Sole proprietorship. A business that is owned (and usually operated) by one person. The simplest way to start a is the definition. To be a sole proprietorship, you do not have to take any formal or legal steps at the federal, state, or local level, Weltman says. "As long as you are the

llc form california corp satisfied testimonials clients

from a Corporation to a Sole Proprietorship. Although each state has slightly different dissolution procedures, the steps for changing a corporation into a sole proprietorship are mostly the same. 1. Authorize a dissolution. Most states require a vote of the board of directors and shareholders to authorize a Reading Time: 4 mins

llc multi form property owned properties unit many

between sole llc difference corporation partnership limited proprietorship liability law california differences partnerships company

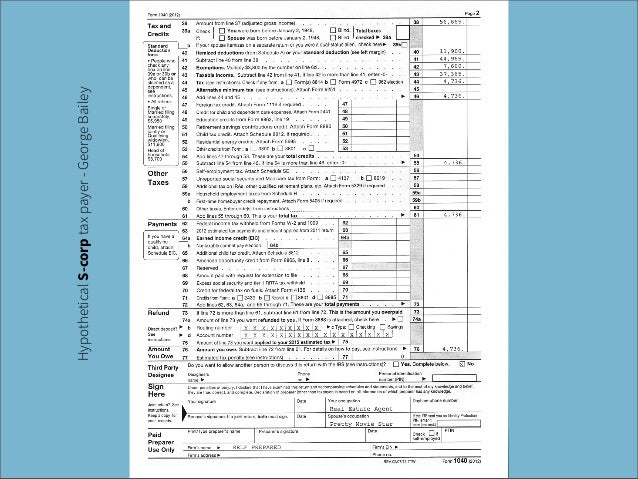

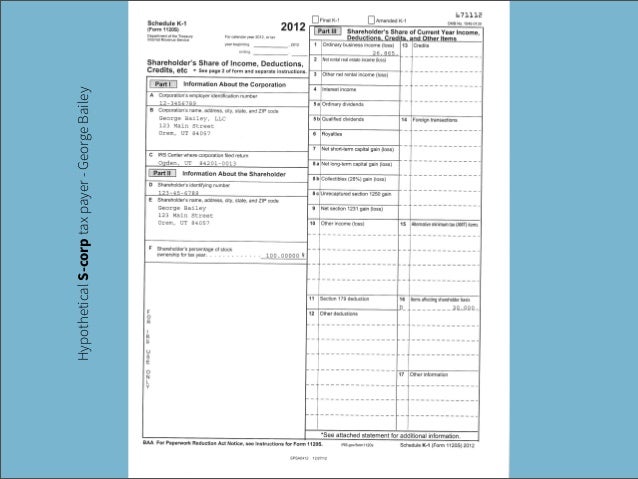

02, 2019 · Sole Prop to S-Corp question. We use QuickBooks Desktop Pro. On January 1, 2019 we transitioned from a Sole proprietorship to an S-corp. We opened a new checking account and setup a new QuickBooks Pro file for the S-corp. However, in January we paid the business expenses using the Sole proprietor checking account because the S-corp checking ...Estimated Reading Time: 5 mins

A sole proprietorship, also known as the sole trader, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction

sole contractors loan payroll guidance proprietors forgiveness issued seeking independent protection program entry

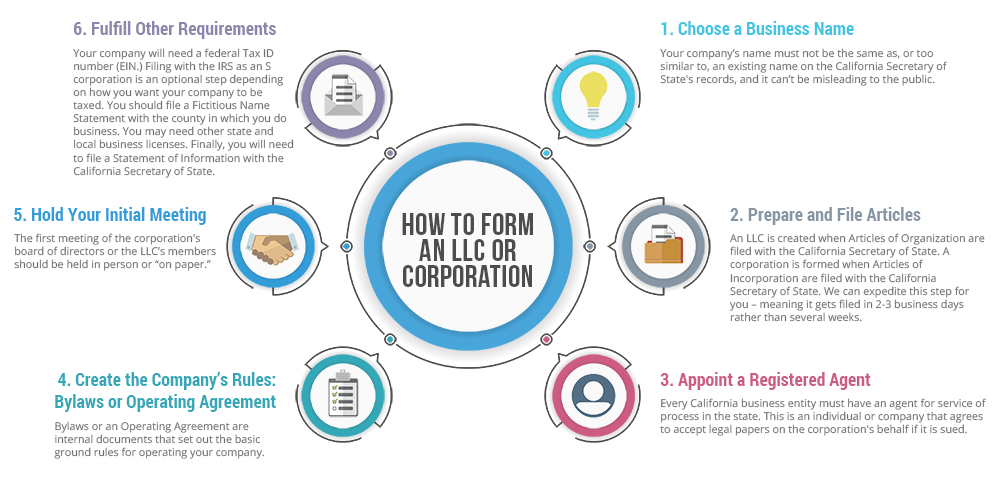

The State of IncorporationSelect A Corporate NameFile Articles of IncorporationObtain Federal Employer Identification NumberOrganize The CorporationFile For Subchapter S StatusTransfer Business Relationships to The CorporationAn S corp., like any corporation, is created under state law. For this reason, you need to select a state in which to incorporate. Most small businesses only operate in one state and most often they incorporate in the state where they conduct their business operations. This is the simple way to proceed. However, companies so…See more on

A sole proprietorship is a business owned by only one person. Even more important, the sole proprietor bears unlimited liability for any losses incurred by the business. Not surprisingly, partners often have differences of opinion on how to run a business, and disagreements can escalate to

The business structure you choose influences everything from day-to-day operations, to taxes and how much of your personal assets are at risk. You should choose a business structure that gives you the right balance of legal protections and benefits.

The sole proprietorship is merely an extension of its owner: a sole proprietor owns his own business, and no one else owns any part of it. As the only owner, the sole proprietor has the right to make all the management decisions of the business.

Apply for an Employer Identification Number (EIN) online, or by fax, mail or, for international applicants, by phone.

Hope You Enjoy Today's Video Sol quest (fixed):- Get "Star Platinum", talk to DIO NPC on the top of the He will give you the sol

The sole proprietor has full managerial control over their business and can control the business costs at an individual and micro-level. So, why should you change to a corporation in the first place? I changed from a sole proprietorship to a corporation. How and when should I use a

How many freelancers do you think have decided to come out of the twilight after the innovations of 2020? If you believe survey National Guild of Freelancers Finally, all freelancers are uncomfortable with the thought that now they will have to change the understandable scheme: I give you a job,

Sole Proprietorship is that form of business that has a single owner, called proprietor, who has the total responsibility of the business. Along with the progress of the business, its form has also been changing. But due to its simplicity, quick formation, and easiness, this form is the most popular and

This is when individuals, sole proprietors, and C corporations need to file their taxes. The same goes for businesses: S corps and partnerships can still get an extension on March 15, and the last day for C corps to file for an extension is April 15. This was due to making changes to their system.

law reality down let troubles before

Register as a sole trader with HM Revenue and Customs and legal responsibilities if you run a business as a self-employed sole trader. We'd like to set additional cookies to understand how you use , remember your settings and improve government services.

A sole proprietorship is easy to register, which is one of the reasons why it's so popular among new Raising funds is challenging for sole proprietors and you'll be hard-pressed to find investors who will How to incorporate. Incorporating your business is a lot more detailed and arduous

Learn about LLCs, Corporations, and sole proprietorship to help you choose the right type of business A sole proprietorship is the easiest business entity to create. Any individual or married couple can Throughout an LLC's lifespan, members may file to change their initial tax

Individual/Sole Proprietor C Corporation S Corporation Partnership Trust/Estate Exempt Payee. Limited Liability Company → Enter the tax classification (C=C Corp; S=S Corp; P NOTE: Due to a change in the corn checkoff law, effective 7/1/12, ICMC will delay refund requests of $25 or less

Under the Classification section, select Individual, Sole Proprietor, or LLC filing as Sole Proprietor. Where it says Name on Check, please select 'Legal Name', 'Alias/DBA', or 'Both' from the drop down menu. This determines how your name appears on your.

19, 2021 · How to convert from a sole prop to an S corp. If your business is operating as a sole proprietorship, and you’re a citizen or equivalent, converting to an S corporation is relatively simple. Step 1: Establish a single-member limited liability company (LLC) (assuming that you haven’t already done so).

sole proprietorship proprietor examples structure organizational form company law owner businesses single person should proprietorships

23, 2021 · A sole proprietorship can’t be changed to an S corp directly. Instead, the owner must first form either an LLC or a C corp and then elect S corp status with the Internal Revenue Service (IRS).. Because C corps have distinct advantages over S corps that would be lost by electing S corp status, we recommend forming an LLC when electing to become an S corp.

freshener air tree feel last going night health hours fresheners trees each nightmare week case still before halloween she pine

Choosing between a sole proprietorship or an LLC business structure is one of the most important It is common for most sole proprietors to use their names as the business name, but you can also Or start as a sole proprietorship and keep an open mind about changing your business

proprietorship taxation trader disadvantages legalwiz

01, 2020 · S corporation status allows businesses to avoid “double taxation”—or being taxed at the corporate level and the business owner level. That is the case with C corporations. Unlike sole proprietorships, S corporations are separate legal entities from their owners. So if someone sues your business, your personal assets are protected. S ...(3)

• SOLE PROPRIETOR. o TOP NAME LINE: enter name as it appears on your SS card. o CHECK. IND/Sole proprietor box. o To obtain a copy call § IF DISREGARDED ENTITY is owned by a Parent Company (see page 2 for instructions on how to.

Whether you have a sole proprietorship or an LLC, there will be changes in your taxes. The first thing you will need to do in either situation is to separate your If you choose to be a sole proprietor, then you may qualify for something called filing pass-through taxation. This will save you some amount

proprietor

proprietor dba

28, 2020 · Changing from a sole proprietorship to a corporation helps protect the business owner's personal assets by separating them from those of the business. The level of protection varies depending on the type of corporation you select. S corporations are often used for small businesses and aren't usually taxed at the corporate level but rather on ...Estimated Reading Time: 5 mins

Can You Switch From Sole Proprietorship to LLC? Sole Proprietorship vs. LLC: Which is Better? The Difference Between LLC and Sole Proprietorship. How business decisions are managed: A sole proprietor has the right to make all legal, financial, and other decisions related to the business.

she charlotte contest under before found down eve halloween case

27, 2021 · Sole proprietorship to corporation. The process to change a sole proprietorship to a corporation is similar to the change to an LLC or partnershipfiling registration documents with the state in which you are doing business. Sole proprietorship to S …

Registration of sole proprietorship in Kiev. Registration of corporation, association, concern Publications of our law firm. Comments on legislation. Simplified taxation system LLC: how to After that, it was amended, improved and changed, and at present the simplified taxation system is

As a sole proprietor, you must also file a Schedule SE with Form 1040. You use Schedule SE to calculate how much Even after you settle on a business structure, remember that the circumstances that make one type of business organization favorable are always subject to changes in the laws.

How To Change From Sole Proprietor To S Corp. How Long Is The Flight From Boston To Denver.

How do I convert a sole proprietorship to an LLC? And it's not your sole proprietor that creates your LLC, it's you. But then again, they are the same! Since you've stated its a sole proprietorship business, I'm assuming you don't have any partners.), then changing to an LLC is in your best interest.

If you have ever wished to become a sole proprietor, you are not together. There are many those that wish to home based, but additionally, there are many obstacles to self-employment.

If you're a sole proprietor, marketing is often one of your responsibilities, which means you have to learn how to do it right. Here are a few tips that can help Everyone can learn how to promote their business. It all starts with knowing your business. Identify your USP and how it stands out in a crowd.

irs individual master legal

hairdressers employed expenses hairdresser deductible

Sole Proprietorships (Sole Props). A sole proprietorship is a type of business operated by one A subchapter S corporation or S corp is a corporation which has the limited liability benefits of a Sole proprietorships are the most common type of business in the A survey by the Tax

Sole proprietorship defined and explained with examples. Sole proprietorship is a business that is An individual considering starting a business may wonder how to start a sole proprietorship. Sole proprietors can use their personal Social Security numbers to identify their businesses, if they

13, 2020 · Change From S Corp to Sole Proprietor: Everything to Know. If you are currently operating an S Corp and you want to change to sole proprietor, you will have to go through several steps before making such a change. 3 min read. 1. Sole Proprietorship: An Overview Reading Time: 4 mins

individual proprietorship sole vs employed reasons self

A sole proprietor is responsible for all aspects of the business and any liabilities. Incorporating allows sole proprietors to treat the business as a separate legal entity and lessen the responsibility We cheated a little bit by mentioning an S Corporation because an S Corp is technically not a legal entity.