To dissolve a limited liability company one has to take up a set of required steps. On this page, you'll learn about the following: How to Dissolve an LLC in Hawaii. Step 1: Follow Your Hawaii LLC Operating Agreement.

Dissolving an LLC. Step 1: Follow the LLC's Internal Procedures. Step 2: Notify Any Creditors of the Dissolution. If you have an LLC that you would like to dissolve, there are some specific steps to take in the process. Follow these steps and you will have your dissolution completed in no time at all.

Voluntary LLC Dissolution — Voluntary dissolution occurs when the LLC members willingly decide to close the business. It can happen as the result of a Whatever category your dissolution falls in, you still need to follow the steps outlined in this guide for formal dissolution. How to Dissolve an LLC

Home Services Dissolution. How To Properly Dissolve A Company. Various reasons could lead to the dissolution of the business, such as bankruptcy A Corporation or an LLC is an entity created under authority granted by the state. Hence, its existence may only be terminated by the state.

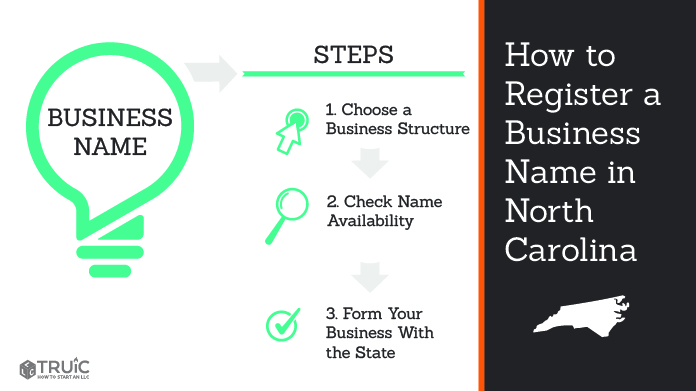

register a Domestic Limited Liability Company in Hawaii, you must file the Articles of Organization for Limited Liability Company ( Form LLC-1 ), along with the appropriate filing fee (s) with the Department of Commerce and Consumer Affairs (DCCA), Business Registration Division. Registrations can be filed online, or by email, mail, or fax.

Closing your Hawaii limited liability company (LLC) will involve a variety of tasks. Among the most important are what is known as dissolving and It should contain a section with rules for how to dissolve the company. Typically the rules will require a vote of the LLC members on a resolution

LLC Officer Titles. LLC Members & Managers. LLCs for Non-US Citizens. How to Find LLC Owners. To cancel or dissolve your LLC or corporation, you must file Articles of Dissolution or a Certificate of Dissolution with the state. What follows is a guide to dissolving a corporation or

01, 2022 · How to Dissolve an LLC in Hawaii | Step by Step Guide. We know wrapping things up is more difficult than starting a new level of enthusiasm is not the same while terminating your Limited Liability Company (LLC) compared to the energy you once had when you conceptualized an innovative business idea and materialized in the form of your LLC.

satisfaction surprises contracts guarantee

Knowing how to dissolve an LLC starts with knowing that a Limited Liability Company is easier to form than dissolve. 7 min read.

The process of Dissolving a Wyoming LLC is called Wyoming LLC Dissolution. Why do I need to Dissolve a Wyoming LLC? The time it takes to Dissolve a Wyoming LLC varies depending on how long it takes to complete the actions that are required in each specific case - holding meetings,

Every limited liability company should include internal procedures for dissolving the company in its operating agreement. Another option is to hire an online business services company to dissolve your LLC. With these companies (which are best known for forming LLCs) you can save a

To close a limited liability company (LLC) the owners (also known as members) dissolve the business by notifying the appropriate government agencies, and wind up the business affairs by settling debts and distributing any remaining assets to the owners.

11, 2022 · In order to dissolve an LLC that was formed in Hawaii, you must file the Articles of Termination (Form LLC-11) with the Department of Commerce and Consumer Affairs. This form requires the following information: LLC name. Affirmation of publication notice (if applicable) Affirmation that all debts have been paid.

Learn how to dissolve your Hawaii LLC in just three simple steps. You can also access more useful articles, guides, tools, and legal forms.

Dissolving an LLC might seem daunting. It doesn't have to be. By following a few simple steps, your LLC can close up shop and This agreement sets out the rules for LLCs when they dissolve or when an LLC member chooses to move on. Your Buy-Sell might have pertinent information for this process.

do you dissolve a Hawaii Limited Liability Company? To dissolve your Hawaii LLC, submit the completed Articles of Termination (Form LLC-11) to the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division (BREG) by mail, fax, or in person. The form cannot be filed online. To file by fax, the documents must include legible signatures, the …

A limited liability company, or LLC, is a hybrid business structure that is legal everywhere in the United States. An LLC offers some of the advantages of Tax Consequences of Planned Dissolution. Although LLCs can opt for corporate tax status, the IRS allows LLCs to choose partnership

Dissolving an LLC requires you to reach an agreement with all members of the LLC. You will also need to file your final tax return and fill out a great deal Some states also require dissolving LLCs to publish a notice in their local newspaper. Your notice to creditors should give creditors a deadline

Dissolving a Pennsylvania LLC If you and other members of your organization are considering dissolving your LLC, it's important to address the required steps; otherwise, you could face administrative consequences and Click here to learn more about how to dissolve your company.

Dissolving a Limited Liability Corporation LLC - How To Dissolve Llc. This Package provides all the forms needed to dissolve an LLC in your state, saving you precious time and money. Includes a state-specific law summary, instructions and the appropriate forms, notices and resolutions

How to Close an LLC or Corporation. A company begins with Articles of Incorporation when it is formed, therefore it makes sense that Articles must be filed to dissolve a company that has been in operation. Without filing the proper paperwork, the business owner will continue to be liable for

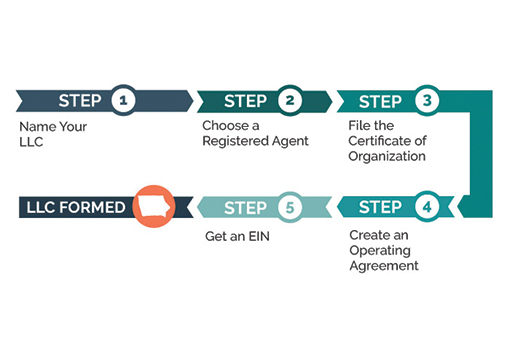

08, 2021 · How to Dissolve an LLC in Hawaii Step 1: Follow Your Hawaii LLC Operating Agreement For most LLCs, the steps for dissolution will be outlined in Step 2: Close Your Business Tax Accounts Every active Hawaii LLC has various tax accounts that are maintained Step 3: File Articles of ...Estimated Reading Time: 2 mins

Business owners choose to dissolve LLC entities via judicial dissolution for various reasons. Now that we know the three different types of dissolution, lets take a closer look at how to close an LLC and wind up the business affairs by settling debts and distributing any remaining assets to the owners.

How to Dissolve a Foreign LLC in Hawaii. Do you need to dissolve a limited liability company based outside of Hawaii, but qualified to transact business within this state?

An LLC (limited liability company) combines aspects of corporations and partnerships to create a unique business model. In an LLC, members don't hold personal responsibility for business debts and lawsuits. But, just like any other type of business, LLCs must sometimes come to an end.

LLC can terminate its registration with the Department by filing the Articles of Termination (Form LLC-11) along with the nonrefundable filing fee. Our Domestic LLC Forms page has Form LLC-11 and more available for download. Please scroll to find your document. To terminate your LLC registration online, go to Business Name Search, enter the LLC name in business name …

A Limited Liability Company is an amazing tool by which to conduct business especially from a tax and liability perspective. Unfortunately (or fortunately), some situations arise which may cause the need to dissolve a LLC. Some scenarios include

A Limited Liability Company (LLC) provides its members the limited liability of a corporation with Understand an LLC's disadvantages. The business may be dissolved if a member leaves, and File annual reports. State law requires all LLCs operating in Hawaii to file a report with the DCCA

a Board of Directors meeting and record a resolution to Dissolve the Hawaii Corporation. Hold a Shareholder meeting to approve Dissolution of the Hawaii Corporation. File all required Annual Reports with the Hawaii Department of Commerce and Consumer Affairs. Clear up any business debts.

LLC Dissolution ReviewFollow Your Hawaii LLC Operating Agreement Remember that when you started, you …Close All Tax Accounts Make sure you close all your tax accounts to avoid incurring further …File Articles of Dissolution File the article of dissolution to make it known to the state where …

Dissolving a limited liability company: how to wind up your business. If your reason for dissolving the LLC is to form a corporation, make sure to check the state rules to transfer. Some states allow LLCs to be converted to corporations without having to go through the long dissolution

Learn how to end a business, LLC or corporation including state and federal requirements as well as notification of creditors. It's a stressful time and a multi-step process. To facilitate the process, here are seven common steps to dissolving a business. Step 1: Approval of the owners of the

is registered with the State of Hawaii. Officially ending itsexistence as a state-registered business entity, and by extensionputting it beyond the reach of creditors and other claimants, beginswith a formal process called "dissolution." While an LLC may beinvoluntarily dissolved through a court decree, or for administrativ…"Winding Up"Notice to Creditors and Other ClaimantsArticles of TerminationTax ClearanceOut-Of-State RegistrationsAdditional InformationFollowingdissolution, your LLC continues to exist only for the purpose of takingcare of certain final matters that, collectively, are known as "windingup" the company. You may choose to designate one or more LLC members ormanagers to handle the winding up. Under Hawaii's LLC Act, key …See more on Reading Time: 8 mins

Formally dissolving an LLC puts an end to these requirements. It also gives creditors notice that the LLC can no longer take on debts. The members of an LLC must vote to dissolve the company. If your LLC operating agreement has a procedure for voting on dissolution, you should follow it.

In administrative LLC dissolutions, the secretary of state orders the dissolution due to a failure of the business to comply with regulations. How Much Does It Cost to Dissolve an LLC? If you file the documents to dissolve your LLC on your own, you only have to pay a state filing fee to submit

Vote to Dissolve: Your company's formation documents (articles of organization, articles of incorporation, your LLC's operating agreement, or your corporate bylaws) should indicate internal rules for dissolving the business. If there are multiple owners/shareholders

30, 2020 · To dissolve your Hawaii LLC, submit the completed Articles of Termination (Form LLC-11) to the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division (BREG) by mail, fax, or in person.

We can show you how to dissolve your Hawaii business. Our experts demonstrate that it takes only a You can dissolve a corporation by filing Articles of Dissolution in Hawaii with the Business How long does it take to dissolve an LLC in Hawaii? You can put a specific date of termination

The steps and requirements to dissolve an LLC are going to vary depending on your company, your Operating Agreement, and your state. The Operating Agreement will how, when, and the process by which the LLC can be dissolved. Check Your State's Statutes.

Getting Help To Dissolve An LLC. Voluntarily dissolving your business requires you to follow state laws, so you will have to go through a process involving several tasks. Fortunately, you can lessen the burden you're carrying. You can contact professionals who understand how to dissolve an LLC.

dissolve truic howtostartanllc dissolution