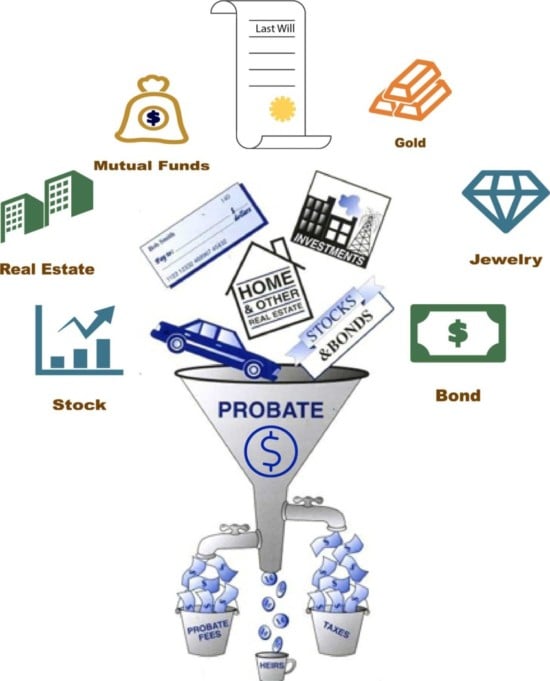

Probate is needed in Texas when someone dies with assets in their single name, whether they have a will or not. Full court probate (court supervised) is required in Texas when the total assets of the estate are greater than $75,000 and or if there is a will. How can you avoid probate? Have a small estate.

probate texas collin county fee flat application lawyer

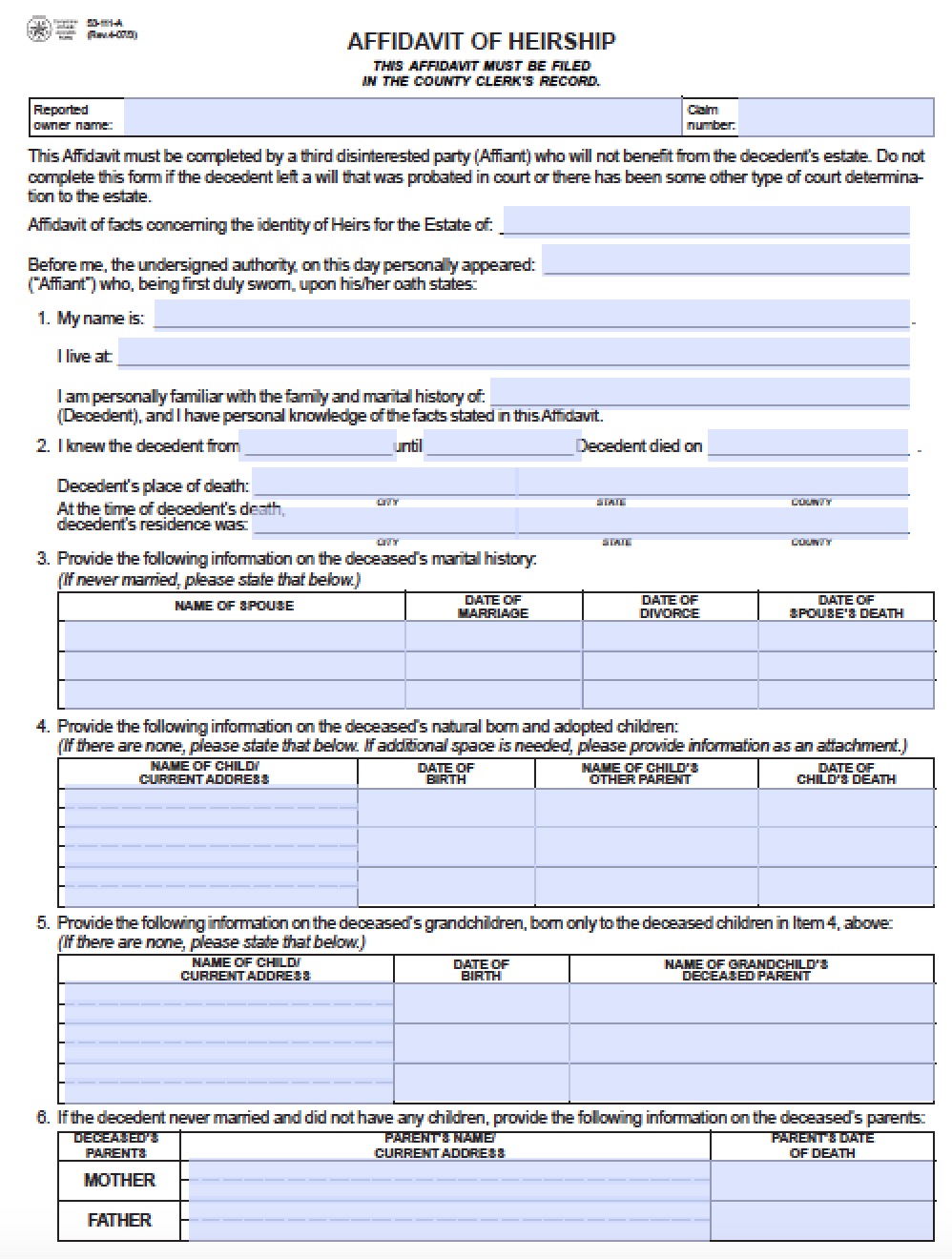

23, 2021 · Avoid Probate in Texas With the Small Estate Affidavit. Not everyone has a sizable estate or a will that sets out how assets will be distributed after they die. The probate process can be costly and time-consuming for family members after a loved one dies.

: RobindMethods for Avoiding Probate in TexasCreate Living Trusts. A trust is something like a container that we can use to hold assets. …Payable on Death Accounts. Then, after death, the funds will pass to the designated …Transfer on Death Deeds. Similar to a payable on death account, you can create a

probate

probate

Texas ancillary probate is used to probate assets in Texas for a non-resident decedent, when decedent's home state conducted probate. Placing the assets in Texas into a company or trust will avoid ancillary probate in Texas. For example, oil and gas interests could be placed into a

affidavit heirship form texas pdf tennessee california tx examples doc word adobe microsoft

probate

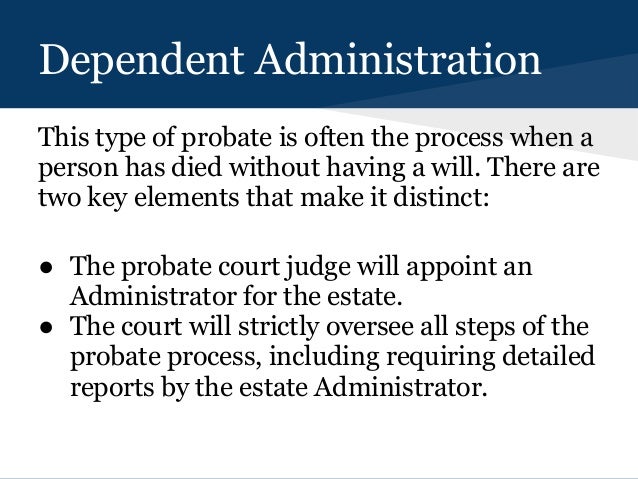

probated probate dependent

deed claim quitclaim arkansas ftempo

Probate Guide for Texas: Texas law requires that the executor publish a "Notice to Creditors" in a local newspaper. This notifies the public that the estate is in probate and gives them directions on how to make a claim. The other requirement is the executor must provide the court an "Inventory of

The following are exceptions to probate in Texas: Estates valued at less than $75,000, not including the value of the house, where the decedent died Find out if probate applies in your situation and how to make sure your rights are protected. Contact a Waco probate lawyer at (254) 826-8151 today!

How do you avoid probate in Texas? If you want to avoid probate for almost any asset you own, you can make a living trust to someone . That requires you to create a trust document that is very similar to a Will and to name someone to take over as a trustee after your death. This works for real

Create a living trust. You can place practically any asset you own in a revocable living trust, …Designate accounts “payable-on-death” Avoiding probate for bank accounts is not difficult. …Make property jointly owned. There are multiple ways to pass real estate to another person …Sign a transfer-on-death deed/registration. A transfer-on-death (TOD) deed (also called a …Gift property. For the tax year 2021, you can give a person up to $15,000 tax-free or $30,000 …See full list on

How Long Does Probate Take in Texas? Do All Estates Have to Go Through Probate in Texas? However, there are ways to avoid probate if you are aware of your options. How Do You Avoid Probate in Texas? The best way to avoid probate completely only works if you plan ahead.

Do you always have to probate a will in Texas? Most Texas estates need to go through probate after a person dies. If there is no valid Will, the assets. 2 How much does an estate have to be worth to go to probate in Texas? 3 What happens if you don't probate a will in Texas?

![]()

probate texas wills

Going through probate in Texas can take anywhere from around six months to more than a year, depending on how complex the estate is. Some people want to avoid probate, and that's understandable. Probate can be stressful and taxing.

In this detailed guide of Texas inheritance laws, we break down intestate succession, probate, taxes Spouses in Texas Inheritance Law. In Texas, you don't have to go the traditional marriage route to To avoid this, you will need to draft a new will following your divorce with your former spouse if

Is it possible to avoid probate in Texas? With this method of avoiding Texas Probate, an heir must file the small estate affidavit with the probate court clerk. Plus, the individual still needs to name an executor, describe how he wants the estate's debts to be paid, name guardians for his minor

Probate in Texas is not difficult or expensive if the will was well written and no heirs want to "fight". Otherwise, you are looking at years of litigation It is possible to avoid probate entirely with careful planning. This is desirable for some people because doing so not only reduces legal fees, but it

04, 2020 · Many families opt to take affirmative steps to avoid the probate process as much as possible. Several simple steps can be taken to reduce the assets that are subject to probate. These include: Beneficiary designations: Texas law permits both account holders to use Payable on Death (POD) and Transfer on Death (TOD) designations. These designations will …Estimated Reading Time: 3 mins

probate california avoid

Wills and estates. Advice. How to Avoid Probate in Texas. This guide discusses the options you can utilize to possibly avoid probate in Texas.

How Can I Avoid the Probate Process? The main advantage to avoiding probate is cost. Probate costs generally include attorney's fees, and can be costly Travis has written about numerous legal topics ranging from articles tracking every Supreme Court decision in Texas to the law of virtual reality.

deed beneficiary pdffiller revocable signnow fillable

The Texas probate process isn't as scary as you might think. Find out how it works and how you Although the legal process can appear complicated to a layman, an experienced probate attorney can Texas now allows this to be avoided by the executor providing the inventory to all

/Enhanced-Life-Estate-Deed-56aa10bb3df78cf772ac382f.jpg)

deed probate beneficiary vesting deeds tod thebalance fabtemplatez

How To Start The Probate Process in Texas. Probates filed in the incorrect court will likely be thrown out even after going through all the steps. This is further complicated by each court in Texas having its own set of probate proceedings and qualifications.

Reasons to Avoid Probate. As simple as probate can be, probate does take time and typically Most courts in Texas require an executor to be represented by an attorney in a probate matter because How to Minimize the Need for Probate? Probate is not necessary for many items of personal property.

Probate is generally easy to avoid yet many people fail to accomplish this task. Although, probate court proceedings in Texas may be simpler than in most other states, in most cases steps should be taken to avoid them. Here are some effective options that can be utilized to avoid probate in Texas

21, 2018 · The 8 Steps of Texas Probate Step 1: Filing. An application for probate must be filed with the proper Texas probate court in the county where the decedent resided. Step 2: Posting. After the probate application is filed, there will be approximately a two week waiting period before a hearing is held for the (1)Email: swforbes@

This article provides information on how to avoid probate court. This material is excerpted from a 2016 article by Judon Fambrough of the Real Estate According to Six Ways to Avoid Probate by Judon Fambrough (2016), one technique for avoiding probate "is a statutory procedure created in

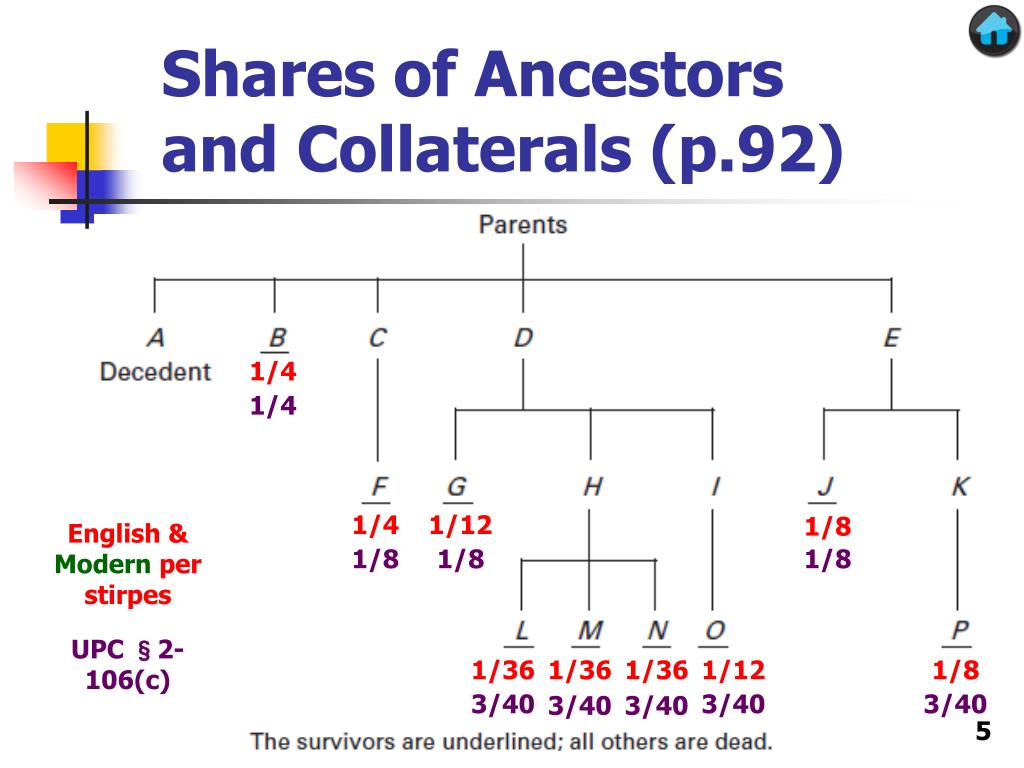

stirpes capita competing

, there are multiple ways to avoid Probate in Texas. One way is to ensure that survivorship rights are clearly spelled out in the wording of your assets. Bank accounts, mutual funds, life insurance policies, retirement accounts, and other assets should list your name and the name of your beneficiary, and include specific “transfer on death” or “payable upon death” …

09, 2018 · According to Six Ways to Avoid Probate by Judon Fambrough (2016), one technique for avoiding probate "is a statutory procedure created in Texas on Nov. 3, 1987, with the passage of an amendment to the Texas Constitution (Article 16, Section 15). The amendment permits spouses to agree in writing that all or a part of their community property belongs to the …Estimated Reading Time: 2 mins

This process allows you to avoid probate administration by transferring title to property, typically a homestead. Family settlement agreements can also be used when a party wants to contest the will. To avoid a will contest, the beneficiaries of the will agree to contract how the estate will be divided.

This helps in avoiding any sort of conflict of interest where the witnesses may have an incentive to lie about certain details in the affidavit. The attorney will help you with the complex process of dealing with the county recorder and probably the probate court. It's not a must that you should keep

How to Use TOD or Beneficiary Deeds to Avoid Probate. A transfer-on-death (TOD) deed, also known as a "beneficiary deed," is a special type of deed that can be used to transfer ownership of real estate outside probate in a growing number of states.

Determining how to avoid probate requires looking at how ownership of property is currently set up, and making any necessary changes. All states except Louisiana and Texas have adopted the Uniform Transfer-on-Death Securities Registration Act for stocks, bonds and other securities.

06, 2022 · Texas Laws. Probate is primarily discussed in the Texas Estates Code, which was added to be effective Jan. 1, 2014, replacing the Texas Probate Code. Some older resources may reference the Probate Code, but that information will now be found in the Estates Code. If you find these statutes difficult to understand, you may want to view the ...

Avoiding Probate in Texas. How to save your family time, money, and hassle. Updated by Valerie Keene , Attorney. Probate court proceedings (during which a deceased person's assets are transferred to the people who inherit them) can be long, costly, and confusing. It's no wonder so many

Ways to Avoid Probate. Payable-on-Death Bank Accounts. All you do is state, on the paper that shows your ownership (a real estate deed, for example), how you want to hold title. In Texas, you need a separate written agreement. To set up a joint tenancy in Texas, all joint tenants must sign

probate

elizabeth duff drozd law

How to Avoid Probate: 6 Actions to Consider. In California, you can hold most any asset you own in a living trust to avoid probate. Real estate, bank accounts, and vehicles can be held in a living trust created through a trust document that names yourself as trustee and someone else - a "successor"...

's no wonder so many people take steps to spare their families the hassle. Different states, however, offer different ways to avoid probate. Here are your options in Texas. Living Trusts. In Texas, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), …

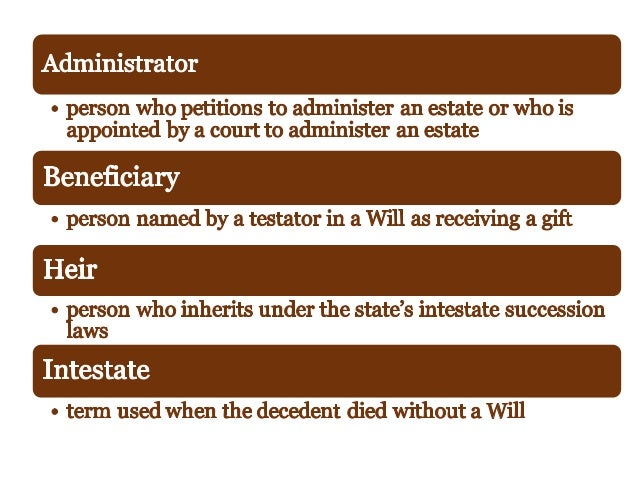

The Texas probate process differs a bit depending on your circumstances. How to Determine Ownership After a Death. If someone dies without a will in Texas, they can complete an Affidavit of Heirship. Even if there is a will, many prefer to avoid going through probate to save time and money.

15, 2021 · While you can do most or all of the work yourself, it’s wise to involve an attorney, if only for advice. Here are six things you can do to avoid probate: Joint ownership of property– You can jointly own property. On the deed to the property (usually real estate), you state how you want that property to be held.

thevindicator

What is Probate? How to Probate a Will in Texas. Submission of The Will. The First Court Hearing. The Texan county of the testator (the individual who wrote the will) or where they lived before they died may also be important. Courts in Texas use the county to determine whether the will's executor

trust revocable deed word eforms

probate frequently asked questions sign glossary issues

How to do Probate in Texas. Probate is needed in Texas when someone dies with assets in their single name, whether they have a will or not. Full court probate (court supervised) is required in Texas when the total assets of the estate are greater than $75,000 and or if there is a will.

Yet, as simple as Texas probate can be, there are still reasons that one may want to avoid it. Independent administrations that account for the majority of probates in Texas usually involve only one court hearing and allow the executor to settle the decedent's estate without further court supervision.

Tell you how to avoid probate without an expensive living trust by using deeds to transfer real estate at your death. As you'll see, probate is a pay-now-or-pay-later scenario. You can decide whether you want to take a few steps to avoid probate now, or leave it up to your loved ones to straighten it out

probated probate