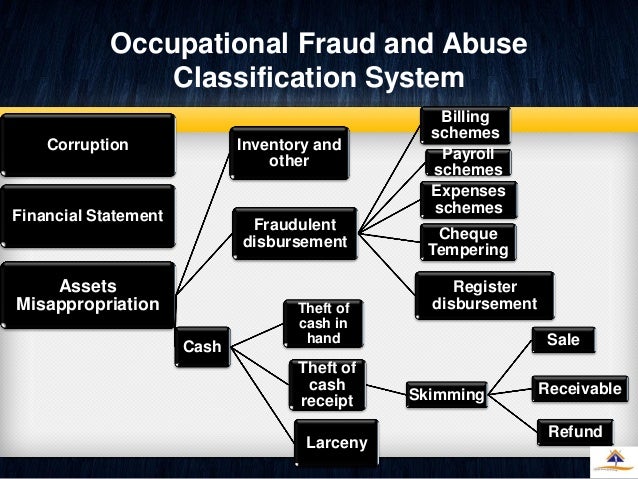

Fraud risk assessments help prevent fraud that can take place in the form of corruption, asset misappropriation, and theft of intellectual property, among others. what are the types of fraud risk; tips on how to conduct a fraud risk assessment effectively

which best practices to use for developing and implementing an effective fraud risk assessment. Identify key factors that should be considered when assessing fraud risk. Recognize methods to address fraud risks identified during the risk assessment process. ADVANCED PREPARATION: NONE.

Conducted correctly, a fraud risk assessment framework keeps the business a few steps ahead of fraud perpetrators by viewing the company holistically For this reason, assessing fraud risk based on the email, domain, phone number, or device and IP address being used for transactions is critical.

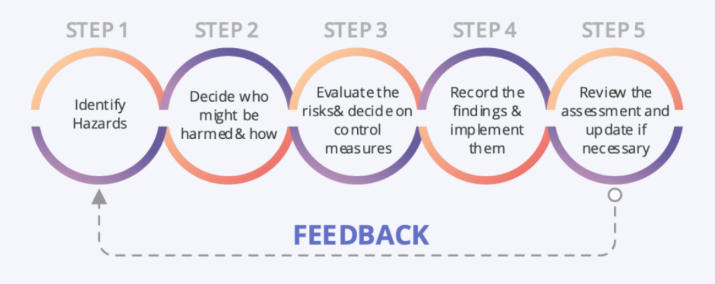

Fortunately, identifying fraud risks and mitigating them doesn't have to be difficult. With a fraud risk assessment, companies can understand the overall risk universe. In this article, we break down the main components of an effective fraud risk strategy, providing 5 simple steps on how to conduct

Perform a Comprehensive Fraud Risk Assessment. Fraud risk assessments should be tailored to each company's industry, risks and needs and should focus on To assist in the performance of this evaluation, management may elect to conduct employee interviews or facilitate workshop sessions.

Data analytics for assessing corruption and fraud risks in infrastructure. Data-driven corruption risk assessments can help managers to identify the riskiest This section details how risk management and internal control can effectively support project managers to identify, mitigate and manage

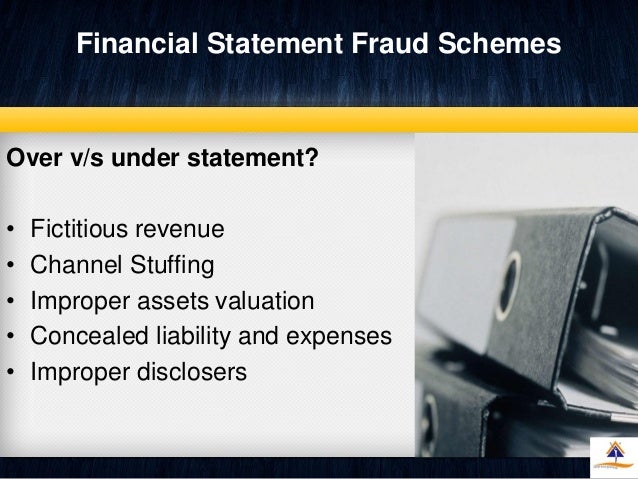

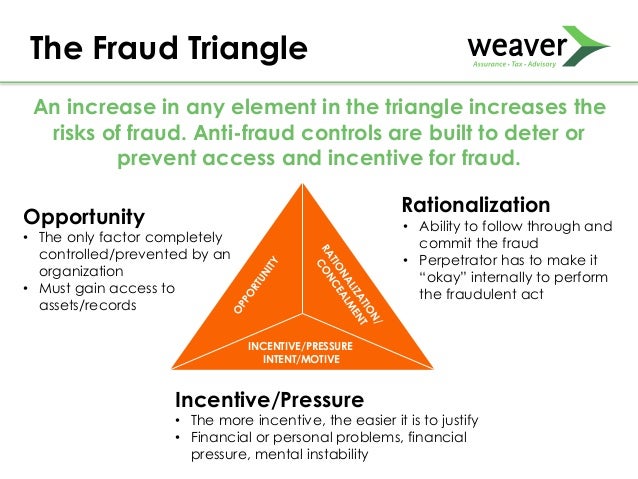

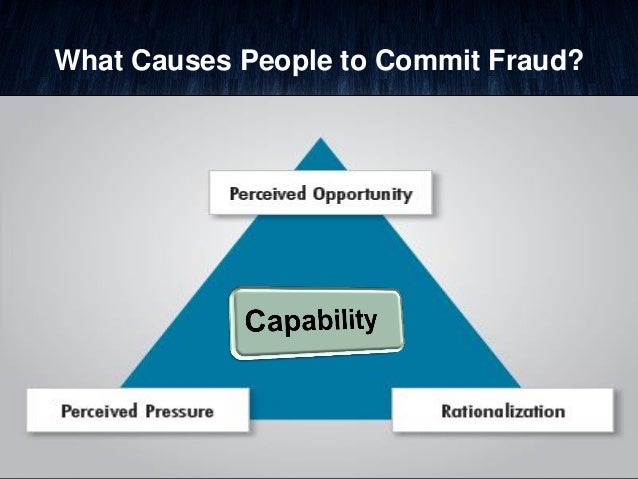

Fraud Risk Factors. Fraud generally occurs when three conditions are present Specific examples of fraud risk factors for Fraudulent Financial Reporting and Misappropriation of Assets are Significant operations located or conducted across international borders in jurisdictions where differing

fraud assessment risk prevention perform useful tip

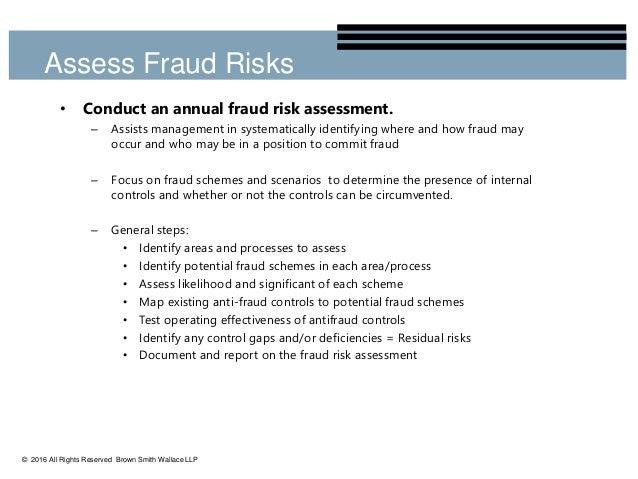

— Establishing fraud risk governance policies — Performing a fraud risk assessment — Designing and deploying fraud preventive and detective. control activities — Conducting investigations, and — Monitoring and evaluating the total fraud risk management.

By doing regular fraud risk assessments, you can protect your company by figuring out who might Here's how to build a fraud assessment team and protective systems. Small businesses can be So, as the small-business owner, it's important to conduct fraud risk assessments on a regular basis.

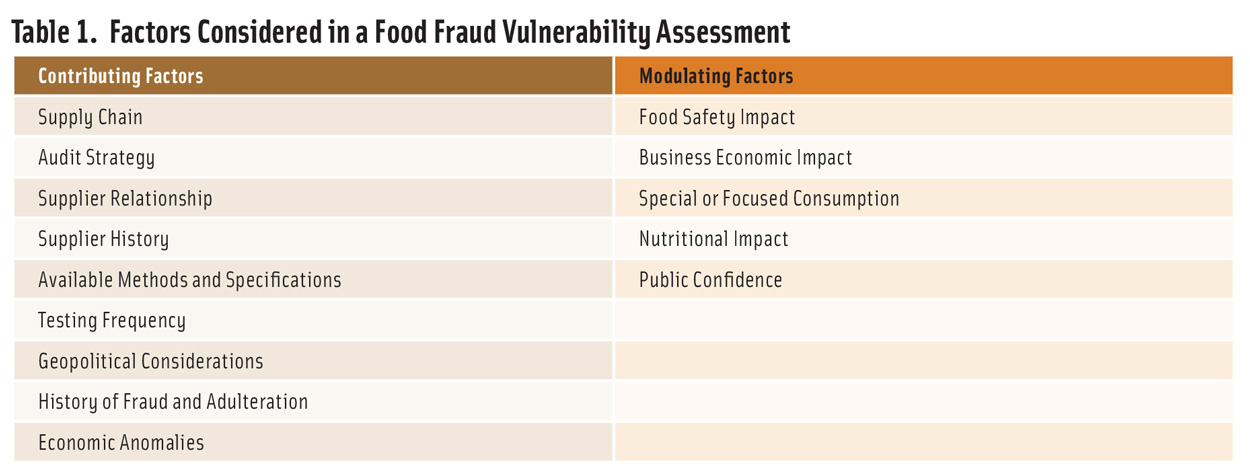

fraud vulnerability prescreening

risk

fraud

fraud

Understand the steps involved in conducting a fraud risk assessment and how to apply a framework to them. Describe approaches to responding to an 8 Why Should Organizations Conduct Fraud Risk Assessments? Improve communication about and awareness of fraud Identify what activities are

RISK ASSESSMENT All agencies are subject to fraud risks and need to complete a fraud risk assessment for their agency at least every biennium. A detailed fraud assessment needs to be performed by division and/or function. Functions and services that need to be included in the assessment are Finance and Accounting, Human Resources

internal aga iia

risk ibm management solutions services analytics cognitive industry lab animated data banking forecasts sector accelerate value singapore demands meet

Risk Assessment Use the results to: • Begin a dialogue across the company. • Look for fraud in high-risk areas. • Hold responsible parties accountable for progress. • Keep the assessment process alive and relevant. • Modify or create the code of conduct or ethics policy. • Monitor key controls.

auditing johnstone

3. fraud risk self-assessment. 4. guidance on minimum requirements for The guidance in Annex 1 explains in detail how to complete the fraud risk assessment tool. Code of conduct - a unambiguous code of ethics that all staff must routinely declare adherence to,

engagement to assess fraud risk, conduct a limited set of forensic audit tests, and respond to. elevated fraud risk by, for instance The second is a fraud risk assessment model, FR = RI x RA x RO x. RSP, developed by Srivastava, Mock and Turner (2007, 2009) based on the risk factors.

Conduct a Fraud Risk Assessment? • Improve communication and awareness of fraud • Identify where the institution is most vulnerable to fraud and what activities put it at the greatest risk • Develop plans to mitigate fraud risk • Develop techniques to monitor and investigate high‐ risk areas • Assess internal controls 35

25, 2021 · Fraud Risk Management Principles. To better understand all factors of performing a successful fraud risk assessment, management should first consider the Fraud Risk Management Principles 3 developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) and ACFE. These principles help an organization prevent and …

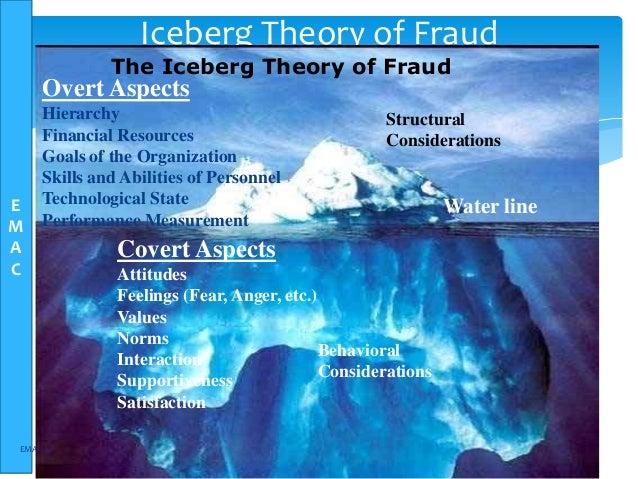

McKonly & Asbury Certified Fraud Examiner David Hammarberg analyzes the three aspects to fraud and how organizations can limit the perceived

Similar to fraud risk assessments, there are many companies that may have certified fraud examiners, attorneys, and certified public accountants on the payroll who may be able to conduct an effective internal investigation. However, if the amounts involved are potentially material to

fraud iceberg elsam consultants

Assessing fraud risks necessarily involves looking at how employees—including top management—interact with the resources of the As such, the risk assessment effort has to be very clear and detailed about how controls, policies, and procedures interact with specific roles.

A fraud risk assessment is a tool used by management to identify and understand risks to its business Assessment of control effectiveness: Ineffective to very effective. Fraud risk response: Additional controls Monitoring activities: To be periodically conducted and frequency of occurrence.

...internal auditors should conduct a fraud risk assessment as part of engagement planning It outlines the process of incorporating a fraud risk assessment into engagement planning overview of the characteristics of fraud, followed by a description of how to assess fraud risks and

10 ways to strengthen your fraud risk assessment 1. Understand your complete risk universe. You don't have to conduct an enterprise-wide fraud risk assessment right out of the gate. They actually understand how controls are implemented and where you have potential gaps or vulnerabilities.

conduct a high level Fraud Risk Assessment (FRA). The fraud risk assessment was completed in a four phase process as follow: Identified fraud risk factors relevant to ECCC through a series of interviews with ECCC management and employees and developed fraud risk scenarios.

Fraud risk management. How to establish a robust framework. Conducting a fraud risk. framework should include the following • evaluating management's assessment of fraud risk. • holding discussions with the external and internal auditors as to their views on the potential for fraud.

Fraud Risk Assessment Framework. 1. Identify potential inherent fraud risks and schemes. 2. Assess the likelihood of identified inherent fraud • Extent—How many transactions were tested and which attributes of the internal controls were tested? • Results—Were deviations from

compliance hyperproof

Workplace safety risk assessments are conducted in a unique way at each company. However, there are some general, basic steps that should be part Many of the risks employees face in the workplace are easy to spot and don't require a complex solution. Not sure how to conduct a risk assessment?

04, 2021 · Here are some tips for conducting an effective fraud risk assessment: Build a team – create a team who will plan and set the goals for conducting the risk assessment Identify – know what fraud risks your business may be exposed to Assess – what will be the risk’s impact on the business? What needs ...Estimated Reading Time: 7 mins

5 Steps for Conducting a Thorough Risk Assessment. Risk assessments are generally broken down into five steps. Each of these plays an important role in 3. Assess the Likelihood and Severity of the Risks. During this step, you'll consider how likely it is that each hazard could cause harm to someone.

improve corporate understanding and commitment to the fraud risk assessment process; confirm that fraud risk assessments are conducted to an acceptable standard, are performed in a timely manner and are sufficiently resourced; encourage business units to actively engage with fraud risk assessments; exercise their authority to implement change and monitor outcomes; …

08, 2017 · The fraud risk assessment should address: Asset misappropriation. Financial and non-financial reporting. Regulatory compliance areas. Illegal acts. The assessment should be performed by management and managers responsible for each significant department or area within the organization and then shared with the Board of Directors. Jointly, all parties can then …Estimated Reading Time: 3 mins

Business. Finance Q&A Library Explain how to conduct a fraud risk assessment. Risk Management in Financial Institutions.

Conducting a fraud risk assessment. To protect your company, you need to be aware of any vulnerabilities that you may be exposed to and strengthen your existing arrangements. This is why you need to conduct a robust fraud risk assessment , by following four simple steps.

Auditing Track Assessing Fraud Risks. What Is a Fraud Risk Assessment? § A process aimed at proactively identifying and addressing an organization's • How might a fraud perpetrator exploit weaknesses in the system of controls? • How could a perpetrator override or circumvent controls?

class will help individuals learn and develop the skills necessary to help drive, implement and execute an effective Fraud Risk Assessment as part of an overall Fraud Risk Program through the use of case studies, best practices and interactive exercises with the class. Learning Objectives. Learn how to conduct a fraud risk assessment

fraud

Despite the serious risk that fraud presents to business, many organisations still do not have formal Case study 1 demonstrates just how much of a threat fraud can be to public safety and that there Further guidance on risk assessment and controls is given in later chapters. The results of PwC'

Fraud risk in the financial statements has been elevated amid the coronavirus pandemic. Auditors should conduct engagements with a mindset that acknowledges the possibility that a material Identify and assess the risks of material misstatement of the financial statements due to fraud

The responsibility for conducting fraud risk assessment usually lies with the fraud risk management team. While many organizations assign this responsibility to their internal audit team, some leading organizations appoint a separate fraud risk management team comprising of members from

• Performing a fraud risk assessment. • Designing and deploying fraud preventive and detective 2. The organization performs comprehensive fraud risk assessments to identify specic fraud In contrast, organizations conduct separate evaluations periodically that vary in scope and timing

From the federal level to clearinghouses, fraud risk assessment experts are looking for better ways to see across entire payee ecosystems. Thousands of people download it every day. The fraud bible contains fraud methods and tutorials describing how to commit forged identities and Social