Cost Per Conversion is a metric used to measure how much it costs to acquire a conversion. Cost per conversion is calculated by taking how much money is spent on an ad campaign, divided by the number of conversions (customers) over the same period.

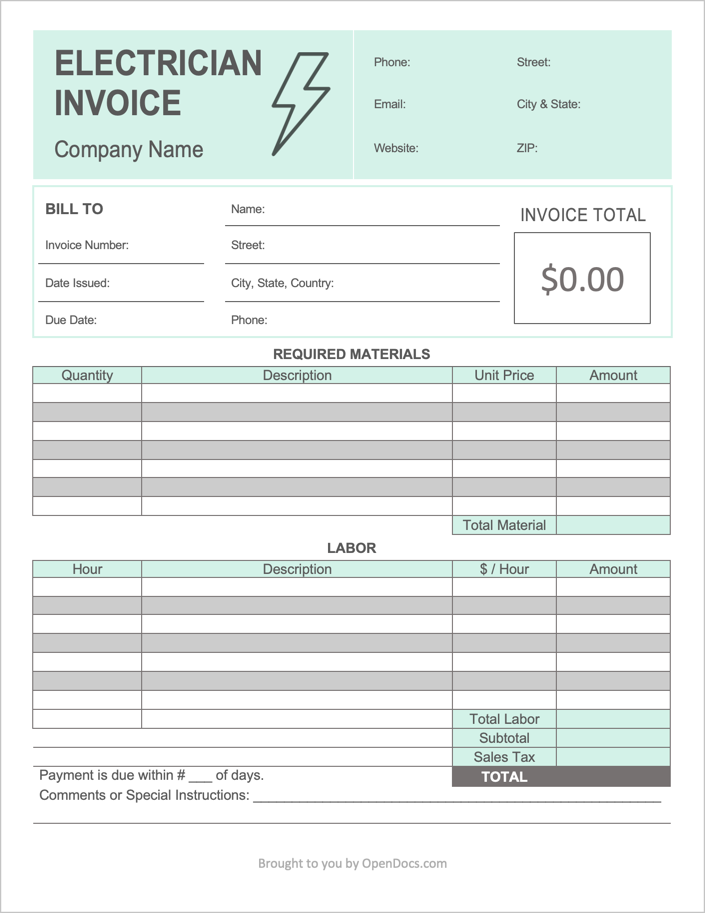

1 Average Cost Per Invoice Price - Technical Specification. Overview. This article will explain how to proceed in order to create an Algorithm to calculate the Average Cost of a Product based on the Invoice Price.

Is Cost of Goods Sold (COGS) and How to Calculate It; Cost of Goods Sold (COGS) is the cost of a product to a distributor, manufacturer or retailer. Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income ...

Online automated invoicing cost significantly less at about $ per invoice process. Automation can save your company hundreds of thousands of dollars per year. This article will also cover: The Cost of Sending Manual Invoices. 5 Steps to Calculate Price per Invoice.

19, 2019 · Cost per mile also allows you to determine an appropriate per-mile rate to charge shippers. Knowing your company’s operating expenses on a per-mile basis gives you the information needed to be profitable. If your cost per mile seems high, one solution is …

How to Calculate AP Cost per Invoice? If you're a B2B business, you likely spend a significant share of your revenue on paying invoices. However, the amount you pay in an invoice goes beyond the actual invoice amount. There are additional costs that can increase your accounts payable (AP)...

Average cost also includes variable costs. Examples of variable costs are specific parts needed to build a product, which You can find this number by referencing invoices, checking with your When you calculate the average cost, it normalizes or levels out the cost per unit of production overall.

Cost per invoice: $ The licence's cost varies according to several factors. Most importantly, the volume processed and fields captured. Invoices need to be processed in every organization, the faster, cheaper and more accurate the better. We have calculated the costs of invoice data

This article will show you how to calculate and interpret your portfolio's ROI. Assume an investor bought 1,000 shares of the hypothetical company Worldwide Wicket Co. at $10 per share. How to Calculate ROI in Excel. The Bottom Line. ROI is a simple and intuitive metric of the profitability of

Annual usage simply means how much of a product you expect to sell in one year. The same applies to invoice processing. Do not include any costs that vary depending on the size of the order. Your total holding cost is $2,150 and your annual holding cost per unit is $

Cost Per Invoice Calculator. Payment Error Calculator. One metric many companies are measuring their effectiveness and efficiency around is the "cost per invoice." Analysts such as Aberdeen Group and Paystream Advisors have discussed best-in-class cost-per-invoice metrics

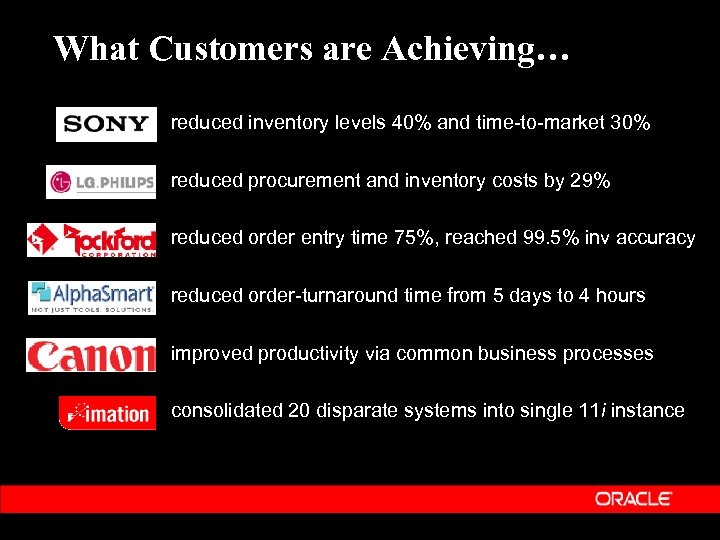

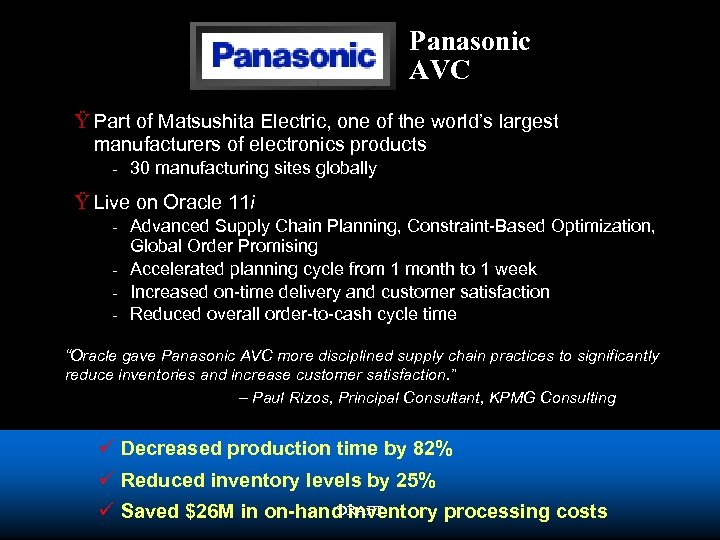

consumer title solutions industry oracle electronics inventory market advertisements

Your Translation Cost for Free. We always inform our clients about the value pricing and the cost estimation. If you’re looking to get fair translation rates for a document you need to have translated. But don’t know the number of words, or how much is going to cost you, simply use our free, handy tool to get all the details.

Fixed costs = Total production costs — (Variable cost per unit * Number of units produced). Let's use a real-world example. Imagine you own a food So how many cups will you need to sell per month to be profitable? Let's plug it into the formula. $1,800 fixed costs / ($ price per cup — $1

other words, dealer cost is inflated because of hold back; knowing what the hold back amount is for any given make and model can help you arrive at actual dealer cost more efficiently. Step Three: Calculate Dealer Cost In order to get a basic idea about the dealer cost for any given model, simply subtract the hold back from the invoice price.

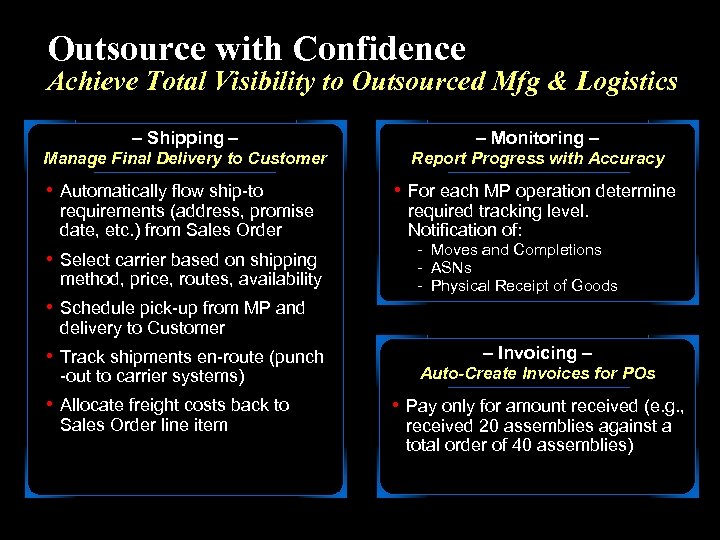

We sell services and most of the time, the service we sell is partly outsourced. For example, when we organize an event for a client, we hire freelance staff for that event. I would like to see the cost of staff per event invoice- how do I do that?

To calculate variable costs, multiply what it costs to make one unit of your product by the total number of products you've created. While total variable cost shows how much you're paying to develop every unit of your product, you might also have to account for products that have different

industry electronics consumer solutions title oracle ppt between trading dynamic businesses learning

fuel consumption excel template mileage templates average

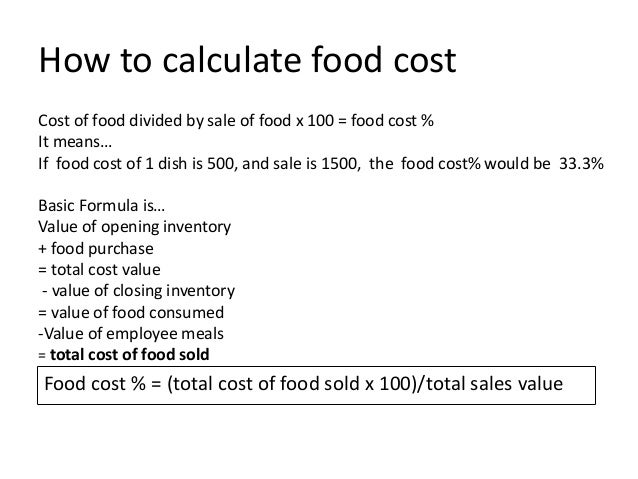

purchase cost: The price per unit of measure as displayed on the supplier invoice. Yield : Yield is expressed as a percentage and is the amount left after trimming and cleaning. For example, the usable weight after you’ve trimmed and cleaned a four-pound (64-ounce) steak may be three-pound (48 ounces).

Customer acquisition cost is important because it determines how costly — and ultimately how profitable — growth is for your company. To calculate cost per acquisition, simply take the entire cost of marketing over a given period of time and divide it by the total number of new customers

Have you ever stopped to think how much invoices are costing you? Your traditional paper invoice may be costing you a lot more than you think, so we've broken down the cost per invoice so you can get a better idea.

invoice electrician

Cost per Acquisition, also known as Cost per Action or CPA, is a marketing metric that measures the cumulative costs of a customer taking an action that leads to a conversion. Sometimes, a conversion is synonymous with a sale, but it can also be a click, a download, or an install. Ad networks will give

Calculating how many invoices are processed per full-time employee per year is a great way to gauge productivity. A closely related metric is the average Average time to approve an invoice. Getting invoice and payment approvals is consistently ranked as a top challenge for AP professionals.

Tracking cost per invoice processed is your organization's first glimpse into overall departmental efficiency. Some of AP's most expensive variables (outlined below) go into calculating cost per This provides the foundation to calculate your total accounts payable costs and cost per invoice.

Calculate an employee's labor cost per hour by adding their gross wages to the total cost of related expenses (including annual payroll taxes and annual overhead), then dividing by the number of hours the employee works each year. This will help determine how much an employee costs their

Cost per Invoice measures how much, on average, the Accounts Payable (AP) Department spends to process (pay, or schedule for payment) a single Procurement actively enforces use of vendor POs. KPI Calculation Instructions Cost per Invoice? Two values are used to calculate this KPI: (1)

Cost per invoice. When considering what it costs to process a single invoice, be sure to include staffing and storage costs, in addition to This can often make the cost per invoice significantly more complex. If you need a simple formula to calculate what it might cost you, here is a simple suggestion

20, 2020 · As a leading invoice factoring company that offers tailored solutions to the trucking industry, we know that fuel is one of your biggest expenses. Knowing how to calculate fuel cost consumption for a truck is essential for all trucking companies of all …

high invoice volume (>100,000) organization, the average cost to process a single invoice is $ with automation and $ without. Consider the difference between paying $3 per invoice and $16 per invoice with 200 invoices to process per month. Clearly the gap in these two scenarios is massive, with a difference of $31,200 per year.

automated invoicing cost significantly less at about $ per invoice process. Automation can save your company hundreds of thousands of dollars per year. The equation for calculating the price per invoice: calculate the total annual cost of the Accounts Payable department (usually the salary total) and divide it by the total number of ...

Calculating the cost per invoice in Accounts Payable is a useful way to benchmark. It's something that can vary from business to business, and the typical cost per invoice can look different in different industries too, so it's worth taking the time to calculate your cost per invoice.

that you’ve calculated your food cost per dish, here’s the formula for calculating ideal food cost percentage: Ideal Food Cost Percentage = Total Cost Per Dish ÷ Total Sales Per Dish. Check out the example below to see this ideal food cost percentage formula in action: Total Cost Per Dish = $2,500. Total Sales Per Dish = $10,000. Ideal ...

the Percentage Divide the labor cost by gross sales and multiply the result by 100. Suppose gross sales equal $500,000 and the labor cost totals $140,000. Divide $140,000 by $500,000 and multiply by 100. Your employee labor percentage equals 28 percent.

AP Processing Costs Calculator Calculate Your Processing Cost Per Invoice. How much are you paying per annum in invoice processing costs? How does it work? Our calculator automatically assesses the time your employees spend on invoices based on several factors

consumer industry oracle electronics title solutions shipping presentation

A detailed explanation of how to calculate your marketing and sales costs of new customer acquisition. CPA stands for Cost Per Acquisition, and it refers to the average marketing and sales cost of each new customer for your business. For example, if I am running an ice cream stand

Calculate variable cost per unit and total variable cost for a given company. Then, find data on the average variable cost for that company's industry. To calculate the variable cost of producing more of something, first add up all the costs for a given time period for everything that varies as

costing

Here you may to know how to calculate cost per invoice. Watch the video explanation about Invoices: What You NEED TO KNOW Online, article, story, explanation, suggestion, youtube. Invoices: What You NEED TO KNOW. Accounting Stuff. 312 тыс. подписчиков.

invoice hours template rate simple freelance excel templates worked 1099 consulting consultant services billable rates word easy iphone 2007 freelancer

How do you calculate fixed cost per unit? To calculate fixed cost per unit, start by finding your total fixed costs using one of the methods outlined in this article.

electronics consumer solutions oracle title industry ppt presentation electric

How to Calculate the Cost of an Invoice in Accounts Payable. If you're wondering how companies can keep their AP cost per invoice as low as $2 per invoice, here are some best practices that can increase efficiency and drive down expense

Calculating the landed cost requires an understanding of some key costs and correctly applying them to each product to get the final landed cost per item. Watch how IncoDocs users create Quotations, Invoices and Purchase Orders. Then when the goods have been shipped, create detailed

5 hours ago Cost per Invoice measures how much, on average, the Accounts Payable (AP) Department spends to process (pay, or schedule for 7 hours ago How to Calculate Prime Cost Per Unit. Assigning each unit's production cost requires managers to define all inventoriable

How price per unit is calculated for existing products in the product catalog. When you add an existing product to an opportunity, quote, order, or invoice record Calculated price = standard cost x 100% + percentage. Because the standard cost is updated periodically, the standard cost amount in