29, 2020 · To get the average accounts receivable for XYZ Inc. for that year, we add the beginning and ending accounts receivable amounts and divide them by two: $2,500 + $1,500 / 2 = $2,000 To calculate the accounts receivable turnover ratio, we then divide net sales ($60,000) by average accounts receivable ($2,000):

Close Accounts receivable overview. Article. 11/29/2021. 2 minutes to read. The following table lists the forms that support the close Accounts receivable business process component. The table entries are organized by business process component task and then alphabetically by form name.

How-to Guide - Acumatica Period Closing Process. Accounts Receivable Period Close. To perform reconciliation, for each Accounts Receivable account used in Accounts Receivable documents of the period to be closed, you have to compare the total balance of open documents

end clock financial ticking

Most businesses have formal accounts receivable policies that dictate when to bill, how much to bill and when to collect. From there, you can identify the steps you need to take to close those gaps. Beyond simply helping you identify areas for remediation, Deloitte's working capital professionals

receivable

02, 2009 · Do you close out accounts receivable? Technically yes. Once a person or company pays off a balance owed to you (hence the account receivable) the books show this as a zero balance. Though the ...

Accounts Receivable Explained: How to Record Them, How They Differ from Accounts Payable, and Why It Matters for Businesses. A healthy business typically has an AR/AP ratio closer to 2:1. At 3:1, there is usually room for savings or reinvestment into the company.

The accounts receivable department manages the flow of revenue via the invoicing and collection process. From credit application to invoicing, follow-up and debt collection of late payments, the purpose of this business process is to provide healthy cash flow to support business growth

close the year in Accounts Receivable: Back up your data files. For more information, see article 17256, How do I use File Tools to back up data files? From the Tasks menu, select Close Year. Verify that the New year end date is correct and click Start. To view customer totals: From the Accounts Receivable Setup menu, select Customer. Enter the Customer.

Skimming accounts receivable sales receipts involves an employee receiving customer cash, recording the payment and then charging an Older or closed accounts are often not monitored as strictly as active accounts. These might includes accounts where customers tend to pay slowly.

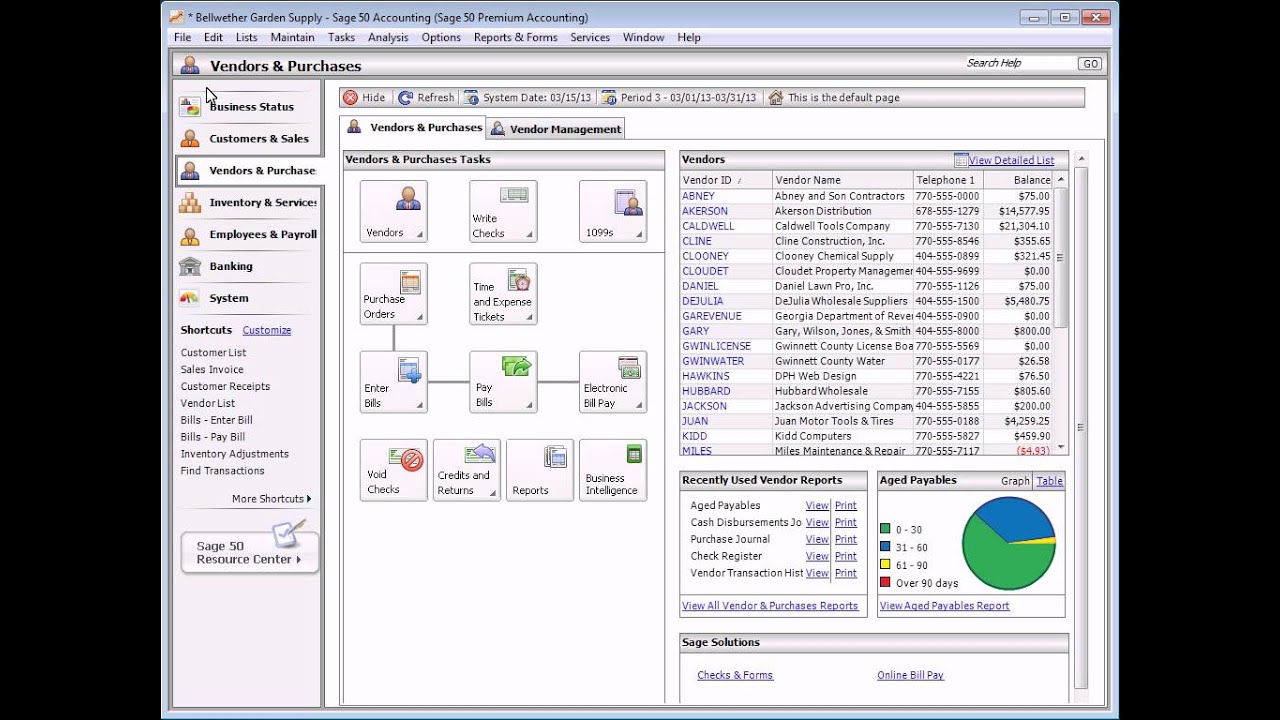

sage accounting accounts tutorial payable

Accounts Receivable - refers to sales that have occurred on credit, meaning that the company has not yet collected the cash proceeds from these sales. Generally speaking, a low Accounts Receivable to Sales ratio is almost always favorable, as it means that the company's cash collection cycle

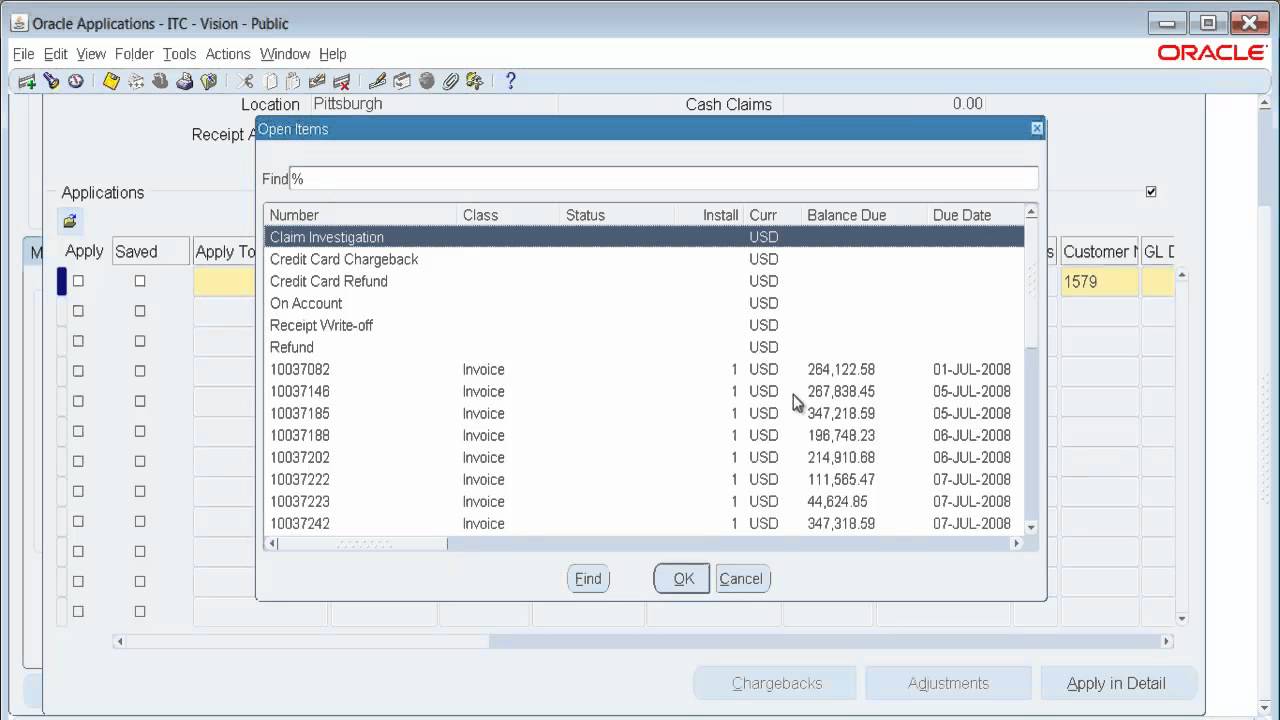

oracle cycle payables r12 financials

control accounts

Accounting for Receivables. Opening and Closing Accounting Periods. How Does Accounting in Receivables Work? Each business event that has accounting impact is called an accounting event. Oracle Subledger Accounting Implementation Guide. Multi-Fund Accounts Receivable.

If your business has accumulated a pile of accounts receivable, you need to learn how to reduce this pile to dust and get some money back into your business. However, no business will be able to avoid racking up large amounts of accounts receivable or ARs that can produce major delays in cash flow.

Accounts receivable risks include slowing the cash flow - or working capital - that sustains your business and allows you to grow. Effective accounts receivable risk management lowers your exposure by ensuring that invoice balances are paid on or before the invoice due date.

The accounts receivable turnover ratio is a simple financial calculation that shows you how fast your customers are at paying their bills. We calculate it by dividing total net sales by average accounts receivable. Let's use a fictional company XYZ Inc.'s financials for the year 2018 as an example.

receivable accounts dashboard template

Accounts Receivable Reconciling Items. When the reconciliation is conducted, there may be differences between the two amounts. One reason is that a journal entry was made to the general ledger account that bypassed the subsidiary sales ledger. This is the most common reason for

Accounts Receivable means all accounts (including late fees and interest charges thereon) and notes receivable of the Company in existence as of the Closing Date as set forth on the Closing Date Balance Sheet, determined in accordance with GAAP and on a basis consistent with the accounting practices of PentaStar but excluding in any event any Residual …

: [general-ledger] Close out Accounts Receivable. Posted by MoneyMom on Feb 1 at 4:22 PM . IWe have closed one of our manufacturing plants, and the only thing I have left open on my Accounts receivable are credit balances. What is an acceptable way to close these out on my balance sheet? 0.

Negative Accounts Receivable. The resultant credit from an overpayment shows the credit Negative Accounts Receivable. Negative A/R is the correct posting of an unapplied customer credit. Click Save and Close, and select Yes when prompted to record the transaction. In the Issue a

Accounts receivable is just another name for getting paid. Find out how it works and what happens when customers don't do their part. It's all in this So the accounts receivable process includes things like sending invoices, watching to see if they've been paid, taking steps to chase payment,

28, 2019 · Go to the Account field. Select Accounts Receivable. Enter the amount under Debit column. Choose a Customer Name from the drop down list. In the next line, select the offset account. Type in the amount under Credit column. Apply the General Journal Entry to the Existing Credit. Click the Customers. Choose Receive Payments.

Accounts receivable, abbreviated as AR or A/R, are legally enforceable claims for payment held by a business for goods supplied or services rendered that customers have ordered but not paid for. These are generally in the form of invoices raised by a business and delivered to the customer for

FA24 - Accounts Receivable - Aging of Receivables Method. Sage 50 - How to run the Year End Wizard. Sage Customer Support and Training.

Management of accounts receivable is important because the timing of receivables is a major factor in the company's cash flow. Reconciling the individual customer account balances with the general ledger balance establishes the accuracy of the balance sheet asset.

Accounts receivable are usually material items on the balance sheet; hence to audit accounts receivable, it is very important to perform proper audit procedures in order to obtain sufficient audit evidence for making appropriate conclusion on receivables.

accounts management template excel cast

(Closed means the account balance is transferred to retained earnings, perhaps through an income summary account.) The detailed information in the accounts receivable subsidiary ledger is used to prepare a report known as the aging of accounts It also reports how far past due the accounts are.

oracle r12 receipt receivables line features financial

accounting dashboard financial reporting sfdc crm standards google dissertation order

Avoid accounts receivable problems by implementing the policies discussed below. The Levelset Platform makes it easy to manage credit and payment paperwork. Get in touch with us to talk to an expert and learn more about how you can jumpstart the process of streamlining your

Find out how to record accounts receivables in the books of account? Importance & benefits of receivable management. Management of receivables refers to planning and controlling of debt owed to the customer on account of credit sales. In simple words, the successful closure of your order

With this automated accounts payable and accounts receivable software, companies can fully control their accounting, leading to efficient The following table outlines key differences between accounts payable and accounts receivable: How Do Accounts Payable & Accounts Receivable Differ?

Accountants may perform the closing process monthly or annually. The closing entries are the journal entry form of the Statement of Retained Earnings. This is the process to make that happen! The following video summarizes how to prepare closing entries. In accounting, we often refer to

05, 2021 · Accounts receivable (AR) is an account on a company's balance sheet that represents the money that a customer owes to a business for products or services a customer has received and paid for on short-term credit. The party that has supplied the products or services would list their accounts receivable items on their financial balance sheet as ...

Accounts receivable track payments due from your customers for goods or services you provide. Receivables might have a duration of 30, 60 or 90 days or longer. As a business manager, you need to know how much you have in total receivables. This helps determine your company ...

How much do you know about accounts receivable? Yes, accounts receivable is an asset, because it's defined as money owed to a company by a customer. Let's take the example of a utilities company that bills its customers after providing them with electricity.

The post closing trial balance reveals the balance of accounts after the closing process, and consists of balance sheet accounts only. Used by Google DoubleClick and stores information about how the user uses the website and any other advertisement before visiting the website.

Accounts receivable is a thief's paradise due to the influx of money at all times. Accounts receivable fraudsters take advantage of the trust they've built Refusing to take a vacation, unwillingness to share job tasks, or being unusually close with a customer (or two) are also signs that they might not

How Are Receivables Different From Accounts Payable? Receivables represent funds owed to the firm for services rendered and are booked as an asset. The average collection period is the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable.

The risk for accounts receivable would be internal control risk and inherent risk. The risk of being susceptible to misstatement due to the nature of Accounts receivable should be recorded alongside sufficient supporting documents. Supporting documents include customer purchase order, letter

Receivable vs. Accounts Payable While Accounts Receivable refers to money that a company expects to collect from customers, Accounts Payable refers to the money that a business must pay. Accounts Payable (AP) usually takes the form of recurring bills, operational costs, and general expenses.

How calculate accounts receivable turnover ratio? Sales Revenue/Accounts Receivable = accounts receivable turnover ratio. Does accounts receivable close at the end of the year?

31, 2021 · In this article. The following table lists the pages that support the close Accounts receivable business process. Note. To open some of the pages in the table, you must enter information or specify parameter sales order: Update sales slip posting: Update packing slips for sales orders.

19, 2022 · The reconciliation of accounts receivable is the process of matching the detailed amounts of unpaid customer billings to the accounts receivable total stated in the general ledger. This matching process is important, because it proves that the general ledger figure for receivables is Reading Time: 2 mins