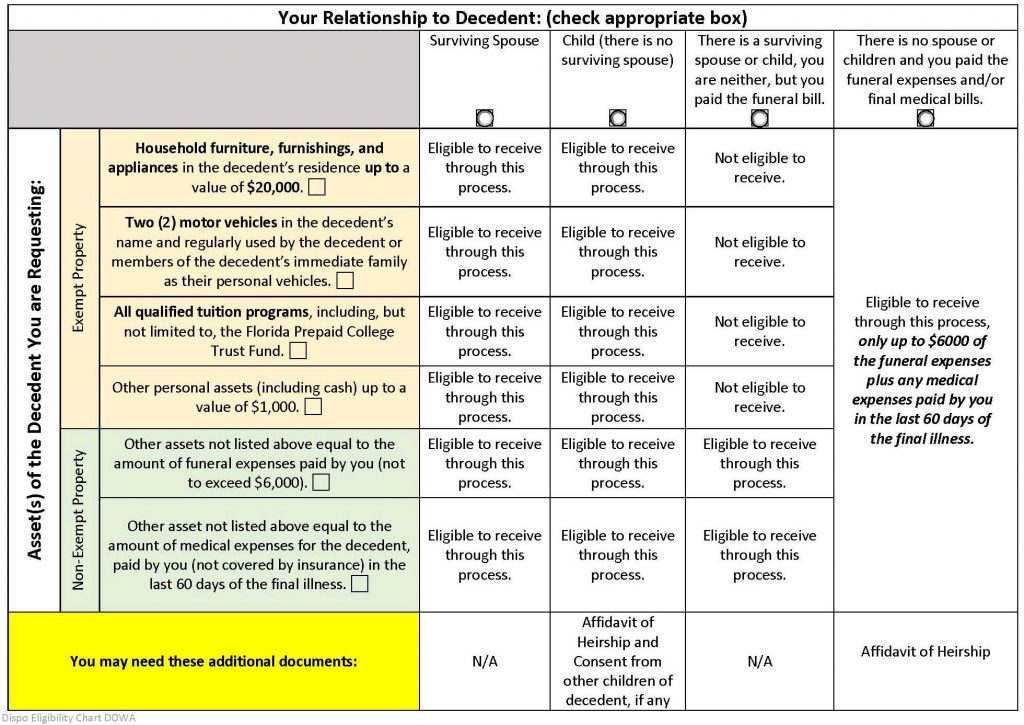

Alternatives to Florida probate include ancillary administration (which may or may not require formal administration) and disposition without administration. Ancillary administration is the administration of the estate of an out-of-state resident who leaves real or personal property in Florida, has

Probate is the legal process of transferring title of property from a decedent to his or her heirs. When probate is involved, an heir or family member must file the appropriate probate pleadings with the proper court. In Florida, you

Florida's probate laws are extensive and explicit. They have been in force since Florida became a state and are continually being updated. There are three types of administration of a decedent's estate in Florida: formal administration, summary administration, and disposal of personal

Any probate lawyer will tell you that the only thing worse than regular probate is ancillary probate For that, there may need to be a separate probate in the Florida courts. Instead, the second state may only require you to file your letters of authorization from the first state and a copy of the will.

How Long Does Probate Take in Florida? The Florida probate process takes 7-10 months. Determining which type of probate to file depends on the amount and nature of property in the In Florida, ancillary administration is the process to probate a Florida home or other real property for

Ancillary probate administrations are common in Florida, and are governed by Florida Statute section Florida Probate Law Group is experienced A "notice to creditors" is filed in a newspaper in the county where the decedent lived, alerting potential creditors that they have 90 days to file a

Florida Ancillary Probate. Helping Clients with Probate Matters since 1994. Florida is a beautiful place and lots of people retire here, or buy vacation homes and condos, or maybe buy a boat and keep it docked along the Florida coastline. It's surprising how many people own property within the

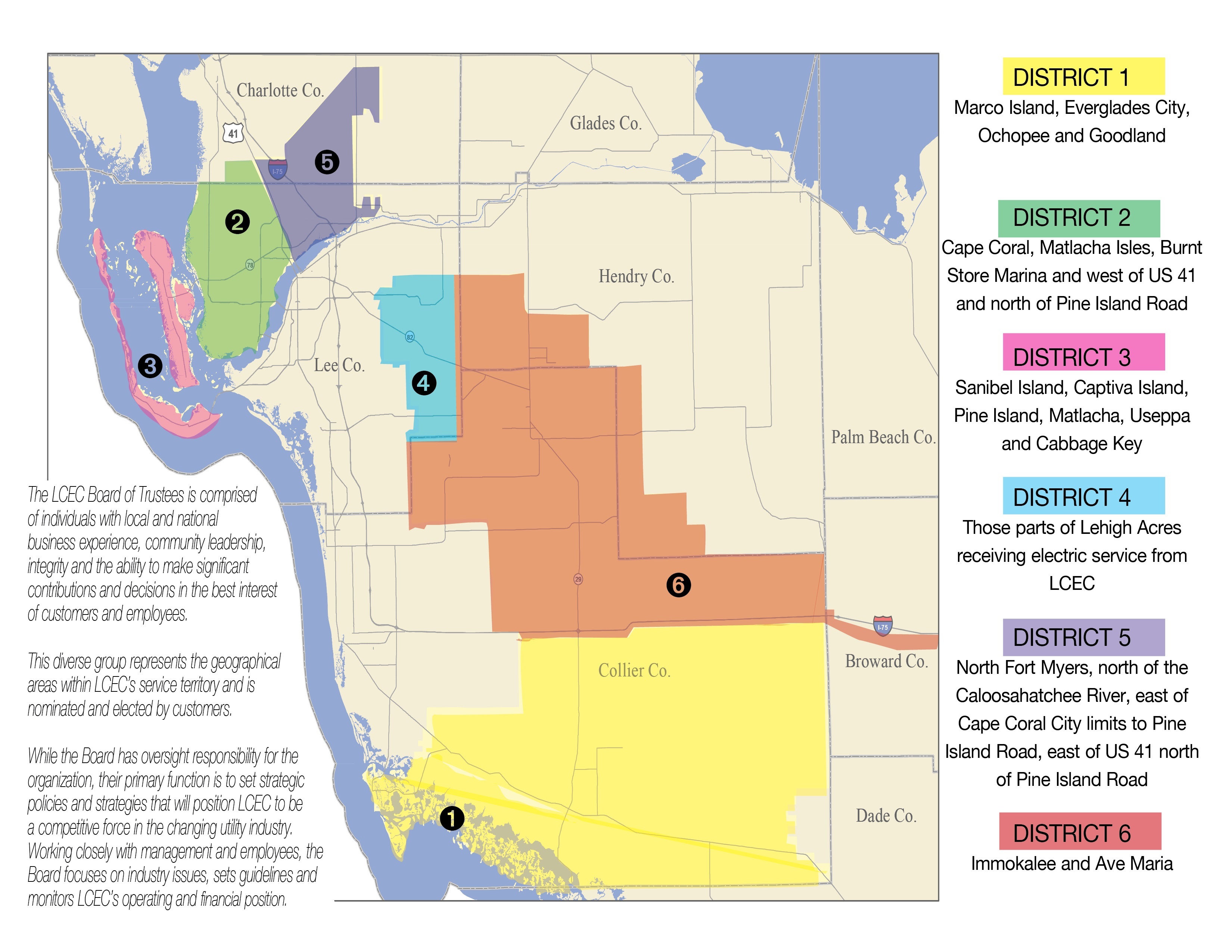

hendry county probate florida process residents lake fl non

In Florida, ancillary probate administration is defined under Chapter 734, Florida Statutes. Thus, if a decedent owes money to a creditor in Florida or another state, that creditor can still file claims in both the main probate case according to the particular state's law, or in the ancillary administration.

florida deadline visa applications 1b april employers

probate residents inverness

Understanding Ancillary Probate in Florida. Perhaps an individual lives in Massachusetts but owns a condo in Florida. Creditors have only two years to file claims against a deceased individual's estate under the applicable statute of limitations. After the two-year period, a larger estate, such as

How Long Does Probate Take in Florida? Probate isn't a quick process. It can vary on how long the entire process lasts, depending on the size of the Most estates must go through probate in Florida unless they are in a living trust or have a payable or transfer upon death attached or have a

Florida Ancillary Probate summary by Larry Tolchinsky, a Probate Lawyer since 1994. Ancillary probate typically becomes necessary when the deceased person owned real estate in Florida but If a claim is filed, the administration most likely will be converted to a formal ancillary administration.

If a non-Florida resident dies owning property in Florida, ancillary probatey administration will be required in Florida. Contact us today. Depending on how many places the decedent held assets, multiple probate proceedings may be required. A personal representative will be chosen for

How long does probate take in Florida? If you ask someone who's been through the probate process and they're going to tell you it's a long After the estate's executor has taken the estate into account, they have to file their findings with the court. All interested parties may dispute this Accounting Notice.