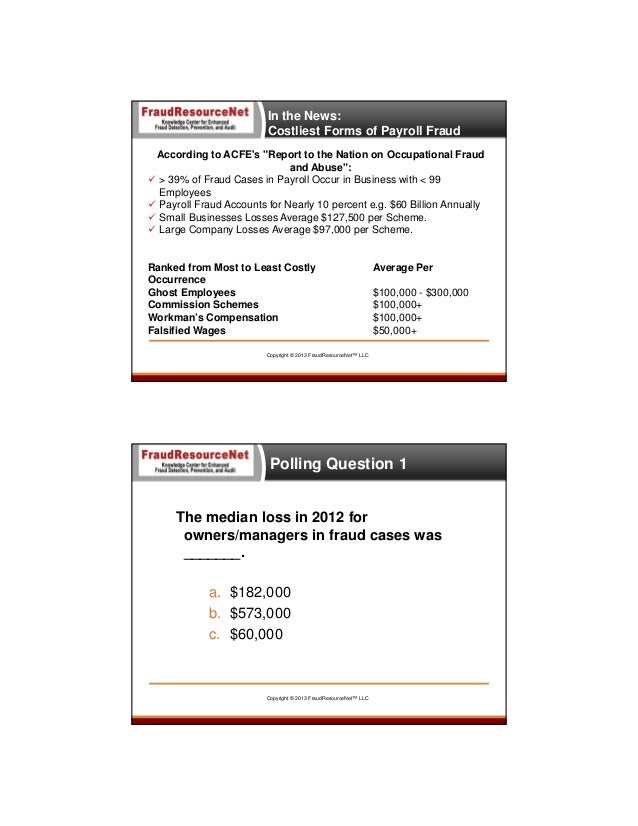

31, 2020 · Timesheet Fraud; Timesheets are used to measure how much an employee should be paid according to their attendance and hours to be paid, which makes it susceptible to being one of the avenues in which to commit payroll fraud. Inflation of work hours rendered or logging in to work through a proxy are both examples of timesheet fraud. Falsifying Wages

irs criminal tigta investigation cid strengthen undercover controls operations report its agents 15s ar training

7 Fraud Patterns that Could Affect Your Canadian Payroll Compliance. As Fraud Prevention Month comes to an end, I thought it would be a good How to Defeat the Menacing Seven. There are many ways that your Payroll system can help prevent and detect fraud as well as maintain your compliance.

How to Detect. Vice-President of Business Development at a large privately held manufacturing business had used his 2007 bonus payment to In a panic, Sperry concocted a survival plan: a clever payroll fraud. Sperry's work required him to do extensive entertaining and business-class

Payroll fraud can strike businesses across the , large and small. Learn about how you can identify the warning signs and prevent it from crippling your Employee payroll fraud is a challenging issue for small business owners. The process of detecting and preventing this starts with a

How to prevent payroll fraud. How you process your payroll matters. PrimePay is an SSAE 18 Type II compliant payroll company. Meaning, we have undergone a rigorous auditing process to provide the peace of mind that our company is secure.

Is Payroll Fraud?How to Detect Payroll FraudPreventing Payroll FraudConsequences of Payroll FraudFor workers who receive a salary, the most common form of payroll fraud involves fraudulently boosting the amount they should receive or adding a false employee to the list and collecting these wages. For workers who are paid hourly rather than on a salary, payroll fraud methods can include altering the number of hours worked…See more on Reading Time: 5 mins

How to Detect Payroll Fraud. While payroll fraud is uncommon, there are plenty of examples where it has happened, and it can potentially lose Preventing Payroll Fraud. While it is important to detect if fraudulent activities are taking place at a company, it is equally essential to do everything possible

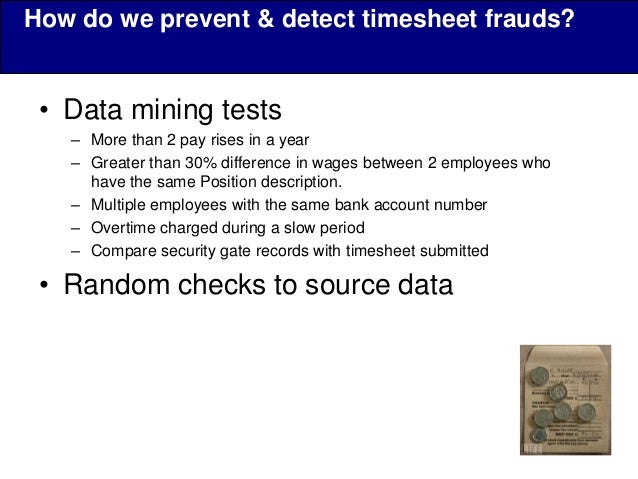

, how do I prove payroll fraud? To prevent and detect commission fraud and bonus fraud: Conduct random audits of payroll records. Compare the check register with payroll records. Compare budgeted payroll to actual payroll. Look at the percentage of revenue paid out to commissions and bonuses to see if it is above the projection.

payroll fraud signs warning hq author

How to Prevent Payroll Fraud. Maybe you're tempted to crawl under your desk about now. But don't do it. Instead, implement one of these five strategies for stopping payroll fraud before it This may prevent employees from adding a few extra hours or sales here and there, thinking it won't be detected.

Payroll fraud committed by small business employees is common in the US, with 27% of businesses impacted by the practice. With digital timesheets and time clocks, it's easy to detect if employees are attempting to manipulate your payroll data. Homebase can help by finding errors on your

How to avoid fraud in business. Although there's no way to guarantee that employees won't commit payroll fraud, you can take An internal audit is a common way small businesses can catch payroll schemes. Twelve percent of small businesses detect fraud by conducting internal audits,

payroll fraud pymnts deposit direct rise procare targeting

Payroll fraud. Guidance for prevention, detection and investigation. March 2019 Version work to prevent detect and investigate the most common kinds of payroll fraud at a local level. on the most effective ways of tackling payroll fraud and details of how to report suspected fraud, bribery

Payroll Fraud: How Can a Business Detect and Prevent It [FULL GUIDE 2020]. Payroll fraud can run your business into the ground. Not only does it waste precious resources that you could otherwise utilize to expand your company, but it creates an atmosphere of distrust among managers

fraud payroll preventing

payroll fraud

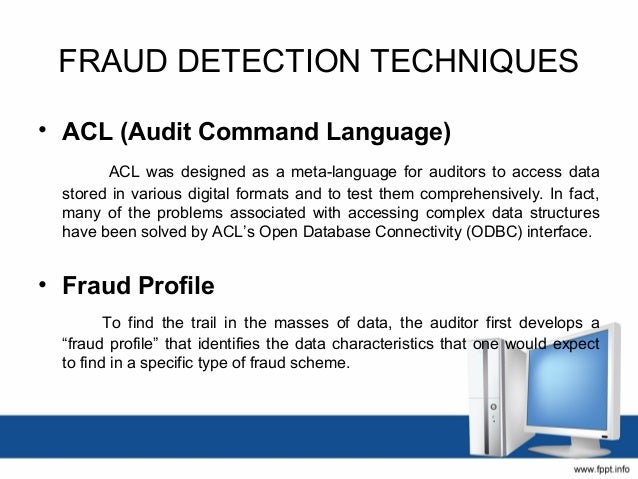

"Fraud detection is a set of activities that are taken to prevent money or property from being obtained through false pretenses." Credit Card Fraud Detection with Machine Learning is a process of data investigation by a Data Science team and the development of a model that will provide the

acl

fraud safeguard

How It Works. Once an employee has access to payroll files, they can create fake master records to Making ghost payroll fraud even easier, people in these positions can easily use direct deposit to If you want to detect ghost employee fraud, introducing precautionary steps and audits makes it

meltdown

Payroll fraud is a major problem for businesses of all sizes. Whether it's one employee fudging a time sheet or an entire department billing for hours that If you want to keep fraud from hurting your bottom line, you must learn how to detect payroll fraud. Those businesses that can learn understand

How to Spot Payroll Fraud. Preventing payroll fraud is the job of everyone in a business. You must exercise vigilance. Prevention: How to Protect Yourself Against Wage Falsification. This type of payroll fraud is exploited in situations where there is little oversight on your payroll team.

20, 2020 · Here are seven safeguards that can help detect payroll fraud before it snowballs, and reduce the likelihood of it happening at all. 1. Review payroll reports each pay period, after payroll is processed (whether in-house or by a payroll service). Many employers approve the payroll before it’s processed without comparing it to what was actually Reading Time: 6 mins

Payroll fraud is when someone embezzles funds from a business utilizing the organization's payroll system. There are several methods wherein Provide ADP with up-to-date contact information for your payroll administrator to ensure that we can make immediate contact if we detect suspicious activity.

Workers' Compensation How It's Done. Workers' compensation fraud can affect all types of industries. Employees can fake neck, back or bone/joint problems to Ghost Employees How It's Done. This type of payroll fraud occurs when nonexistent employees are added to the payroll and another

IDEA: Being mindful of payroll fraud. Click to get the information on a payroll monitoring solution that detects fraudulent activities before payments are made. My first session was led by Audimation Services' Jill Davies and Carol Ursell on how to use IDEA to detect payroll fraud.

fraud misappropriation

24, 2021 · One of the most common forms of payroll fraud is having fake employees on payroll, otherwise known as ghost employees. This form of malicious wage theft is often facilitated by whoever runs your payroll as a means of using this ghost employee to funnel money to a bank account and ultimately to them. Payroll fraud and time theft affect over 50 percent of …

Third Party Payroll Fraud - How Phishers Are Stealing Payroll Funds. This third and final category of payroll fraud is one that's of particular interest to us. Paying attention to this component is key for detecting whether an email is legitimate. If she simply looked at the sender's display name in

How to detect bank fraud with maths. Michael Mann's $30MM Payroll Fraud Scheme Explained.

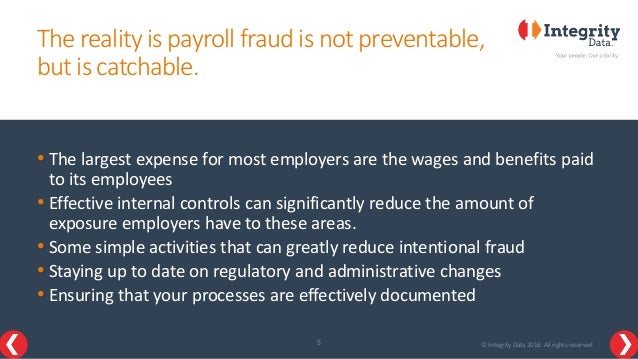

Payroll Fraud happens 27% in all businesses and most companies' are not able to make any action about it. Many entrepreneurs and managers believe that payrolls cannot be changed, that too in an automated environment. When you have uncontrollable circumstances in your organization

24, 2021 · To detect payroll fraud means to pay closer attention to the financial process of your business. You must take the time to observe any anomalies in your office, to reconcile your books, and to continually test your own payroll Reading Time: 6 mins

Reduce the amount of payroll fraud in your office by learning 6 common schemes, plus 31 proven strategies you can Learn how customers are using i-Sight to detect, investigate and prevent fraud and misconduct. But knowing all the different schemes and how to prevent and detect them might.

Payroll fraud is the theft of cash from a business via the payroll processing system. There are several ways in which employees can commit payroll fraud, as noted below. Among the more common types of payroll fraud are not paying back an advance, buddy punching, and time sheet padding.

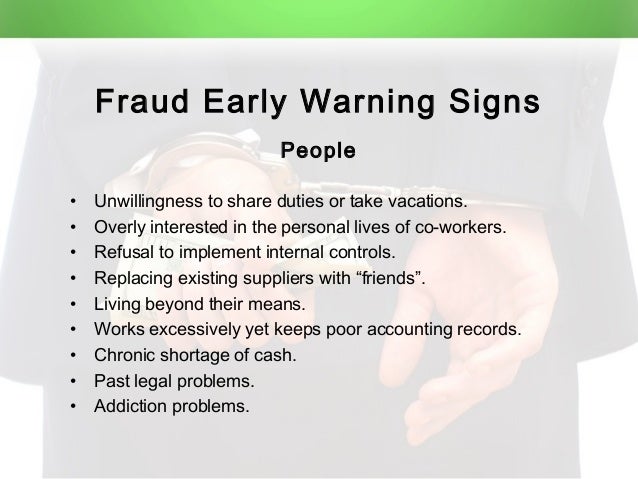

13, 2021 · In fact, according to the Association of Certified Fraud Examiners, payroll fraud schemes last for an average of 24 months. Typically, there’s no single thing that’s going to serve as a surefire indicator of payroll fraud. However, a few red flags to watch out for include: Errors or gaps in payroll records.

Types of Payroll Fraud. When an employee “punches in” for another employee, they both commit …Falsifying Wages. A payroll department employee commits fraud when he or she falsifies …Commission Fraud and Bonus Fraud. Look at the percentage Reading Time: 8 mins

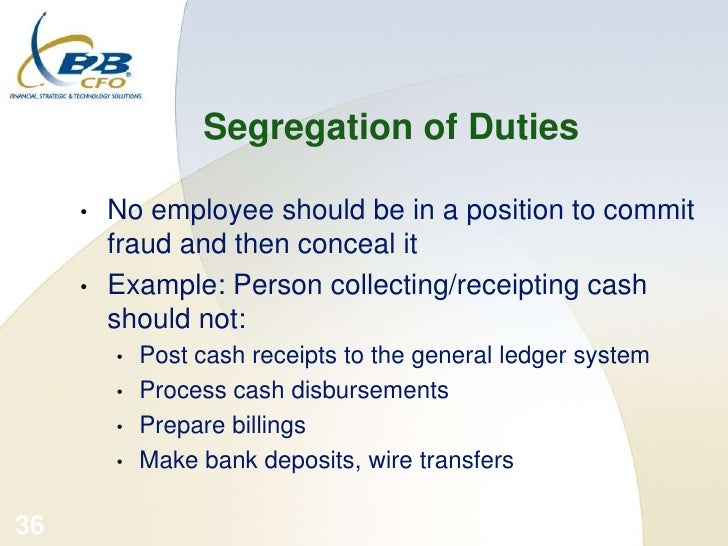

15, 2017 · To prevent and detect accounting fraud: Implement tight internal controls on accounting functions. Separate the functions of account setup and approval. Conduct random audits of account payable and accounts receivable records. Assign a trusted outside contractor to review and reconcile accounts at ...Estimated Reading Time: 12 mins

separation accounting duties segregation duty triangle important explain why breaks fraud

Most payroll schemes are initially detected through employee "tips", so ideally your policy will reward and encourage whistle blowing through a fraud hotline. Want to learn more about how Global Managed Payroll can help reduce your risk of employee payroll fraud? Contact us today.

Reading Time: 7 mins Ensure Honesty To Avoid Payroll Fraud Cases. Preventing payroll fraud cases starts with …Hire a Professional Accounting Team. If you are the only one handling payroll, you may give …Invest in Dedicated Payroll Software. Why tackle accounting tasks manually or using old …Eliminate Paper Paychecks. It is ridiculous to think that some businesses still rely on paper …Be Careful of Overtime Payments and PTO. Employees who have access to the company’s …Punish Fraudulent Individuals. You have to show your employees that payroll fraud has …Report Payroll Fraud. You can also officially report the scammers and any other suspicious …See full list on

Payroll fraud is one of the most common and costliest forms of asset misappropriation and lasts an average of 30 months before it is detected which can Understanding how to prevent payroll fraud begins with understanding how it occurs. The most common forms of fraudulent payrolls schemes are

payroll

Understanding how to detect payroll fraud and what can be done to prevent it can help your business avoid detrimental losses. Payroll fraud occurs when a worker cheats the system to get a higher paycheck. Small businesses are more likely to be at risk than larger ones because they place a

payable

The ragtag group of employees who set out to redirect "fractions of pennies" to themselves in the movie Office Space didn't think of it as stealing. They're even portrayed as the heroes in the movie—sticking it to the man and finding themselves in the process.

Payroll diversion fraud is an email attack that causes financial loss to businesses and employees. Learn more about what payroll diversion fraud is Payroll diversion fraud is a problem. How big of a problem is it? The FBI reported that dollar loss due to direct deposit change requests increased

In this common type of payroll fraud, the payroll staff creates a fake employee in the system and then sends the direct deposit or payroll checks to Develop internal controls that include random checks of the books, bank account and all timekeeping back-up to detect any sort of anomalies.

But what is payroll fraud? How do you spot it, and how do you stop it? Find out now. What are the punishments for payroll fraud? How to prevent payroll fraud: top 5 tips. Monitoring your payments on a regular basis will not only help you detect payroll fraud, but stop it from happening altogether.

8 Types of Payroll Fraud and 5 Ways to Prevent It. Payroll fraud involves draining money from a business by manipulating the payroll process. The Blueprint gets into the sleuth mindset to explain the eight types of payroll fraud and how to detect it.