Health savings accounts (HSAs) and Medicare Advantage Medical Savings Accounts (MSAs) are individual accounts offered or administered by Optum Bank®, Member FDIC, and are subject to eligibility requirements and restrictions on deposits and withdrawals to avoid IRS penalties.

this form to request the closure of your Health Savings Account (HSA). Investment funds (if applicable) will be liquidated prior to account closure and you hereby authorize and direct us to liquidate investment funds on your behalf. Customer service professionals can be reached by calling the number on the back of your debit card

walls floor paintable theme wallpapers textured bin flooring floorboard geometric wood 3d wallpapersafari a45 grasscloth desktop

Similar to how some savings accounts have withdrawal limits, eligible withdrawals from an HSA are also limited. Often times, your HSA account will come with a debit card that you can use to pay qualified expenses directly. But if you put medical expenses on your regular credit card, you can

Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are health benefit accounts that allow you to contribute a portion of your salary or wages (before taxes) to cover Yes, you can add your FSA or HSA card as a payment option in Your Account by clicking here.

Looking for a health savings account in the Bay Area? Visit Redwood Credit Union and open an HSA to enjoy flexibility and control over health care costs. Saving money is easy with an HSA and gives you peace of mind knowing you're prepared for a medical emergency.

Here you may to know how to cancel hsa account. Watch the video explanation about 2 Health Savings Account (HSA) hacks. Online, article, story, explanation, suggestion, youtube.

While a Health Savings Account (HSA) is not intended to be used for retirement, it acts as a powerful savings tool if you know how to use it correctly: Betterment CFP Nick Holeman calls it "kind Besides being a good way to save money on health care costs, HSAs can supplement your retirement savings.

Account Number: OR Social Security Number: Your remaining HSA balance, less the $25 account closing fee, will be mailed to you within three weeks of HSA Bank receiving this form. For additional assistance, please contact our Client Assistance Center at (800) 357-6246, Monday - Friday, 7

8889 form

If you over contribute to your HSA, you have excess contributions and need to remove them. We show how to withdraw these amounts to avoid penalty The IRS defines a maximum amount that you can contribute to your Health Savings Account each year, appropriately called the HSA Contribution Limit.

Here's how to cancel your HSA Bank subscription when billed through a payments provider that is not the Appstore, Playstore or Paypal. Sometimes, you may start a subscription directly on a company's website without using an extra layer of security like Paypal or Apple. To unsubscribe, you might

to administer your HSA account if you. withdrawal when funds are deposited. A: You can track your HSA account activity online anytime — day or night. Upon request, you may receive monthly statements that show any contributions to, withdrawals from, and interest earned on your account.

flexfoam unscented

A health savings account (HSA) is an employer-sponsored health plan that is much like a savings account and is typically maintained and administered by The most attractive feature of an HSA is the ability to make tax-deductible contributions into a Health Savings Account that can earn interest.

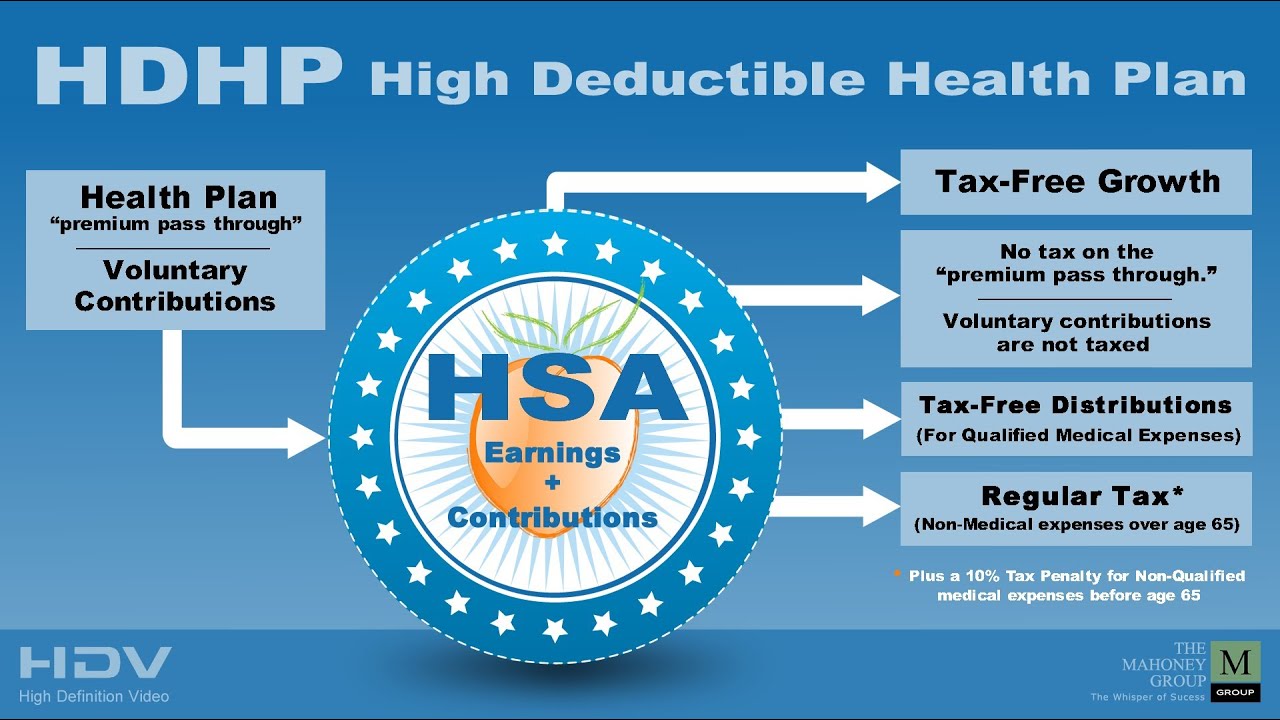

How Does a Health Savings Account Work? Contributions to a HSA are tax-deductible. This means contributions will be deducted by payroll for The type of account opened will dictate the type of investments that may be available. Plans provided through banks usually offer no more than high

An HSA, or health savings account, is an increasingly popular alternative to standard health care plans. Why Are HSAs Catching On? Not everyone has heard of HSAs but large numbers of employers offer them because they can save everyone a lot of money.

Reason for Cancellation. How to Cancel Fundancer by Phone (Live Agent). Step 1. Contact the business at 1-888-983-1287. Step 3. Request that you be refunded. Step 4. Provide the agent with your account info. Step 5. Ask for a verbal confirmation code or email as proof of your cancellation.

How to get help with a hacked Facebook account.

Health Savings Accounts help pay for deductibles, coinsurance, copayments, and other medical expenses. Once the money goes into the Unfortunately, some restrictions come along with having a Health Savings Account with Medicare. HSA is only for those enrolled in a high-deductible plan.

How to Cancel Obamacare Marketplace Health Insurance. Online: If you're dropping an Affordable Care Act How to Cancel Health Insurance on Behalf of a Deceased Person. What Is a Health Savings Account (HSA)? How to Sign Up for Health Insurance What to Check Before You

deductible health insurance hsa plan hdhp savings georgia accounts

05, 2021 · Account closure process. Complete the account closure form by clicking the 'Complete Online' button above or download the form below. We will process your form within three business days. We will initiate a blackout period of five business days to allow outstanding transactions to process. You ...

The health plan determines eligibility for a Health Savings Account (HSA) or a Health Reimbursement Arrangement (HRA). A Health Savings Account allows individuals to pay for current health expenses and save for future qualified medical expenses on a pre-tax basis.

Our Vanguard Portfolio: How We're Investing for Financial Independence. Our Budget for Financial Independence - How to Pay Yourself First.

kotex tampons unscented

30, 2020 · How can I cancel my HSA? Click on the Health Savings Account app on your dashboard. Click the Change Contribution button near the top of the page. Enter $0 as your contribution amount, then click Save Changes.

How do you cancel an Optum HSA account? Typically, an HSA plan accompanies a high deductible plan you have at work. If you are still working for the company that you received the HSA through, I would ask your Human Resources department for advice on how to cancel.

Having a health savings account (HSA), flexible spending account (FSA), or health reimbursement account (HRA) is a great HSA - Money in your HSA can be used to reimburse yourself for medical and dental expenses incurred by you, your spouse, or eligible dependents (children, siblings,

iowa state vs isu cookie divided ia logos poll linn

· Home · Accounts · Resources · Message Center. · Your account(s) and balance(s) will Clicking View More provides additional information on why we require this and how to submit your · After you have submitted the account information, HSA Bank will send a small deposit to your account

account savings health ramseysolutions hsa

peri bottle care perineal postpartum walmart cleansing monmartt

8889 form tax hsa forms account savings health irs line taxes deduction

10, 2011 · One of the best parts of having an HSA is you can keep your account open and continue to use the funds to pay for medical expenses if your insurance plan changes, or even if you currently don’t ...

Cancel Hsa Account and the information around it will be available here. Users can search and access all recommended login pages for free. HSA what happens when you cancel them ... great The good news is that the HSA account stays with you regardless

Welcome to your Optum Financial health savings account (HSA). Explore all the ways we're making it easy for you to get the most out of your HSA. If you're a new account holder, you may want to explore this guide to help familiarize yourself with your HSA.

If you have a health savings account, you'll need the right HSA tax form to report details to the IRS. And you should know a few other HSA tax rules as well. Finally, don't forget that there is a separate HSA tax form to fill out if you contributed too much to your account.

Learn about health savings accounts by reviewing the definition in the Glossary. By using untaxed dollars in a Health Savings Account (HSA) to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your overall health care costs.

Rarely, if ever, do people take into account how much cash on hand they will need upfront between going under contract and making it to the closing table. I immediately canceled the card and called PayPal. Well, PayPal said they couldn't do anything and told me to file a dispute with my

Resources to help you stay on top of health account topics and get the most out of your individual HSA, FSA or FSA account. Explore the learn pages for tips on account management as well as information on the benefits of your account. Whether you are a beginner or more advanced, you

Health savings accounts (HSAs) help you set aside money to pay for qualified medical expenses, but did you know they can also be a great tool for retirement planning? How To Make An HSA Part Of Your Retirement Plan. David Rodeck, Benjamin Curry.

07, 2018 · Last Updated: 11/7/2018 10:10:10 AM Select the Health Savings Account component. The Health Savings Account page is displayed. The user’s existing HSA Select Self-Service. The Health Savings Account (HSA) Allotment Self-Service Request page is displayed. Select Stop to stop allotment for the ...

novell dialog nw restriction space quotas managing directory field change box open

Do you have a flexible spending account (FSA) or health savings account (HSA) where you're stashing money tax-free to help pay for medical expenses? The new rules essentially mean you no longer need a doctor's prescription to use those accounts to buy certain over-the-counter medications.