are subject to change without notice. For the most current fees, contact the County Clerk directly. Document Formatting Requirements * A document in Dallas County, Texas should provide enough space (at least 3 inches) at the bottom of the last page of the document for the recorder's stamp.

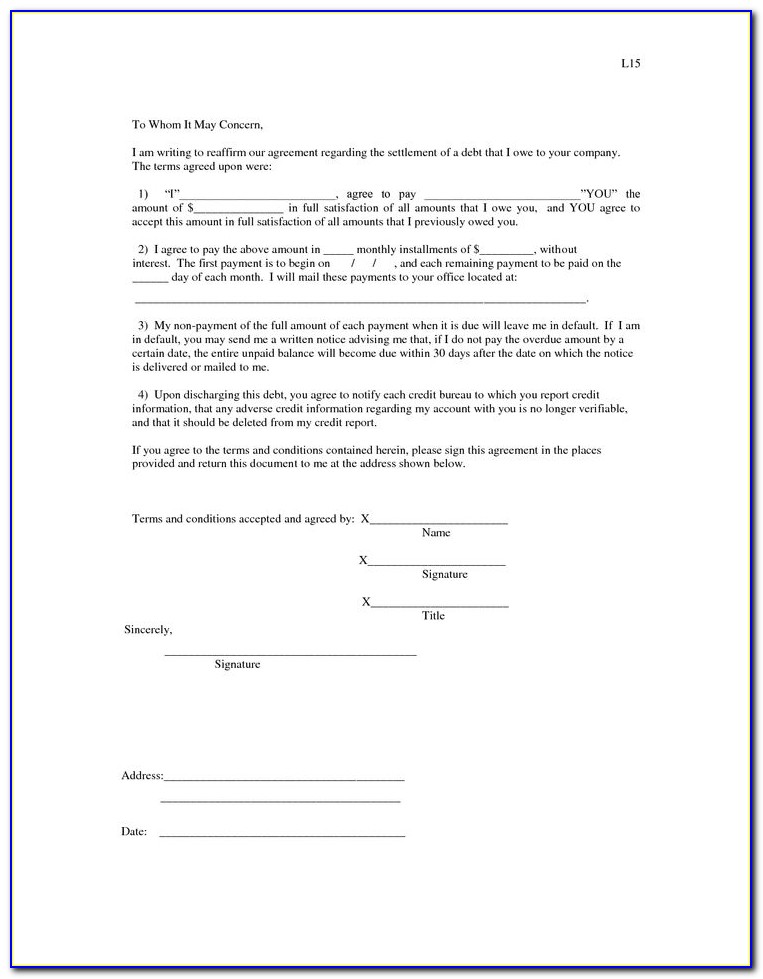

form legal iou codicil

In Texas, executors can fulfill this measure by posting notice in the local newspaper. A Texas probate judge must hear these disputes before proceedings can continue. Asset Distribution - Upon settling disputes, expenses and debts, beneficiaries may receive the remaining assets of the estate.

This law allows Texas residents to change the memo as often as they like without having to redo (and Therefore, your Executor does need to hire an attorney to handle the probate of your estate in How long does probate take in Texas? The typical probate in Texas takes less than a month

Executor's Deed in Texas. How to Change the Name on Property Title Deeds in Texas. An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will.

[Grantor] of the property in front of a notary public to prevent identity theft and title theft. This is required by law. Good to know: It is the duty of the notary to verify that the person signing the document is the person whose name is on the document. However, it is not the notary’s duty to conduct a title search or to verify the person signing the document really owns the property.

The general rule in Texas is that the executor has four years from the date of death of the testator (person who drafted the will) to file for probate. The court will often appoint one of the primary heirs to act in this capacity. How To Start The Probate Process in Texas. There are 18 probate courts in

testamentary pdffiller

What does an executor do? Your executor takes on the job of carrying out the instructions you leave in your will when you die. It can be a complicated job even if your instructions and your property are quite simple - it's not unusual for the process to Anyone aged 18 or above can be an executor of your will.

To change the executor named in your will, you need to prepare either a codicil or a new will. Some states refer to this role as the executor or administrator of your estate. This person has the authority and responsibility to settle and distribute your estate after you die.

infoboxes alternate politics wikipedia current

04, 2022 · The Governor of Texas has temporarily "suspended certain statutes concerning appearance before a notary public to execute a self-proved will, a durable power of attorney, a medical power of attorney, a directive to physician, or …

15, 2018 · Go to the county assessor's office and record the new deed title. The executor signs the quitclaim or grant deed. Quitclaim and grant deeds are official notices of change.

So, can the executor of a will change it to remove beneficiaries? No. If you're named in the will as a beneficiary, the executor won't be able to reduce the In cases like this, the executor will need to work with the beneficiaries involved to decide how to distribute the possessions in a way that feels fair.

How to Hire an Executor. Thinking about hiring a professional executor for your loved one's estate, or naming one in your will? PROBATE, TRUSTS, ESTATES: Need a great attorney?

If you're wondering how to change the executor of a will after the fact, the process is easier than you might think. As you go about the process, it may There's no rule preventing a beneficiary of a will from also serving as executor. While beneficiaries can't witness a will in which they have a

most states, all you need to complete is a Renunciation of Executor form, which is a legal document that states the person named in the will as executor will not act as executor for the estate. This form can be filled out in your local probate court. Some states offer this form online as …

An executor of a will is the person responsible for administering the decedent's estate during the probate process. This position gives the executor broad rights of access to the estate and may result in abuse. To remove an executor against his will, you must petition the probate court and

An executor is the person named in a will to carry out the wishes of a person after they die. And a will is sacrosanct and the executor cannot change it 'willy-nilly ' and just because they feel like it ! The problem comes if there are multiple surviving children and how the division of TPP is to be made.

In Texas, an executor is entitled to 5% of all amounts the executor actually receives or pays out in cash in the administration of the estate, not to exceed 5% of the estate gross value. This calculation does not apply to receiving funds that, at the time of the decedent's death, were on hand or stored in

How many executors of a will should you have? Some people choose more than one executor so that the responsibilities are shared. There are different laws across the UK if you wish to change the executor of a will - see Citizens Advice Scotland or NI Direct for more information.

How can I change the executor of my will? - Legal Guides ... If you're making significant changes to your will, you may want to draw up a new one entirely. But if all you want to do is change the executor of your estate, you can simplify the process and add a "codicil" to your will.

Intestate Succession Please note: There are no substantive changes in these laws; effective January 1, 2014 code references are to the Estate Code rather than to the prior Probate Code. Property That May Descend Each and every title to every estate of inheritance, real, personal or mixed, owned by the intestate

I was just named independent executor of someone's will. What do I need to know? You need to understand the importance of your job as independent If the real property is not being sold for one of these purposes, the independent executor must have express authority in the will (in other

How to change the executor of a will. If you're making significant changes to your will, you may want to draw up a new one entirely. Be sure to get legal advice on how to change the executor of your estate according to the laws of the state you live in. After all, you don't want to inadvertently

How to Amend a Will. The effective date from the Last Will along with referencing the sections needed to be changed is needed in order to complete the codicil. Make a note of the Sections and language that needs to be changed. It's required in the Codicil for the specific sections be referenced.

executor ohio executors letter appointment wills regarding law living

My mom wants to change the executor on her will from my sister to my brother. I am trying to assist her with this. Is it as simple as completing a Codicil of will changing the executors? I just wanted… read more. Fully licensed attorney in Texas in private practice.

The appointment of an executor is initiated by the initial filing of the probate of the estate. You can state in the petition to have the will allowed that the named executor is unwilling to serve and then you can name another person who you Can an executor of will change beneficiaries before or after death.

The executor of the will passed away several years ago and the second in line is his brother who is 80 years old. I'm sure he will be willing to give up the executor title to me. There is nothing there to collect in the will, but for legal reasons involving control of ownership of two insurance policies has gone

Executor duties in Texas typically include collecting and compiling an inventory of the estate assets If the decedent leaves detailed instructions in his will for how he wants his executor to be paid Under Texas law, an executor of an estate is entitled to a commission of 5 percent of the value of the estate.

Executors. The Concurrency API introduces the concept of an ExecutorService as a higher level replacement for working with threads directly. Executors are capable of running asynchronous tasks and typically manage a pool of threads, so we don't have to create new threads manually.

Texas will allow permitless carry of handguns, starting Wednesday. Farmers' Almanac predicts another rough winter in Texas. Q: I recently hired an attorney and updated my will. After only a couple of months, I want to change the executor. I know it is not as easy as crossing out a name and

Adventures of Billy & Penny Women & Money - Spanish Edition Women & Money - Be Strong, Be Smart, Be Secure - NEW The Ultimate Retirement Guide for 50+ The Money Class, Create the Future You Deserve The 9 Steps to Financial Freedom Action Plan: New Rules For New Times Women & Money Suze Orman’s Financial Guidebook The Road to Wealth: Suze …

They are the executors — the relatives or friends designated in a will as the final administrator of a deceased person's estate. If you have agreed to serve as an executor, you likely know the outlines of the task you face: closing accounts, inventorying assets and distributing bequests. Even when it's

Executors and Administrators. How Do I Resign as Executor in Texas? I wish to decline duties as executor of my mom's will. My mom passed away Monday night. Being executor of her will causes me to have to deal with her sister who is a very unkind women.

In Texas, you cannot name an executor who has been convicted of a felony under any state or federal law, unless he or she has been pardoned In Texas, a nonresident executor must appoint someone who lives in the state to act as a resident agent. How it Works. Briefly tell us about your case.

not, the executor must pay the taxes and obtain a release from the tax agencies proving they were paid. These documents are needed to close the estate with the probate court. 3. File the final accounting with the probate court. The executor must submit the final accounting form which lists all of the estate's assets, income, and expenses.

duties executor texas administrator probate slideshare estate responsibilities

Some jurisdictions call an executor of an estate the "personal representative." Whatever the legal title, this is the person who manages someone's estate However, in some situations the executor may act in an untrustworthy manner, for example by stealing estate assets. To change the executor of a

Being named an executor or choosing the executor of a will does not imply such a person must have legal or financial expertise. Executors need not do this all by themselves. Should they need expert help, the executor of a will can easily get assistance from a lawyer, para-legal or accountant at

An executor certainly has no remit to change the will, even if they deem it unfair on the beneficiaries (or, more to the point, those who are not named). If you are the executor of a will and believe that it should be changed, then the first thing to do is to discuss the issue with the people who are

12, 2019 · The executor of a will is in charge of making sure the wishes of the deceased are carried out, as well as handling the final affairs of the estate. The executor has authority from the county probate court to act in this role, but that doesn’t necessarily mean that the executor has the final say on all decisions regarding the estate.

cases of extreme disagreements, one executor (or a beneficiary) can even ask the probate court to remove one or more of the other executors, so the estate can be settled without too much delay. As you can imagine, such disputes can result in many years of resentment—exactly what you are trying to avoid in the first place.

If the executor is not a Texas resident, they will need to appoint a resident agent who can accept legal papers on behalf of the estate. Adam understands the duties of an executor of a will in Texas. He knows how to help executors and beneficiaries alike and can help you ensure that your loved one'