quarterly bonus is paid in parallel with the salary of the current month at that moment. When the basic fee is charged to the employee from the actual output, the bonus is calculated as follows: output per quarter should be multiplied by the current premium percentage;

: Salary is 40,000, bonus payout is 80% 40,000 x %= $3,000 $3,000/4= $750 $750x 80%= $600 That would be your quarterly payout. If you’d like me to do yours for you I can, just private message me details and I’ll help you out!

Use our free compound interest calculator to estimate how your investments will grow over time. This flexibility allows you to calculate and compare the expected interest earnings on various investment scenarios so that you know if an 8% return, compounded daily is better than a 9%

Quarterly bonus is paid from monthly bonus calculations less 20% for each under target month. EG: Target $1000 Actual amount = $1200 x 30% = $ bonus EG: Target $1000 How to total the visible cells? Click here to reveal answer. From the first blank cell below a filtered data set, press Alt+=.

...someone could easily calculate an estimated quarterly bonus payout based on the quarterly net profit of the company. and FROM THE TABLES OF DATA ATTACHED, we would like to display the estimated bonus payout for each quarter.

Here are all the activation links for the Q4 2020 bonuses for cards that earn 5% each quarter in rotating categories. ~ All of the credit cards with rotating quarterly categories have now opened registration for Q4 2020. We've provided details below of each card's categories from October 1

21, 2021 · Follow these steps: Determine the sign-on amount. Determine the contract length. Divide the sign-on amount by the contract length.

Calculating your pay. It's important to know how to calculate a week's pay as it is used to work out how much you should get when claiming some employment rights, such as redundancy If you are paid a quarterly bonus then you can include a part of that bonus in your 12-week average weekly pay.

form report expense church forms cd record attendance pdf excel office microsoft format template expenses bonus freechurchforms calculate automatically below

13, 2020 · Based on the facts provided, it is appropriate for the employer to allocate the lump sum bonus of $3,000 equally to each week of the ten-week training period – $3,000 lump sum bonus divided by 10 weeks equals $300 in bonus allocated per workweek to be included in calculating the regular rate of Reading Time: 4 mins

Calculating your business's quarterly earnings is an important way to measure your financial performance during the year. Each year consists of four quarters. Each quarter's earnings equal the total revenues for that quarter minus the total expenses for that quarter.

How do you calculate a quarterly bonus? "Quarterly Bonus" is the frequency of payout, based on some quarterly criteria. Bonuses are a funny thing. At best they are bait and switch - the last company I was with set a bonus target in Q1 and was doing so well by Q3 that they changed

You'll earn 5% cash back on quarterly rotating bonus categories on up to $1,500 per quarter, with all non-bonus purchases making just 1%. The killer If you fail to register your bonus categories on any of these cards, the purchases will only code as 1%. You'll also need to keep an eye on how much

How to pay for college Student loan repayment plans How to consolidate student loans Complete your FAFSA Pay There's no quarterly spending limit, but the total cash amount of cash back you can earn in a year is These bonus categories apply to the Chase Freedom® and the Chase Freedom Flex℠...

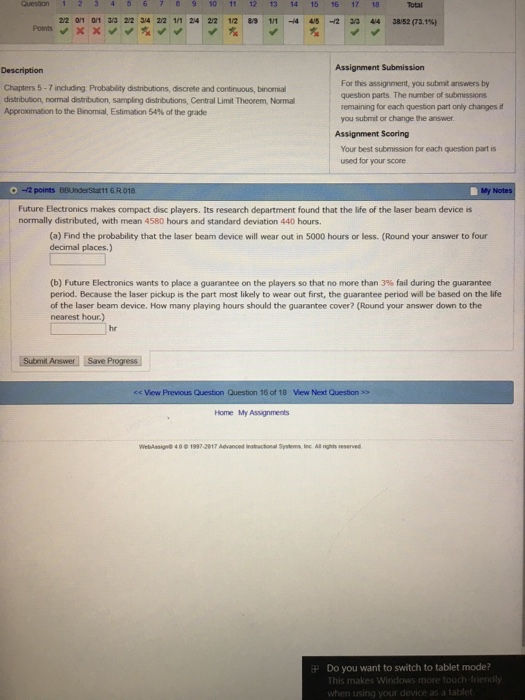

probability statistics assignment submission 1314 chapters queston distributors total answers distribution questions brora continuous normal

Calculate first, second and third quartiles, Q 1 Q 2 Q 3 , for a set of data. Find median, interquartile range IQR, dataset minimum and maximum for statistics data analysis.

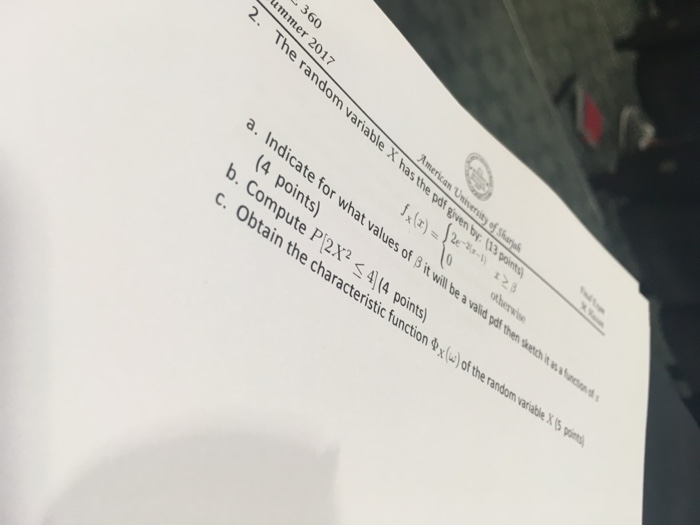

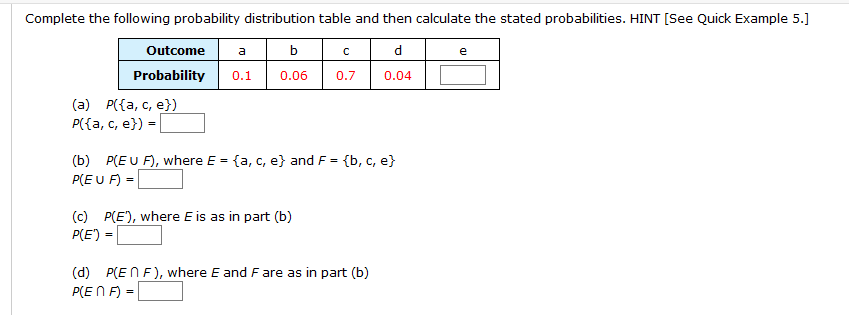

probability

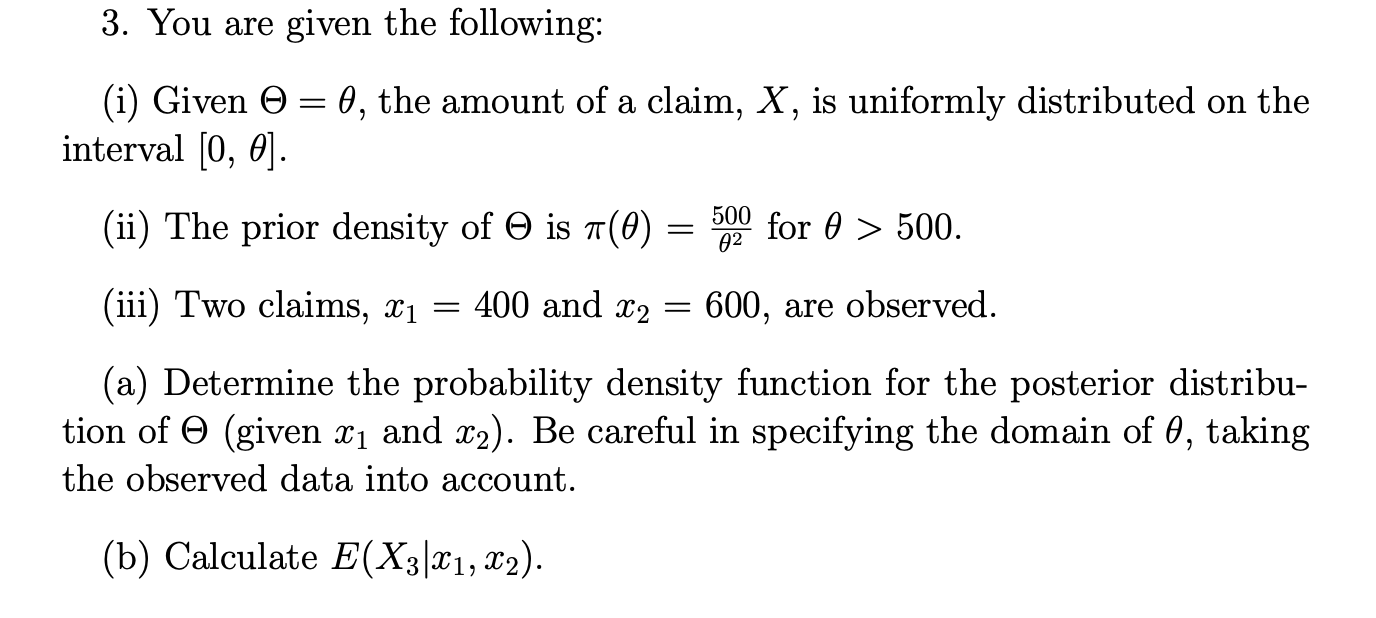

probability statistics random answers questions

One of the challenges you will encounter building monthly debt schedules is the need to calculate and show interest expense in each month, and then

How to calculate compound interest in Excel - formula for daily, monthly, yearly compounding. Well, let's take a step forward and create a universal compound interest formula for Excel that can calculate how much money you will earn with yearly, quarterly, monthly, weekly or daily compounding.

probability statistics answers questions

Calculate your mortgage payment. How much house can you afford? That way, you can use your bonus category card every time you make a purchase that falls within its quarterly bonus categories and your flat-rate cash back card for every purchase that doesn't qualify for bonus category rewards.

nadac rule update training ring

However, if that interest is compounded quarterly, your bank balance will benefit. There's a formula to help you determine how much interest you'll earn Multiply the APY by the balance of the account to calculate the annual interest paid on the account. For example, if you had a savings account

13, 2011 · If the employee worked all the days in the billing period, we add up all the earned amount due to monthly premiums, and divide by three. Of average earnings during the calculation period generate interest accruing quarterly (14)Estimated Reading Time: 2 mins

Guide to Compounding Quarterly Formula. Here we discuss a calculation of quarterly compounded interest along with examples and downloadable excel templates. You are required to calculate the quarterly compounded interest. Solution. We are given all the required variables

Quarterly Bonus. Calculate Incentive. Per interval. On the Performance Measures section toolbar, click Create in the Actions menu. Name it Quarterly Attainment. In the Performance Interval field, select Quarter.

Cash back cards that offer quarterly bonuses are a little different. Every quarter, usually new spending categories become eligible to receive a cash back bonus. What Are Rotating Bonuses Worth? If you're considering a 5% cash back credit card, you might wonder just how valuable those

Quarterly Tax Calculator - How to Calculate and Pay Your. How. Details: To calculate you quarterly taxes click here or set aside 25 to 30 percent of every paycheck in a business savings account to make sure you ready to deliver the full amount of tax calculated for your quarterly taxes.

so, it’s easy - divide by 4. If you mean how much you could make per quarter in a defined, written bonus scheme based on certain factors (sales targets, utilized hours, various quotas met/exceeded, certain performance evaluation numbers, etc), then it’s also fairly easy: figure out what vectors of your bonus you have control over, and which you don’t, and plug those …

7 How to Calculate & Pay Taxes on Bonuses. 8 Pay Bonus With Regular Check Without Specifying Amount. Performance-based bonuses can include individual sales incentives or sales commissions, department-wide incentives, and annual or quarterly performance compensation.

The quarterly bonus program is described in Exhibit A. The bonus payable on July 30, 1997 shall be calculated for the initial period beginning January 1, 1997, but prorated as of June 1, 1997. Quarterly Bonus. (a) For each fiscal quarter of the Employment Term, the Executive shall be

Bonus Calculation with The Percentage SystemRevenue SharingConclusionThe percentage system is highly dependant on the employee’s performance. The better their performance and their service time are, the more bonus they will receive. The percentage number can vary from one company to the other. The example below is not absolute, so your HR team can decide the best proportion for each more on Reading Time: 4 mins

Bonus Tax Percent Calculator. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. If your state does not have a special supplemental rate, you will be forwarded to the aggregate bonus calculator. This is state-by state compliant for those states who allow the ...

assessment chapter exploring excel issuu formulas functions

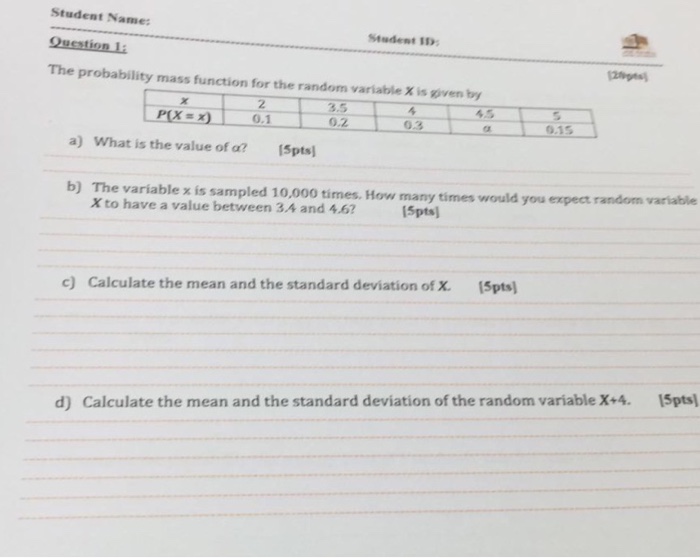

complete distribution probability following table solved transcribed problem text been

Use our compound interest calculator to see how your savings or investments might grow over time You can calculate compound interest growth on your savings or investments using the compound Include any regular monthly, quarterly or yearly deposits or withdrawals. You can use the results as

Learn how to calculate employee bonus by the various bonus types with examples of each. Holiday bonuses are extra sums of money gifted to employees at the end of the year. Some employers award this money as either a percentage of an individual's salary or a flat rate.

Calculate how many time periods there are in a year. In order to annualize, you first consider the time period being featured. For a quarterly investment, the formula to calculate the annual rate of return is: Annual Rate of Return = [(1 + Quarterly Rate of Return)^4] - 1. The number 4 is an exponent.

college fictional consider calculating inflation simple using basket cspi student each solved following table suppose purchases typical goods annual based

probability statistics answer answers questions random

My question is, how would I calculate the percentage change in quarter? For example if I was to calculate the March 2012 quarter percentage change do I subtract the closing price of the stock market index at March 30th 2012 from the closing price December 30th 2011 divided by the

Calculating quarterly compound interest is just like calculating yearly compound interest. Interest amount for each quarter will add to the principal amount for the next quarter. To calculate the quarterly compound interest you can use the below-mentioned formula.

Quarterly Bonus Calculator Economic! Analysis economic indicators including growth, development, Details: Bonus Tax Percent Calculator. or Select a state. This federal bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such

When calculating your interest amount, separate the annual interest from the total interest, if necessary. Add your interest rate to your principal then divide the total by four. Example: Your principal is $10,000 and your total interest is $700, calculate as follows to arrive at your

28, 2016 · Here’s how to calculate how much you should withhold for taxes: Add the bonus amount to the amount of wages from the most recent base salary pay date, February 1: ($2,000 in regular pay + $2,000 bonus = $4,000 total) Calculate the amount of withholding on the combined $4,000 to be $686 using the wage bracket Reading Time: 8 mins

Writing Formulas to Get Quarterly Totals from Monthly Data: First, understand a little math formula called ROUNDUP() I've yet to discover how to calculate quarterly numbers based on my date selection. My date is determined by: =DATE(2018,12,31)+7*(A2-1) with A2 updating based on

Small business owners need to understand what quarterly taxes are, how to calculate them, and when the deadlines fall during the year. Figuring out how to manage your taxes is one of the most stressful aspects of running a business. Federal tax law is complicated, and it's easy for a

MIL here. my SL has kind of explained to me how it works but i'm honestly still so lost. how do we calculate what we'll make on our quarterly bonus? how is it measured? for example if we scored 80%, how would we calculate what we're gonna get on our bonus? i know i could just wait until.

03, 2009 · The calculation is as follows. Quarterly bonus is paid from monthly bonus calculations less 20% for each under target month. EG: Target $1000 Actual amount = $1200 x 30% = $ bonus. EG: Target $1000 Actual amount = $900 x 30% = $ no bonus. EG: Target $1000 Actual amount = $500 x 30% = $ no bonus.