How Banks Make Money. Bank of America Corporation (BAC). Income Statement. Bank of America's income statement is below from their annual 10K for 2017. To make matters confusing, sometimes analysts quote total interest income instead of net interest income when

Calculate the Income Statement formula for the same. Now let's calculated all the ratios one by one: Gross Profit Margin is calculated using the formula This has been a guide to Income Statement formula. Here we discuss How to Calculate Income Statement along with practical examples

income interest cash flow analysis financial statements loans method table loan borrowing understanding tables extension does tractor purchase

The income statement calculates the net income of a company by subtracting total expenses from total income. This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues.

Financial Statements for Banks. How banks differ from typical businesses. This guide breaks down how to calculate in the subsections below. Again, the overall structure of an income statement for a bank doesn't stray too far from a regular income statementIncome StatementThe Income

Here we discuss how to calculate Income Statement items - gross profit, operating income & net income with examples & downloadable excel sheet. Income statement formula consists of the 3 different formulas in which the first formula states that gross profit of the company is derived

Calculating the operating profit before changes in working capital. The fundamentals of preparation of cash flow statement under Direct method is more or less same as in Indirect method with only a few exceptions in terms of its The Cash flow statement under Direct method is prepared as follows

This number helps indicate how wise a bank is about investments that result in profit. Once you obtain the interest income, interest expenses and average earning assets from the bank's income statement, you are ready to calculate the net interest margin.

Companies prepare their historical income statement data in line with US GAAP or IFRS. Below is an example of how to input Apple's historical results into a financial model Most investment banking analysts spend very little time conducting the due diligence required to arrive at their own assumptions.

Financial Ratios Using Income Statement Amounts. The times interest earned ratio is calculated by dividing a corporation's net income before income taxes and before interest expense for a recent year by the interest expense for the same year. Please let us know how we can improve this explanation.

Income statement formulas are calculations that you can make using the information from a The interest coverage ratio is important when you are dealing with banking, insurance, real estate, or Calculating the return on assets tells you how well a company uses its assets to generate income.

Most income statements include a calculation of earnings per share or EPS. This calculation tells you how much money shareholders would receive for To calculate operating margin, you divide a company's income from operations (before interest and income tax expenses) by its net revenues, or.

All banking calculators. Get advice. How to save money. Federal Reserve news. What is a savings account? To calculate your debt-to-income ratio, add up all of your monthly debts - rent or mortgage payments, student loans, personal loans, auto loans, credit card payments, child

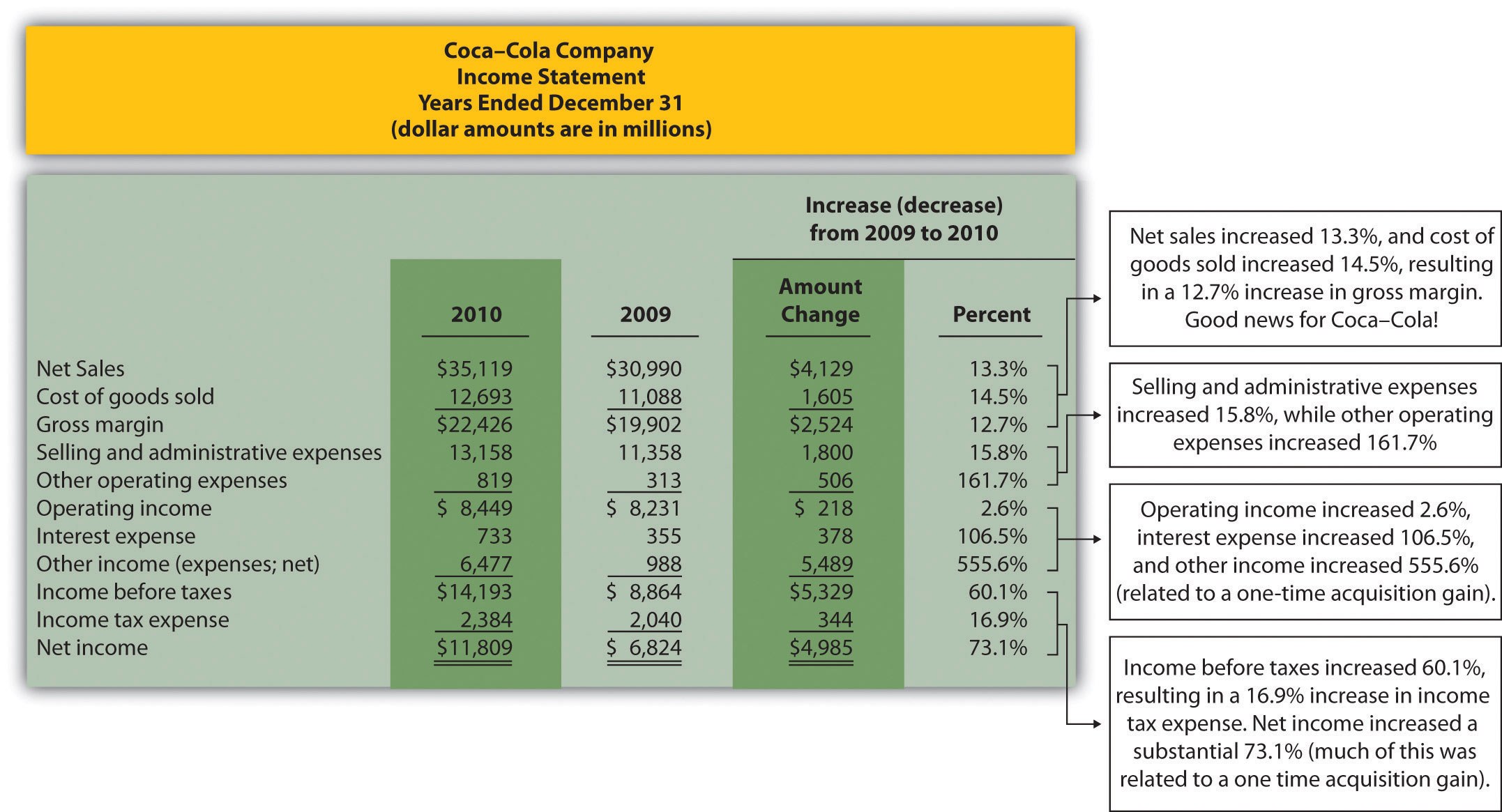

analysis trend financial statements report template accounting statement income change percent cola coca balance sheet example sales increase decrease amount

Download various income statement samples & templates: multi step income statement, pro forma income statement A common size income statement is used to analyze how each separate item on an income statement affects How do you calculate interest expense for an income statement?

Of the three key numbers that determine your financial health—verified income, credit score, and debt-to-income ratio—debt-to-income ratio (DTI) is probably the least commonly discussed. What is debt-to-income ratio?

Here's how to calculate net income with three examples. In some cases, the accounts on the balance sheet -- assets, liabilities, and equity -- can also shed light into items that would normally be found on the income or cash flow statement.

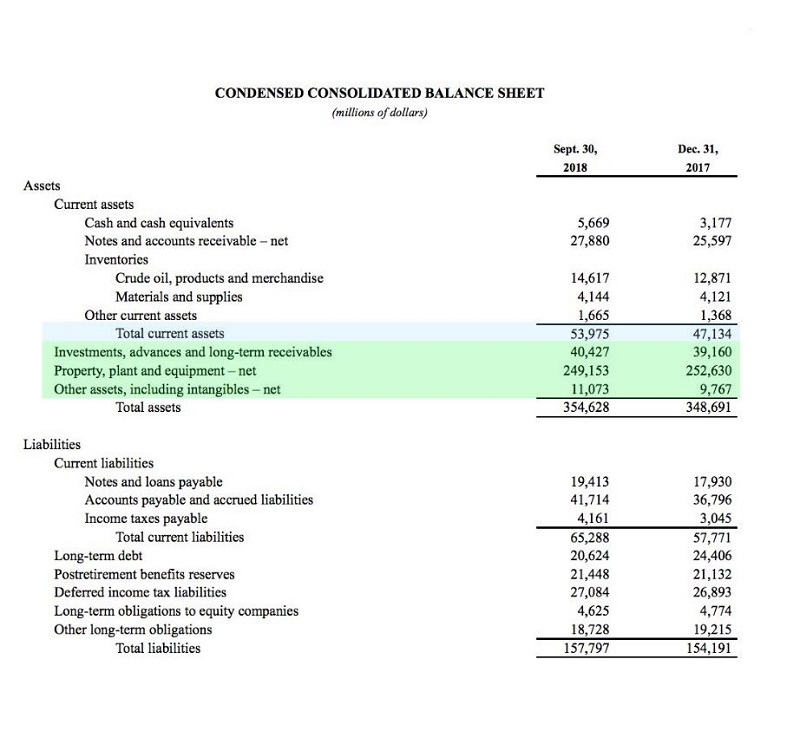

balance sheet debts presentation calculation

Net income, net earnings, bottom line—this important metric goes by many names. Here's how to calculate net Income statements—and other financial statements—are built from your monthly books. Your bookkeeping team imports bank statements, categorizes transactions, and

Preparing the statement of cash flows using the direct method would be a simple task if all companies maintained extremely This represents amounts paid by the company for income taxes. The amount is calculated by Proceeds for bank loan of $4,000 represents additional borrowings during the year.

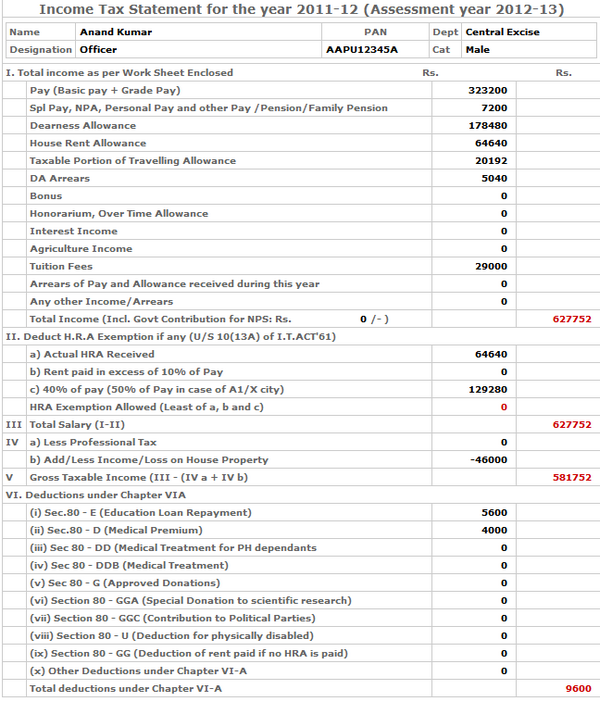

How can you calculate interest expense on an income statement? Income tax is calculated depending upon the total income earned by an individual during a financial year and the income may be from pensions or salaries, house rent, income from business, interest from various

To calculate your annual income before taxes, obtain a copy of your most recent paycheck. Then, determine how much you were paid during that pay If you have multiple sources of annual income, your calculation becomes much simpler. For example, let's say you earn an annual income from

Income statement analysis involves reading an income statement so that you can understand the financial performance of a company over a period. As a working professional, business owner, entrepreneur, or investor, knowing how to read and analyze data from an income statement—one

...historical balance sheet, income statement and cash flow statement of Target Corporation, shows how you can calculate some financial ratios, and a few ways to For example, if the balance sheet is presented as of May 1, 2018, you would see the bank account balances from that date in the

income tax calculator assessment statement order sheet gconnect features personal detailed tutorial values correct

balance sample sheet accounting example sheets wikidownload

An income statement shows you the company's income & expenses. Learn how to read the Banks and other financial institutions can also analyze this document to decide whether the business is EBT is calculated by subtracting expenses from income, before taxes. It is one of the line items on

Using a bank's income statement, you can calculate its net interest margin. But you'll need the income statement and to know exactly what to look for as you review the statement. By extrapolating the right data, you can perform a simple calculation and get the information you need.

bookkeeping

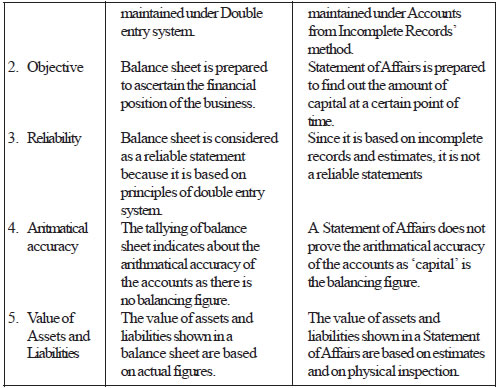

statement affairs between opening balancesheet xi closing given capital case distinction cbseguess ebooks account incomplete accounts records

Cost to Income Ratio: Meaning, Example, Formula, Calculation, and More. It is useful in analyzing banking stocks. There exists an inverse relationship exists between the Cost Income ratio and bank Let us take the following example to calculate the cost to income ratio of Sinra Inc., a small bank.

income example balance sheet calculate definition meaning formula template statement cost goods sold company economics editable scorecard lessons management noun

Calculating the interest earned in your checking or savings accounts during a bank statement period can help you prepare an accurate budget. When looking at a narrow time frame like a single bank statement period, the compound interest formula will give similar results to the simple interest formula.

Income statements are based on a few very simple concepts, which you already understand. How about when the talk turns to income statements, or profit and loss reports, or even a If the document doesn't already show the percentage change in every category, calculate those numbers yourself.

This is how to calculate your annual income with our calculator: Enter the hourly wage - how much money you earn per hour. Gross means before taxes and net means after deducting taxes. What you receive in your bank account is net income.

Learn how to calculate your taxable income with help from the experts at H&R Block. This post will break down the details of how to calculate taxable income using these steps. Faster access to funds is based on comparison of traditional banking policies for check deposits versus

How to Prepare the Report: Trial Balance to Income Statement. This quiz is a 15-minute timed test consisting of 10 multiple-choice questions and will test you on the theory above as well as the components of the income statement and various calculations including incomes, expenses,

Income statement ratios are the ratios that analyze the company's performance in the market This would tell how well the company performs during the accounting period comparing to the previous The nine income statement ratios below are the ratios that can be calculated using the