GIPS compliance offers a globally accepted ethical framework for calculating and presenting investment performance and many firms value the internal and external assurances that the GIPS standards provides. Many institutional investors require or recommend GIPS compliance in order

up to a minimum of 10 years of GIPS-compliant performance. Firms may link non-GIPS-compliant performance to their GIPS-compliant performance provided that only GIPS-compliant performance is presented for periods after the minimum effective com-pliance date, which differs depending on the asset type:

In this short educational video, our GIPS experts discuss the primary steps to becoming GIPS compliant.

How can I become GIPS compliant? Standards require companies to first submit a history of at least five years of GIPS-compliant data. After this minimum, the company must build a 10-year history. If the association has existed for less than five years, the company must show its entire history since

adaptiveness

Start studying 2. GIPS: Fundamental of compliance. Learn vocabulary, terms and more with flashcards, games and other study tools. Two important issues that a firm must consider when becoming compliant with the GIPS standards are the definition of the firm and the firm's definition

deviation standard distribution normal dispersion internal external exam table mean deviations bell cipm tricks tips chart required curves spaulding ex

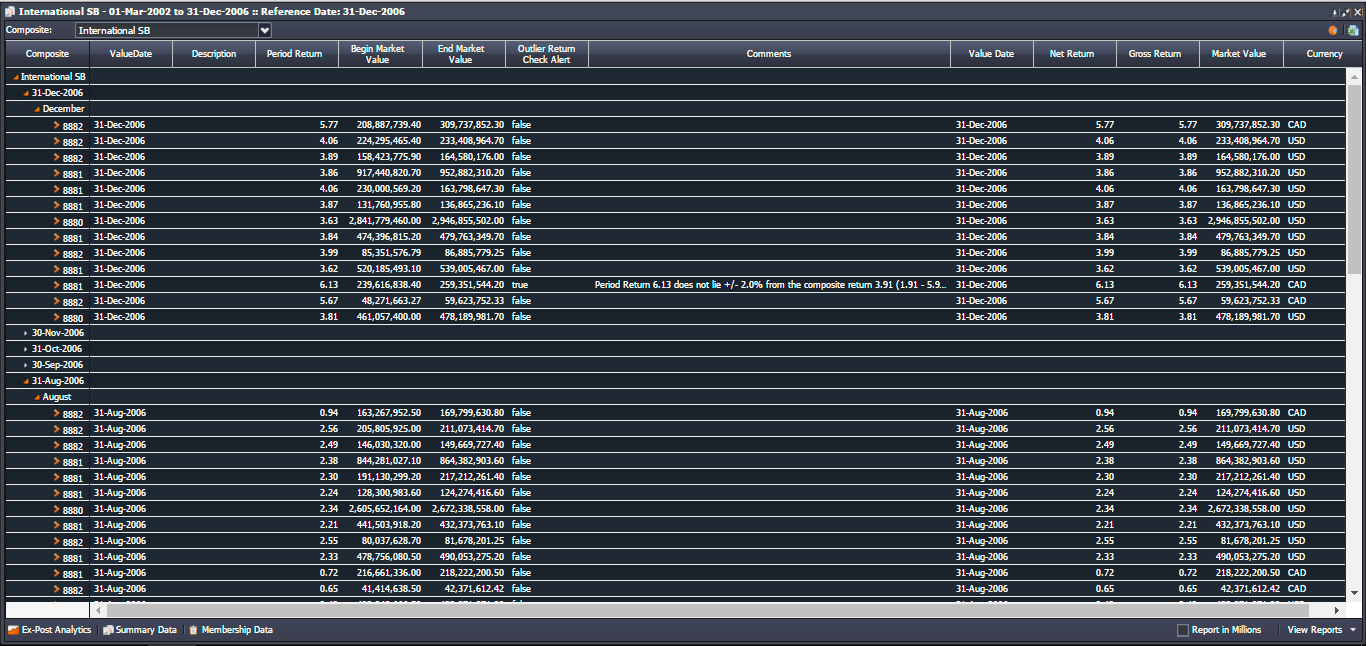

Established GIPS-based requirements for input data, calculation methodologies, composite construction, and performance reporting. Used Advent Geneva®, the industry's leading portfolio accounting platform, to create performance composites and underlying accounts.

In order to claim GIPS compliance, a firm must present at least five years of annual investment performance that is compliant with GIPS. Flay asks two of his performance analysts, Catherine Cora and Luigi Batali for suggestions as to how Mesa can incorporate the recommendations.

GIPS-compliance solutions often cost thousands of dollars, do far more than you need, and require a staff to maintain. Easy ROR Pro is the simple solution. Only external cash flows (balances, deposits and withdrawals) for your clients are needed to generate accurate, detailed,

Five years of GIPS compliant performance or since inception if 5-years not available. Questions are welcome. I don't know how to attach my mind maps but am happy to post them here if anyone can tell Don't let this failure stop you from achieving your ultimate goal of becoming a CFA Charterholder.

GIPS are standardised guidelines created by the Chartered Financial Analysts (CFA) Institute to provide an ethical framework for the calculation and Commenting on GIPS, the Managing Director, FBNQuest Asset Management, Mr. Ike Onyia said the adoption of GIPS standards in Nigeria will improve

While being GIPS compliant overall is significantly broader than simply using GIPS calculation methodologies We found that processes to track the distribution of GIPS-compliant presentations to clients are often informal and manual at many alternative investment management organizations.

Our whitepaper reviews the key areas of focus for asset owners when seeking to become GIPS compliant, identifies requirements that are different for asset owners as compared to investment managers, provides a guide for an asset owner to become GIPS

GIPS is a set of standardized, industry-wide principles that provide investment management firms with broadly accepted guidance on how to calculate One of the main challenges for a firm that intends to become GIPS compliant is to establish an appropriate firm definition. For a firm that manages

Firms that are GIPS compliant ensure they fully disclose and fairly represent their investment performance to potential and existing clients. 1, 2006. As of this date, the AIMR-PPS ceased to exist, and AIMR-compliant firms were encouraged to become GIPS compliant. Why Move to a

Compliance with the GIPS standards, as with other existing local standards, is voluntary. Local market support and competitive pressures will ultimately determine how successfully the GIPS standards will be embraced in different countries and regions around the world. Interpretive Guidance.

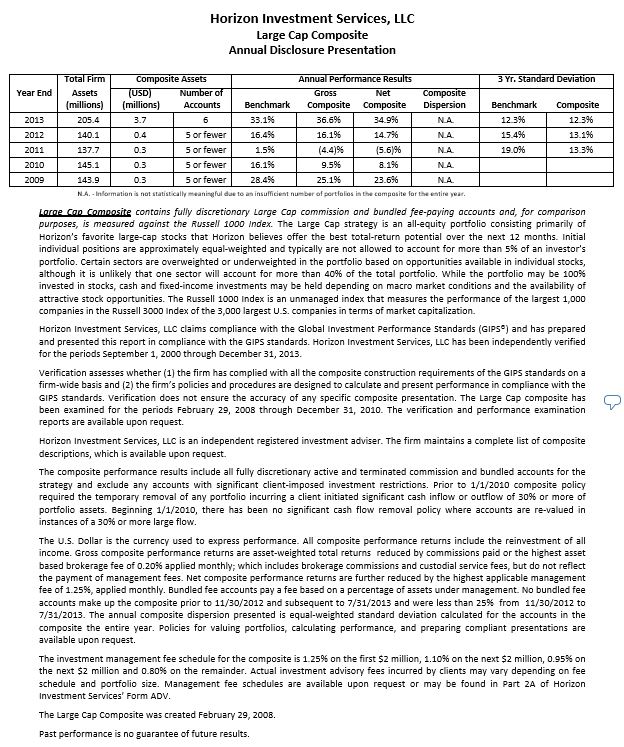

Under the GIPS standards, a "compliant presentation" is a presentation for a composite that contains all the information required by the GIPS standards and may also include The GIPS standards require firms to make every reasonable effort to provide a compliant presentation to all prospective clients.

Even some smaller RIAs are becoming GIPS compliant in order to gain a competitive advantage and have the peace of mind that comes from complying Does your advisory firm report GIPS-compliant results? How has it impacted your business? Or are you a firm considering whether to pursue

If fund managers are also GIPS-compliant, then it's easier for the asset owners to integrate the underlying That remains the key driver for people wanting to become GIPS-compliant for the first time. How does the firm ensure that every prospective client receives the compliant presentation?

Building investor trust through GIPS compliant performance reporting. We draw on this technical expertise to give you best practice advice on how to gain the confidence of existing and addresses the critical success factors for GIPS compliance. It includes a thorough gap analysis of the

GIPS® compliance 20/20: The way forward. Analyzing the Global Investment Performance Standards. Investment management firms are constantly on the lookout for changing trends that This proposal asks IM firms to provide pooled fund reports or compliant presentations to existing investors annually.

Follow these six steps to begin the compliance process and become PCI compliant. How TokenEx Helps. Our Cloud Security Platform was specifically designed by two former Qualified Security Assessors to help reduce the cost and complexity of PCI compliance.

Google Shopping to find the products you’re looking for, track & compare prices, and decide where to buy online or in store.

Being GIPS-compliant can actually make things easier for firms that are trying to compete in multiple markets, because they have to abide However, because the GIPS standards have become so widely accepted, an institutional asset manager that is noncompliant may be at a competitive disadvantage.

Many firms are interested in becoming GIPS compliant, but are intimidated by the initial process of bringing their firm into compliance. How your firm is defined for GIPS purposes is primarily based on how the firm is held out to the public, which may differ from the legal structure of your firm.

Why should my firm become GIPS compliant and verified? The same can be said of verifications: our research shows that most compliant firms have them done. We also use third-party cookies that help us analyze and understand how you use this website.

Quickly become GIPS compliant in order to qualify investment products for global distribution and reduce manual processes for client reporting. GIPS certification is a competitive best practice for asset management companies who want to distribute their products globally.

Compliance with the GIPS standards has become a firm's "passport" to market investment This Guidance Statement explained how the requirements of the GIPS standards did or did not apply to Firms may link non-GIPS-compliant performance to their GIPS-compliant performance provided

mashreq capital bank psc

GIPS are the ethical standards created by CFA Institute to ensure a trustworthy representation and disclosure of investment performance results. These standards help investment companies to bring more transparency and provide guidelines on how to calculate and present their investment results

How to claim compliance? Compliance is a firm-wide process that cannot be achieved on a single product or composite. Two important issues that a firm must consider when becoming compliant with the GIPS standards are the definition of the firm and the firm's definition of discretion.

Complying with GIPS® is voluntary, and it requires a significant amount of preparation and ongoing oversight; however, firms can realize key advantages by becoming GIPS® compliant. GIPS® compliance can provide a competitive edge.

guns psn investment k4

Why would a GIPS-compliant firm want to be verified? More than 1,700 firms currently claim compliance with the GIPS standards. The Verification Process - How does a firm become verified? A verification tests that the firm's policies and procedures for maintaining GIPS compliance

If you are thinking about becoming GIPS compliant or need to fine-tune your existing process, this document will help you understand the steps involved. It is designed to help you understand the value of compliance, what's needed to achieve it, pitfalls to avoid, and how to ensure that