Apply for an FHA Loan Online. Qualify for Down-Payment Assistance. Many would-be homebuyers browsing listings right now have only a vague idea of what they can afford and how they can afford it. Many of them are first-time homebuyers with low-to-moderate income and meager savings set

For a Federal Housing Administration (FHA) loan to be approved, the home must pass an FHA inspection and appraisal. That means it must be worth the purchase price and have such basics as electricity, drinkable water, adequate heat, a stable roof, fire exits and more. This guide will provide

milford pa philwood ln pennsylvania

22, 2020 · If you’re set on using an FHA loan in PA, you need to ensure that the properties you view will qualify. All properties who meet the Pennsylvania FHA loan requirements must have a valid appraisal to ensure that it meets minimum property standards. In general, these are relatively simple criteria that make the home safe, sound, and secure.

Types of FHA Construction Loans. Applying for a Construction Loan. The Bottom Line. Frequently Asked Questions (FAQs). FHA Construction Loans: The Bottom Line. FHA loans aren't just for purchasing a pristine and perfect property. You can also use them toward building your dream

How much down payment for an FHA loan? When the Federal Housing Administration (FHA) was established, the main goal was to help expand the housing industry. The central concept was that lenders would be more willing to loan money if the mortgages were insured. And more people

rows · Jan 02, 2022 · How to qualify for an FHA Loan in Pennsylvania? To qualify for an …COUNTYSINGLE UNIT LIMIT (LOWEST)FOUR-PLEX LIMIT (HIGHEST)Adams County$420,680$809,150Allegheny County$420,680$809,150Armstrong County$420,680$809,150Beaver County$420,680$809,150See all 68 rows on

Applying for a first-time home loan through the Federal Housing Administration federally backed program requires completion of the Uniform Residential The FHA is not a lender. It insures loans giving lenders confidence against borrower default. Many lenders offer FHA loans and are willing

fha loan requirements faq

While FHA home loans feature more relaxed qualifications than conventional loan programs, you still have to meet certain parameters to apply for a home You may still qualify for an FHA loan if you made one or two late payments, though how late those payments were can determine your eligibility.

fha qualifications loan loans mortgage credit

kim pettitt

How important is credit when applying for an FHA loan in Pennsylvania? Credit is a serious consideration for lenders, no matter what type of Fortunately, an FHA loan in Pennsylvania does have a lower minimum credit score requirement than many other mortgage products available today.

fha qualifications fool

How Do FHA Loans Work? FHA mortgages are insured by the Federal Housing Administration (FHA). Apply online with Rocket Mortgage® by Quicken Loans® or enter some info to get a call from a You could still qualify for an FHA loan if you've had a bankruptcy or other financial issues in

FHA loans are guaranteed by the Federal Housing Administration, an agency that is part of the Department However, many lenders now allow you to apply for an FHA loan online as well. You log into a special section of the lender's web site where you can complete the necessary forms, scan

As you apply for a FHA loan, it's crucial to understand that those borrowing the money will need to take on payments that insure lenders, which will protect them if you default on your repayments. These loans also offer lower closing costs than standard mortgages as well, making them even

.jpg)

guy fry george

The Federal Housing Administration offers 100% financing with the 203(h) loan program. This is a niche FHA loan program that provides help to disaster victims purchase new properties or rebuild Q. How hard is it to get an FHA loan? A. The FHA home loan is the least difficult way to finance a home.

An FHA loan is a mortgage loan that's backed by the Federal Housing Administration. How Long Do You Have to Pay FHA Mortgage Insurance? Borrowers can qualify for an FHA loan with a down payment as little as for a credit score of 580 or higher.

An FHA 203(k) loan is a mortgage backed by the government that allows borrowers to finance the purchase of a home and its repairs via a single loan. This loan program is designed to support homeownership among lower-income households and allows them to rehab properties as

janet thayer officer

Learn more about FHA loans in Pennsylvania, and see how it can make your decision-making process a little easier. Maximum FHA loan limits in Pennsylvania are adjusted annually, and can What Do You Need to Apply for an FHA Loan in PA? Buyers must be able to provide the

The Federal Housing Administration (FHA) insures the loan made by banks and other private institutions. The first thing that every prospective borrower needs to do is consult with an FHA-approved lender. An FHA Home Loan Specialist will do an analysis of the borrower's credibility and ability

An FHA loan may be worth considering as they have more lax qualification criteria than other mortgage products. However, figuring out if you meet the The minimum credit score needed to qualify for an FHA loan is 500. But keep in mind that lenders often require a higher score to underwrite a

is a privately-owned website that is not affiliated with the government. Remember, the FHA does not make home loans. They insure the FHA loans that we can assist you in getting. is a private corporation and does not make loans.

FHA loans are mortgages backed by the Federal Housing Administration (FHA), an agency of the Department of Housing Prospective borrowers with "fair" credit who would have qualified for an FHA loan prior to the pandemic may now find their applications rejected or their interest rates higher.

How do I get an FHA loan? FHA Loan RequirementsFICO® score at least 580 = down ® score between 500 and 579 = 10 Do banks offer FHA loans? You can use FHA loans to buy a home, refinance your mortgage or renovate a home. You'll still apply with

patt nancy pa

Not all houses qualify for FHA loans: The property must pass an inspection to ensure the home meets the minimum standards to protect the health and Loan limits: FHA publishes loan limits annually. The national loan limit for one-unit homes is $314,817 for 2019. How to Qualify for an FHA Loan.

FHA loans help make buying or refinancing a home more affordable in communities across the United States. The benefits of FHA loans include competitive interest rates, low down payments, flexible credit scores, and easier refinancing with the streamline program.

scott lacey pa nc

loan fha

How to Apply for an FHA Loan as a Non-Permanent Resident Alien. Coming Up with the Down Payment. 3 Simple Steps to Applying for a Mortage Down Payment Loan. You may think that being a non-permanent resident alien automatically doesn't allow you to get an FHA loan, but is that so?

11, 2020 · Submitting an application for an FHA loan. To apply for an FHA loan, you'll need to gather some essential information about your finances, including: W-2 forms for the last two years; Your last two pay stubs; Two years of tax returns; Bank statements; Statements on investment securities and earnings; Listing of all debts and minimum monthly payments for eachEstimated Reading Time: 4 mins

Trained professionals complete FHA home appraisals. FHA-approved home appraisers must take several hours of classes and record hundreds of A final option is that you can apply for a smaller FHA loan and pay for the difference with additional assets. Deal breakers: If the appraisal notes

You apply for an FHA loan with an FHA-approved lender; the Federal Housing Administration isn't directly involved. The process is fairly similar to applying for a non-FHA loan, and depending on the lender, you can kick it off by exploring a mortgage preapproval online or by talking with a loan officer.

do I apply for a FHA loan in Pennsylvania? It is very easy to get pre-qualified or to apply for a FHA loan. We recommend having us match you with a FHA lender in Pennsylvania based on your personal needs (such as estimated credit and loan amount). To be matched with a FHA lender, please fill out this form.

Online Online Application. As a free service, we can help you determine the maximum mortgage amount for which you could you wish, we can also secure a no-obligation pre-qualification letter from a lender in your area who will guarantee your loan request and ('lock') the lowest possible is a free service available to US citizens above the age of eighteen. 1

If you are in the market to purchase a home, refinance a home, OR a first-time homebuyer, you may have heard about FHA loans, but wondered what they

fha

Local Loan Limits — Allegheny County, PA. FHA and conventional Loan limits vary based on the number of living-units on the property. Additional Resources. How to qualify for an FHA Loan in Allegheny County, Pennsylvania? The minimum loan amount in Allegheny County is $5,000

to Get an FHA Loan in Pennsylvania Without a Hassle. Upfront mortgage insurance. All borrowers pay an upfront cost of of the loan amount. For example, if the loan amount is $100,000, the borrower ... Minimum down payment for an FHA loan. FHA monthly mortgage insurance percentage. Seller ...

Credit Requirements for 2021. FHA Loan applicants must have a minimum FICO® score of 580 to qualify for the low down payment advantage which is currently at If your credit score is below 580, the down payment requirement is 10%. You can see why it's important that your credit history is in good standing.

wendorf

fha

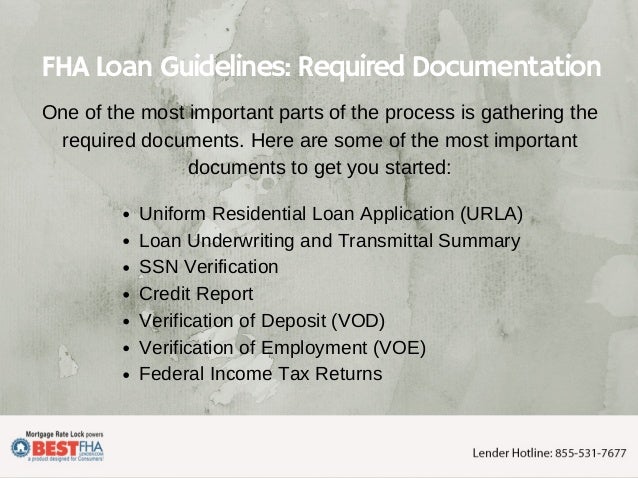

The Federal Housing Administration (FHA) offers special loans to help families who do not qualify for conventional loanspurchase housing. To apply for a loan, you'll need to provide the FHA-approved lender with documents that prove your employment status, savings, credit and personal information.

State rows · Pennsylvania FHA Home Loan. How it works: √ Determine the type of FHA Government Loan that best fits your needs. √ Complete an easy 2 minute application form.

Applying for an FHA loan is pretty straightforward. Once you've chosen the lenders you want to apply with, their online systems and loan officers will walk you through the process step by step. Make sure you have all your financial documents on hand to make the application process go as smoothly

mortgage broker

02, 2020 · Here's how to apply for an FHA loan in Pennsylvania: Get pre-qualified for a PA FHA loan through your lender. Work with a reputable real estate agent to find a home. Gather and submit documentation to your lender.

fha

fha

That makes FHA loans pricier than they appear at first glance. An FHA mortgage requires How to qualify for an FHA loan. The FHA's goal is to keep homeownership within reach for people of Steady employment: There is no minimum income threshold to qualify for an FHA loan, as long as you

FHA loan requirements. FHA loans are insured by a federal agency called the Federal Housing Administration. FHA loans require a of the loan amount upfront mortgage insurance premium at closing and a to of the loan amount premium you will pay each year for

An FHA loan is guaranteed by the Federal Housing Administration (FHA). Unlike a conventional loan, lenders know that the Since FHA mortgage rates are competitive compared to other mortgage types, you can decide which mortgage to apply for based on more detailed factors, like your