Probate lawyer fees in Tennessee can vary, making it hard to estimate the total cost. Many probate attorneys just bill by the hour, but some charge a flat fee. How to Avoid Probate in Tennessee? Some people would rather avoid probate, and with good reason.

probation

How to Avoid Probate in Tennessee? Most people want to avoid probate so their beneficiaries can receive their inheritances more quickly without getting caught up in the tedious probate process, which can take a long time.

12, 2019 · Although there are a few different ways you can attempt to avoid probate, the most common is to claim as a small estate. This is only possible, however, for estates that have a combined value of $25,000 or less, and don’t include any real property, such as a home or land. Spouses in Tennessee Inheritance Reading Time: 4 minsLocation: 535 5th Ave, New York, 10017

In Tennessee, the local chancery courts handle the probate of wills and the administration of estates. Some of the larger counties have separate probate courts at the local level to handle these matters. Meeting with a lawyer can help you understand your options and how to best protect your rights.

Probate laws will vary from state to state. The following are your options to avoid probate here in California. Joint Ownership with Right of Survivorship to Avoid Probate in California. When you own assets with How to avoid the Obamacare surtax aka Medicare Surtax that is terrible for your tax bill.

Home > Estate Planning > How Can I Avoid Probate in Tennessee? There are two bits of good news for Tennesseans with this concern. First, the probate process in Tennessee is relatively straightforward and inexpensive compared with many other states.

The probate process is not required in Tennessee if the decedent has set up a trust (or family trust) which in most cases helps their estate to avoid probate. However, if those trusts or plans were not made, the only way estate assets can be distributed in Tennessee is through the probate.

How to Avoid Probate: 6 Actions to Consider. In California, you can hold most any asset you own in a living trust to avoid probate. Real estate, bank accounts, and vehicles can be held in a living trust created through a trust document that names yourself as trustee and someone else - a "successor"...

In Middle Tennessee, the court costs for probate can be as much as $500. If you avoid probate, your beneficiaries oftentimes receive cash in hand almost immediately. However, if your assets go through the probate process, then beneficiaries will not be able to touch that money until the

15, 2017 · Practical Tips to Avoid Probate in Tennessee. Using joint tenancy with a right of survivorship or tenants by the entirety. In Tennessee, if property is titled in just one person’s name, then only ... Using a living trust. This is a document that transfers your assets to a trust when you create the ...Estimated Reading Time: 3 mins

robbery armed crime police lawyer tennessee defense murfreesboro arrest common criminal defenses motorists warn spike burglaries safe stay explains state

Why should you avoid probate? Although probate is often straightforward, many people want to avoid it. The reasons can vary, but there are some Since it is a state legal proceeding, what goes on in probate court does not stay there. All the material in the probate process goes into the public record.

Probate can be avoided by use of a revocable trust or "living trust" instead of a will. The problem is that most people will pay more for a lawyer to draft a trust than if the lawyer drafted a will (they are usually considerably more complicated). In addition, the lawyer usually drafts a will anyway, a "pour over"

A popular alternative to probate in the is the use of a transfer on death (TOD) account, which is a special type of investment account recognized under state law. When the account owner dies, the remaining assets will pass directly to the TOD beneficiary previously named by the owner

We have 352 Tennessee Probate Questions & Answers - Ask Lawyers for Free - Justia Ask a Lawyer. If there are assets that need to have the title/ownership changed, probate is how it is done. Take the bank account, for example. I assume it is in her name and she did not name a

"How much will this cost?" A number of factors will determine a family's options for estate administration. There are two types of probate in Tennessee: common form and solemn form. It is generally best to seek advice from a qualified attorney to avoid time-consuming and costly delays.

The Probate Process in Tennessee Inheritance Laws. The executor of an estate is the individual that is responsible for paying off the debts of the estate, taking Although there are a few different ways you can attempt to avoid probate, the most common is to claim as a small estate. This is only

What is probate in Tennessee? Estates usually need to go through a legal process referred to as probate upon the death of a decedent. If the decedent created a detailed estate plan in advance of his or her death, it likely included strategies to avoid many aspects of probate.

The Probate Avoidance Principle. So how do you avoid probate? There are several ways to avoid probate, but they all depend on a single principle: You can avoid probate by arranging your assets so that everything you own either passes automatically to someone at your death or can be

bonnaroo

irrevocable trusts centsai grantor revocable

Determining how to avoid probate requires looking at how ownership of property is currently set up, and making any necessary changes. It also often involves tax considerations. One or more of these methods may be used to avoid probate. Which method, or combination of methods, is best for

What Factors Determine How Long Probate Will Take? If you were recently informed that you are a beneficiary under the terns of a decedent's Will, you may think it If you have additional questions or concerns about the time it takes to get through formal probate in Tennessee, or if you

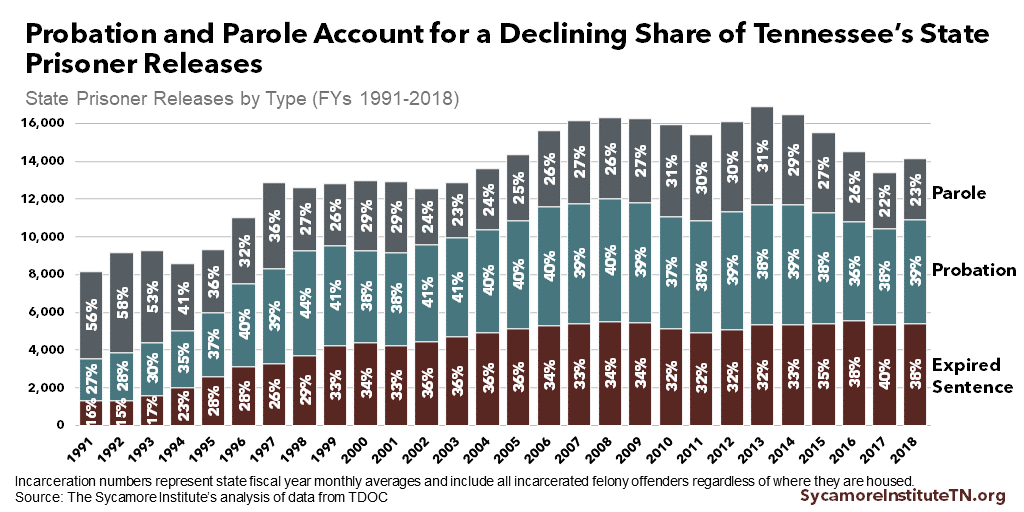

geographical probation indications

Learn how to avoid probate where a court oversees the distribution of property formerly belonging to a deceased individual. So, for example, a decedent who leaves behind real estate and retirement accounts adding up to $1 million might leave heirs with $50,000 or more in probate costs.

Does Tennessee Law Require Probate? Yes, probate is a requirement for estates in Tennessee. This is the method used to distribute the assets to the heirs and ensure the will is followed. In some cases, it is possible to avoid probate, especially if you utilize estate planning. What Happens if You

Avoid Probate with Joint Tenancy Ownership. If an asset is owned by two or more people as joint tenants, it will usually not be probated. These assets can be identified by the words "joint tenants," or "in joint tenancy," "JT TEN," or similar wording. When a joint tenant dies, the other joint tenant

2012 Probate Guide is provided by the Probate Committee of the Tennessee Clerks of Court Conference. Committee Members: Ted Crozier-Chair Rebecca N. Bartlett Kenneth Todd Elaine Beeler Merry B. Sigmon Kathy Jones Terry John Bratcher Tim Burrus Kenneth Hudgens Sherrie Pippin Judy Trent Jane Link . 1

Tennessee, you can make a living trustto avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee). Then—and this is crucial—you must transfer ow…Joint OwnershipPayable-On-Death Designations For Bank AccountsTransfer-On-Death Registration For SecuritiesSimplified Probate ProceduresIf you own property jointly with someone else, and this ownership includes the "right of survivorship," then the surviving owner automatically owns the property when the other owner dies. No probate will be necessary to transfer the property, although of course it will take some p…See more on Reading Time: 6 mins

How to Avoid Probate and Why It Matters. Probate is the legal process of administering the estate of a deceased person—resolving all claims and distributing that Whether you've retired to the sunshine state or have a seasonal beach house here, these three tips are key to avoiding probate in Florida

In short, avoiding probate is a matter of transferring assets outside of your Will, and there are a Finally, while a trust-based estate plan can help to avoid probate upon your death, all trusts must How an Estate Planning Attorney Can Help You Avoid Probate. When you consult

probate tennessee law legal faqs estate court frequently assistance asked needed kind questions

06, 2021 · In Tennessee, real estate is not a probate asset, unless one or more exceptions apply that bring the real estate into the probate estate. Thus, if the decedent’s estate consists only of non-probate assets, then the family does not have to “go through probate” in order to gain access to such assets.

estate planning lawyer lawyers

Avoiding Probate in Tennessee. How to save your family time, money, and hassle. Updated By Valerie Keene , Attorney. Probate court proceedings (during which a deceased person's assets are transferred to the people who inherit them) can be long, costly, and confusing.

Avoiding probate in estate planning allows the decedent's property to be distributed to the designated person at a designated time without substantial costs. Also known as transfer-on-death accounts, these allow you to name one or more beneficiaries of the account to avoid the probate process.

probate minnesota process avoided slideshare

12, 2019 · Keeping assets out of probate helps your loved ones avoid the courtroom. If you have questions about your estate planning, then contact established probate attorney John Crow online or at 931-218-7800 to learn about the best ways to …Email: john@: 512 Madison St Ste A, Clarksville, 37040, TennesseeEstimated Reading Time: 4 minsPhone: 12187800

You can avoid the need for probate, minimize you tax consequences, and reduce the ability of creditors to take the assets. In Tennessee, if property is titled in just one person's name, then only that person has the right to control the property including how it is handled at death.

probate avoided

02, 2013 · Probate can be avoided by use of a revocable trust or “living trust” instead of a will. The problem is that most people will pay more for a lawyer to draft a trust than if the lawyer drafted a will (they are usually considerably more complicated).

American probate law is state law. This means that as executor for the estate of a deceased person, you may have to go through probate in more than one state if the person owned property in multiple states. This often happens if someone has a vacation home in another state.

How to avoid probate? You may have another There are many ways to avoid probate in California. Plus, some estate planning tools are so simple that you can implement them without having to hire an attorney!

Avoiding probate makes it easier for everyone in the family. Click here to learn how to save your family time, emotional energy, and money. "Family infighting is the most common complication in probate cases, especially when it comes to personal property.

to avoid probate in TennesseeHire a good estate planning attorneyOpen bank accounts and designate heirs as beneficiaries of the accountsAdd a ‘transfer on death’ deed to any real estate you ownSee full list on

Do You Avoid Probate in Tennessee with Estate Planning The best way to avoid going through probate with an estate is to plan before the owner dies. A revocable living trust with the entire estate will mean probate isn’t needed.

: 1804 Williamson Court Suite 207, Brentwood, 37027, TNPhone: (615) 716-1150 Name a Beneficiary. The probate process only applies to those accounts or other property …Create and Fund a Revocable Living Trust (RLT) Once the RLT has been created, and you …Own Property Jointly. Probate can also be avoided if the property you own is held jointly with …