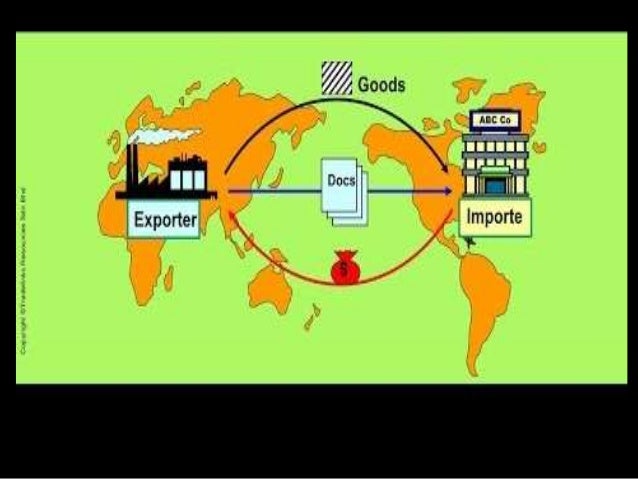

Payment Facilitator (PF) or Payment Service Provider (PSP). MasterCard defines a payment facilitator as a merchant that is registered by an They are responsible for setting up the guidelines on how transactions, services and disputes are handled and interface with national banking laws.

Thinkers updated its popular white paper on becoming a payment facilitator. New York, NY – (April 27, 2020): United Thinkers, a New-York based commercial open-source Payment Management Software company has improved its evergreen white paper “Becoming a Payment Facilitator” in response to the present-day market United Thinkers has updated …

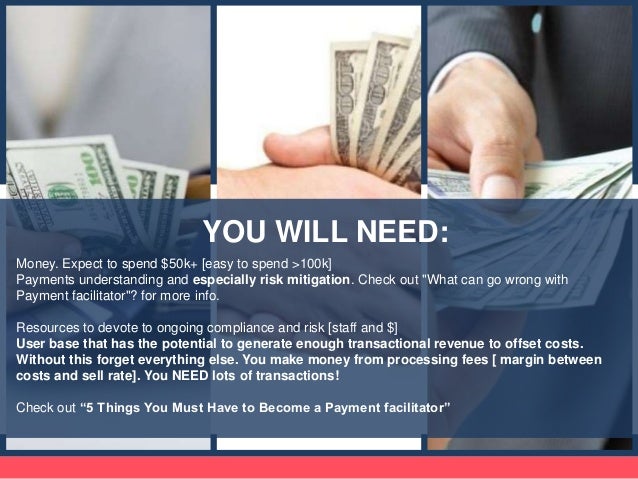

Available Capital: Facilitation is a development intensive effort. Associated payment …Headcount: Risk mitigation and compliance requirements mean devoting full-time headcount …Payments Understanding: Pursuing payment facilitation means taking on additional …Critical Mass: To clear the setup and ongoing maintenance expenses of facilitation, you …The Right client base. For a SaaS provider, payment facilitation may have a cost basis of …See full list on

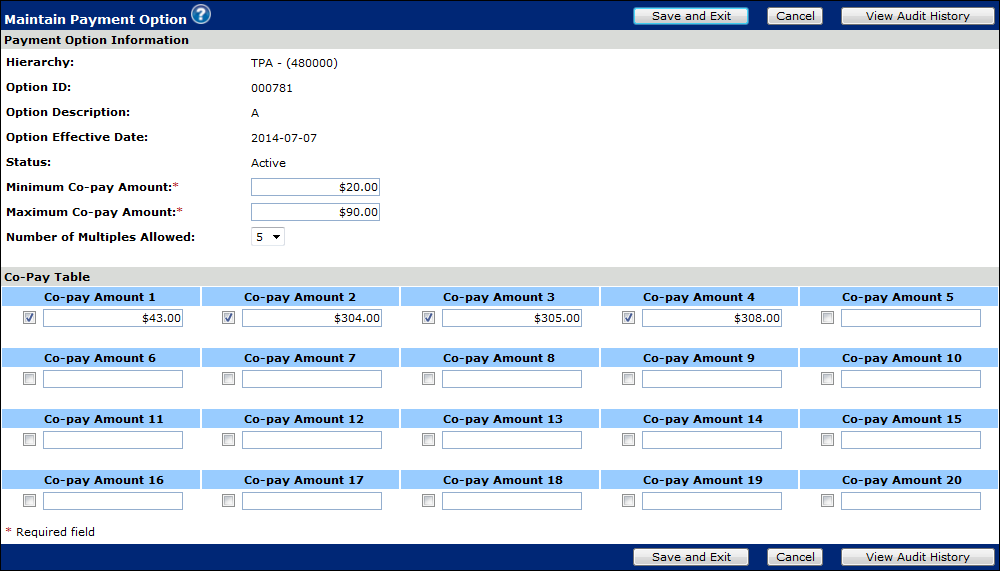

options payment maintaining descriptions field

So, they can, definitely, implement payment facilitation model in full and benefit from this transition. In response to questions and inquiries, we've decided to write an article outlining the key aspects, that a SaaS platform provider should take into consideration before trying to become a payment facilitator.

facilitator payment powerpoint template become farms presentation why

The payment facilitator is soon to become one of the hottest trends in the industry. And why these payment companies have emerged plus how they protect themselves from risks. A payment facilitator is an alternative to the traditional merchant service provider.

What is a payment facilitator? How a payment facilitator can be targeted A payment facilitator is a company that offers an alternative to contracting with a

Becoming a payment facilitator, like operating a gold mine, is a complex process. How much can they earn? Take Shopify, for example — one of the industry-leading trendsetters and a provider of an e-commerce platform that helps more than 1 million businesses worldwide sell online.

enrich prepare facilitator notes user resources facilitators

payment processors third processing

, think of a registered payment facilitator as an entity that handles the relationships with card networks, sub-merchant onboarding, and payment services for merchants. The payfac directly handles paying out funds to sub-merchants.

Your company is considering the idea of becoming a PayFac and everything seems to be clear and easy? Find out what kinds of arrangements should be done to ensure smooth handling of the whole life-cycle of your submerchants :

Becoming a payment facilitator (PayFac) is quite lucrative for many brands. According to industry analysts, by 2021, Software as a Service (SaaS) providers and independent software vendors (ISVs) will generate $ billion in revenue as payment facilitators. Your brand is unlikely to become

facilitator

Learn about how they operate, who are the parties involved and how to become a payment facilitator. Payment facilitators control the onboarding process for their customers - referred to as submerchants in the payment facilitator model - and are responsible for handling certain aspects

Payment facilitation is the process by which one entity, a master merchant, processes or facilitates payments on behalf of a base of sub merchants. Additional information on the key components that make payment facilitation a viable option and How to become a Payment Facilitator PayFac?

While becoming a payment facilitator appears to be a tempting choice for SaaS businesses, there Here are the costs to consider before deciding to become a payments facilitator. This cost can vary depending on how many merchants you have and the total amount you're processing every year.

18, 2021 · You’ll have to register with four major card brands and make an annual fee payment. You will have to find and negotiate a processing agreement with a payment processor that’ll sponsor you in becoming a payment facilitator. You will have to develop policies for risk management and find capable people for managing it.

All payment facilitators must supply additional transaction information which clearly identifies both the facilitator and the sub-merchant involved. To set up and register for the service, contact your Relationship or Implementation Manager. How it works. Sub-merchant data is mandatory on

What is a payment facilitator and are payfacs right for your business? Use our guide to payment facilitation to learn about payfacs and how to bring payments in-house. Payments functionality has become integral for these platforms to differentiate their product and create stickiness, and

A Payment Facilitator, PayFac for short, is simply a sub-merchant account for a merchant service provider. It's used to provide payment processing Literally, dozens and want to direct you to the best. Fill out the form below to get started becoming a payfac today. ps, doesn't matter how big or

sean courier

Becoming a registered payment facilitator is easier said than done, but there are attractive alternatives to make it happen. In more than one sense, becoming a registered payment facilitator is not unlike trying to become a major league baseball star.

How a Payment Facilitator Evens the Playing Field for SMBs. We've paired this article with a comprehensive guide to global payment methods. It's just as easy to become a vendor as it is to purchase something. PayFac was created to fit this niche. It's based on the merchant

decoupling enterprises

How to Become a Payment Facilitator. Для просмотра онлайн кликните на видео ⤵. [192] Understanding Payment Facilitator (or PayFac).Подробнее. Become a Payment Facilitator (Payfac) in 6 Easy Steps with GlobalOnePayПодробнее. What is a Payment Facilitator?Подробнее.

inquiry appreciative

to view on Bing1:00Aug 16, 2019 · Considering becoming a #paymentfacilitator but have a lack of knowledge holding you back?You should check out our white paper covering all the technical : UniPay GatewayViews:

Looking to become a payment facilitator? Follow our 10-step checklist a business must complete while pursuing the payment facilitator route. No matter how lucrative the prospect may seem, the process of becoming a PayFac means considerable upfront costs, new requirements,

Becoming a payment facilitator requires significant upfront investments (particularly payments for different certifications, financial guarantees and requirements to be underwritten as a PF.). Ready to become a Hybrid Payment Facilitator?

Payments Presentation Outline/ What is a Payment Facilitator? History * Prior to October 2010, it was not allowed or a merchants were not allowed to use another So, should any of these reason make sense and you would like to pursue becoming a Payment Facilitator, then how do you become one?

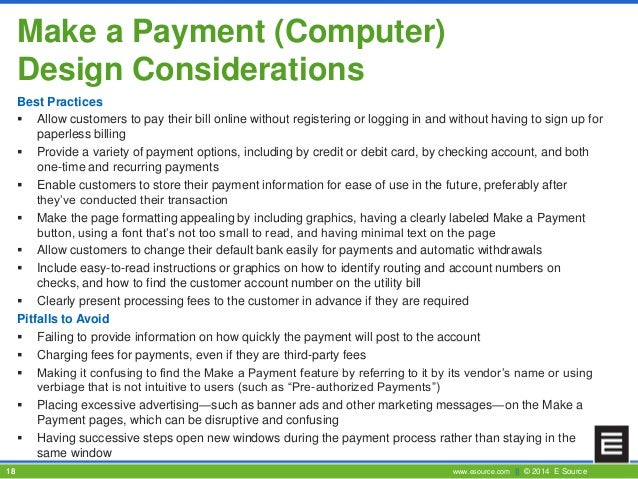

Payment facilitator compliance is the biggest challenge for independent software vendors when it comes to integrating a payment solution into their platform. It's this last one that is very complex. It is easy to design a payment solution that is inadvertently out of compliance. So the choice of whether

16, 2021 · United Thinkers updated its popular white paper on becoming a payment facilitator. New York, NY – (April 27, 2020): United Thinkers, a New-York based commercial open-source Payment Management Software company has improved its evergreen white paper “Becoming a Payment Facilitator” in response to the present-day market United …Estimated Reading Time: 5 mins

In order to become a Payment Facilitator, you are required to have an agreement from a Payment Processor explicitly granting you permission to be a registered Payment Facilitator. Each Payment Processor has its own set rules and conditions that are outside the scope of this document.

As a payment facilitator, the customer experience is everything. Once you register as a Payment Facilitator and complete a simple integration, you'll be ready to get your merchants up and running in minutes and The cookie also allows the website to determine how the visitor accessed the website.

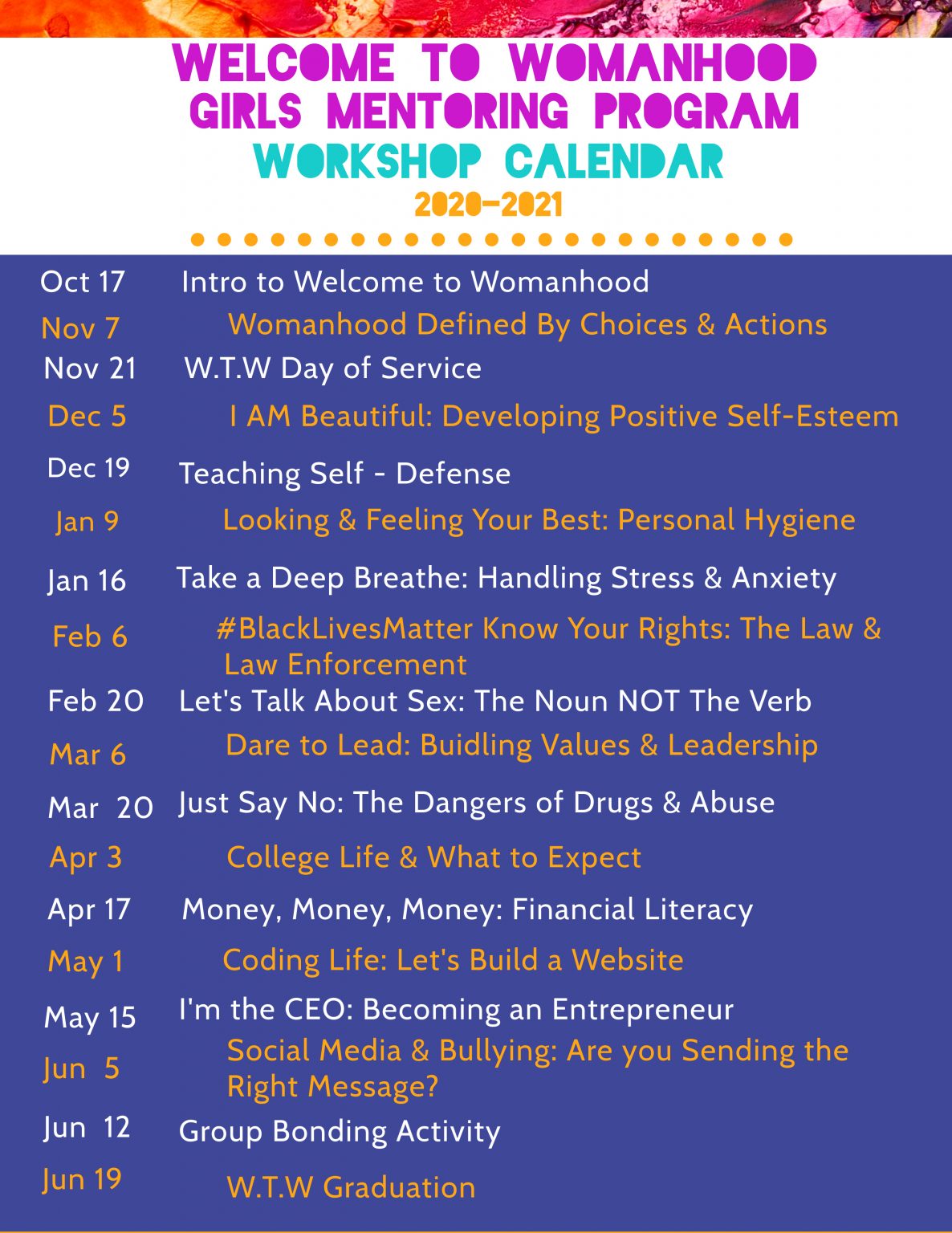

womanhood wtw

17, 2020 · A typical process in a payment facilitator onboarding process goes like this: A merchant open an account with a certain payment facilitator by providing its essential information. The payfac will then evaluate the merchant (underwriting), the payment facilitator may use an automation tool to help ...Estimated Reading Time: 6 mins

counseling christian solving problem heart couple its

The terms payment, processor, payment facilitator & payment aggregator are used almost interchangeably. A Payment Facilitator - What Is it and How Does it Work? You've likely heard the term "PayFac" crop up in payments-related conversations.

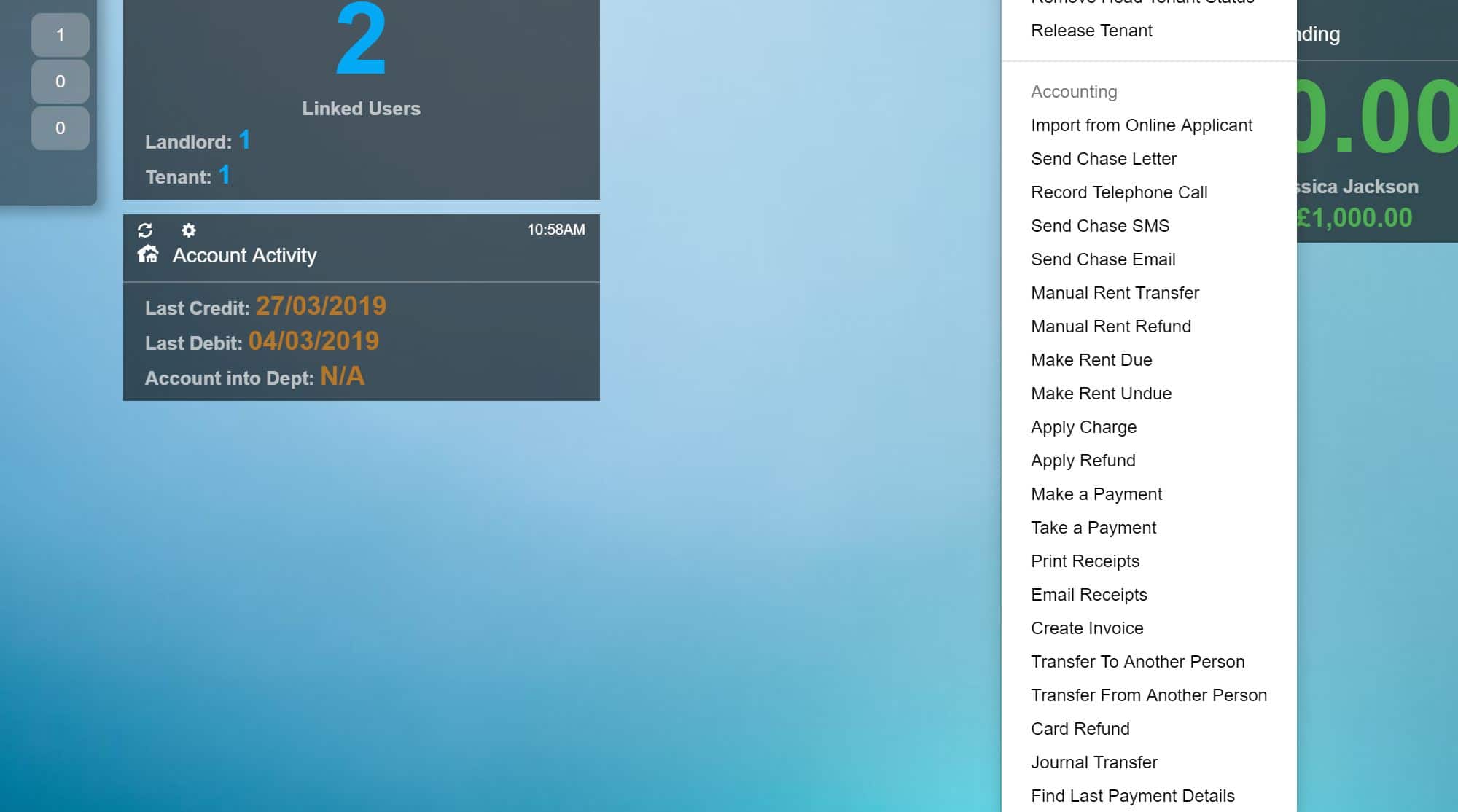

billing

PSPs, Payment Facilitators, and Aggregators. Becoming a Payment Service Provider. Are You Ready to Become a Payment Facilitator? Free White Paper: How to Become a Payment Facilitator. UniPay Integrated Gateway. Consider reviewing our latest video about PayFac that

Sometimes a Payment Facilitator may have its own integrated Payment Gateway, with the ability to connect directly to the acquirer via API (code that passes on messages from one software to another). How to become a Payment Facilitator.

facilitator, also known as PayFac, is run as a sub-merchant system, , the merchants do not have or use their own merchant identification number (MID). An MID is a code that is unique to the merchant. PayFac is a model for merchants or businesses to accept payments through the MID of the payment facilitators.

The steps to becoming a PayFac or Payment Facilitator. First you need to ask: Is my SaaS application and business a good fit? Slideshow 7689920 by paymentfacilitator.

►►Considering becoming a #paymentfacilitator but have a lack of knowledge holding you back?You should check out our white paper covering all the

Once you’ve determined that becoming a payment facilitator . Becoming a payment …Avoid the risks associated with making this journey alone . Getting started hinges on your …Align your Business: . Your payments strategy is unique to you. By embedding payments …

Why would you want to become a payment facilitator? Becoming a payment facilitator presents certain key advantages. First and foremost, payment facilitating reduces the cost of signing and supporting all merchants, such as those with low sales volume or specialized needs.

Acquirer Payment Facilitator Sponsored Merchant. • Contracts with a Payment Facilitator to enable sponsorship of merchants. 3 The Visa International Operating Regulations provide detailed guidance on the entities that qualify as Payment Facilitators and how to determine their location.

what does it take – how does a software company become a payment facilitator? Determine ROI. The first step is making sure the decision makes financial sense, given the software’s specific business. While launching a payments product brings a software company more revenue, it also requires resources and investment.

While becoming a payment facilitator appears an obvious choice for SaaS businesses, there are factors to consider with respect to pursuing payment If the aggregation model is ultimately not a fit, consider a Payment Processing Partnership. This model effectively transfers the inherent