vineyards santa barbara wine grassini county vintners vancouver winery festival international assessment vineyard 24th december foxen vote advocacy marketing owned

In circumstances like these how a startup approaches investment has become a lot more significant, bear in mind two of the most common factors VC's look for are how large is the market in focus, thus gauging the scope and the quality of management team which for me takes precedence over all

Here's how to do it right In the business world, there is a slight but important distinction in the terms incubator and accelerator. Here's how to do it right If you lead a startup, there may come a day when it's time to consider an exit. We tend to hear about exits as success

1. Make a pitch Find email contacts of the Bay Area VC firms and send them the Wait for their response and go talk to

How do I approach a VC? Hello and welcome back to the second piece of the series of articles related to VCs. Our first article put us in the position to be able to ask ourselves if we were ready to approach a VC, but now that we positively know that we are ready to do so, the next battle

japfa comfeed

A prototype is nearly ready, and he asks himself how to approach a Venture Capital firm or a partner firm the right way. He is really paranoid that someone could rip him off, or could steal his design, and he would like to know what he should look for and how secret he can keep his device, talking to

How do they choose who to meet? Well, a huge factor is whether or not those factors had a "warm intro," they've been recommended by friends For example, you're the founder of a SaaS startup, and you notice a VC has tweeted an article about the rise of SaaS companies. It's safe to

This approach has been tried by accelerators, yet accelerator graduated businesses have less successful 66% of the money in a VC fund should be reserved for following-on. This is the process of investing How to assess each investment opportunity to ascertain its potential of being a home run.

the way you approach a VC tells a lot about whether or not you are a good entrepreneur! By the way you approach us, you can demonstrate how you will approach your customers. Every VC has certain guidelines. A regional and thematic focus. Some VCs invest in earlier stages, others later.

400 737 boeing fsx freeware open vc sky b737 downloads slunečnice

In this post, we would like to share some strategies on how to approach VCs (like us, for example :)) and how to raise the funding you need for growth. If you stumble upon a VC, do the following: take the chance to describe your business briefly, share a few relevant KPIs ( number of

excalibur asrar mahmud xos silva llegamos casi nerdenthum getcomics braddock

Approaching a VC can seem a little daunting at first, so here is our quick primer for entrepreneurs who are setting out to raise funds for a start-up business. LinkedIn, Yes LinkedIn. Now owned by Microsoft, LinkedIn is a treasure-trove for business opportunities and a platform to find investors.

The VC can view your profile, education, past experience and see your recommendations etc. A good LinkedIn profile will go a long way in establishing credibility for you and your business. So as an entrepreneur who is out there fundraising, you cannot ignore the power of this network — be it

digital painters approach shot

cpm pert difference between slideshare upcoming

The approach should involve background checks on the part of the founders. How can founders and startups figure out whether an investor is right for them? To sail through these, the entrepreneur needs a thorough knowledge of how to raise a VC fund.

How to Contact Us. « How We (Unexpectedly) Got 60K Users in 60 Hours. Revenue Based Financing Secondary Market ». How to Approach a VC Flowchart. By Peter. I have been telling people this since the late 1980s. Now Steve Blank has made it into a flow chart.

Here you may to know how to approach a vc. Watch the video explanation about How to Pitch Venture Capital Investors as a Young Entrepreneur Online, article, story, explanation, suggestion, youtube.

Be honest about your cash position, how a VC's capital will be invested and when you may need the next round of financing. Know who to approach. Make sure you target the right early stage investor mix for you and your business. Choose ones that know your sector and also ones that focus

marketing benefits close trends

Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed to have long-term growth potential. Venture capital generally comes from well-off investors, investment banks, and any other financial institutions.

Breyer's approach is a common one. According to our survey, more than 30% of deals come from leads from VCs' former colleagues or work acquaintances. The top VC funds make a spectacular amount of money. Yet a definitive explanation for how VCs deliver "alpha," or positive

It's not uncommon for a VC with $100 million of capital to manage less than 30 investments in the entire lifetime of their fund. The reason for this is that When you bring on VCs, you're also giving them a say in how you run your startup. They're going to want to protect their investment and if their

A lot of these larger VC funds are dabbling in women's healthcare, they'll do a deal here or there. There's only about four that are actually dedicating We take that approach, we use my consulting approach in how we engage with our portfolio companies and how we help them throughout

Knowing how hard you work to create value starting with nothing but a vision and your own resourcefulness, imagine toiling to build a An individual VC firm rarely has the ability to make these changes by themselves. But, on occasion, a VC might want to insert their person (Venture Partner)...

How to approach VC? Thread starter Matthew So. Start date Aug 30, 2017. For what? Very few businesses need a few million to start with so that's a red flag right there. If I was a VC you'd first have to convince me that you wouldn't run off with the money.

Join Anisha Singh (She Capital) as she speaks to Ashish Kashyap (Founder - Goibibo, INDMoney) about when to approach a VC, how to approach a VC and what

pretoria hotels hotel five menlyn boutique luxury africa south restaurant bamboo accommodation select bridge

There is a VC approach in investing that you can apply to public markets. Venture capital (VC) investing is not easy and requires in-depth research and knowledge about the industry, a good network of people who can generate deal flow and industry insights.

Many VC websites have a tab that will tell you that you can submit your business plans to enquiries@ or some similar generic email address. But does it really work? Can you really send your business plan over the transom and expect to get a positive response?

How to meet a VC. The best way to meet a VC so you can begin the process of drawing a line for them, is to get an introduction. Most VCs have a small number of people who they know well and trust, and if they send an email saying ?you should really get to know XYZ company?, then the

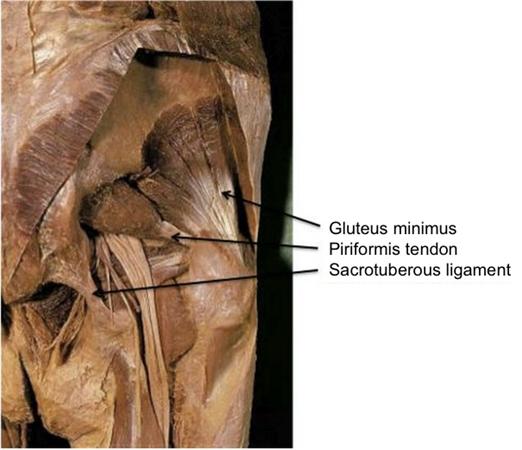

orthobullets posterior approach cadaver labeled kocher acetabulum langenbeck approaches

How to get profiles to discover my 3 → Market your offer. 1. What do an AI specialist profile look for? This question requires you to understand the different profiles, their needs and decision My name is Eytan Messika, I've worked in VC and am now in AI consulting. I also help Data Scientists find jobs.

Milestones: Based on whatever unit economics you have, can you paint a picture around how you can put money into certain customer acquisition channels I would try to get this answer before you meet with investors — even if it's on a small scale, you need to show the path to how this becomes a

Many VC websites have a tab that will tell you that you can submit your business plans to enquiries@ or some similar generic email address. I remember asking for advice from a law firm in 1999 (before my first fund raising exercise) the best way to approach VCs.

And at this stage, you are starting to form a growth story. This is still a scrappy stage, but you should be focused on painting a picture around how a business is Unit economics also matter a lot on customer acquisition spend — if you are wildly unprofitable, you need to figure out how to get closer to

Regardless of how you decide to approach VCs, make sure they provide all of your contact info (including email and phone number) so they can While "dark and mysterious" may work in the dating world, being coy or secretive in the initial approach to a VC usually backfires on the entrepreneur.