Klarna gives customers a range of payment options during checkout. Available payment options vary depending on the customer's billing address and the transaction amount. Klarna covers disputes driven by customer fraud or inability to repay installments provided you follow Klarna's shipping policy .

Klarna does checks to assess your financial standing, though its soft credit check will not affect your credit score. However, if you use one of the services' financing There is no minimum for how much you need to spend on Afterpay's end, but some merchants will apply one.¹⁰. Klarna spending limits.

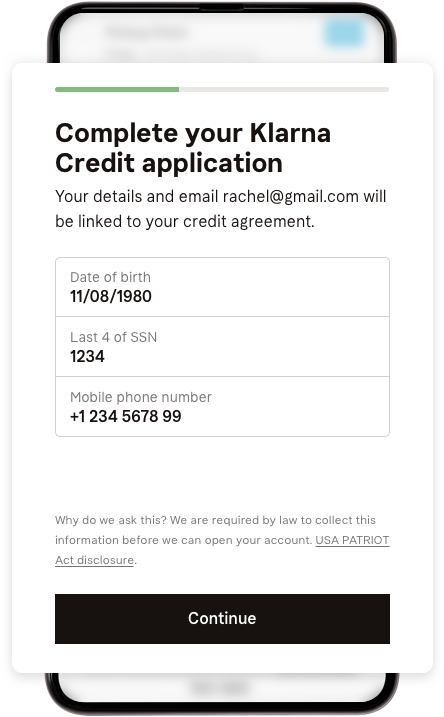

06, 2021 · The steps are simple in order to avail of the financing option in Klarna: Step-1: Sign up for a Financing account in Klarna. Step-2: You will receive an email confirmation from Klarna and your credit limit. You can now use it on your next checkout. Step-3: Select to pay later with financing upon check out of your order

08, 2021 · So if you want to see your Klarna spending limit, your maximum credit for 4 payments purchase, then you really should watch this video!You'll find answers

19, 2021 · Tip: Note that every Klarna plan is approved on a case-by-case basis, and you’ll get a spending limit based on various criteria like your Klarna account and purchase history. On the downside, you’ll be charged late fees of up to $7 …Estimated Reading Time: 10 mins

klarna startet internetworld

can always check your credit limit in the Klarna app. Can I increase my credit limit? We automatically determine if you are eligible for a credit limit increase when you shop with Klarna. You can try to make a purchase that is above your credit limit and if we are able to grant that increase it will be done at that time. Currently, we cannot accept customer-initiated requests for …

19 How use Klarna Australia? 20 What Is Klarna limit Australia? 21 Can I have 2 Klarna accounts? Klarna performs a soft credit check which does not affect your credit score and will not be visible to other lenders when: Deciding to 'Pay in 4 interest-free installments' Preferring to 'Pay in 30 days'...

bukhari sahih sanad 16x20 alim alimah 18x24

venti

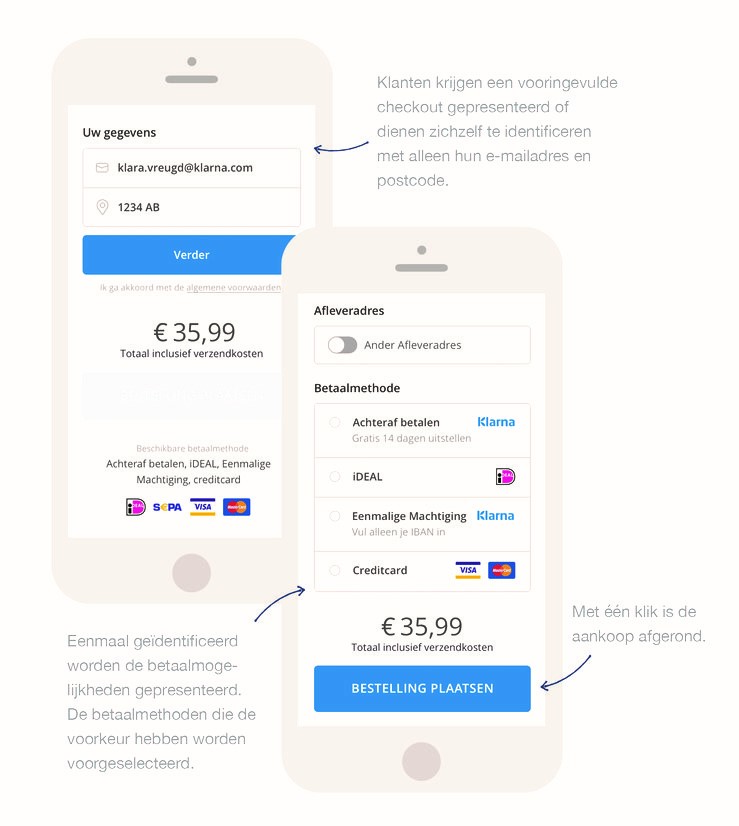

This official Klarna extension also makes it easy for you to handle orders in WooCommerce after a purchase is complete. With a single click of a button, you can activate, update, refund and cancel orders directly from WooCommerce without logging into the Klarna administration.

Learn how Affirm works, how Afterpay works, and how Klarna works with our guide to buy now, pay If you apply for Klarna financing, Klarna will run a hard credit check, which could hurt your credit score and will All services place individualized limits on purchase amounts based on a number of

But, because of its invisible credit limit, Klarna is potentially damaging the credit scores of In the background, Klarna runs quick credit checks through its third party credit provider There are two main ways to access your Klarna account, through its website or app, but my main gripe is just

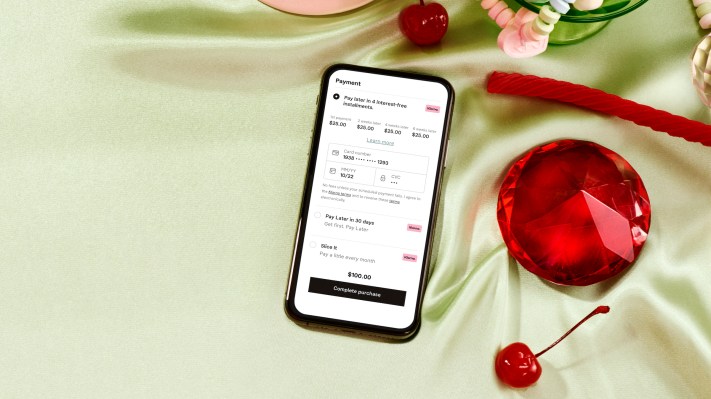

The Klarna one time card is a "virtual" card which you can access via the Klarna mobile app. It lets you purchase any item and pay for it in 4 interest free instalments . Klarna is a popular "pay later" service which lets you buy goods online and pay for them later though instalments.

So if you want to see your Klarna spending limit, your maximum credit for 4 payments purchase, then you really should watch this video!You'll find

Klarna's credit limit is dynamic and individual for each customer. Before you can use a Pay Later product, Klarna will perform a soft credit check - this initial search will not affect your credit rating and the check is not visible to other lenders.

tranquil lapghan

Yes, Klarna's credit limit increases depending on your repayment status and how long you've been a customer at Klarna. The more orders you successfully pay Yes, Klarna does not accept 100% of orders. Klarna will run an affordability check on you before accepting your first order and will take

What Is Klarna? How Does Klarna Work? Klarna Pros and Cons. Wondering how to use Klarna and how it works? As mentioned, you'll need to sign up for a free Klarna account to get started. So what can you buy with Klarna? The answer depends on your spending limit.

klarna lookfantastic auf

I just checked Klarna again and I've been hit with a late fee for January. I've contacted customer support again, and no direct answer to this problem. How many people on here use klarna to buy clothes? If you do, do you not realise that you are absolutely mental! Noone should be paying for

Klarna determines this credit limit based on factors such as your credit score, how long you've been using Klarna, and how well you've paid back Klarna checks your credit each time you use the service to make a purchase, but the kind of credit check depends on the payment option you choose.

There is no set limit for how many purchases you can place using Klarna. How do I check my Klarna spending limit? Your spending limit is an estimated amount based on available credit decision data in real-time. How do I increase my Klarna spending limit? Your repayment history with Klarna to date.

klarna pay later shops started everything need inthestyle

How Klarna works. Klarna offers a few different kinds of payment solutions, each with their own functionality. Additionally, there is only a soft credit check, which won't affect your credit score. Tip: Note that every Klarna plan is approved on a case-by-case basis, and you'll get a spending

How does Klarna work? Klarna's most popular payment plan, Pay in 4, lets shoppers split their Have a credit card but don't have a high credit limit. Taking a Klarna loan is better than maxing out Klarna may perform a soft credit check. This will not affect your credit score or show up on your credit report.

checkout categories

› How does klarna card work. › How to find klarna limit. How. Details: Choose Pay with Klarna when you shop in our app or create a new One-time card from the My Klarna tab. That being said, not all retailers accept Klarna, so check with the store before trying to pay with Klarna at the register.

Does Klarna perform a credit check on me, and will this affect my credit score? As a responsible lender How does Klarna work first payment? When you create a One-time Card or choose our Pay In 4 interest-free instalments service, we place a reservation for the first instalment on your account.

Klarna and Sezzle are two popular buy now, pay later services. How do both compare in 2021? The article covers Klarna vs. Sezzle. Credit check and affect. How do both work? Klarna. Sezzle. Limits.

How do I contact Klarna customer servic. What is the catch with Klarn. What's better klarna vs Afterpa. Does klarna have a limi. How do I report a problem on How long does it take for klarna to refund yo. What happens if you don't pay klarna at al. Why will klarna not wor. Why did klarna charge me a dolla.

, Klarna is a legit and safe option for the following scenarios: If You Don’t Have a High Credit Limit. If you have a credit card but would want a higher credit limit, a Klarna loan may be a good alternative to maxing out your card, which can lower your credit score. If You Do Not Qualify for a Credit Card

Check out the details below. Pay Later with Klarna This option gives you up to 30 days to pay once Choose how to pay. Once you get to the checkout, you can find Klarna's payment methods by These cookies are used to deliver ads relevant to you. They also limit the number of times that

is no predefined credit limit when using Klarna products, instead, you can see your Purchase Power in My Klarna if you are a returning Klarna customer. Your purchase power is an estimated amount based on factors such as credit, your payment history with Klarna, and your outstanding balance. If you are using the Shopping extension on your browser, you can see …

Your credit limit is the maximum amount of credit Klarna will offer you at this time. This takes into account many different factors including time of day, size of the purchase, how long you have been shopping with Klarna, and how many You can always check your credit limit in the Klarna app.

klarna credit pay later smoooth financing application albion agreement

You can always check your credit limit in the Klarna app. What credit score do you need for Klarna? how to snooze a klarna payment missed klarna payment by one day what happens if you extend your due date on klarna can you snooze klarna pay in 3 klarna pause payment return

How Klarna works. Like Afterpay, Klarna is a financial technology (fintech) company that allows consumers Klarna: When shopping with Klarna, users aren't restricted to a hard borrowing limit. Klarna: Whether or not Klarna will run a credit check depends on the retailer you're shopping

Limit bei Klarna: Das ist bekannt. Klarna stellt jedem Kunden einen persönlichen Verfügungsrahmen bereit. Der flexible Ratenkauf über Klarna ist sicher und transparent. Einzig das persönliche Limit beim Klarna Ratenkauf wird nicht vorab bekanntgegeben, sondern bei jeder Bestellung anhand

14, 2021 · If you sign up for a Financing account, Klarna will send you an email with your credit limit. You can also find this number on your monthly statement and on the home screen of your Klarna app. The Klarna browser extension may also show you how much you're approved to spend on a particular retailer’s site.

klarna payments fintech presence expand cityam krona techcrunch 460m bans watchdog etherington urged opt darrell deemed irresponsible betakit

klarna haruka

03, 2022 · why can’t i pay with klarna anymore how to check my klarna limit klarna spending limit reached klarna couldn’t verify personal details klarna not working on nike klarna unfortunately this option is not available. please choose a different payment method. klarna not approved for one-time card. Share. Tweet. Email.

Klarna nor Mattress Online run credit checks against you that could impact your credit rating. Klarna may run "soft credit searches" (also known as "unrecorded Klarna will send you an email when payment is due each month, including instructions on how to pay and an overview of your account.

31, 2022 · When you have successfully paid off your first order with Klarna, you will be able to see an estimated spending limit on the home page of your Klarna app. Your spending limit with Klarna will change over time but may be as high as $2000.

How Does Klarna Work? Klarna is a buy now, pay later service designed primarily for online purchases. Generally, the more often you use Klarna to pay, the larger your credit limit may be Yes, Klarna can check your credit. But whether this involves a soft or hard credit check depends

19, 2021 · When you have successfully paid off your first order with Klarna, you will be able to see an estimated spending limit on the home page of your Klarna app. Your spending limit with Klarna will change over time but may be as high as $2000.

Contents 10 What Is Klarna limit? 13 How do I check my balance on Klarna?

Does Klarna have a spending limit? Tip: Klarna does not apply any set limit to the number of instalment plans you can have open at one time, but your payment history and We manually check every order and double check everything via email personally with you, so if we think there are

:max_bytes(150000):strip_icc()/PayPalCredit-cb85e79a143d444db22be1804f89c9d2.jpg)

beanbags thebalance highback financing calla otters tumbling prince2 practitioner bristles beanbag purchases 50s voltage hydraulic micropigmentation

spechler microcheck

venetian maske karneval masquerade brasilianische

klarna

Increasing a Klarna limit is possible through a request. However, Klarna will not allow most requests to encourage responsible spending among its users. Klarna has no specific limit when it comes to credits and spending. However, the limits will take place only during purchases.

klarna gelanceerd