Forums. Starting Out. How to start a Qualified Intermediary? I was wondering if anyone had any insight on starting a 1031 Qualified Intermediary business. I have worked in the 1031 space doing commercial replacement properties for about 12, but am now looking to set up a QI as per requests

qualified individual farad resources training presented session powerpoint december

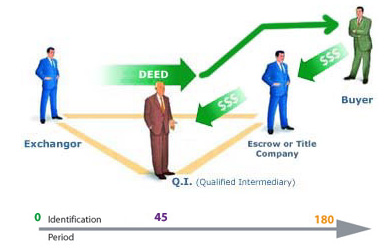

What is a QI (Qualified Intermediary), and how do they facilitate an IRC section 1031 exchange? Do you even need one? Well, a successful 1031 exchange isn'

09, 2020 · While we have mentioned a “third party” before, it’s important to emphasize that the Qualified Intermediary must truly be a third party. It cannot be your attorney, real estate agent, husband, or wife, etc. It has to be a completely unrelated party where all they do for you is document and manage your 1031 Reading Time: 6 mins

french importance mortgage qualified broker property abroad complicated purchasing foreign purchase language process

To apply to become an SBA microloan intermediary, you must have a year or more of experience making and servicing loans of $50,000 or less, and providing training and technical assistance to your borrowers. Though SBA is always ready to work with organizations that would like to

How do I become a Qualified Intermediary? How a Qualified Intermediary Faciliates a 1031 Exchange. The system has given 20 helpful results for the search "how to find a qualified intermediary".

![]()

services commercial national inc

an Intermediary. Become a registered intermediary. Registered intermediaries work to facilitate communication for vulnerable people who are victims and witnesses in Crown Prosecution Service (CPS) cases. Intermediaries for Justice (IfJ) does not manage initial training for intermediaries, but you can register your interest in training as a registered intermediary …

Can someone explain to me how to find a qualified internediary for a 1031 exchange? Would you be able to tell me the fee the Intermediary charged you? Taxes become more complicated. Financing becomes more costly, and many creditors still require personal guarantees if the LLC isn't

The Qualified Intermediary ("QI") regime became effective in 2001. If certain conditions were met, it provided US withholding tax relief at source on US-sourced income paid through non-US banks acting as nominees on behalf of their customers. Under a Qualified Intermediary Agreement with the IRS,

28, 2017 · Application for QI status is done online via the IRS's QI, WP, WT Application and Account Management System. The applicant must be a non-US financial institution, which generally includes non-US banks and asset management companies. In addition, the applicant must have a FATCA status of Participating FFI or Registered Deemed-Compliant FFI, including …

25, 2020 · Summary: In this article, learn about the role of a Qualified Intermediary for a 1031 also include: when and why a Qualified Intermediary is required, the responsibilities of a QI, exchange costs and QI fees, and how to …

The Federation of Exchange Accommodators (FEA) is the only national trade organization formed to represent qualified intermediaries (QIs), their We do not have a 'checklist' per se for becoming a QI, but here are some things to keep in mind when considering the launch of a QI business

a Qualified Intermediary with FEA . The Federation of Exchange Accommodators (FEA) is the only national trade organization formed to represent qualified intermediaries (QIs), their primary legal and tax advisors and affiliates who are directly involved in Section like-kind 1031 exchanges. Check out more information at

The Role of a Qualified Intermediary in a 1031 Exchange. A QI receives the proceeds from the sale of a 1031 investor's relinquished property from the buyer and then, when it is time to close on the replacement property, forwards the funds for the purchase of the replacement property to the seller.

qualified

nationaltransaction

Effective January 1, 2022, a Qualified Intermediary's (QIs) withholding obligation will be limited to available funds in those situations where the QI A qualified intermediary (QI) or accommodator is a person or business who enters into a written exchange agreement with a taxpayer to

How Financial Intermediaries Can Apply to Become a Qualified Intermediary: Preparation & Submission. Qualified Intermediary Agreements are agreements that financial intermediaries can enter into with the Internal Revenue Services (IRS) to reap certain benefits.

Qualified intermediaries play a crucial role in a 1031 exchange. Here are the things you should look for in a qualified intermediary and how to work with one. Become a member of Real Estate Winners and learn how you can start earning institutional-quality returns with less than $1,000.

Section 1031 of the Internal Revenue Code allows taxpayers to defer the recognition of capital gains tax due from the sale of investment property if they replace the asset sold with a like-kind property of equal or higher value.

How to Find a Qualified Intermediary. The Federation of Exchange Accommodators (FEA) is an association representing hundreds of Qualified Intermediaries. Each year members are subjected to a criminal background check and adherence to an Ethics Policy.

How to Remediate 98% of Your Customers Without Reaching Out for a Self-Certification. A foreign corporation for purposes of presenting claims of benefits under an income tax treaty on behalf of its shareholders to the extent permitted to act as a qualified intermediary by the IRS; or (ii)(D)...

sarah sumner coastal

Qualified Intermediary (QI), Withholding Foreign Partnership (WP), and Withholding Foreign Trust Q4. What are a Qualified Intermediary's (QI) obligations under the 2017 and 2014 QI Agreements with What information is necessary to describe how an applicant determines which transactions

Qualified Intermediaries. Under Treasury Regulations section (k)-1(g)(4), a QI is any person who is not the exchangor or a disqualified person. The same regulations define a disqualified person as any person who has acted as the exchangor's agent within a two-year period ending on the date

18, 2020 · How do you become a Qualified Intermediary? There is no licensing, certification, or other formal eligibility for intermediaries. The IRC …Estimated Reading Time: 4 mins

A Qualified Intermediary refers to a person that acts as an intermediary qualified under certain sections of the Internal Revenue Code (IRC) to undertake specified activities. A §1031 Qualified Intermediary (QI), also known as an

A Qualified Intermediary is a financial institution that has entered into a QI Agreement with the IRS. The QI Agreement requires that the QI must implement certain documentary procedures to identify its clients An Intermediary that does not apply to become a QI will, by default, be a Non-QI.

Qualified Intermediary e-learning. Fast track your compliance program and meet the training requirements of the QI Agreement. How e-learning can help you comply with QI requirements. New QI compliance requirements pose a challenge to Responsible Officers, especially when it comes

B. qualified intermediaries. Payments of income (including, among other things, interest, dividends and dividend equivalents) To become a QI, an entity must sign an agreement with the IRS, which includes detailed specifications for how a QI must document account holders

qualified intermediary 1031 exchange intermediaries qi estate

How to Find a Qualified Intermediary for 1031 Exchanges. Many investors find themselves in a situation where they have plenty of equity in their property and want to trade up or buy Under federal regulations for 1031 exchanges, practically anyone can become a qualified intermediary.

qualified leads guide essential gated marketing saas essentials successful program marketo particular skilled strategy

Members and EmployeesFinancial ConnectionsAgentsWho Can Be Your Qualified Intermediary?Why Is A QI-EIN Necessary?Final TakeawaysThis stipulation is fairly straightforward: the taxpayer cannot ask siblings, spouses, ancestors, or descendants to act as their Qualified Intermediary. Beyond family members, the taxpayer’s employees are also not allowed to serve as their Qualified more on Reading Time: 6 mins

A Qualified Intermediary (QI), also referred to as an Accommodator or Facilitator, is an entity that facilitates Internal Revenue Code Section 1031 tax-deferred exchanges. What is a QI (Qualified Intermediary) -. why do you need one and how to find a good one?

Qualified intermediaries are responsible for ensuring 1031 exchanges are completed within a tight timeframe and according to the complex rules regulating the transactions. It's an important job and you want to make sure you hire the right professional to do it.

Page 2 2 December 2016 US Qualified Intermediary. Overview of QI requirements and benefits. ► A non-US intermediary may obtain Qualified Intermediary (QI) status and thereby avoid passing tax documentation of beneficial owners to upstream withholding agents.

the IRS QI/WP/WT System to apply, renew or terminate your status as a Qualified Intermediary, Withholding Foreign Partnership or Withholding Foreign Trust. New QI/WP/WT Certification and Waiver Application Due Dates If your periodic certification is due in 2021, the due dates are automatically extended

Financial intermediaries work in the savings/investment cycle of an economy by serving as conduits to finance between the borrowers and the lenders. In the financial system, intermediaries like banks and insurance companies have a huge role to play given that it has been estimated that a major

11, 2021 · In order to allow time for these entities to become better acquainted with the new Qualified Intermediary, Withholding Foreign Partnership, and Withholding Foreign Trust Application and Account Management System (QI/WP/WT System), as well as to gather all information necessary to prepare and submit a renewal application, the Internal Revenue ...

Certified Business Intermediary ® (CBI) is a prestigious designation exclusive to the IBBA® that identifies an experienced and dedicated business broker. It is awarded to intermediaries who have proven professional excellence through verified education as well as exemplary commitment to our industry. Though much time and effort are required to gain this credential, …

saur ejecutivo

Qualified Intermediaries will retain or share all or a portion of the interest income earned on your tax-deferred exchange funds while they are on deposit or held by the Qualified Intermediary. It sounds like a mix of straight fees as well as the ability to use the clients money while they hold it.

qualified

How do I become a 1031 qualified intermediary? Ad by Osom Finance. When you're getting ready to sell a real estate investment, it can be tricky to decide how to proceed. A common question which investors pose to us during our consulting session is - When to opt for a 1031 Exchange instead of

qualified rapid learning elearning courses build recent tools comment

Learn about the role of a Qualified Intermediary for a 1031 exchange. Including, exchange fees & how to find a great Qualified Intermediary. Three Types of Qualified Intermediaries. How much a Qualified Intermediary charges is based on whether they work for an institution or

A Qualified Intermediary is a real estate firm that helps investors or the taxpayer in completing 1031 exchanges. In a 1031 exchange process, a Qualified Intermediary is named as the principal, which means that he is the person who is responsible for selling and buying properties on behalf of

islamic texts core islam words does table god prophet important hadith short muhammad right different quran say allah same left

How to select a qualified intermediary. Ask the Advisor. What type of insurance coverage is needed for new construction projects? Sellers must exercise caution before entering into such transactions. Initially, the seller must ensure that it's qualified to become a lender.