21, 2021 · How does guarantor car finance work? When applying for car finance, the lender is likely to run a number of checks on whether you can afford to repay the balance and that you’re responsible with credit. If the finance company finds that you have a poor credit rating, you may be refused finance.

Yes - it's important when applying for guarantor car finance that your guarantor has a good credit score, to ensure that they are able to keep up the monthly repayments on your lease car if you default. It might be worthwhile asking your guarantor to access their credit file using a credit reference

Guarantor car finance is the type of finance product which involves someone vouching for you and if for any reason you can't make the payment they Find Me Car Finance is a trading site of Sandhurst Associates Limited (Sandhurst). Sandhurst is registered as a limited company in England and

15, 2020 · Your guarantor must have a good financial record and a good credit score. The guarantor must have better creditworthiness than the borrower, otherwise brokers or lenders will not consider your car loan application with a guarantor. A guarantor should also be employed and/or have a good residential ()Estimated Reading Time: 7 mins

Guarantor Car Loans. Finding it tough to get finance on your own? You might be eligible for guarantor car finance! Guarantor car loans are a lot like personal loans but the big difference How is a guarantor loan different to other loans? The main difference with a guarantor loan is that there

What does car finance no guarantor mean? No guarantor car loans or car finance without a guarantor means that you are solely responsible for your repayments. They tend to be a lot more popular than guarantor loans as they give you the independence.

Yes you can use a guarantor car finance loan to buy your car from any dealer, which makes it much more flexible than traditional dealer finance, and also How to lease a car with a guarantor? This is really easy, you simply apply for your finance and then negotiate the leasing agreement alongside it.

faq

Do You Get A Guarantor Loan?The ProsThe ConsFurther InformationThe applicantTo obtain a guarantor loan - or another kind of car finance - the applicant must be at least 18 years of age. They will need to demonstrate that they have a regular income, so the company can be confident that they make the repayments. The applicant must also have a UK bank account, …The guarantorThe guarantor will usually be a family member or close friend of the applicant, because they are placing their trust in them. If the applicant does not make payments, the guarantor becomes liable for this. Unpaid debt will also affect the credit scores of both the applicant and the guarantor. To …See more on

14, 2021 · Unfortunately, guaranteed car finance isn’t a thing and there are a few requirements you need to meet before you can get accepted for car finance. You are over 18 years old; You have lived in the UK for a minimum of 3 years; You are not currently bankrupt; You are able to prove your affordability; If you can meet the above requirements, you could be …

Guarantor car finance - is it a good option? Last updated May 21, 2021. In this article we will explain how guarantor finance works, the benefits and drawbacks of using a guarantor, who can be your guarantor and the alternative finance options when buying a car.

04, 2020 · Guarantors typically must be over the age of 21, or sometimes 18. They must have a good credit rating, showing a strong history of making timely and correct repayments on loans. In many cases, guarantors for car finance need to own their own home.

How does car finance with no guarantor work? Quick Car Finance is a trading style of Automotive Online Ltd which is an authorised credit broker, not a lender, registered in England, company registration number 07968386, data protection registration number ZA458903.

Financing a car with a guarantor loan is quick and easy. The loan is based on the fact there is a guarantor, and so the process is fast, and the loan is not secured by the car. You can be approved for your loan, know how much you have to spend, and then buy a car like a cash buyer, and be able

24, 2021 · Getting a guarantor for your car loan is a good idea if you don’t have a good credit score. Also, doing this can help you rebuild your credit score. How does it work? Guarantor car finance is like a personal loan. The difference is that you’ve asked someone else who could step in if you can’t pay back the loan. The guarantor car finance will also give an extra sense …

Guarantor car finance is aimed specifically at people struggling to get car finance. It's especially aimed at young people who haven't had the If you can comfortably and reliably afford the monthly payments, guarantor car finance can be a canny way to add to your credit score while driving a

Many lenders offer guarantor car loans, guarantor personal loans and guarantor home loans, because of the significantly reduced risk to the lender. Smaller loan companies and credit unions tend to be more competitive in their battle for your business. There are plenty of lenders willing to lend

Admittedly, car finance with a Guarantor isn't something you hear about often; however, many mortgage companies and landlords continue to ask If you have been asked to be a Guarantor you should definitely think about it carefully before you agree to anything, and most definitely before

How is guarantor car finance different? The important difference between this and most car loans is that it involves a third person. Having a guarantor will help you build your credit score. But also remember that it will also affect their credit score. How do I find someone to be a guarantor?

How guarantors on car loans work in practice. What a guarantor needs to know. Having a guarantor as part of your car loan agreement can help you with securing car loan finance. Since the guarantor is "backing up" your claim to be a low risk, your guarantor's finances can dictate

Guarantor car finance is a car loan where a third party agrees to guarantee the repayment of the finance in the case of you failing to meet the repayments. How is a guarantor loan different to other loans? The main difference with a guarantor loan is that there is not just a two-way

countries

Used car finance guide. Switching energy supplier. Being a guarantor involves helping someone else get credit, such as a loan or mortgage. However, you should only be a guarantor for someone you trust and are willing and able to cover the repayments for.

With guarantor car finance, not only is the loan secured against the vehicle, there's also the added buffer of the guarantor to make the due instalments. When it comes to the pros of guarantor car loans, these tend to be relevant to any type of guarantor loan. So whether you're taking out

Guarantor Car Finance is suitable only if you have bad credit and you will require somebody with a good credit score to be your guarantor. How does a guarantor loan work? Is guarantor car finance only for young drivers? Who can be a guarantor for me?

I Become a Guarantor for an Auto Loan? Practically anyone can sign-up to be a guarantor for an auto loan, however, typically, this is a responsibility shared by a close friend or a family member. You see, being a guarantor for an auto loan is a huge responsibility and you're basically agreeing to pay someone else's debt if they fail to do so.

loan vehicle private finance call center hourly campaign limited setia transfer vehicles commercial ltd transparent leads clipground services

Need car finance but have a bad credit rating? A £1,000 to £15,000 guarantor loan could be a great option. No restrictions on car use - other finance can have terms relating to returned condition, mileage, and how the car is used. "With a loan via us, you can use the car exactly how you wish -

Guarantor car finance - is it a good option? Last updated May 21, 2021. If you have a poor credit rating or are a young driver who hasn't had 7 answersWhen you are a loan guarantor for my loan, it means that you agree to be responsible for the repayment of my debt in case I can not pay.(30)…

lending

dating

This is where guarantor car finance comes in. It would involve someone close to you signing up as a guarantor for your application. Today, I'll be talking about how you can find a guarantor on car finance as well as give you some advice on how to get approved for such a loan.

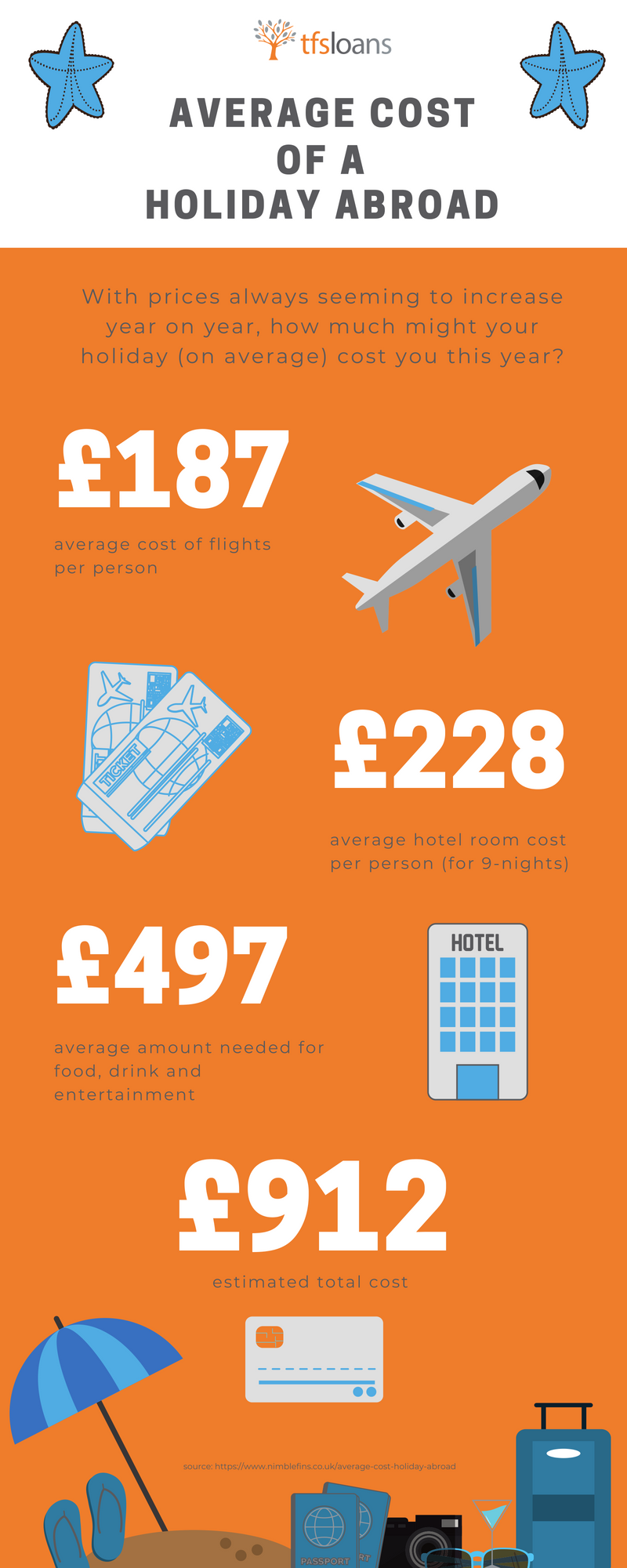

average cost holiday nimblefins abroad source

Guarantor car finance is a type of loan where a third-party individual is involved and agrees to take over your car loan repayment if you fail to pay your balance in full. A guarantor reduces the risk for the lender, as he becomes responsible for the credit payment that you cannot make.

A guarantor loan is a type of loan you take out with someone else - usually a family member - who promises to pay your debt if you're unable to. Guarantor loans are an alternative option for those who might otherwise struggle to get a loan - often due to a low credit score or having no credit history.

trustworthy nowhere

The majority of cars are now bought on finance, and payment options available on a new car have never been better. But if you have a poor credit history, it can be tricky to get approved for car finance. That's particularly true for young people or if you're taking out a loan for the first time.

charging electric vehicle points homes could required

Guarantor finance is designed for borrowers with little credit history, rather than anyone who is struggling for money, because monthly payments Understand what you're signing up for, however, and it could be an affordable way to drive a newer car than you could otherwise afford. If you're

Obtaining car finance with a guarantor loan can help lessen a lender's worry about missed payments. Find out more and apply today. And, when it comes to guarantor car finance, we have seen how it acts as a fantastic opportunity for people to work their way up to an excellent credit rating, which

When is a car finance guarantor required? Guarantor loans, also referred to as joint applications, are Car finance calculator. See how much you could borrow. What to do next. There are two simple options A guarantor for car finance is usually somebody who has a strong credit rating and,

No, you cannot get car finance with a guarantor with us, as we do not offer the option of having a guarantor on your car finance. We'll only ever offer finance based on your own income, affordability and circumstance. You can make a joint application with a partner or family member, but that

Using a guarantor loan as car finance is a way to offset a bad credit history. One of the popular car loan options you may want to consider is car finance with a guarantor. This simply means that you provide someone who'll guarantee your loan repayments if you have a problem.

Guarantor car finance is a perfect solution when you need a car but are worried you won't get approved on your own. Car finance with a guarantor can also see you offered a lower APR % because the risk is reduced from the lender's perspective. We've put together the best advice on

Get Car Finance Here is a leading provider of affordable car finance packages on cars from the biggest manufacturers. We strive to find a solution to In most cases, guarantors tend to be family members and close friends. It is important to remember that whoever agrees to act as your