26, 2020 · Payroll Data for Data Insight and Analytics (DI&A) August 26, 2020 | 5 Mins David Daly. The value of payroll data is starting to be recognized more and more, particularly among business leaders at multinational organizations who are looking to leverage available data within their organization to carve out a strategic edge in the Reading Time: 12 mins

The best payroll software is Xero. The end-to-end accounting platform gives you a robust payroll processing module that packs useful innovation tools and automation features behind a simple interface design.

09, 2017 · Five great places to start analyzing payroll data. Sage HRMS. JULY 14, 2016. Benoit Gruber, VP, global product marketing at Sage, shares five unexpected places to look when examining your payroll data. Payroll is a vital source of data in your business and has the potential to have an immediate financial benefit.

the due dates for semi-monthly federal payroll tax deposits by using the CHOOSE and WEEKDAY functions. Discerning the nuance involved in making pivot tables present data in tabular form. Determining the previous Friday when payroll dates fall on a weekend by using the IF and WEEKDAY functions.

1 How Doing Payroll in Excel Works. 2 Review & Edit Payroll Excel Template. Check how the cells with formulas automatically calculate totals in the monthly payroll tabs once you enter data All data automatically populates within this tab, so you shouldn't have to change any information in the cells.

Payroll Processing and Analysis. The main purpose of the payroll run is to calculate employee pay correctly For example, you can roll back a payroll run when you want to carry out a test run without keeping any record of You can choose how often you want to run the continuous calculation process.

Payroll Operations Resume Samples and examples of curated bullet points for your resume to help you get an interview. Review payroll and data entry activities, processes and systems to maximize efficiency, accuracy and improve performance.

How to Schedule Payroll in Background? Go to System → Service → Jobs → Define Job or SM36. Managing and scheduling background jobs in the system. How to Schedule a Background Job? It stores the payroll and time status data. This is automatically created when an employee is hired.

Important data insight and analytics can be extracted from global payroll data-We take a closer look in The value of payroll data is starting to be recognized more and more, particularly among business leaders at How much does it cost to pay them? What is our most/least expensive payroll country?

Learn how to analyze data with this guide to help you master some basic analysis skills: cleaning data, analyzing trends, and drawing While data analysis can be a time-consuming task, it's important to remember that it isn't the end goal. You're analyzing data to be able to make

How Relevant streamlined payroll operations at a US-based fintech company with a custom Data security is critical in financial software development. Payroll operations use a vast amount of We also use third-party cookies that help us analyze and understand how you use this website.

Analyze how many employees are on the floor at one time. Is there downtime? Are you overstaffed during certain times and understaffed during others? Use your POS system and payroll processing data to their full potential in analyzing the number of employees on the floor compared to

Discover how to trade this report without getting knocked out by the volatility it can create. Like any other piece of economic data, there are three ways to analyze the non-farm payroll number: A higher payroll figure is good for the economy.

Payroll is a list of employees who get paid by the company. It also refers to the total amount of money paid to the employees. Learn how to do payroll. To make sure that your employees are happy and you are law compliant, you need to have a proper understanding of what payroll is and how to

Payroll data is a vital source of your business and has the potential to have an immediate financial benefit. Here are 5 ways to start analyzing payroll. If you continue browsing, you are consenting to our use of these cookies, but if you would like to know more, including how you can change

value upstate

paycom reporting practice

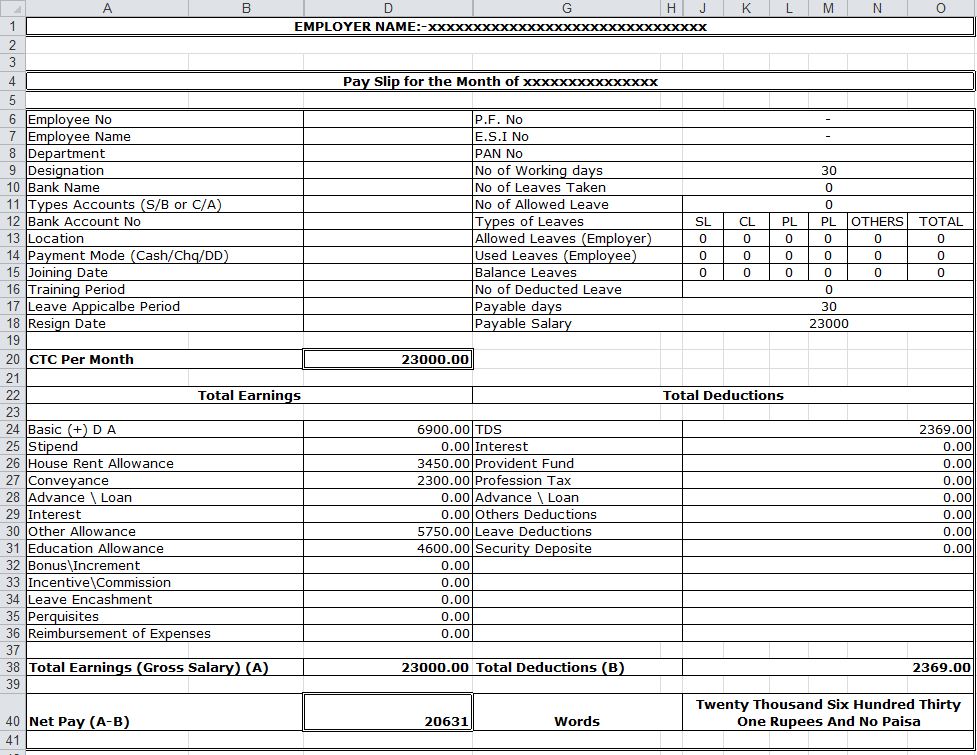

payroll salary slip template templates checks pay leave deductions total track payable days

Meticulously analyze payroll data supplied by clients, input and balance exact totals, examine all payroll reports before distribution to clients. Provided client and employee support in areas related to payroll, benefits and file maintenance. Built strong rapport with other departments such as

This article outlines how the weaknesses of payroll can be analysed top-down using a cost distribution chart to target organisational departments most likely to suffer from fraudulent over-payment. Once departmental subsets have been identified, data mining across a variety of information sources

Read more about how to set the compensation for international employees. Payroll operations can't be separated from the issue of taxes and compliance. This is especially true when you are entering new markets and sensitive issues such as payroll data are now visible to more and more employees.

ibm 705 processing data system mainframe history exhibits archives

Because payroll is often a company's biggest cost, it's critical to be able to analyze payroll data and its impact on profitability. It can be difficult to do that Payroll solutions reduce the need for data entry, saving time and increasing accuracy. It's especially helpful if systems enable employees to check

Use this report to analyze payroll allocations for project categories in a date range that you specify. How to filter the data on this report. In the Category payroll allocation form, select the project categories to include on the report. To add more than one category, click Add.

Why bring data analytics into your payroll process? After the compensation manager gathers data on competitor's salaries, job descriptions, geographic location How to choose a compensation management system. Generally speaking, there are two types of compensation management systems.

Payroll Fraud happens 27% in all businesses and most companies' are not able to make any action about it. Many entrepreneurs and managers believe that payrolls cannot be changed, that too in an automated environment. When you have uncontrollable circumstances in your organization

dashboards visualization intuitive

Analyze payroll output files to ensure accuracy. Identified, researched, isolated, and resolved any discrepancies to ensure accuracy both internally and interdepartmentally. Here's how Data Entry is used in Payroll Analyst jobs: Performed data entry for voluntary and mandatory payroll deductions.

Payroll can provide you with a rich source of information. It can give you insight into how well your business will perform. It is therefore important to identify key payroll data. This will help your business only analyse employee demographic data which will affect your profits rather than

Typically, running payroll only applies to paying employees. When processing payroll, the tax burden is split evenly between employer and employee. However, independent contractors and freelancers are responsible for all their taxes and benefits.

Payroll Data in Microsoft Excel Revealing the undocumented DATEDIF function in Excel for determining the number of months or years between two dates. Determining the previous Friday when payroll dates fall on a weekend by using the IF and WEEKDAY functions. Employing the ...

18, 2016 · Here are five places to look when analyzing your payroll data: Remuneration: Salaries will be an obvious place to start. With these numbers, …Estimated Reading Time: 2 mins

Payroll reports help small businesses understand payroll costs and summarize payroll data. It's the go-to report if you're wondering how many hours all of your employees worked in the last pay period or how much your business incurred in Federal Insurance Contributions Act (FICA) taxes in the

Payroll journal entries are used to record the compensation paid to employees . These entries are then incorporated into an entity's financial statements When you later pay the withheld taxes and company portion of payroll taxes to the IRS, you then use the following entry to reduce the balance in the

How to Analyze Your Gender Pay Gap: An Employer's Guide. Andrew Chamberlain, , Chief Economist, Glassdoor. Unfortunately, most HR teams today do not have technical data science staff who can perform complex statistical analysis of payroll data.

bi power microsoft desktop visualization source intelligence data tool open analytics stack cloud july features using screenshot service sources screenshots

Browse Analysis, Examples and Payroll content selected by the Human Resources Today Thought bubble: Payroll Reform. Business is moving to a level of integrated data and analysis not The post 3 Common Errors During HR/Payroll User Acceptance Testing (UAT) and How to Fix Them

Similarly, the right analysis of payroll data can inform future strategies. Having visibility into the process and challenges of global payroll and a total picture of your operational costs and requirements puts business leaders in an empowered position from which to plot and evaluate ways to grow

26, 2020 · The hardest challenge with payroll data is ensuring there’s a stream of consistent, high-value data to gather and analyze. Forecasts and predictive analysis aren’t built on short-term data collection, they’re built by analyzing a wide range of historical data over long periods of time. To do this accurately, you need the right technology. Only then can you build a picture of …Estimated Reading Time: 3 mins

How to Use Payroll Data. Payroll data is a cornerstone metric that is relevant beyond the HR department. It contributes to the overall direction of a Analyzing payroll data over time can provide more accurate yearly forecasts, so you are better prepared to manage budgets and cash flow in

How your payroll administrator manages time and attendance - whether it's a time clock, a mobile app or a pencil and paper - is entirely up to you. This guide is intended to be used as a starting point in analyzing an employer's payroll obligations and is not a comprehensive resource of requirements.