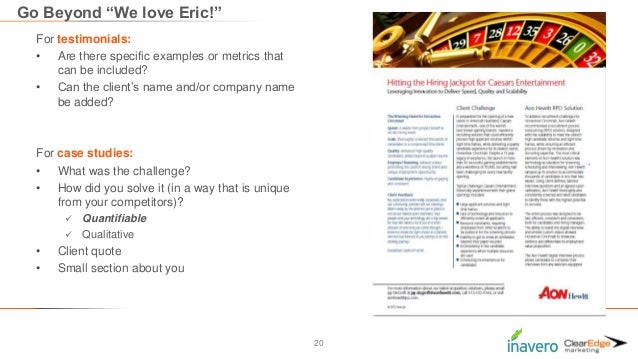

How to Improve Your Customer Acquisition Strategy. Every business needs new customers to grow and succeed, so whether you're a company of five or 5,000, having a roadmap for customer acquisition is a smart move. A solid customer acquisition strategy should be four things:

summary company

The acquisition created the second largest drug company, took three months, and Pfizer obtained control of Lipitor's profits, which amounted to over $13 billion. In little over two decades, the deal has become cemented as the textbook example of how not to conduct M&A. It featured everything

How a company communicates during a transaction has a direct impact on its employees' loyalty and trust. Since employees often feel blindsided when a deal is announced, company leaders and other internal If a company fails to communicate effectively during a merger or acquisition, it risks

Customer Acquisition Cost (CAC) is a critical business metric. Not tracking it? Here's the ultimate guide to calculating, measuring, and improving it. I hope you enjoy reading this blog post. If you want my team to just do your marketing for you, click here. Customer Acquisition Cost: How to

![]()

press icon zetabid minutes

Mergers and acquisitions involving privately held companies entail a number of key legal, business, human resources, intellectual property, and financial issues. To successfully navigate a sale of your company, it is helpful to understand the dynamics and issues that frequently arise.

What if I said you could average 300% (or more) growth this year without doing any additional marketing or branding and without hiring any new team

It's been about six weeks since I last analyzed Digital World Acquisition Company (NASDAQ And that has nothing to do with how somebody feels or doesn't feel about TRUTH Social. For this reason, it was good to see the company announce partnerships with AgFed Credit Union and Corning

an Acquisition to Employees. Acquisitions are stressful for employees. Deciding what to tell my employees, and when, was a tricky decision for me when I sold TEAL Electronics. First, I thought of a number of reasons to tell them right away: We encouraged a culture of honesty, and hiding (or worse, lying about) acquisition talks ...

Customer acquisition is an approach where "the whole is greater than the sum of its parts." By integrating every aspect of this customer acquisition framework, you'll construct a program that best serves the non-linear buying behavior of your B2B more about the

A special-purpose acquisition company (SPAC) is a shell corporation that is involved in the If you're interested in learning more about the rise of SPACs and how they can benefit individual companies Marketing: the SPAC usually issues a press release to announce the upcoming acquisition of

Acquisitions by consulting companies. Emma Rovit, ex-Bain, ex-Instacart. Data analytics companies are a key target for MBB for a couple reasons. First of all, they often have proprietary Then, simulations can be run to forecast how the company might fare under various scenarios.

hoco torqx parts capital partners enters partnership september

Customer acquisition; the practice of bringing in new customers/clients that fit the ideal customer profile (ICP) for your company. If we subscribe to this belief, then your customer acquisition strategy is the lifeblood of your company or organization.

the merger or acquisition: In this section you will want to announce what companies have either been merged or acquired, what the official date of the transaction is, and what the new name is of the entity (if there is one). Background on your firm: Explain the history of your organization in this section. Include when you were founded, what achievements you’ve …

21, 2021 · The Must-Have Items of Acquisition Announcement Press Release. In order for your acquisition announcement press release to work successfully, here are some things you need to cover. Your Press Release should include the following content: Catchy headline; Details about the company. name (new/old), formalities, date; reason for the merger/acquisition,

4: Acquisitions and mergers. Company Name or Letterhead Address City, State Zip. Date. Addressee Address City, State Zip. To the Burford-Hymil Organization: Our company officials and those of Freeman Inc. announced today an agreement has been reached on the merger of our two companies, to be effective May Reading Time: 10 mins

An acquisition of one company by the other company takes place when one of the companies purchases mostly all of the shares of the other company In the year 2017, Amazon, the e-commerce announced that it is going to buy a high-end organic chain of grocery named Whole Foods for

For Announcing A Company Merger Or AcquisitionWho Do We Need to Make This Announcement Too?Do I Have Retention Plans in place?How Will We Combine The Organizations?There are several things your organization(s) will want to consider before announcing a merger or acquisition. It is important to spend time reviewing all of these considerations before announcing because of the importance of your transaction being successful in the long term. The majority of mergers and acquisi…See more on

Announcing our Acquisition by Axiell! Hear from CultureConnect's CEO about this exciting new chapter. Today, I'm thrilled to share a big step forward for CultureConnect. Since founding the company nearly seven years ago, we've successfully helped cultural organizations across the

22, 2021 · Point By Point: How To Give to Employees When Selling a Business. Gather all the employees into a big group. Try and pump people up. Announce that the company has been sold. Be clear and transparent. Have the seller try and get people to ask questions. Assure people that nothing about their salary and benefits will change for the worse.

12, 2012 · The announcement of the acquisition was a remarkable milestone in accesso’s history, and for us presented a great reminder of several critical aspects of communicating such a significant occasion. As with any major organizational announcement or development, it’s important to nail down the communications plan to ensure the right messages ...Estimated Reading Time: 4 mins

15, 2012 · The acquisition announcement is a an awkward moment, one of the high water marks in passive agressive writing. You have to convey the news in an upbeat way, but everyone knows that it means a few people will get rich, some people will lose jobs, or maybe the company just won't exist Reading Time: 1 min

The announcement of the acquisition was a remarkable milestone in accesso's history, and for us They're able to see the whole picture - how the deal affects every audience (internal and external) - and Its not uncommon for a company to be guarded in the level of detail it wants to share when

Before announcing the acquisition of your company, you should have a solid plan in place. How long will the transition take? What are the details of the transaction? You may also want to prepare a media packet that goes beyond a press release to include executive biographies, photos,

information to cover when announcing a merger or acquisition plus the guidelines to follow when writing the press release: Title: Acquiring Company to Acquire Acquired Company (possibly mention price) Subtitle: Other notable information. Paragraph 1: Announcement. Acquiring company announced today… Amount (cash, stock)

Acquisition effects - such as amortization of intangibles - can also make an acquisition dilutive. • Cash is also less risky than stock because the buyer's share price could change dramatically once the acquisition is announced. 18. How much debt could a company issue in a merger or acquisition?

An acquisition is defined as a corporate transactionDeals & TransactionsResources and guide to understanding deals and transactions in investment banking, corporate development, and other areas of corporate finance. Download templates, read examples and learn about how deals are structured.

How Does a Merger Affect Shareholders? How Company Stocks Move During an Acquisition. Stock prices of potential target companies tend to rise well before a merger or acquisition has officially been announced. Even a whispered rumor of a merger can trigger volatility that can be profitable

Companies advance myriad strategies for creating value with acquisitions--but only a handful are likely to do so. There is no magic formula to make acquisitions successful. Like any other business process, they are not inherently good or bad, just as marketing and R&D aren't.

Mergers and Acquisitions (M&A) are considered a very complex financial topic. This is a type of Whereas in the case of an acquisition, one company is taken over by another company and in the Several times a less powerful company is compelled by the bigger company to announce

When it comes to mergers or acquisitions, communication is key. Here's how to make the initial announcement to your staff to ensure the process starts off on the right foot.

In April 2019, Property Finder announced the acquisition of JRD Group, owner of and broker CRM solution PropSpace 1. Look at the rationale behind the acquisition. You might be attracted by the brand or the people, but how does acquiring this company fit into your strategy?

Guide to Acquisition Examples. Here we discuss top 4 examples of acquisitions - Amazon - Whole Foods, Microsoft & LinkedIn, Disney & 21st Century Fox Acquisition takes place when the financially strong entity acquires the entity which is less strong financially by acquiring shares worth more

A company acquisition can be a difficult time for your employees. These tips explain how to help calm their concerns and guide them through the process. Seen through an employee's eyes, the company acquisition process can be an upsetting experience. Their first response naturally revolves

08, 2021 · Before announcing a single word about the sale of the company, you should have a solid plan in place. A consistent message is critical and the distribution of the information should be carefully coordinated both internally and …

market acquisitions insight merger advising terms healthcare slideshare

dialpad

How to Value an Acquisition Target Acquisition valuation involves the use of multiple analyses to determine a range of possible prices to pay for an acquisition candidate. There are many ways to value a business, which can yield widely varying results, depending upon the basis of each valuation m.

acquisition

Mergers and acquisitions (M&A) are defined as consolidation of companies. Differentiating the two terms, Mergers is the combination of two companies to form one, while Acquisitions is one company taken over by the other. M&A is one of the major aspects of corporate finance world.

Murphy Canyon Acquisition Corp. is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. The Company intends to focus on companies in the

Analysis. What CFOs of SEC registrants should know about the acquisition process. Information you should consider. Chief financial officers (CFOs) provide vital financial leadership and often play an integral role in supporting company growth and long-term investments of a company.

investment deals corporate company deal insurance ltd

In corporate finance, mergers and acquisitions (M&A) are transactions in which the ownership of companies, other business

Why do acquiring companies' stock drop when announcing an acquisition, especially in stock acquisitions? There are some companies that do successful acquisitions of smaller firms all the time, and specific use cases where a merger makes sense.

lakefront estate apartments georgia

acquisition shutterstock mergers