How Do Credit Card Processing Brands Remain PCI Compliant? Before selecting a credit card processing company, you should first ensure you understand exactly what PCI compliance responsibilities will be required of you, and what's handled by the provider.

— Lower your credit card processing fees by having our team of industry experts structure a more cost-effective program with your current processor. Benefits Include: Reduce one of your costliest business expenses

Negotiating your credit card processing fees will keep more profit in your pocket. Knowing the different terms and what processors charge can help you make an informed decision. Leave a comment about How to Negotiate Lower Credit Card Processing Fees?

18, 2021 · Eliminate 100% of your credit card processing fees. ... there are 3 steps to eliminating your credit card fees for your company that are all equally important. And if done right, these steps can literally launch your business to another level, saving you a massive amount of money in merchant account fees each year. ... Credit Card Processing ...

Credit Card processing fees can't be prevented, however the good news is they can be decreased considerably. The following are the few pleasant methods to eliminate credit score card processing fees…

29, 2021 · Big Commerce doesn’t charge any additional fees for using any of the 55 plus pre-integrated payment gateway’s and when Merchant’s add a surcharge in Elavon’s Converge gateway, they can offset and potentially eliminate most of their credit card processing fees. Zero Fee Card Payments can setup a merchant account with a cost-plus pricing ...

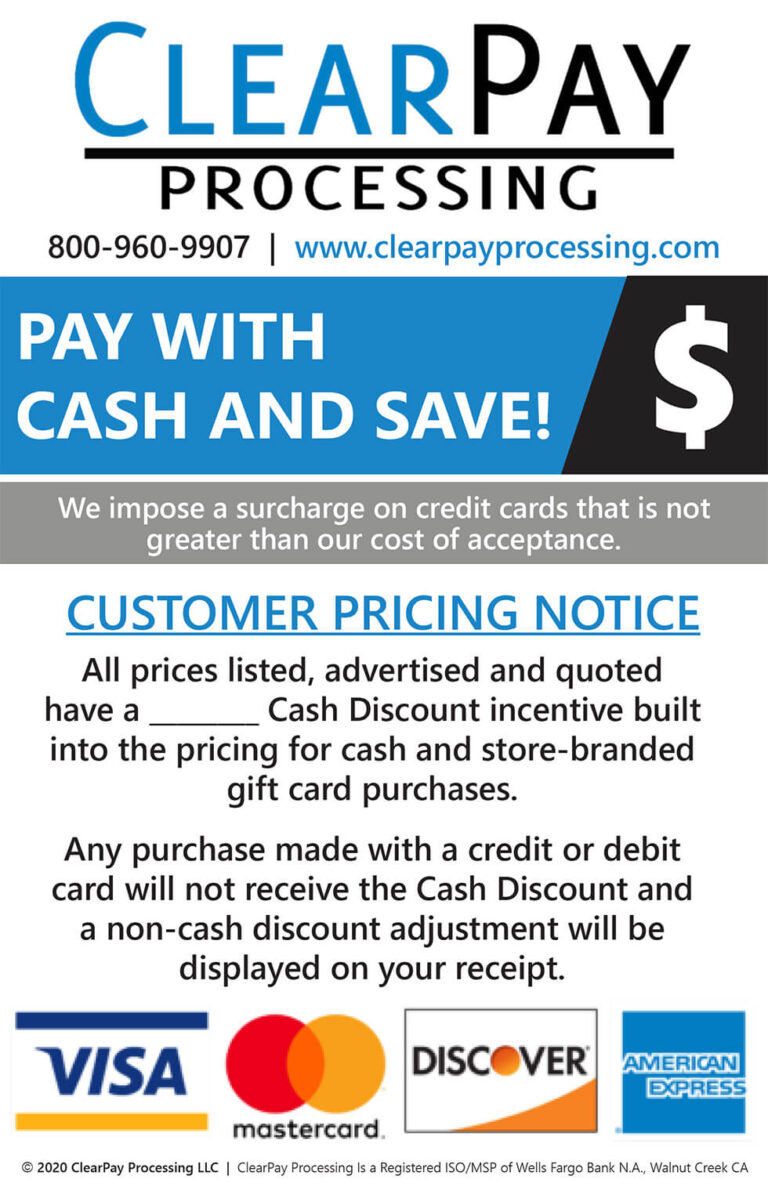

Credit card processing companies are popping up left and right offering "cash discount" programs to eliminate your credit card processing fees. How can you tell if a processor is offering a true cash discount program, or if it's a surcharge program in disguise? Look for the following

card debit virtual right airwallex screen

Learn how to set up free credit card processing and the best tools you need to accept payments online. Read the SeamlessChex blog for expert payment advice. This allows you to legally charge a percent fee on credit card users that will cover your organization's credit card processing

100% of Your Credit Card Processing Fees (Columbus) ‹ image 1 of 1 › license info: Merchant cash advances, Business funding, Business Capital. QR Code Link to This Post. Are you tired of paying costly credit card processing fees? If you answered yes, call us 24/7 at 1-866-905-8872 to speak to a live person now ...

shopify pos cash register systems 2507 credit card

quickbooks 2507

video explains how new legislation allows you to elimate credit card processing fees - forever.

My Fees lets you keep all of your profits by eliminating your credit and debit card processing fees by passing the fees onto the customer. A Non-Cash Charge is automatically implemented in each transaction made using a credit or debit card. The Non-Cash charge covers interchange costs, authorization costs, credit transaction costs, and ...

14, 2018 · If you run a good size business, after the roof over your head and employees, in most cases credit card processing fees is the next biggest expense going into the thousands of dollars a month. If you are fed up with the fees, there is a new way to lower, if not eliminate the fees all together. Here comes the cash discount program.

How To Lower Or Offset Your Credit Card Processing Fees. If the thought of sending 3-4% of your gross credit The ever-increasing cost of accepting credit and debit cards has led many businesses to look for ways to offset their credit card processing fees (or eliminate them) as much as possible.

03, 2019 · How to record credit card processing fee properly. Edit the item and checkmark the box on the left. Now you have an Expense account link and an income account link. Square is not a Customer; that isn't part of sales if it is a refund of your fee. You can enter that into the next blank line of the Make Deposit screen.

While credit cards are a great asset, they often come with numerous fees that can add up to significant charges if you miss a payment, spend over your limit or take other Below, we break down the most common credit card fees and how you can avoid them, potentially saving you hundreds of dollars.

How do businesses pass on the fee for credit card to the customers while staying compliant with surcharging rules set by the card brands.

Companies can eliminate credit card processing fees. Legally Compliant Surcharging Solution allows you to pay 0% in Credit Card Processing Fees while incentivizing Customers to use a no fee option of debit.

Discount Credit Card Processing Cash Discount Credit Card Processing: What You Need to Consider At , our industry expertise puts us in a perfect position to help you implement a complaint, fee-reducing cash discount program. But first, here are some things you should consider before integrating. Why Your Cash Discount Program Must Sync …

cash discount zero processing program pay card fees credit

03, 2020 · Platinum Choice Bancard has been helping business owners around the country eliminate those rising credit card processing fees with our Cash Discount Program! The fact is that there is no end in sight when it comes to rising processing costs and fees. Platinum Choice Bancard gives businesses the ability to continue accepting credit cards but rewarding your …

Credit card processing fees, also known as qualified merchant discount rates are the fees a merchant pays for each credit or debit card sale. This fee is predetermined by your merchant services provider and usually involves three components: interchange fees, assessment or service fees, and

Also, credit card processing companies have wholesale rates they have to pay to Visa and MasterCard. They make their money by marking up their Anyway, people told me she would be tough to work with from the start, but I didn't really care because that money eliminated almost all of my debt.

25, 2019 · If customers pay with a card, they’ll pay an additional 4% processing fee. The first customer checks out and uses their card. The terminal prompts them to accept the total with the 4% fee applied. The transaction goes through, adding the processing fee. This cancels out your processing costs for that purchase.

You can charge your customer the credit card processing fee by adding this to their invoices. Thank you for joining the QuickBooks Community, cmaddox. The ability to set up a credit card processing fee to be a percentage of the subtotal and automatically list it on all invoices and

How Credit Card Processing Works. The act of making a purchase using a credit card triggers a complex process where data is sent from the Costs and Fees Associated with Credit Card Processing. According to the Pew Research Center, 3 out of 10 US adults make no cash

Common credit card fees and how to avoid them. "Consolidating a loan can make it easier for individuals to stay up to date with their payments by putting all of their monthly payments into one payment," said Karra Kingston, a bankruptcy lawyer with Karra L. Kingston Esq., in Staten

Processor Fees With Our Qrev Program. Wouldn’t it be great if you were free to spend hundreds — even thousands — more on the growth of your business and NOT on fees the banks try to pin on you? Quantum’s Qrev Program puts the ball back in the merchant’s court. You could process unlimited payments starting at only $20/month.

Recurring credit card processing fees. In addition to the processing rates you pay for each sales transaction, most companies charge fees for account maintenance. How to negotiate credit card processing fees. Before you sign up with a processing company, bear in mind that most rates

Every merchant faces credit card processing fees. There's one thing merchants can't eliminate - credit card processing fees. As they decide to work online or get a POS in the offline store, this term will follow them during their journey.

quickbooks

If you have credit card debt, then there are several simple steps you can take to eliminate it in less time. 1. Pay Off the Highest Interest Rate Card First. Paying off the highest interest card first is the fastest way to eliminate your credit card debt and reduce your monthly interest fees.

Legally eliminate credit card debt using these smart tactics. Although their payment process is complex, you'll know before every delivery how much money you will make. If you're going to work as a driver to make extra money, why not work for one of the fastest-growing delivery services in the country.

Your Credit Card Processing Fees Share Fees With Your Customers Start Saving Money Instantly! You Only Pay $! Check Out How It Works! Process Card Transactions Online & Face to Face. Start accepting card transaction both online and in …

Processing fees can eat away at your bottom line. Learn how credit card transactions are processed and how fees are calculated. In the simplest terms, credit card processing fees are the fees credit card companies charge to move money from a customer's account to a merchant's account.

> Receiving money (Archive). > How to eliminate credit card payment option? Is there anybody out there who could show me a way to disable credit card payment option for my PayPal account? I could do it because of chargebacks, which not only steal my money but also bring extra fees.

09, 2018 · There is a way that you can, in effect, pay 0% processing fees and pass savings on to your customers. Here’s how it’s done. Let’s start by being clear. There is a processing fee that credit card companies charge for credit card transaction to take place. That fee is how they make money on a transaction, and it will always be there.

If you've started researching how credit card processing works or been looking into a new merchant service provider, you've probably stumbled upon interchange rates. Though processing fees are composed of a number of different factors, interchange rates make up the majority of the fees

This video will show you how to effectively eliminate your credit card processing fees using the cash discount program.

How to Reduce Credit Card Processing Fees. Be vigilant regarding potential downgrades and compliance fees. Downgrades happen when a merchant does not achieve the best interchange rate for a transaction and is assessed a higher rate to process this transaction.

help business owners to eliminate 100% of their credit card processing fees including monthly fees, percentage fees, transaction fees, and Skip to content

06, 2020 · Credit card processing – merchant fees – charge way too much for small businesses. I want a $250 flat monthly rate for processing customer credit cards in my Cafe. I pay a flat rate for my cell phone, my internet provider, and my rent.

05, 2020 · Tip #1: Set a firm minimum for consumers who use credit. To reduce the damage caused by credit card processing fees, some merchants up the ante in terms of how much their customers must spend. In other words, they set a minimum for each transaction they process with credit, say $10. When faced with a purchase minimum to use credit, consumers ...

03, 2020 · business strategy eliminate processing fees processing fees small business owners Nov 03, 2020 In this video, we will talk about how we're eliminating all credit card processing fees across the boards for all merchants.

11, 2021 · Credit card processing fees are a cost of doing business that most companies can’t avoid. Whether they’re buying products or services, consumers, businesses and government agencies often prefer paying with a credit card. And as a result, credit card purchases may account for 65 to 100% of a company’s sales and thousands of dollars in ...

Credit card debt is an unfortunate reality. The Federal Reserve reports that the average household has over $16,000 in credit card debt. If want to know how to eliminate credit card debt legally and quickly, here are Many of these cards will charge a fee of 3-4% (of the total being transferred)

A brief history of credit card processing, how a credit card is processed and what merchants need to know about compliance, fees and security. History of Credit Card Processing. How a Credit Card is Processed.

Other Credit Card Processing Fees & Costs. Merchant service providers also charge consumers monthly fees and minimums. The costs are vary widely from provider to provider. Below we highlight how different these merchants can get by breaking down the additional costs of Cayan and First Data.

31, 2019 · With Zero Cost Credit Card Processing, your customers will pay a fee for certain credit card types, but they will always have the option of paying with a debit card to avoid fees altogether. This takes the cost of processing off of your shoulders while still giving your customers a certain degree of flexibility. Stop paying for other people’s airline miles.

01, 2022 · Credit card processing fees can be cut down by either raising prices or offering discounts to those who pay in cash. The networks’ rules that you accept should also be checked for changes that could reduce or eliminate credit card processing fees. If you want to offer discounts on your products, consider passing the card processing fees to ...

cheapest credit card processing for small business is called Zero Fee Processing, offering the lowest credit card processing rates with free equipment. Low cost credit card processing is what most business owners look for, but credit card processing with no fees is the only truly cheap credit card processing for small business.

Short video explains how new legislation allows you to elimate credit card processing fees - forever.

time you take a credit card, you're getting gouged with fees. As independent payments industry experts, we are dedicated to helping you eliminate credit card processing fees and the tens of thousands of dollars you lose every month. We guarantee you'll love the savings.

14, 2012 · In fact, of all registrations through LeagueApps contain a processing fee. These fees vary, usually between $1 – $5 per registration. Many organizations use processing fees to roughly cover the costs of credit card charges that hover between Processing fees are not a fit for every organization.

most popular solution available for business owners who want to eliminate credit card processing fees. • No Contract • No Monthly Program Fee • No Hidden Fees • Next Day Funding. CLICK HERE to ELIMINATE PROCESSING FEES. NOT QUITE READY TO JUMP IN & ELIMINATE 100% OF YOUR END OF MONTH PROCESSING FEES?

26, 2020 · A cash discount program is a way of passing debit and credit card processing fees to your customers. It’s adding a small service fee on all transactions except cash or check payments. This program allows the business owners to accept the credit or debit cards but without the loss in fees, which is usually 3 to 4%.

Credit card debt can come with high interest rates that make it expensive and hard to whittle down. Avoid debt settlement companies that charge upfront fees or make grand promises. No one can guarantee that your creditors will agree to your proposal, and it's not likely that you'll settle

08, 2019 · This is because the credit card processing fees are charged every time you do a transaction. Yes, you are correct. When you process an invoice for $5145 (invoice amount and credit card processing fee) you'll still be paying another which would be a total of $ That said, you won't be able to receive the full invoice amount.

processing payments

Credit card fees vary widely by provider and pricing structure, but in general, they're to of the transaction. Here's how you can save. How much will I pay in credit card processing fees? Use this calculator to see how monthly payment processing costs will vary based on transaction

Fees - The biggest reason businesses switch over to our program is the elimination of all of their credit card processing fees. 2. Keep Profit Margins Consistent - Traditional processing fees are charged as a different percentage depending on the type of card used.

30, 2019 · KUALA LUMPUR: Low-cost carrier AirAsia said on Tuesday (Jul 30) it will no longer be charging customers who make payments via credit card and online banking a processing fee. “We (will) still ...

Are credit card processing fees the cost of doing business? We'll explore how much fees are costing you and how to stop paying for them. However, if you accept credit card transactions, then you need to pay processing fees. Credit card processing fees take money off your bottom line.

Do you have mounting credit card debt and need a plan to get out from under it? Team Clark helps you map your escape within one year. Finding that extra $160 each month could eliminate your debt in half the time! Step 4: Consider Applying for a Balance Transfer Credit Card to Expedite the Process.