rockville

In other situations, probate courts will determine how your estate will be distributed using state inheritance rules. In most cases, the estate distribution hierarchy begins with your spouse. Although probate is often straightforward, many people want to avoid it. The reasons can vary, but there

The easiest way to avoid the probate process is to plan; but if you are now in a situation where you How Is A Probate Started In Maryland? Although any beneficiary or creditor can initiate probate, normally the person named in the will as the Executor starts the process by filing the original will

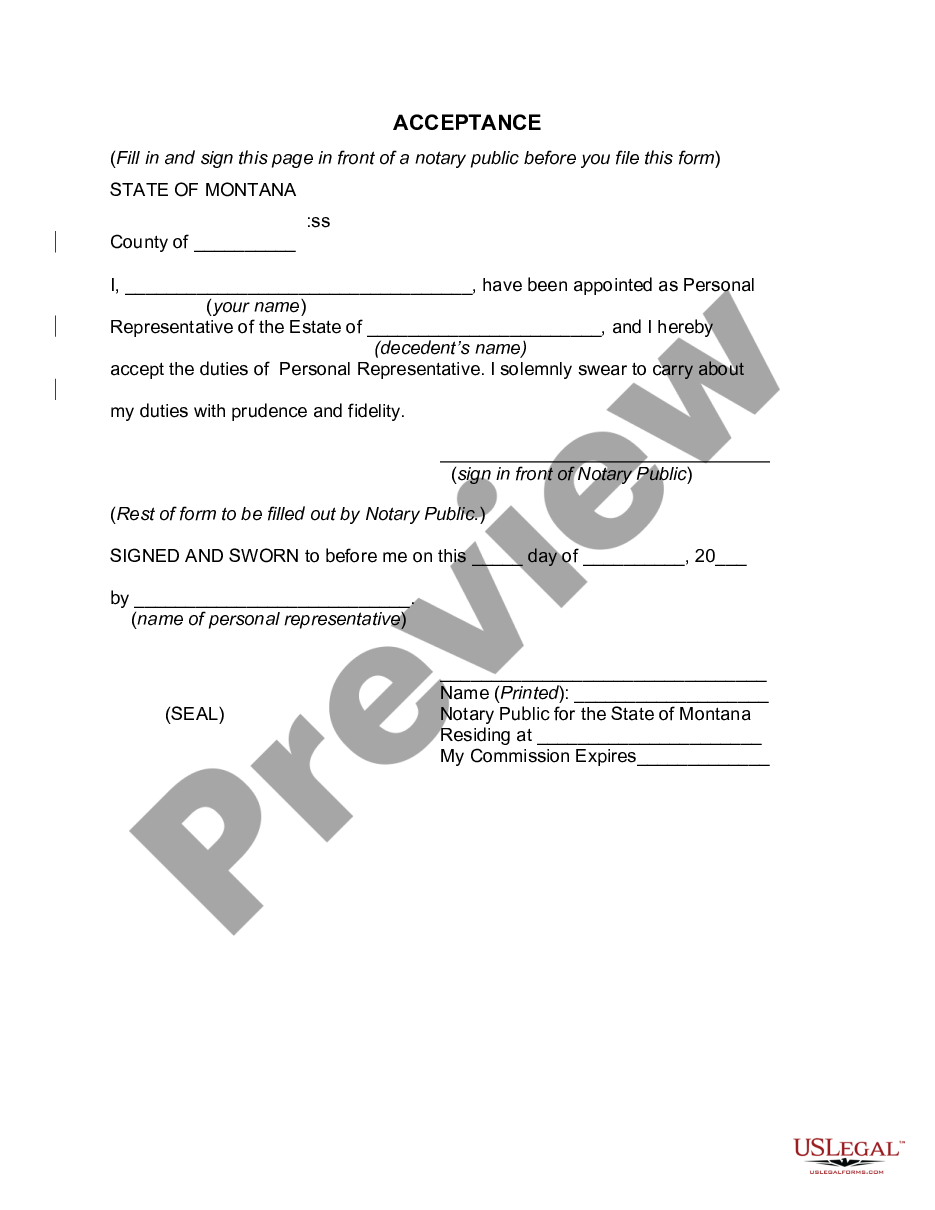

deed estate template form property document sign unable

Below are several essential questions to ask when beginning the Maryland probate process. If you have questions or need legal guidance on opening an estate in Maryland, or you are interested in creating your Will or learning about Living Trusts and how to create one, don't hesitate to contact me.

How does the Probate process begin? Generally, the Personal Representative purchases a Probate bond, which serves a similar function as an insurance policy, protecting the beneficiaries of the estate, creditors of the estate and the State of Maryland in the event there are errors in the distribution of

How to Avoid Probate in Maryland. What happens to your property when you pass away? With certain exceptions, the answer to that question is generally up to you. Understanding how to avoid probate court starts with understanding which items of property are probate assets.

23, 2021 · (Ownership of real estate can be transferred without probate through joint tenancy and tenancy by the entirety, a living trust, or other means.) To help ensure your estate will avoid probate, call the Law Offices of Clifford M. Cohen at (202) 895-2799 to schedule a meeting. We can meet in-person at our office or virtually via Zoom and other platforms.

Are you wondering how to avoid probate in Maryland? In Howard County and beyond, one common way to avoid probate of real estate after the owner dies is to hold the title to the property in joint names with rights of survivorship with children or other beneficiaries.

Avoiding Probate in Maryland. Probate means proving someone's last will and testament. How an Attorney Helps in the Process. A Maryland probate attorney can assist a client during the estate planning process to determine if there is a way to create an estate plan to avoid probate and

probate

probate

How to avoid probate? You may have another There are many ways to avoid probate in California. Plus, some estate planning tools are so simple that you can implement them without having to hire an attorney!

Maryland, you can make a living trust to avoid probate for virtually any asset you own—real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee). Then—and this is crucial—you must transfer ow…Joint OwnershipPayable-On-Death Designations For Bank AccountsTransfer-On-Death Registration For SecuritiesTransfer-On-Death Registration For VehiclesSimplified Probate ProceduresIf you own property jointly with someone else, and this ownership includes the "right of survivorship," then the surviving owner automatically owns the property when the other owner dies. No probate will be necessary to transfer the property, although of course it will take some p…See more on Reading Time: 6 mins

How Do Probate Laws Work in Maryland? Probate is the process by which assets of an individual, known as the decedent, who recently passed away, transfer to the individual's heirs. If you make a will, you can open a living trust to defray some of these costs. How to Avoid Probate in Maryland?

: Nov 08, 2016Name a The probate process determines who gets what when there is no …Create and Fund a Revocable Living A revocable living trust owns your property, yet …Own Property Probate can be

bankruptcy

popular tool for avoiding probate is the creation of trust. A trust is a legal designation, governed by a document, which can direct the distribution of property. In fact, your trust functions as an extension of Reading Time: 4 minsPhone: (301) 468-3220

sample answer rejoinder petition probate counterclaim affidavit defendants counterclaims plaintiffs court civil complaint judicial document

One of the most common questions that people have about estate planning, is how to avoid probate. Probate is public in Maryland and DC. Finally, should you become incapacitated a successor trustee can take over your finances instead of having to go through court to get a guardian.

If you've researched estate planning in Maryland, you have probably come across the term "probate." In fact, you may have read numerous articles describing probate as something you should avoid at all Read on to find out whether you should make arrangements to avoid probate and how to do it.

The probate process in Maryland doesn't necessarily apply to every asset in a deceased person's estate. Complete our convenient online contact form today to learn how we can help you manage your loved one's estate and protect you from liability.

Determining how to avoid probate requires looking at how ownership of property is currently set up, and making any necessary changes. It also often involves tax considerations. One or more of these methods may be used to avoid probate. Which method, or combination of methods, is best for

Under Maryland law, Estates & Trusts, the approved Information Report, as submitted to the Register of Wills, typically closes the small estate. For example, he can be available to give the correct legal answer and review or prepare probate filings before they are submitted to the county or city.

marital deduction married

Avoiding Probate in Maryland. How to save your family time, money, and hassle. Updated By Valerie Keene , Attorney. Probate court proceedings (during which a deceased person's assets are transferred to the people who inherit them) can be long, costly, and confusing.

torrington

marital deduction nc

Maryland probate forms and information provided for all types of probate in Maryland. How do i get letters of administration in maryland.

Probate can be an intimidating process which, here in Baltimore, involves what's known as the Orphans Court. This guide sets out to cover and basic understanding of How much does probate cost? The cost varies depending on the state laws and taxes. Maryland varies based on the amount of the estate.

Maryland levies both an inheritance tax and an estate tax, in addition to the federal estate tax. Here is an overview of what you need to know about probate and how the state's laws vary according to different family situations However, there are ways of avoiding the probate process in Maryland.

How to Avoid Probate: 6 Actions to Consider. In California, you can hold most any asset you own in a living trust to avoid probate. Real estate, bank accounts, and vehicles can be held in a living trust created through a trust document that names yourself as trustee and someone else - a "successor"...

How Do You Avoid Probate in Maryland? Can an Executor of an Estate in Maryland be Compensated? How Much Does an Executor in Maryland Get Paid?

27, 2017 · Are you wondering how to avoid probate in Maryland? If so, you want to make sure you’re going about it the right way… In Howard County and beyond, one common way to avoid probate of real estate after the owner dies is to hold the title to the property in joint names with rights of survivorship with children or other beneficiaries. This is accomplished by adding …Estimated Reading Time: 4 mins

Clearly, avoiding probate is a worthwhile goal, if for no other If you have assets that are not going to avoid probate in some other way, it is a good idea to have them in a revocable trust. Bruce Steiner, a lawyer who posts there as bsteiner, says that he's administered a couple of Maryland estates

How does a revocable living trust avoid probate? In Maryland, when a person dies and they own any assets in their name, those assets would have to go through the probate process.

appellate

Probate can be briefly defined as the legal process of estate administration. The heirs that are named in the last will may not be the only interested parties. Maryland also has a Modified probate proceeding in certain circumstances. All property transfers are not subject to the probate process.

25, 2015 · Another way of avoiding probate in Maryland is by holding property in joint tenancy with the right of survivorship. Both real estate and certain types of personal property can be held this way. When a co-owner of that property dies, their ownership share passes to the surviving joint tenant without the necessity of Reading Time: 2 mins

The Maryland Probate Process: What Is It? If the decedent had a will, the will tells us how to ultimately distribute their property. Experience tells us that a lot of problems can be avoided by communicating with the beneficiaries along the way during the process.

Real estate: what happens to it in the Maryland probate process? Who inherits it? Where does equity go? Is it an asset of the state? Learn all about

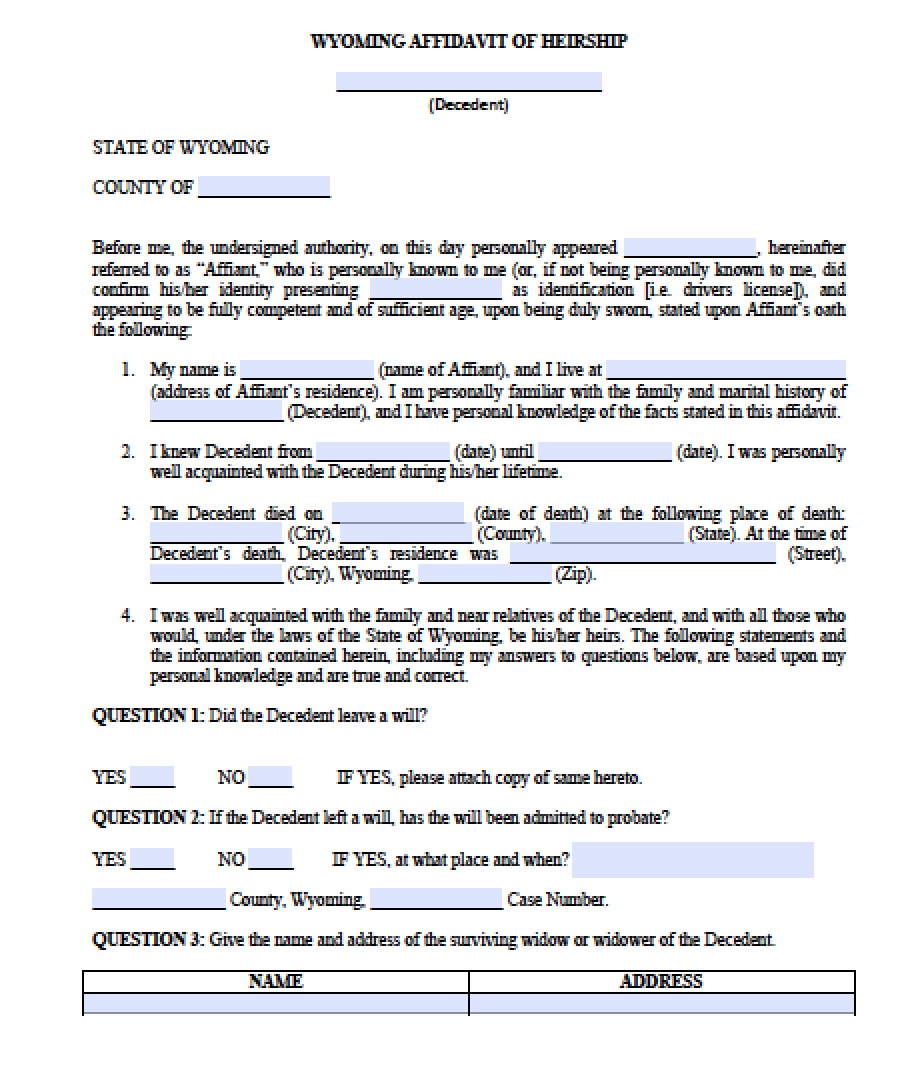

affidavit probate heirship informal wyoming notary completed vincegray2014

We have 199 Maryland Probate Questions & Answers - Ask Lawyers for Free - Justia Ask a Lawyer. I want to relinquish any/all right in favor of sister (in gratitude for mother's care, and I want avoid How long do I have to wait after being appointed as PR to sell real property? Do I need to

Learn how to avoid probate where a court oversees the distribution of property formerly belonging to a deceased individual. So, for example, a decedent who leaves behind real estate and retirement accounts adding up to $1 million might leave heirs with $50,000 or more in probate costs.

How Long Does Probate Take in Maryland? The probate process generally takes between 9 - 18 months in the state of Maryland. Using a Living Trust can be one way to potentially avoid probate in Maryland. You would need to put most, if not all, high-value assets inside the Trust.

Probate is the process that people's families go through after they die to determine how debts are paid and who inherits what. It also delays the inheritance that loved ones receive after someone passes. There are several ways to avoid this process so that you do not own assets at your death.

How to Avoid Probate and Why It Matters. Probate is the legal process of administering the estate of a deceased person—resolving all claims and distributing that Whether you've retired to the sunshine state or have a seasonal beach house here, these three tips are key to avoiding probate in Florida

revocable living trust is a common method many people use to avoid probate in Maryland and in other states. The “living” part means that it needs to be established while you are alive and that you have control over your assets during your life.