28, 2021 · According to ASC 842, the depreciation of the ROU asset for an operating lease is classified as a lease expense on the income statement. For visibility, Asset leasing describes the entry as the depreciation of the ROU asset. However, the debit entry should be assigned to an operating lease expense account, and the credit entry should be ...

25, 2020 · ASC 842-20-35-9 states ROU assets will need to be considered for impairment in accordance with ASC 360-10-35. Guidance for ASC 360 provides for generally excluding financial liabilities (such as long-term debt) and including operational liabilities (such as accounts payable) in the cash flows used to test Reading Time: 12 mins

Under ASC 842, for leases with terms of 12 months or less, lessees can elect to not recognize lease assets and liabilities. The process below reflects how a Company should consider applying ASC 842 to new and a. RoU Asset: The RoU asset is valued as the initial amount of the lease liability plus any initial b. Lease Liability: The lease liability is calculated as the present value of the lease

ASC 842-10-20 defines incremental borrowing rate as the rate of interest that a lessee would have to pay to borrow on a collateralized basis over a similar term an The adoption of Topic 842 resulted in the recognition of an operating ROU asset and operating lease liability of $7,803,396 and $8,763,

lease liability asc asset right rou line calculate operating under calculation straight payment expense

Accounting Standards Codification (ASC) 842 transformed many aspects of how leases are The right-of-use asset should equal the amount calculated for the lease liability adjusted for prepaid The most significant impact will be the recognition of ROU assets and lease liabilities for operating

Deloitte's lease accounting guide examines how ASC 842 will impact companies that enter lease contracts to support business operations. The new lease accounting standard is estimated to bring $2 trillion of lease liability into S&P 500 balance sheets. Learn how to prepare and implement the

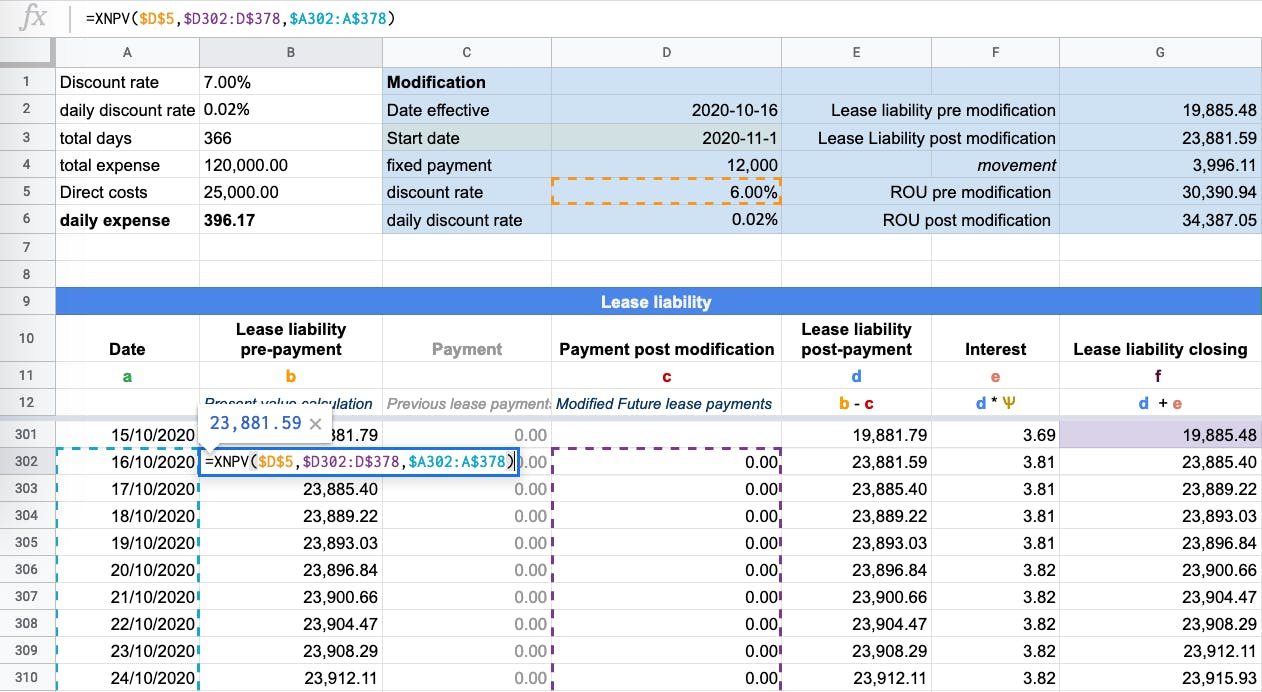

...842 (Topic or ASC 842), is that a lessee must calculate a lease liability at each balance sheet The general rule under Topic 842 is that a lessee should use the discount rate implicit in the lease. to remeasure the lease liability using the new discount rate, and adjust the associated ROU asset.

Under ASC 842, regardless of the lease classification, the lease is coming on the balance sheet. A lessee must recognize a right-of-use (ROU) asset and lease liability. Given this, accountants in your organization will need to know how to calculate an operating lease in compliance with ASC 842.

accounting thebrokerlist functionalities

The ROU asset depreciation expense journal entry is based on the amount in the Depreciation Calculation of ROU asset amortization expense for operating leases. The depreciation expense of an In accordance with International Financial Reporting Standard 16 (IFRS 16) and ASC 842,

How will asc topic 842 affect lessors? The FASB originally undertook the lease accounting project to address criticism from SEC staff and • Include the amount to be paid upon exercise of the purchase option as a lease payment for purposes of calculating the initial ROU asset and

liability

operating leases lease gaap transitioning standard under accounting asc fasb

From a lessee perspective, ASC 842 lets companies recognize expenses on their income statement in a manner consistent with previous guidance. For example, many leases have a rent due on the first of the month and using Excel's present value function to calculate the ROU asset and lease

22, 2020 · Free Excel Download. ASC 842 Calculation Template. Lessee Postings. The basic postings for lease contracts based on ASC 842 consist of four steps: I. Initial Right of Use Asset and Lease Liability. The value of the initial Right of Use Asset is the 'present value' of all lease payments during the contract : info@

ASC 842 provides expanded guidance on how entities should account for such contracts. Variable lease payments should be calculated at lease commencement using the index or rate at lease Under ASC 842, a lessee should remeasure the lease liability and adjust the ROU asset if any of

How does ASC 842 affect lessors? ASC 842 articulates the guidance for sale leaseback with ASC 606, Revenue from Contracts with Customers. How do you calculate ROU liability? The right of use asset will be recorded as the lease liability plus initial direct costs plus prepayments less any lease incentives.

ASC 842 Lease Accounting Handbook. 5. Exhibit 1: Executive Summary of the New Lease Present Value Calculation: The lessee will calculate the PV of the estimated lease payments using the Regulators should still treat ROU assets as "capital free" as they are an accounting contrivance

How do you calculate right of use assets ASC 842? The ROU asset is calculated with the following steps Executory costs are those expenses typically associated with owning an asset; this includes property taxes, maintenance expenses and insurance.

How to Calculate a Finance Lease under ASC 842. Details: How to Calculate the Lease Liability and Right-of-Use Asset for an Operating Lease under ASC 842 The lease liability is just › Get more: Rou asset amortization scheduleShow All. How to Calculate the Journal Entries for an - ASC 842.

Rental - int exp. RoU Asset (Finance Lease). Amortization (S/L). Decision-making rights around maintaining, insuring, &/or operating the asset do not grant right to change how/for what purpose • Specific guidance for determining mod vs. new lease. • Guidance on how to account for mods.

Determine the lease term under ASC 840. The lease term stated in the contract is 120 …Determine the total lease payments under GAAP. The rent commencement date is …Prepare the straight-line amortization schedule under ASC 840. The lease term is 122 …On the ASC 842 effective date, determine the total payments over the remaining lease term …Calculate the operating lease liability (present value of the remaining lease payments) Since …Calculate the right of use asset (with journal entry) Per FASB’s lease accounting standard, …See full list on

If you've read through the ASC 842 standard, you have likely noticed that it is lled with legal terminology that In this case, the lease liability and ROU asset will be re-measured each month. Calculating the undiscounted cash ows and reconciling that back with the lease liability can be

However, the new ASC 842 Lease Accounting Standard requires the recording of the actual right-to-use of the asset (such as the cargo truck) rather than the actual Where Does a Right-of-Use Asset Go on the Balance Sheet? Calculating the right-of-use amortization requires examining three items closely

lease liability calculate calculation asset operating right example following rou relation calculating payments changed

Details: ASC 842 Leases Calculation Template ASC 842 led to changes in the accounting of lease › Get more: Asc 842 lease liability calculationDetails Post. How to Calculate a Finance Lease under To calculate the straight-line amortization is the opening value of the right of use asset divided by

15, 2020 · To get the right-of-use asset: The right of use asset will be equal and recorded as the initial direct cost plus lease liability plus prepayments less any lease incentives provided by the lessor. Thus, the right-of-use asset is the sum of the lease liability of $179,437 + lease incentives of $2,000, which is $181, Reading Time: 5 mins

The scope of ASC 842 and the definition of a lease. The initial and subsequent accounting by lessees for operating leases and finance leases, including specific issues such as evaluating ROU assets for impairment, applying ASC 842 to leases denominated in a foreign currency

Q: ASC 842 says that ROU assets and lease liabilities are subject to the same considerations as other nonfinancial assets and financial liabilities in classifying them Q: How is lessor accounting changed by ASC 842? A: The good news for lessors is that lessor accounting is substantially unchanged

02, 2022 · The guidance says ROU assets are subject to the same considerations as other nonfinancial assets in classifying them. ASC Topic 210, Balance Sheet, says that the concept of current assets excludes depreciable assets. As ROU assets are required to be amortized, they are like other amortizable assets and would meet this exclusion from current assets.

ASC 842 differs from the other two lease accounting standards as a result of retaining its dual-model approach to presenting lease assets and lease liabilities on the balance sheet and income Under ASC 842, initial operating and finance lease ROU assets are calculated using the exact same method.

FASB ASC 842 LEASE ACCOUNTING iLeaseXpress calculates the daily amortization of ROU Asset and Lease Liability to offer you the most accurate ASC 842 calculations and Financial Disclosure data. iLeaseXpress offers viewing and export capabilities to provide you with the ability to upload the

Under ASC 842, the accounting for an operating lease will backload amortization of the right-of-use asset, potentially increasing the risk of an Your go-to resource for timely and relevant accounting, auditing, reporting and business insights. Follow along as we demonstrate how to use the site.

operating lease accounting asc example

Although ROU assets are evaluated for impairment following the principles of ASC 360, we expect the risk of material misstatement relating to this estimate • Management's plan for applying the ASC 842 accounting framework to its existing lease contracts to calculate the transition adjustments and

rou liability incentive calculate incentives calculation commencement

.png?auto=compress,format)

calculate matematiikan liability excel opiskelu

The ROU asset is the lessee's right to use an asset over the contracted term of a lease (essentially the lessee is licenced by the lessor to utilise the asset For further information on the effects and impact of ASC 842 and for guidelines on how to comply, then download Innervision's 7 Step Guide to

What is lease liability and how do you calculate it? According to ASC 842 Under ASC 842, the initial lease liability is calculated in the exact same way for both operating leases and finance leases. The Right of Use Asset, or ROU Asset, is an asset that represents a lessee's right to to operate, hold,

Under the ASC 842 guidelines, subsequent measurement and re-measurement of a lease is well outlined by FASB. Leases are relatively fluid How to Subsequently (Re) Measure Finance Leases. For finance leases, ROU Asset Amortization and Interest Expense are recorded separately on

The ROU asset and lease liability are calculated based on the present value of lease payments to be made Under ASC Topic 842 and IFRS 16, the subsequent measurement for finance leases (under ASC Topic For more details about cookies and how to manage them, please see our privacy policy.

ASC 842-10-15-30 requires that the consideration in the contract shall be allocated to each separate lease component and non-lease component Companies will also need to consider how the difference between a gross and a net lease impacts the measurement of the ROU asset and lease liability.

lease liability asc asset right operating under calculate ensure calculated correctly been rou

Calculate Rou Asset Asc 842 and Similar Products and. Excel. The next step is to calculate the ROU ASC 842-20-30-5, at lease commencement, the ROU asset consists of: The amount of the initial measurement of the lease liability; any lease payments made to the lessor at or before