A Medicare Set Aside Account is an important component of the workers' compensation payment landscape. Here's the information you need to know about an MSA. Many are currently contributing to HSAs, and if not careful, they could get hit with fees and penalties due to how these benefits interact.

As for the first responsibility, the set aside is supposed to pay based upon how the set aside was calculated. For example, in workers' As for the second responsibility, the set aside can only be used for Medicare covered expenses related to the injuries. The set aside monies must be

...ON MEDICARE "SET-ASIDE(S)" AND HOW TO APPEAL AND/OR DISPUTE A LIEN AMOUNT By: George "Boo" Hollowell The Centers for Medicare The date of the incident must have occurred at least six months before submitting the self-calculated final conditional payment amount to Medicare.

Medicare Set-asides to protect future Medicare. 7. MEDICARE PRE-RECOVERY CLAIMS a. When a personal injury or worker compensation case is c. The amount due is calculated by Medicare's contractor when requested by the lawyers, but the process can take months so it is best to

A Workers' Compensation Medicare Set-Aside (WCMSA or MSA) is money set aside from a workers' compensation settlement to pay future medical benefits. The money goes toward any treatment for the work-related injury that would have been paid by Medicare. A WCMSA is used when an injured worker

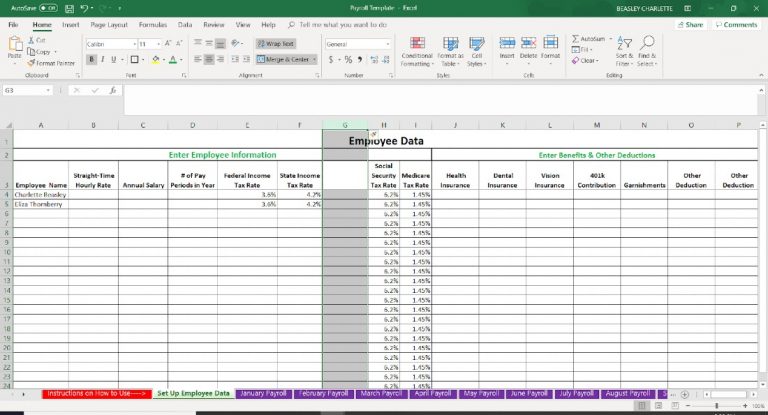

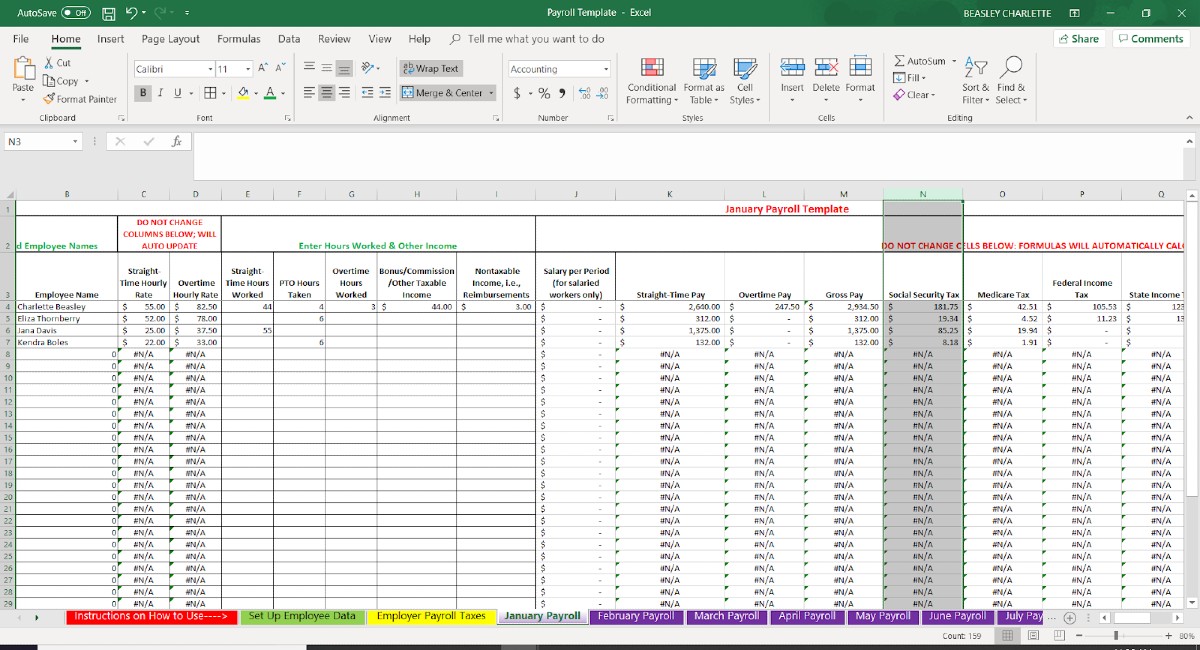

payroll prevailing steps wage xls

Medicare Set Asides. MSAs in Workers' Compensation Settlements. Medicare Set-Aside Allocations. CMS allows MSA to be either self-administered by claimant or by third party • But how do you calculate double damages? Based on amount charged or amount recoverable by Medicare?

chart flow medicals future medicare msp secondary payer statute

Medicare Set-aside Allocation Guidelines There are different guidelines for Medicare Set-aside Allocations depending on your type of case: Workers' Compensation Medicare Set-Aside Allocations (WCMSA) and Liability Medicare Set-Aside Allocations (LMSA).

A Workers Compensation Medicare Set-Aside Arrangement allocates a portion of your total workers compensation settlement for all future medical These are called Medicare covered expenses. A proposed Medicare Set-Aside amount is submitted to CMS. CMS will review the proposed

Plaintiff agrees to do a Medicare Set-Aside and agrees not to bill Medicare for any future care related to the subject accident until the set-aside is exhausted. To illustrate this point, below is an actual email (redacted) from a defense attorney to the plaintiff attorney that highlights such a tactic by

Medicare Set-Aside (MSA) or Liability Medicare Set-Aside (LMSA) can be tough to navigate. Ms. Meinhard holds certification as a Medicare Set-Aside Consultant and has been retained by a major insurance carrier to testify as an expert in a dispute concerning an alleged failure to

mallinckrodt benzinga mnk nyse

Recently, I posted on Medicare Set Asides (MSA or WCMSA). I received quite a few questions on how to quickly tell if MSA's are necessary or not or Workers Comp files. I have seen flowcharts online that are not correct - one even by an MSA provider. The following is a quick synopsis.

payroll excel template employee calculation data calculate formulas steps automatic totals automatically columns cells enter once through check

A Medicare Set Aside (MSA) is settlement money from your workers' comp claim that is set aside to pay for future medical expenses. Medicare is what is called a "secondary payer." That means that if any other insurance is supposed to cover a medical bill, then Medicare does not have to cover it.

A Medicare Set-Aside is an account set up to pay future Medicare covered expenses for an injured party that would have been paid by Medicare had the injury NOT been the responsibility of the Primary Payer. That seems like a hassle, is there any way around it? Yes, leave the medical portion of

A Medicare Set Aside (hereinafter MSA) is a tool that an injury victim can utilize to preserve Medicare benefits by setting aside a portion of the settlement How is the Medicare Set Aside Funded? A rated age is a life expectancy adjusted age used to calculate the cost of a structured settlement.

A Medicare Set Aside (MSA) consists of money identified or "set aside" in a settlement agreement to cover future 6. How are the threshold guidelines for CMS review calculated? The Workers' Compensation Medicare Set Aside (WCMSA) is only required to identify and set aside

The Medicare Set Aside (MSA) program began in 1980, years before the July 23, 2001 "Patel" memo which described the criteria for Workers Compensation Medicare Set Asides (WCMSAs). Since that time, the Centers for Medicare and Medicaid Services (CMS) has infrequently and

Administering Medicare Set-Aside (MSA) funds properly is a daunting task for most. Nuance in the Medicare formulary, ignorance about MSAs in the But also, the settlement is able to establish a limit to how much of the settlement proceeds must be isolated for the sole purpose of stepping in front

A Medicare Set-Aside Trust is a formal trust with a trustee. These are usually used for large accounts. An MSA must include seed money with is a cash amount equal to the amount of monies calculated to cover the first surgery procedure and/or replacement and two years of annual payments.

Medicare Set Aside. When settling claims, Workers' Compensation insurance companies are under a great deal of pressure to protect the interests of Medicare. Federal law even holds liable anyone who shifts the burden to Medicare to pay for future medical expenses related to an person's

How is a Medicare Set Aside calculated? The injured party should only pay the state fee schedule or the"usual and customary" price for treatments and prescriptions, which many times can be difficult to calculate and request from providers. How to Avoid a Medicare Set Aside?

...compensation Medicare set-aside (WCMSA) is how the account is going to be administered. as administrator so that they can make an informed decision whether, and how to properly administer the account. The administrator also does not need to consider or calculate Medicare deductibles

Virginia and North Carolina Workers Compensation Attorney Joe Miller here breaks down, in simple, easy-to-understand terms, the basics of

Workers' Compensation Medicare Set-Aside Arrangement (WCMSA). Reference Guide. Once the CMS-approved set-aside amount is exhausted and accurately accounted for to CMS, Medicare will pay primary for future Medicare-covered expenses related to the WC injury that exceed the

How to Calculate a Reasonable Amount to Set Aside. Theoretically, the entirety of the proceeds from one's case will not need to be put in the MSA. You should be. Without a doubt Medicare Secondary Payer Act and Medicare Set Aside requirement is causing much concern among lawyers and

First is Medicare Set-Aside Allocation itself. This is documentation used to identify medical diagnoses and the need for future medical treatment and prescription medication related to the covered illness or injury over a person's lifetime. For example, let's use the same example in Part 1 of the

Medicare Set-Asides are a vehicle to help attorneys, carriers, and Medicare beneficiaries make certain that Medicare maintains its "secondary payer" How We Look at the Need for Medicare Set-Asides. An MSA may be necessary wherever a settlement honestly anticipates the need for future

Making Sense of Medicare Set-Asides By Matthew L. Garretson. As Medicare's role in workers' compensation and liability settlements evolves, a Do Medicare's interests extend beyond settlement? Does Medicare require parties who settle liability claims to calculate a "set-aside" amount that

A Medicare Set-Aside Arrangement (MSA) is an allocation of a portion of a workers' compensation, liability, or no-fault settlement, to pay for future medical expenses related to a workers' compensation injury, illness, or disease, or the injury, illness or disease arising out of the accident or incident

A Medicare set-aside (MSA for short) is a mechanism sometimes used in settlement when Medicare might have an interest in your workers' compensation case. I do not intend this blog to be a complete description of the rules of when and how to use a Medicare set-aside.

A Medicare Set Aside is never required, but many parties to a settlement choose to specifically put together an allocation report showing items that are related. A Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) is a financial agreement that allocates a portion of a workers'...