liability nv

Dissolving an Oregon LLC If you and other members of your organization are considering dissolving your LLC, it's important to address the required steps; otherwise, you could face administrative consequences and additional Click here to learn more about how to dissolve your company.

Articles of dissolution only. 6. name of limited liability company otherwise misrepresent the identity of the person or any members, managers, employees or agents of the limited liability company.

31, 2022 · Starting an LLC in Oregon is Easy. To start an Oregon LLC, you'll need to file the Articles of Organization with the Oregon Secretary of State, which costs $ can apply online or by mail. The Articles of Organization is the legal document that officially creates your Oregon Limited Liability Company.

Every limited liability company should include internal procedures for dissolving the company in its operating agreement. Another option is to hire an online business services company to dissolve your LLC. With these companies (which are best known for forming LLCs) you can save a

Dissolving a Limited Liability Corporation LLC - How To Dissolve Llc. This Package provides all the forms needed to dissolve an LLC in your state, saving you precious time and money. Includes a state-specific law summary, instructions and the appropriate forms, notices and resolutions

liability

fee

Formally dissolving an LLC puts an end to these requirements. It also gives creditors notice that the LLC can no longer take on debts. The members of an LLC must vote to dissolve the company. If your LLC operating agreement has a procedure for voting on dissolution, you should follow it.

09, 2021 · If you fail to file your Annual Report, the state will automatically dissolve (shut down) your LLC. Your Annual Report will include your LLC name, your office address, your Registered Agent information, and an “LLC Number” from your Secretary of State. The “LLC number” is just a number that your state uses to reference your LLC.

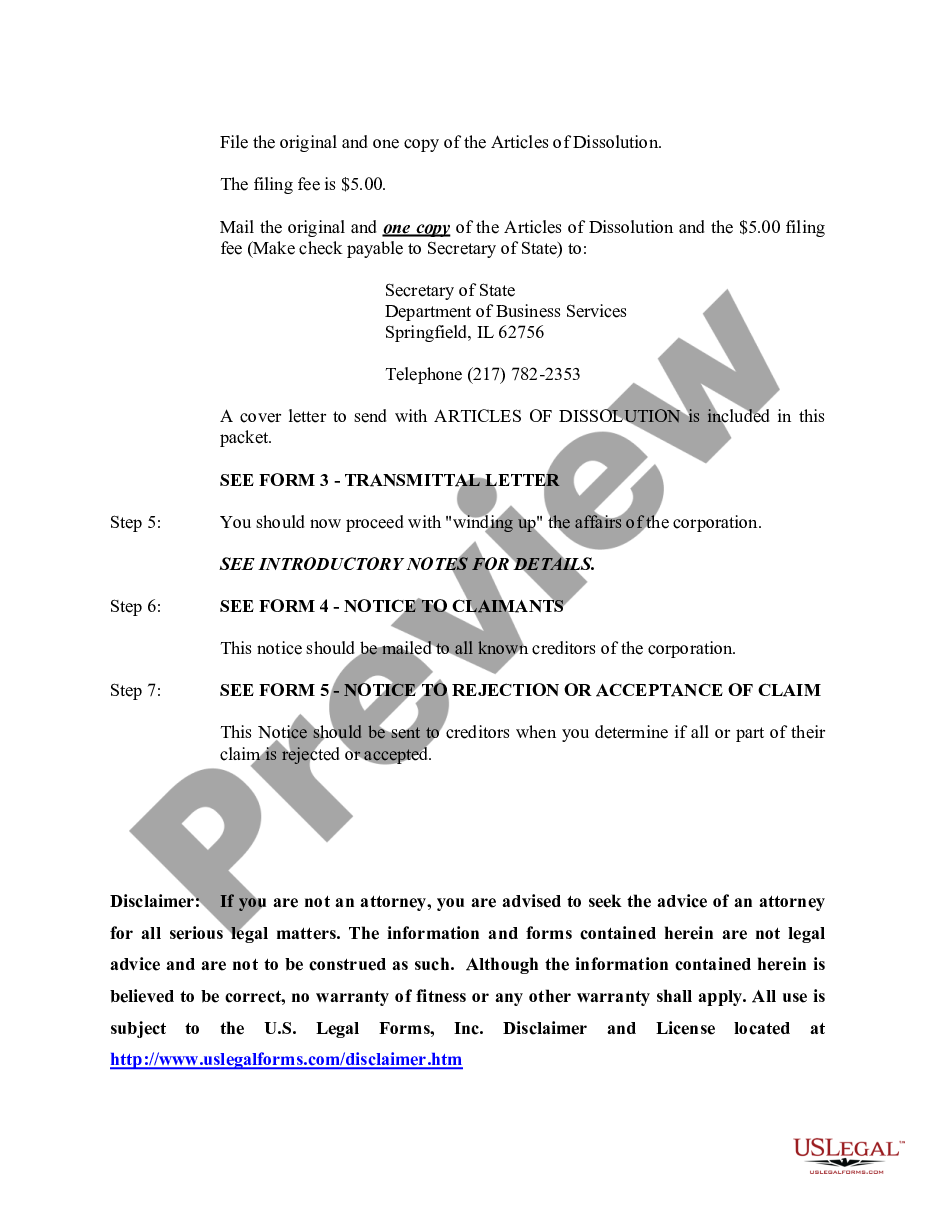

You would dissolve the LLC, the process being called "dissolution." This is done by filing a document often called 'Articles of Dissolution' with the Secretary of State or similar Originally Answered: How do I dissolve an LLC in California, this LLC have the IRS tax ID, could you give me the steps?

How to Dissolve a Foreign LLC in Oregon. While it is significantly more expensive to dissolve a foreign LLC, the paperwork and process are relatively similar both foreign and domestic businesses in Oregon.

How to Close an LLC or Corporation. A company begins with Articles of Incorporation when it is formed, therefore it makes sense that Articles must be filed to dissolve a company that has been in operation. Without filing the proper paperwork, the business owner will continue to be liable for

To dissolve a company in Oregon first step is to have a meeting of its members (for LLC) or directors/shareholders (for corporation) and have a resolution drafted authorizing dissolution. Once such resolution was ratified, the process of dissolution involves the following steps

Vote to Dissolve: Your company's formation documents (articles of organization, articles of incorporation, your LLC's operating agreement, or your corporate bylaws) should indicate internal rules for dissolving the business. If there are multiple owners/shareholders

The process of Dissolving an Oregon LLC is called Oregon LLC Dissolution. The total cost to Dissolve an Oregon LLC varies depending on exactly what is required for each specific OR Dissolution. We charge $ plus any state fees for our Oregon LLC Dissolution services.

Liability Companies Limited liability companies, often referred to as "LLCs," have been around since 1977, but their popularity among small-business owners is a …

Learn how to dissolve your Oregon LLC in just three simple steps. You can also access more useful articles, guides, tools, and legal forms.

Voluntary LLC Dissolution — Voluntary dissolution occurs when the LLC members willingly decide to close the business. It can happen as the result of a Whatever category your dissolution falls in, you still need to follow the steps outlined in this guide for formal dissolution. How to Dissolve an LLC

Learn how to dissolve a company and close it down correctly. Keep in mind that if your business is an Oregon LLC, then the process will be different. (*This article is a longer form, and more in-depth, version of our previously published how-to guide about how to dissolve an Oregon corporation.

How do you dissolve/terminate an Oregon Limited Liability Company? To dissolve/terminate your LLC in Oregon, you must provide the completed Articles of Amendment/Dissolution - Limited Liability Company form to the Oregon Secretary of State Corporation Division by mail, in person

Closing your Oregon limited liability company (LLC) will involve a variety of tasks. Among the most important are what is known as dissolving and In most cases, one of those two documents will contain a section with rules on how to dissolve the company. Typically the rules will require a vote

about the legal and tax issues involved when you convert a limited liability company to a corporation or S corp. By David M. Steingold , Contributing Author The process for converting your small business from an LLC to a corporation will vary depending on multiple factors.

Here is a complete guide on how to dissolve an LLC in Oregon. Learn everything about winding up an LLC here! In Oregon, if you and the members of the LLC want to discontinue business, then it is necessary to dissolve their business legally to avoid any administrative and legal consequences.

dissolution corporation dissolve

Learn how to end a business, LLC or corporation including state and federal requirements as well as notification of creditors. It's a stressful time and a multi-step process. To facilitate the process, here are seven common steps to dissolving a business. Step 1: Approval of the owners of the

A Limited Liability Company is an amazing tool by which to conduct business especially from a tax and liability perspective. Unfortunately (or fortunately), some situations arise which may cause the need to dissolve a LLC. Some scenarios include

In administrative LLC dissolutions, the secretary of state orders the dissolution due to a failure of the business to comply with regulations. How Much Does It Cost to Dissolve an LLC? If you file the documents to dissolve your LLC on your own, you only have to pay a state filing fee to submit

you filed for divorce or your spouse filed, the date of the initial petition is important. The petition to the court is the official notice that one of you intends to dissolve the marriage. After receiving notice of the divorce petition, the other spouse then has a period of time to file an official response with the court.

Corporations, LLCs, Partnerships. How to Dissolve an Limited Liability Company ... When it comes to dissolving an LLC in particular, there are a variety of methods that members can choose from. The easiest of these methods is when a member dissolves an LLC by will.

rationale for limiting an LLC member's personal creditor's remedies to a charging order is to protect other LLC members from having to share management of their LLC with an outside creditor. There are no other LLC members to protect in a single member LLC so the rationale for limiting creditors' remedies to a charging order doesn't apply.

02, 2022 · See Limited Liability Company Forms > Application for Registration of Foreign Limited Liability Company (Form L025). ... Oregon Secretary of State ... So if you shut down for a year, and travel, and don’t make a dime, unless you dissolve the company, you will still owe $800 a year. Even if you don’t send in your annual statement of ...

Dissolving an Oregon business can involve filing paperwork with the government. Prepare yourself by reviewing our discussion of Oregon dissolution paperwork You can answer many of your questions about how to dissolve a business in Oregon by referring to your business's operating document.

liability

Dissolving an LLC. Step 1: Follow the LLC's Internal Procedures. Step 2: Notify Any Creditors of the Dissolution. If you have an LLC that you would like to dissolve, there are some specific steps to take in the process. Follow these steps and you will have your dissolution completed in no time at all.

dba howtostartanllc fictitious assumed establecer

Dissolving a limited liability company: how to wind up your business. If your reason for dissolving the LLC is to form a corporation, make sure to check the state rules to transfer. Some states allow LLCs to be converted to corporations without having to go through the long dissolution

of Organization - Limited Liability Company. Secretary of State - Corporation Division - 255 Capitol St. NE, Suite 151 - Salem, OR 97310-1327 - - Phone: (503) 986-2200 In accordance with Oregon Revised Statute , the information on this application is public record.

LLC itself is not taxed. S-Corp shareholders are taxed on their personal tax returns. The company itself is not taxed. C-Corps are taxed both at the corporate level and again on shareholders' individual returns. Non-Profits are taxed on a corporate level but may also enjoy a host of tax-exempt benefits.

Business owners choose to dissolve LLC entities via judicial dissolution for various reasons. Now that we know the three different types of dissolution, lets take a closer look at how to close an LLC and wind up the business affairs by settling debts and distributing any remaining assets to the owners.

Dissolving Your LLC: Unless you planned for your LLC to last for a limited time period, you might not think you need to prepare for the dissolution of your Now you know how to form an LLC in Oregon following 8 easy steps. Forming an LLC is one of the best ways to lower your liability yet prevent

dissolve dissolution

Dissolution is the act of formally dissolving (closing) a business entity. Let's dig into how you do this for Corporations and LLC's. The process for dissolving an LLC and Corporation are slightly different. Before filing Articles of Dissolution, here's what LLCs and Corporations must usually do

Knowing how to dissolve an LLC starts with knowing that a Limited Liability Company is easier to form than dissolve. 7 min read.

Dissolving an LLC requires you to reach an agreement with all members of the LLC. You will also need to file your final tax return and fill out a great Once everyone has voted and a majority agrees (or a dissolution trigger has occurred), record the decision to dissolve the LLC and keep it with

An LLC (limited liability company) combines aspects of corporations and partnerships to create a unique business model. In an LLC, members don't hold personal responsibility for business debts and lawsuits. But, just like any other type of business, LLCs must sometimes come to an end.