You would dissolve the LLC, the process being called "dissolution." This is done by filing a document often called 'Articles of Dissolution' with the Secretary of State or similar Originally Answered: How do I dissolve an LLC in California, this LLC have the IRS tax ID, could you give me the steps?

Demo starts at 1:10This video demonstrates how to dissolve an Arizona is the link to the Arizona Corporation Commission's Articles of

Every limited liability company should include internal procedures for dissolving the company in its operating agreement. Usually, the procedure to dissolve an LLC involves every owner of a multi-member LLC voting whether to enter the dissolution process or not.

Here is a complete guide on how to dissolve an LLC in Arizona. In Arizona, if you and the members of the LLC want to discontinue business, then it is necessary to dissolve their business legally to avoid any administrative and legal consequences.

Limited liability companies combine aspects of corporations and partnerships to offer liability protection while retaining flexibility. Income is passed through to the members of the LLC instead of being reported on the company's tax return. If you need to close ...

liability dissolution

if you have already closed your business operations, your corporation/LLC, directors, and officers (and in some cases, shareholders and members) will be deemed personally liable for aspects of the business until you file dissolution. ... How to Dissolve a Business or Non-profit; Helping Business Owners Since 2010 Phone: +1 (888) 832-4680

How to Dissolve an LLC. If you're dissolving your LLC voluntarily, you must follow the procedures spelled out in the LLC operating agreement, according to the experts at Wolters Kluwer. Even if you're not required to document the decision, getting it on the record is usually a good move.

Dissolution is the act of formally dissolving (closing) a business entity. Let's dig into how you do this for Corporations and LLC's. The process for dissolving an LLC and Corporation are slightly different. Before filing Articles of Dissolution, here's what LLCs and Corporations must usually do

Dissolving a Limited Liability Corporation LLC - How To Dissolve Llc. This Package provides all the forms needed to dissolve an LLC in your state, saving you precious time and money. Includes a state-specific law summary, instructions and the appropriate forms, notices and resolutions

Why Should You Dissolve an LLC? When the LLC was formed documents were filed with the state, the Internal Revenue Service, and possibly local As long as the LLC is active, the owner is required to file annual reports, pay annual fees, and pay minimum taxes. Formally dissolving an LLC puts

To Properly Dissolve A Company. Various reasons could lead to the dissolution of the business, such as bankruptcy, retirement, or change in career direction. When a business entity is no longer doing business, it is very important to follow the legal steps in …

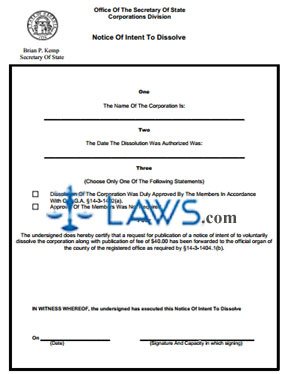

File Articles of Dissolution: The procedure to dissolve your business varies by state. Some states just ask for a certificate while others require a more complex process. Overall you'll want to at least have some important information handy so that you can more easily fill out the required paperwork.

Learn how to dissolve your Arizona LLC in just three simple steps. You can also access more useful articles, guides, tools, and legal forms.

We will show you how to dissolve an LLC in Arkansas below. Fortunately, it isn't complicated. The second step to dissolving your LLC in Arkansas is to close off your business tax accounts. All Arkansas LLCs have multiple tax accounts with different departments in the state government.

Your LLC, Corporation or Nonprofit With Just a Few Clicks. ... If you want to avoid unnecessary expenses, it is recommended that you dissolve the business according to the rules defined by the state and to acquire your Certificate of Dissolution. Until you possess this, your company will be held liable for filing all relevant federal ...

Business owners choose to dissolve LLC entities via judicial dissolution for various reasons. Now that we know the three different types of dissolution, lets take a closer look at how to close an LLC and wind up the business affairs by settling debts and distributing any remaining assets to the owners.

To dissolve a company in Arizona first step is to have a meeting of its members (for LLC) or directors/shareholders (for corporation) and have a resolution drafted authorizing dissolution. Once such resolution was ratified, the process of dissolution involves the following steps

howtostartanllc

How to Close an LLC or Corporation. A company begins with Articles of Incorporation when it is formed, therefore it makes sense that Articles must be filed to dissolve a company that has been in operation. Without filing the proper paperwork, the business owner will continue to be liable for

Dissolving an LLC in Arizona is required by law, and the process to dissolve a business in Arizona is relatively complex. How do I Dissolve a Partnership or Sole Proprietorship in Arizona? The methods for discontinuing businesses in Arizona really are dependent on how it has been

Closing your Arizona limited liability company (LLC) will involve a variety of tasks. Among the most important are what is known as dissolving and winding up the business. In most cases, one of those two documents will contain a section with rules for how to dissolve the company.

A limited liability company is usually founded and then exists for an unlimited time. But sometimes life doesn't always go as planned and the company needs to be dissolved. There are various reasons that can lead to this; economic failure isn't always the reason. The company owner may voluntarily

How to Dissolve a Foreign LLC in California. Do you need to dissolve a limited liability company based outside of California, but qualified to transact business within this state? The dissolution process for foreign LLCs in California is virtually the same as the process for domestic LLCs.

Know how to dissolve a limited liability company the legal way! You organized your LLC to limit liability and that is the very same reason why you should dissolve it properly. Not dissolving your LLC despite discontinued operations means your LLC is idling while simultaneously costing you money.

Voluntary LLC Dissolution — Voluntary dissolution occurs when the LLC members willingly decide to close the business. It can happen as the result of a Whatever category your dissolution falls in, you still need to follow the steps outlined in this guide for formal dissolution. How to Dissolve an LLC

How do you dissolve an Arizona Limited Liability Company? To dissolve your LLC in Arizona, you submit the completed Form LL: 0020 Articles of Termination to the Arizona Corporation Commission (ACC) by mail, fax, or in person. Arizona has a cover sheet that should be included with filings.

Dissolving an LLC. Step 1: Follow the LLC's Internal Procedures. Step 2: Notify Any Creditors of the Dissolution. If you have an LLC that you would like to dissolve, there are some specific steps to take in the process. Follow these steps and you will have your dissolution completed in no time at all.

’s it like to be a registered agent in California? Not many people know, but we do. When you start a California LLC or incorporate in California, you’ll either need to hire a California registered agent or become one. Obviously, we think it’s smart to hire us for just $39 a year.

partnership dissolve dissolution nm

To dissolve an Arizona LLC, file Articles of Termination with the ACC. How long does it take to dissolve an LLC in Arizona? This all depends on how long it takes the ACC to receive the necessary paperwork and determine that the business has met all its filing requirements and paid all

If the Arizona LLC has not commenced business then the AZ Limited Liability Company Dissolution process is easier. What do I have to do before I The time it takes to Dissolve an Arizona LLC varies depending on how long it takes to complete the actions that are required in each specific

When you dissolve LLC Arizona, you officially end the existence of the corporation as an entity registered in the min read.

dissolve

Dissolving an LLC requires you to reach an agreement with all members of the LLC. Some states also require dissolving LLCs to publish a notice in their local newspaper. Your notice to creditors should give creditors a deadline for submitting claims and tell them that claims submitted after

How do I file the California dissolution form? How much does it cost to dissolve a California business? If you don't properly dissolve your corporation or LLC, the California Secretary of State will likely forfeit your business. This means that you'll lose the right to do business in California and

form

A Limited Liability Company is an amazing tool by which to conduct business especially from a tax and liability perspective. Unfortunately (or fortunately), some situations arise which may cause the need to dissolve a LLC. Some scenarios include

To close a limited liability company (LLC) the owners (also known as members) dissolve the business by notifying the appropriate government agencies, and wind up the business affairs by settling debts and distributing any remaining assets to the owners.