How to do payroll for small businesses. Lima Al-Azzeh — Oct 6, 2021. All to say: setting up a payroll process for your company is a necessary task, but it doesn't have to be a daunting one. Here are the six basic steps to getting your payroll process up and running.

• Part 1, Setup, describes how to set up Payroll, including department and position codes, pay codes, workers' compensation codes and local and To do this, the regular pay code hours are multiplied by the overtime hours and divided by the total regular hours to determine the total number of

Setting up payroll and PAYE is one of the most important processes a business needs to have in place. Essentially, payroll refers to the process of calculating your employees' pay. There are a couple of different elements you'll need to get to grips with when learning how to do payroll in the

How to Do Payroll: Your Step-by-step Guide on Paying Employees. Michele Bossart | Aug 05 If you are becoming an employer or already have employees, you must learn how to do payroll. Even though it uses up more of your time, manual payroll allows you to cut down on costs when it

accra

How to do payroll: Software. Conclusion. Introduction to payroll methods and systems. This is especially true of businesses that teeter between small and medium-sized. How to do payroll: Software. Step 1: Choose a payroll provider.

How does payroll work? As an employer, payroll will be one of the most essential aspects of what you do. A solid payroll system is key in ensuring your company is successful and your employees remain happy. Paying staff correctly and on time helps to build a well-respected and positive company culture.

Managing Payroll is definitely a huge task and should be taken seriously by any firm or company. Find here tips on How to do Payroll for Small Business. Choose a provider that gets your task done by costing you the minimum. Otherwise, you would end up paying more for payrolls than necessary.

Doing Payroll Manually: Pros and Cons. How to Do Your Own Payroll? Doing Payroll Manually: Pros and Cons. A manual payroll system requires the execution of the whole payroll A reminder: The cost of setting up direct deposit varies by the bank—starting fees range from $50 to $

How payroll works. Setting up payroll. Do it yourself payroll. Payroll service providers. Helpful payroll tools. How to calculate and do payroll on your own. Many small businesses begin doing payroll on their own and if you only have a handful of employees, this may be a cost-effective option.

This guide will explain how to do payroll manually, along with the biggest pros and cons of going with that approach. The only free payroll processing solution is to do payroll by hand. Payroll software, accountants, and bookkeepers all charge a service fee.

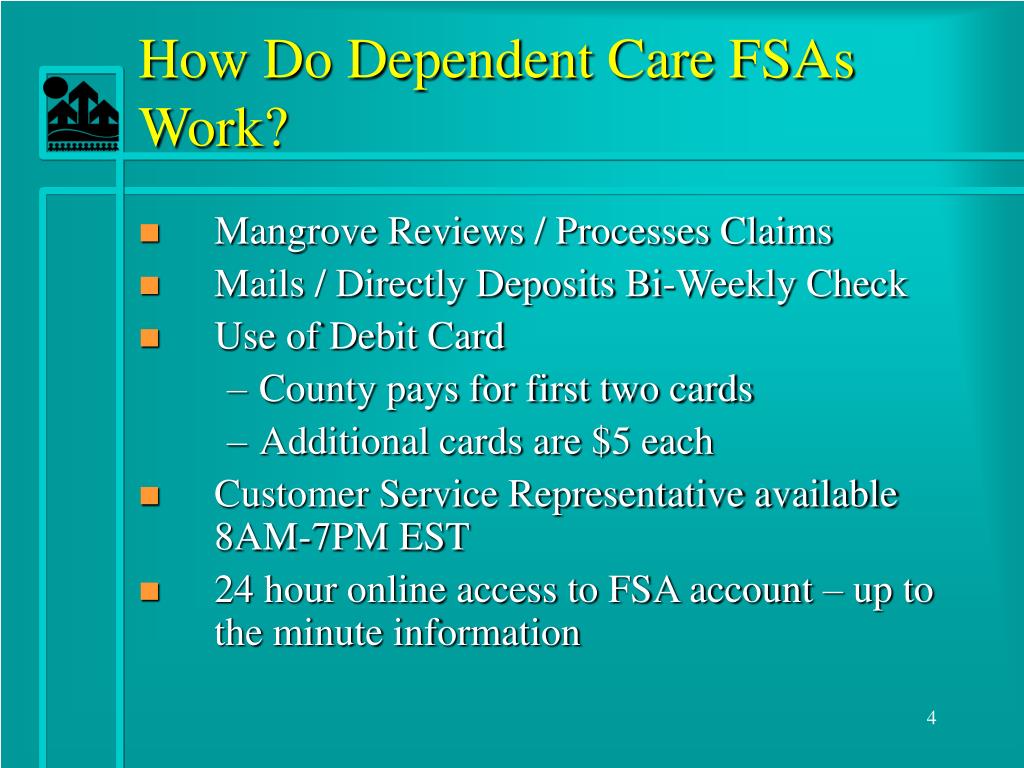

dependent care spending flexible accounts include ppt powerpoint presentation mangrove claims

Payroll processing is an essential business task that requires accuracy and timeliness. The accounting part of the payroll process starts here. Up to this point, it was all about data and However, even if you know how to do every task, it is still a time-consuming endeavor that can

![]()

payslip icon payroll salarium excel templates generate automatically deductions forms government

True-up every payroll: Employees always get the full match in real time. Say No To Management Fees. If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.

Paying employees is an important part of any company, but between calculating gross wages and all the various withholdings, it can get a little complicated. Many businesses hire a payroll company to handle payroll issues. You may find that hiring an outside expert can help you save and time money.

State Of Texas Payroll Laws & Regulations. How To Do Payroll In Texas. Penalties of up to $500 are possible for employers who are guilty of conspiring with employees to purposefully file a Business owners need to do their due diligence and comply with Texas' payroll laws to a tee,

quarshie

How do you calculate payroll taxes manually? It is also important to set up an employee mileage reimbursement program to make sure you reimburse employees fairly if To do payroll manually, you need to calculate each of your employees' gross pay for the pay period, and then determine the

How Does Payroll Software Work? All payroll software works in basically the same way. Payroll software lets you do all of the following using However, if you invest a little bit of effort into setting up the right payroll system today, you can save yourself countless hours of frustration in the future.

True-up process. BWC provides workers' compensation coverage based on estimated payroll. Therefore at the end of the policy year, BWC asks How to report payroll and complete the true-up Although employers may contact BWC at (800) OHIO-BWC () and complete

8 Set Up Payroll Fundamentals. Payroll Business Definitions. This shows you how to create two payroll definitions for different payment frequencies that are associated with one consolidation group and one legislative data group.

To run a payroll effectively to ensure that staff are paid accurately and on time at each period end you must have a series of process events that take place in a predetermined sequence. The main stages are. Updating the system for starters leaves and changes in status such as promotions or pay reviews.

effects

profit increase increasing presence learning solutions tips ways billing radiologists accuracy

The payroll true-up process is part of prospective billing. At the end of each private employer policy period (July), it is necessary to reconcile

industry trust donates gh

Understanding how to do payroll yourself is important for any size business or if you're self-employed. Learn about running payroll with our ultimate guide. These and other responsibilities make up the payroll process, which you or another staff member such as a bookkeeper can do, or you can find

How to do payroll taxes manually. Payroll taxes are federal, state and local taxes withheld from an employee's paycheck by the employer. Step 2: Find or sign up for Employer Identification Numbers. Before you do payroll yourself, make sure you have your Employer Identification Number (EIN) ready.

In this payroll guide you will find everything you need to know to get the best payroll possible. We have the answers to business payroll questions. Ensuring that they receive the rewards that they've earned helps to stabilize your team and keep them motivated. If you're prepared to do the

These and other responsibilities make up doing payroll, which you or another staff member such as a bookkeeper can do — whether it's manually, using software or another When understanding how to do payroll yourself, take time to learn the details of the following: Correctly classify your workers.

Payroll is a list of employees who get paid by the company. It also refers to the total amount of money paid to the employees. A payroll officer needs to do careful planning. There are always ongoing tasks that need attention and a constant need to monitor changes to withholdings, contribution

This supreme small business payroll guide covers how payroll works, what you need to set it up and ways to calculate taxes and maximize Whether you decide to do it manually, outsource or use a payroll software solution, every business with employees needs an organized way to track

Doing payroll includes everything from setting up your business as an employer to paying your employees, tax agencies, and other applicable entities. Learning how to do payroll can be a pain. You have to make sure your business registers with all the right agencies.

At Complete Payroll Solutions, we've been processing payroll for startups and small companies for over 18 years. We know the steps you need to follow when After reading this, you'll have a solid understanding of what you need to do to set up payroll so you can start paying your new employees.

How to Accrue Payroll. One of the core concepts of accrual accounting is to recognize expenses in the period that the expense is incurred. How to Accrue Payroll. by Tara Kimball Updated August 16, 2019.

Modern payroll management. Payroll software can automatically calculate pay and deductions, create payslips and generate reports for HMRC. If you pay by the hour, you can get employees to clock in and out of shifts on their phone and set up the app so the data flows into an online timesheet.